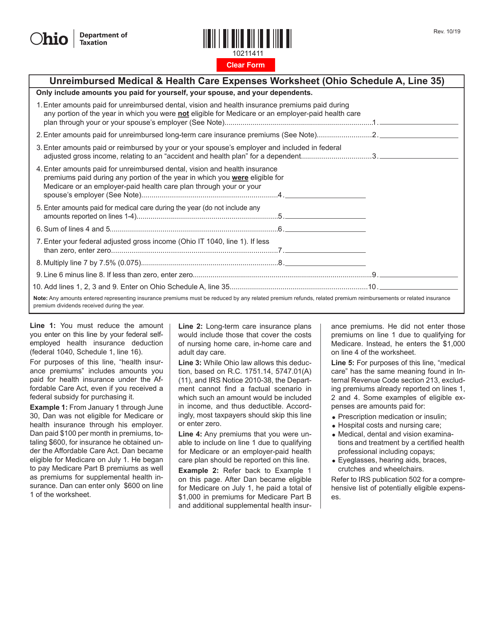

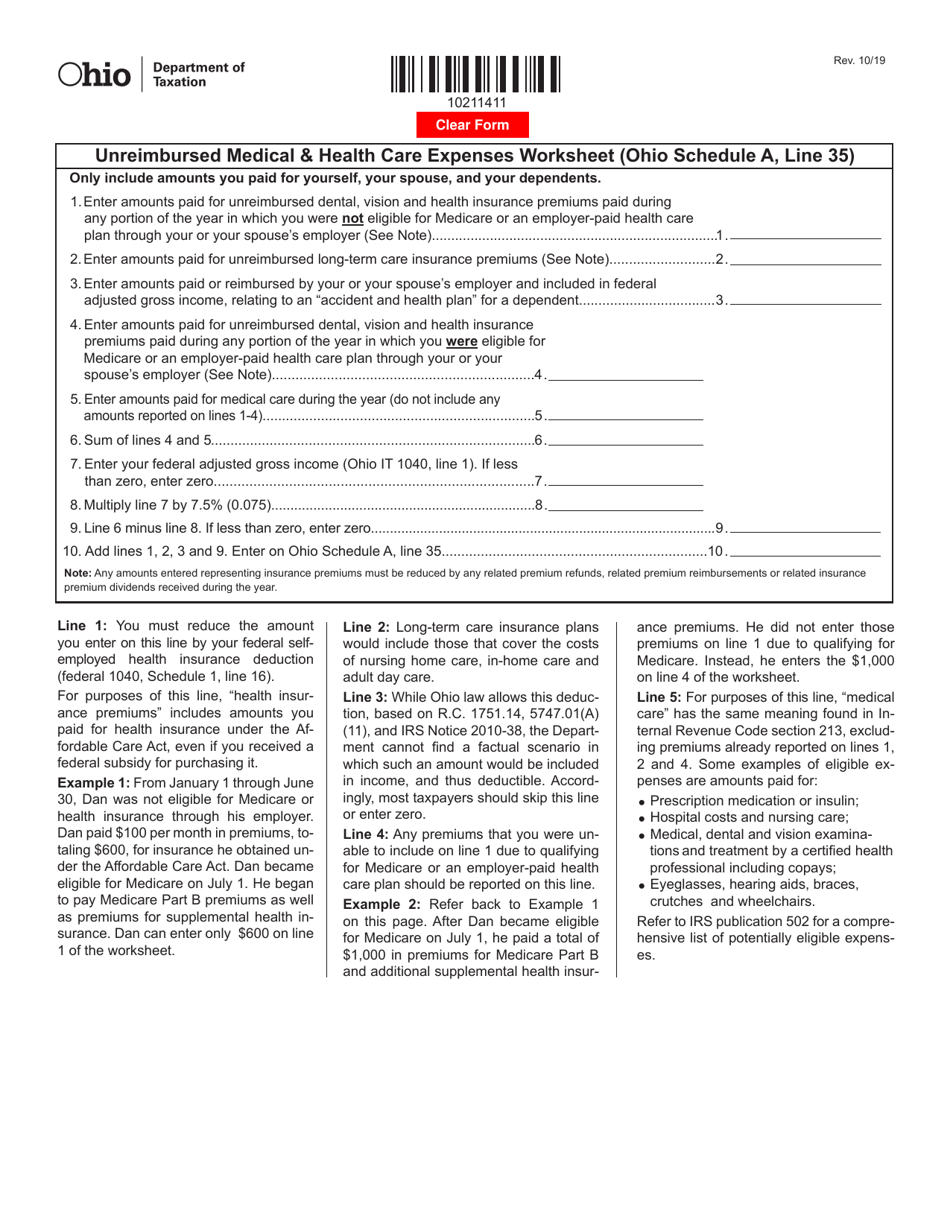

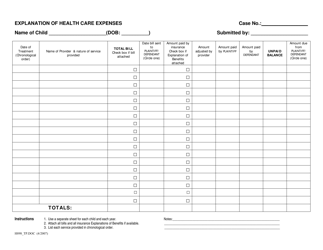

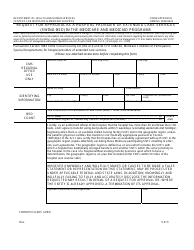

Unreimbursed Medical & Health Care Expenses Worksheet for Ohio Schedule a, Line 35 - Ohio

Unreimbursed Medical & Health Care Expenses Worksheet for Ohio Schedule a, Line 35 is a legal document that was released by the Ohio Department of Taxation - a government authority operating within Ohio.

FAQ

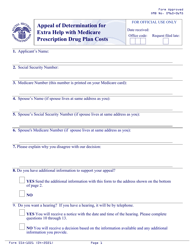

Q: What is the Unreimbursed Medical & Health Care Expenses Worksheet?

A: The Unreimbursed Medical & Health Care Expenses Worksheet is a document specific to Ohio Schedule A, Line 35.

Q: What is Ohio Schedule A, Line 35?

A: Ohio Schedule A, Line 35 is a line on the Ohio tax return where you report your unreimbursed medical and health care expenses.

Q: What are Unreimbursed Medical & Health Care Expenses?

A: Unreimbursed medical and health care expenses are the costs you paid for medical and health care services that were not covered by insurance or reimbursed by any other means.

Q: Why do I need to fill out the Unreimbursed Medical & Health Care Expenses Worksheet?

A: You need to fill out the worksheet to calculate the total amount of unreimbursed medical and health care expenses that you can deduct on your Ohio tax return.

Q: Are there any specific requirements for deducting unreimbursed medical expenses in Ohio?

A: Yes, there are specific requirements and limitations for deducting unreimbursed medical expenses in Ohio. It is recommended to refer to the Ohio tax form instructions or consult a tax professional for detailed guidance.

Form Details:

- Released on October 1, 2019;

- The latest edition currently provided by the Ohio Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.