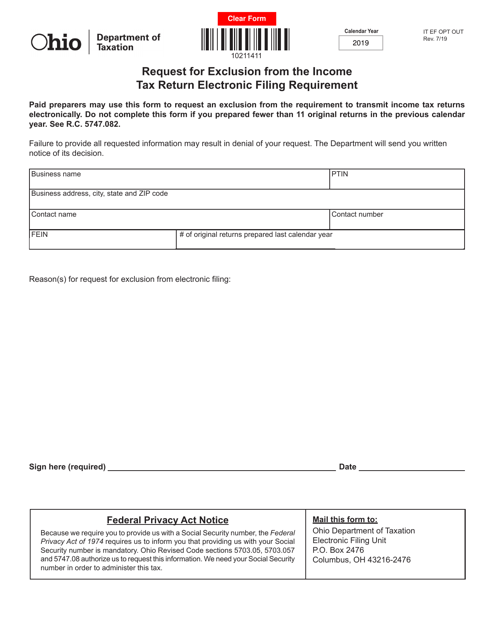

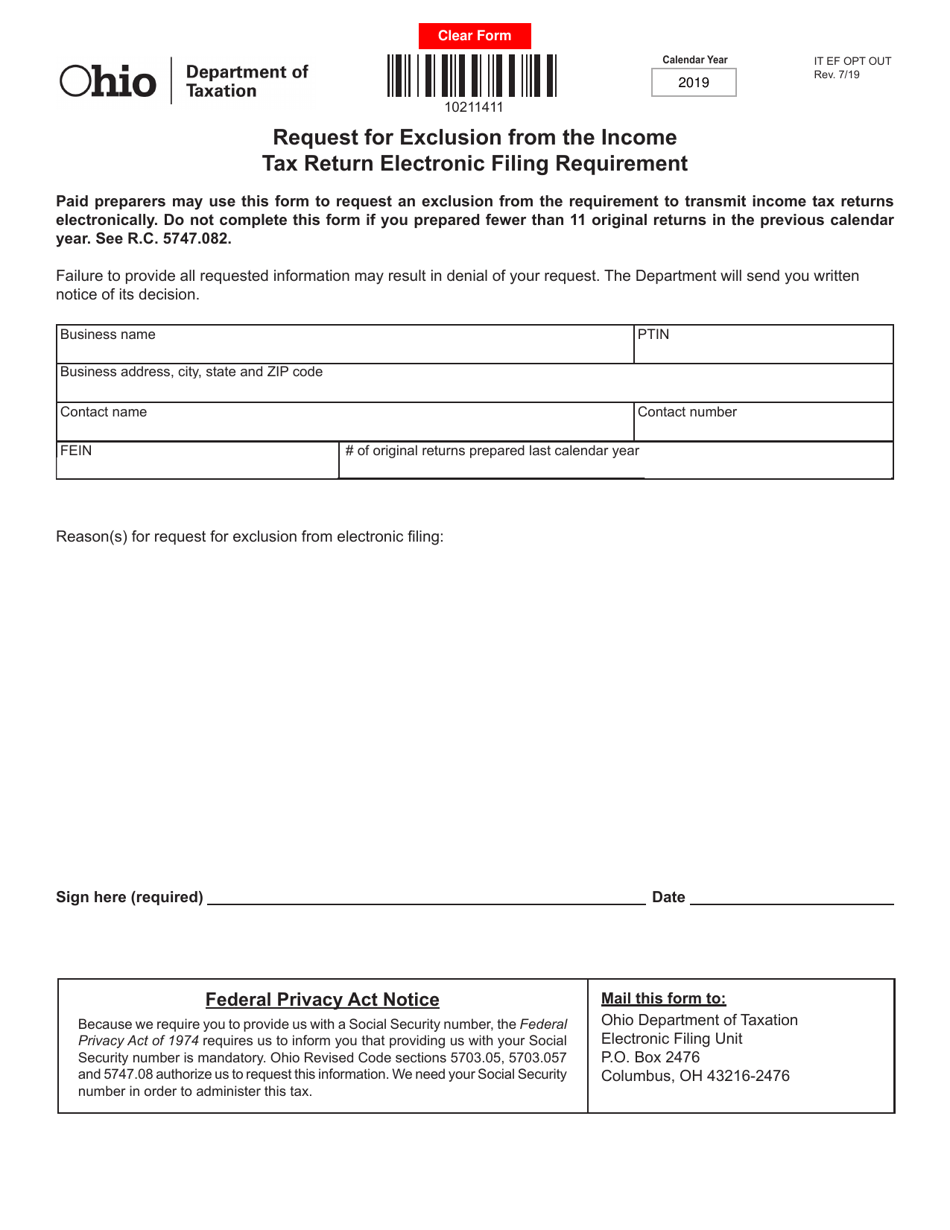

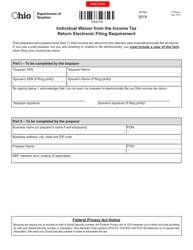

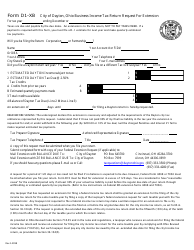

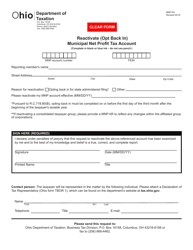

Form IT EF OPT OUT Request for Exclusion From the Income Tax Return Electronic Filing Requirement - Ohio

What Is Form IT EF OPT OUT?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IT EF OPT OUT?

A: Form IT EF OPT OUT is a request for exclusion from the income tax return electronic filing requirement in Ohio.

Q: Who can use the Form IT EF OPT OUT?

A: Any individual or business taxpayer who wants to be excluded from the electronic filing requirement for their income tax returns in Ohio.

Q: Is there a deadline for submitting the Form IT EF OPT OUT?

A: Yes, the Form IT EF OPT OUT must be submitted by the due date of your income tax return.

Q: What are the requirements to qualify for the Form IT EF OPT OUT?

A: You must meet certain criteria, such as not having a computer with internet access or not being able to reasonably comply with the electronic filing requirement.

Q: Are there any penalties for not filing electronically?

A: No, there are no penalties for choosing to opt out of the electronic filing requirement.

Q: Can I opt out of electronic filing for both my federal and state income tax returns?

A: No, the Form IT EF OPT OUT is specific to Ohio state income tax returns.

Q: What should I do if I have already filed my income tax return electronically?

A: If you have already filed your income tax return electronically, you cannot opt out for that specific tax year. You can opt out for future tax years.

Q: Who should I contact if I have questions about the Form IT EF OPT OUT?

A: You should contact the Ohio Department of Taxation for any questions or concerns regarding the Form IT EF OPT OUT.

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT EF OPT OUT by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.