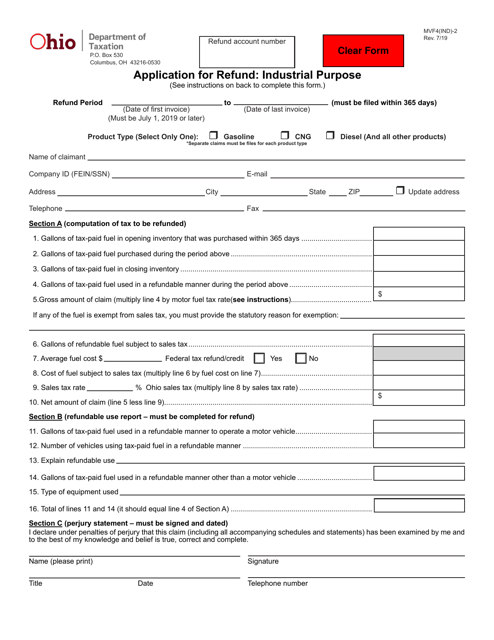

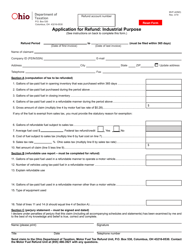

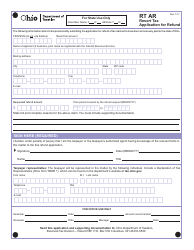

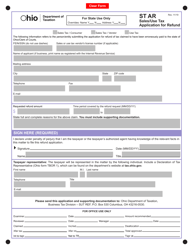

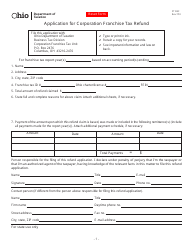

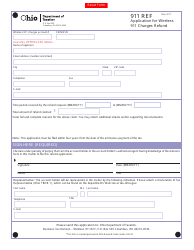

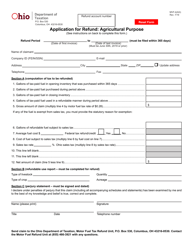

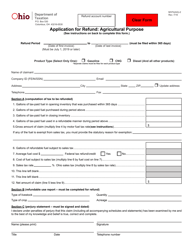

Form MVF4(IND)-2 Application for Refund: Industrial Purpose - Ohio

What Is Form MVF4(IND)-2?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form MVF4(IND)-2?

A: Form MVF4(IND)-2 is an application for refund specifically for industrial purposes in Ohio.

Q: Who can use form MVF4(IND)-2?

A: Form MVF4(IND)-2 can be used by businesses and individuals who have made qualifying purchases for industrial purposes in Ohio.

Q: What is the purpose of form MVF4(IND)-2?

A: The purpose of form MVF4(IND)-2 is to apply for a refund of sales tax paid on qualifying purchases made for industrial purposes in Ohio.

