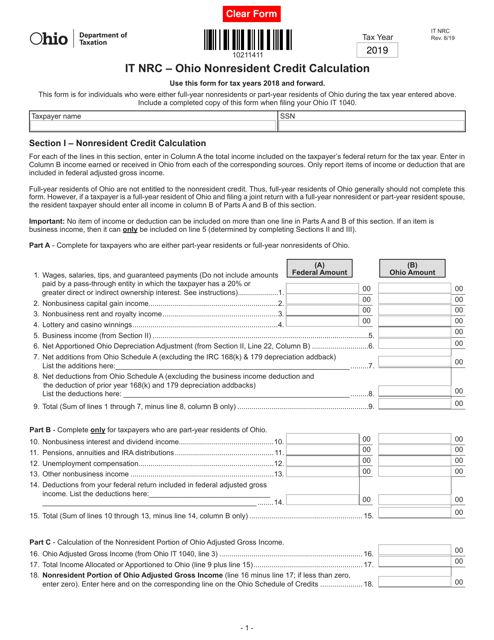

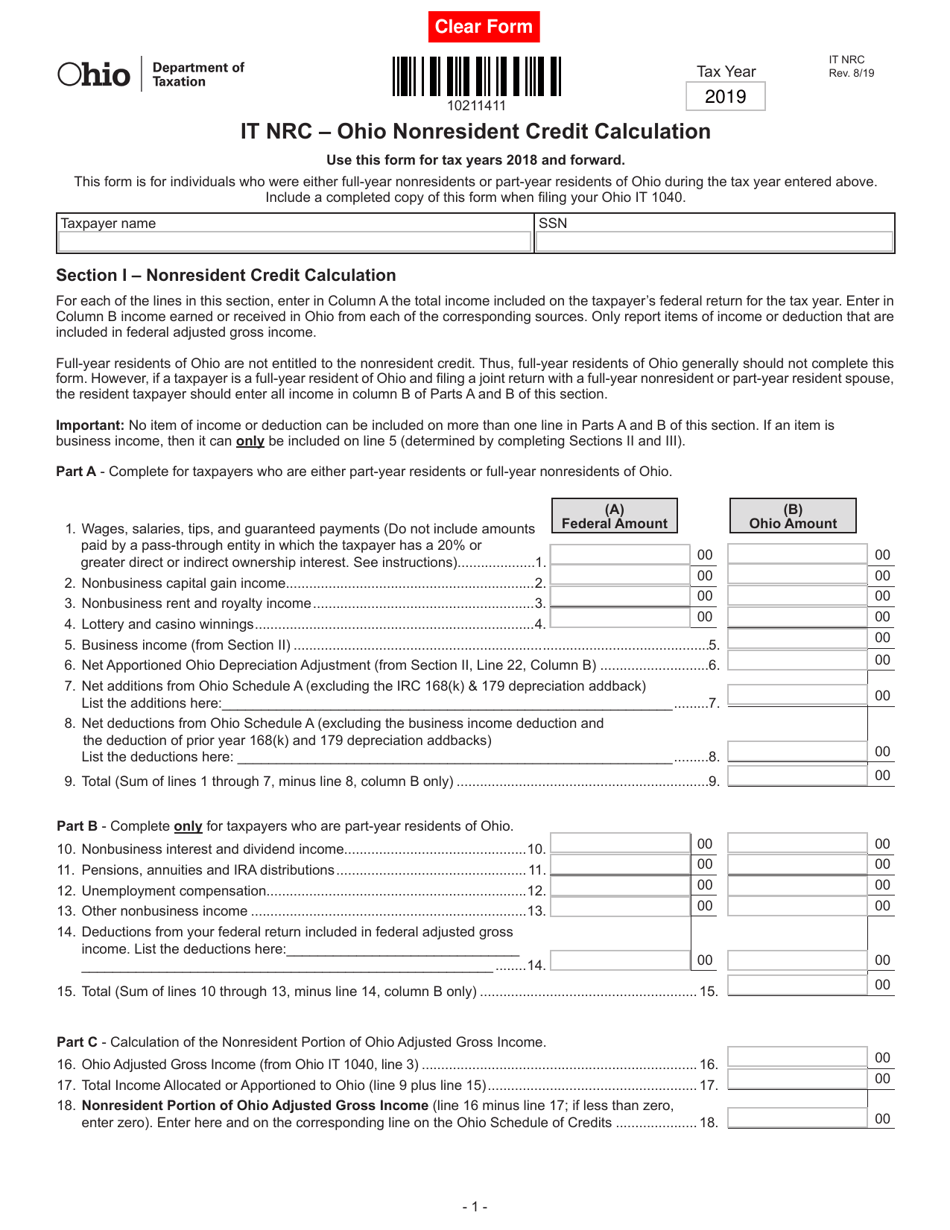

Form IT NRC Ohio Nonresident Credit Calculation - Ohio

What Is Form IT NRC?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT NRC Ohio Nonresident Credit Calculation?

A: The IT NRC Ohio Nonresident Credit Calculation is a process used to determine the amount of tax credit that a nonresident of Ohio may claim on their Ohio income tax return.

Q: Who is eligible for the IT NRC Ohio Nonresident Credit?

A: Nonresidents of Ohio who have earned income in Ohio and have paid income taxes to another state are eligible for the IT NRC Ohio Nonresident Credit.

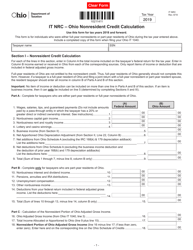

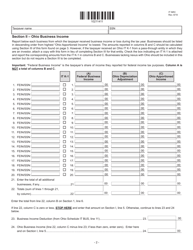

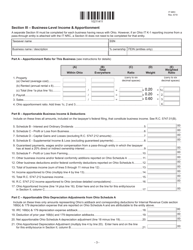

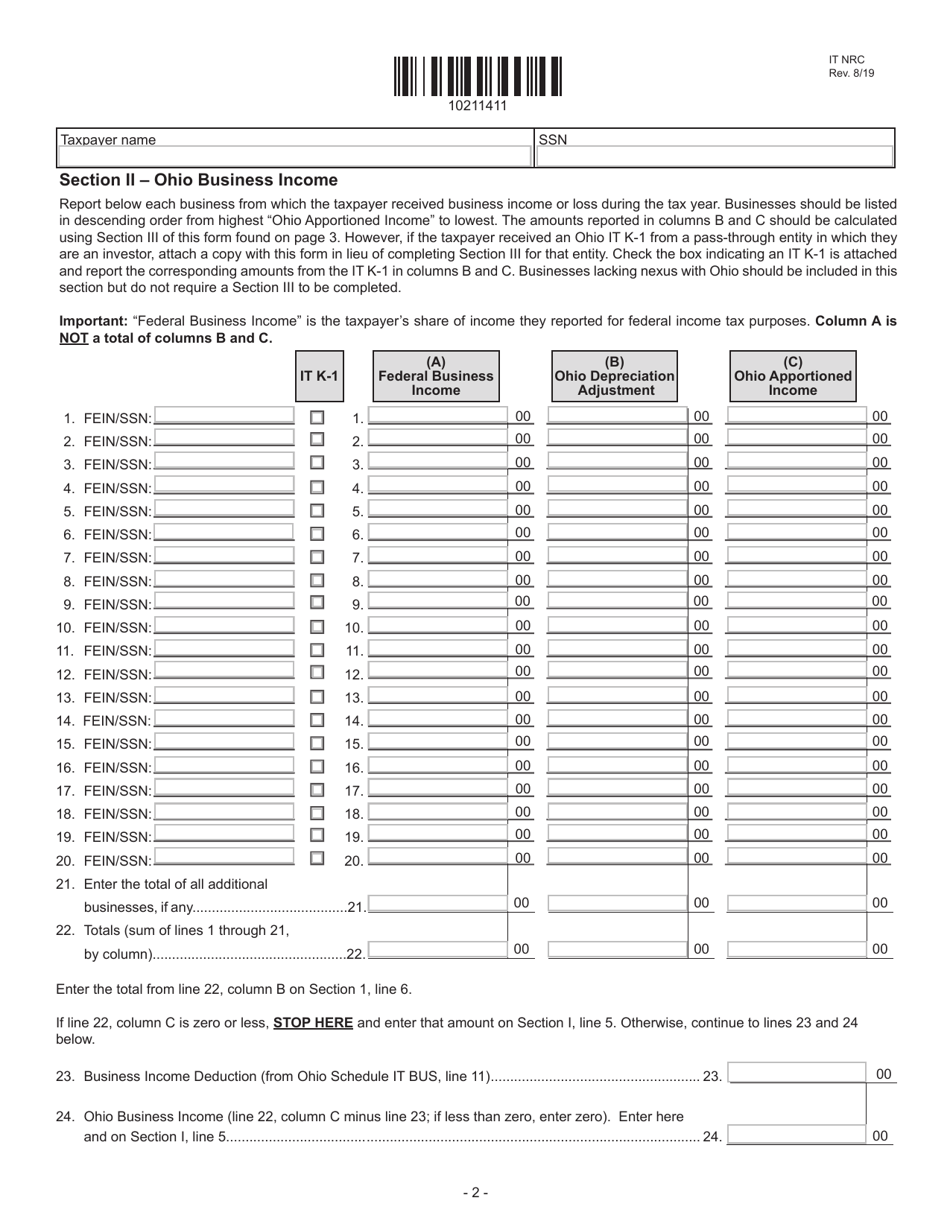

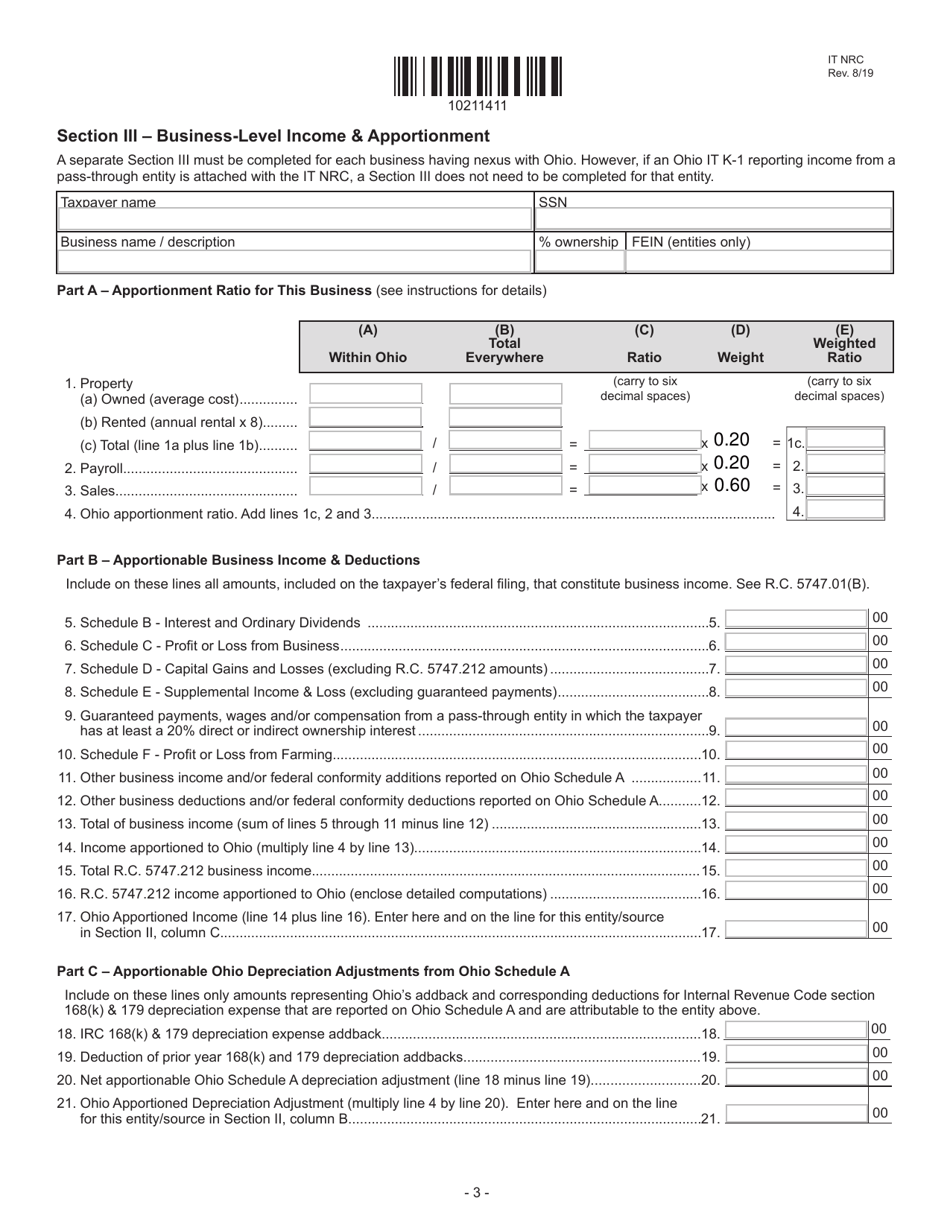

Q: How is the IT NRC Ohio Nonresident Credit calculated?

A: The credit is calculated by multiplying the income tax liability in Ohio by the ratio of Ohio adjusted gross income to federal adjusted gross income.

Q: What is the purpose of the IT NRC Ohio Nonresident Credit?

A: The purpose of the credit is to prevent double taxation by giving nonresidents a credit for taxes paid to another state on income earned in Ohio.

Q: How can I claim the IT NRC Ohio Nonresident Credit?

A: To claim the credit, you must file Form IT NRC with your Ohio income tax return and provide the necessary documentation to support your claim.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT NRC by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.