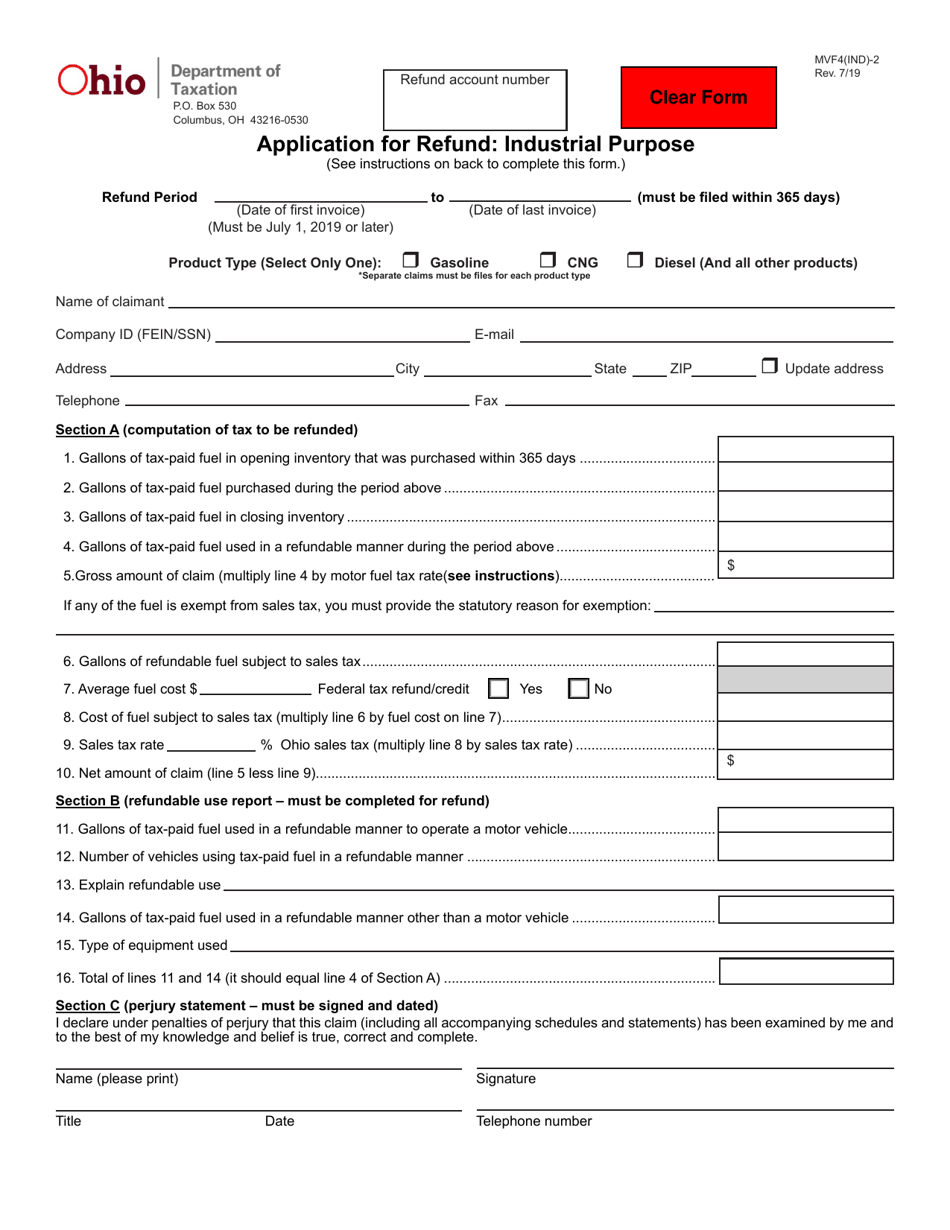

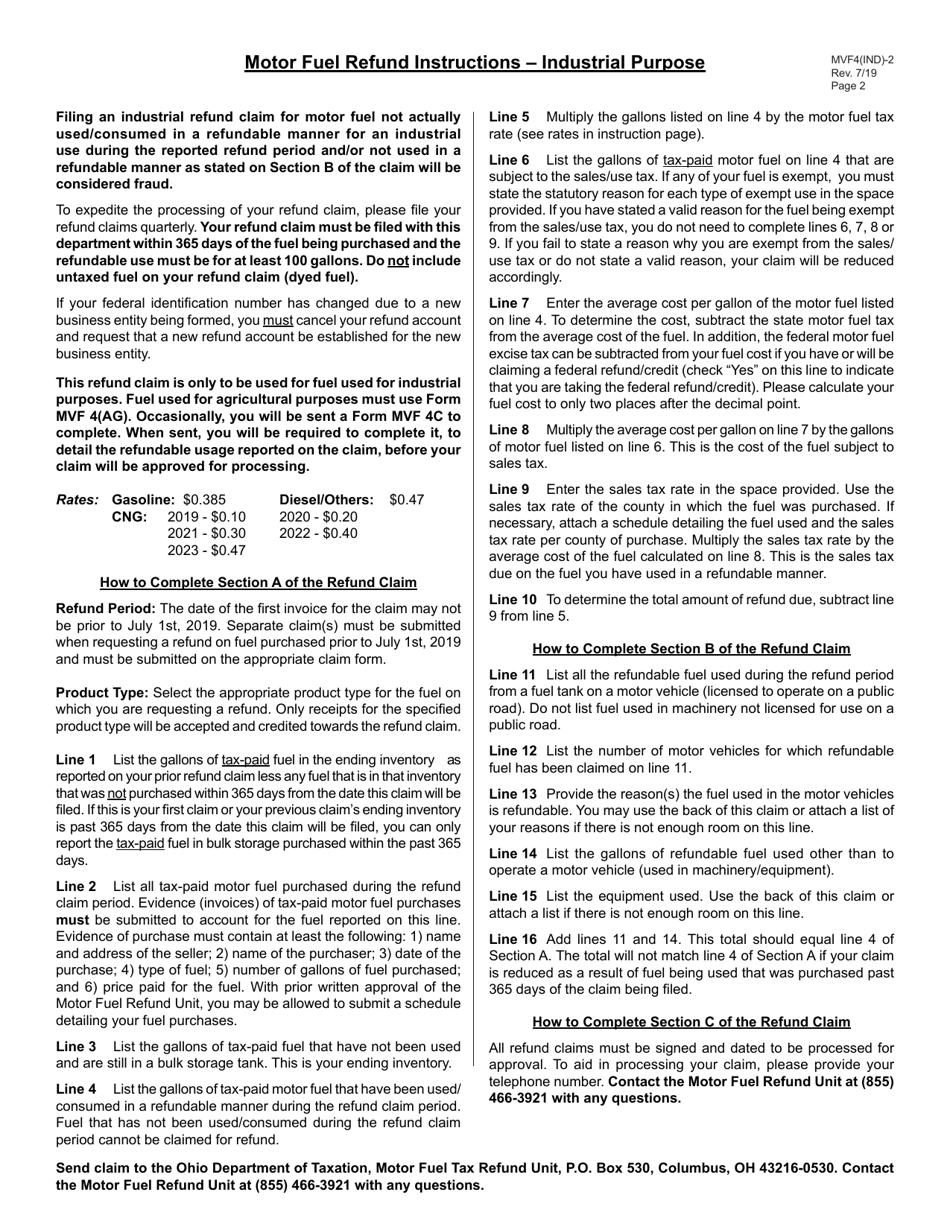

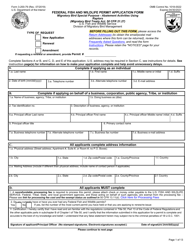

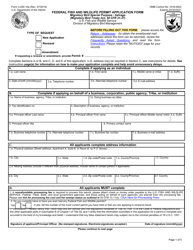

Q: What information is required on form MVF4(IND)-2?

A: Form MVF4(IND)-2 requires information such as the taxpayer's name, address, tax identification number, description of the purchased items, and the amount of sales tax paid.

Q: Are there any eligibility criteria for using form MVF4(IND)-2?

A: Yes, to be eligible to use form MVF4(IND)-2, the purchased items must be used exclusively for industrial purposes in Ohio.

Q: How do I submit form MVF4(IND)-2?

A: Form MVF4(IND)-2 should be submitted to the Ohio Department of Taxation along with any supporting documentation, such as purchase receipts.

Q: What is the deadline for submitting form MVF4(IND)-2?

A: Form MVF4(IND)-2 must be submitted within one year from the date of purchase.

Q: How long does it take to receive a refund after submitting form MVF4(IND)-2?

A: The processing time for refunds can vary, but typically it takes several weeks to receive a refund after submitting form MVF4(IND)-2.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MVF4(IND)-2 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.