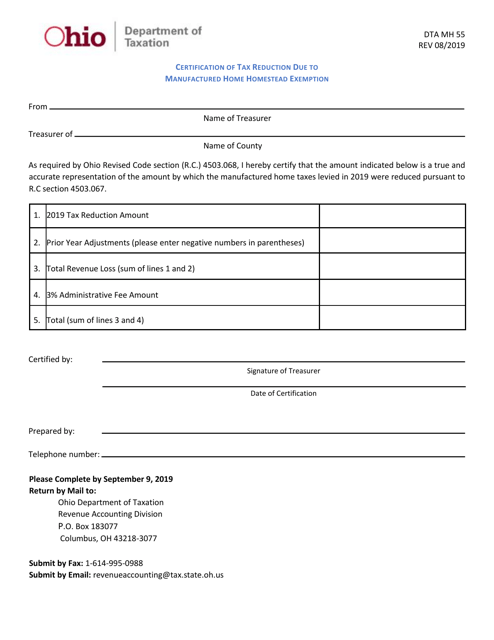

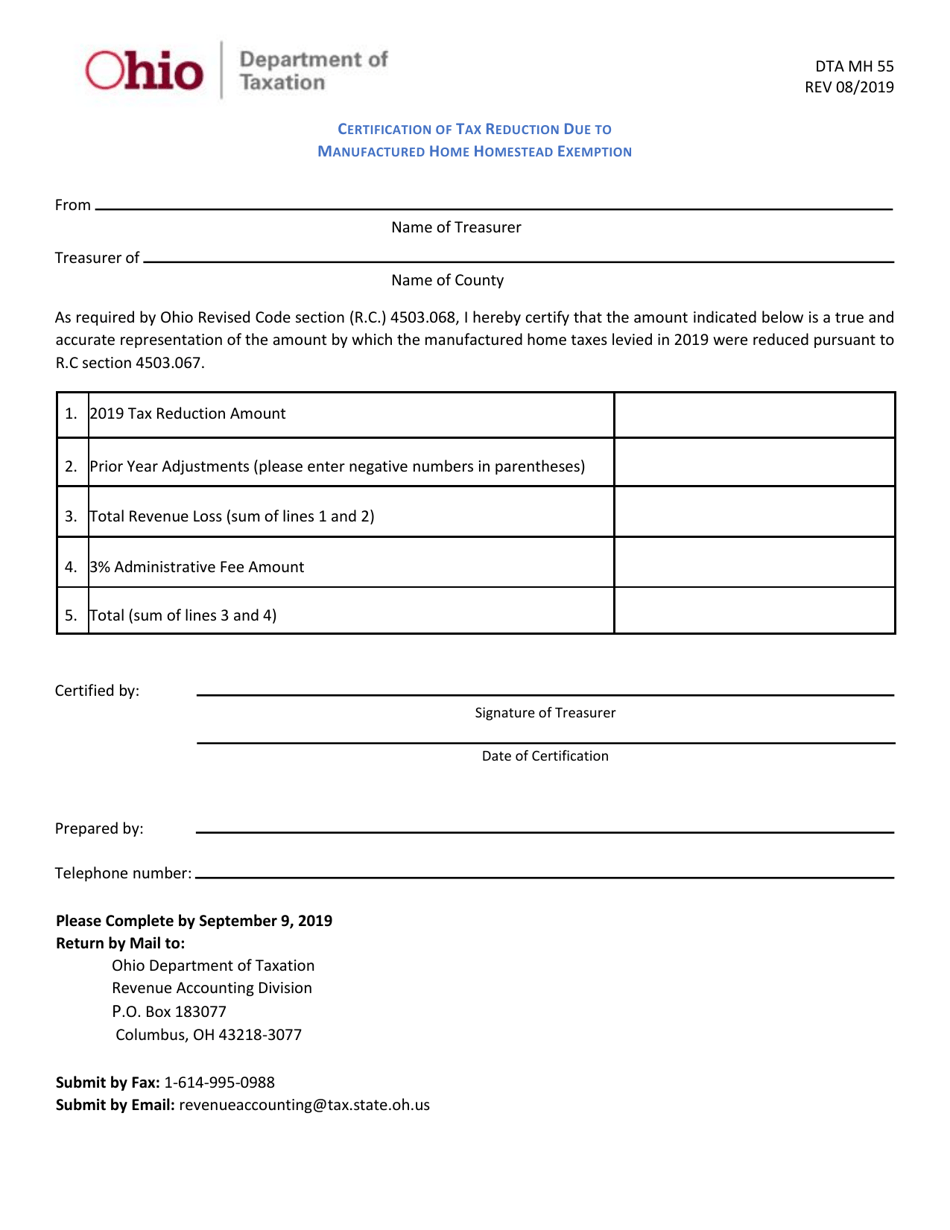

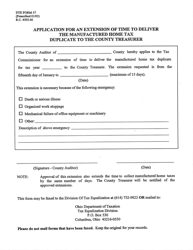

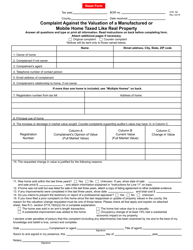

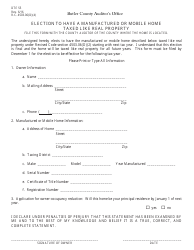

Form DTA MH55 Certification of Tax Reduction Due to Manufactured Home Homestead Exemption - Ohio

What Is Form DTA MH55?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

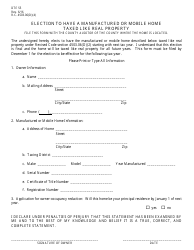

Q: What is a DTA MH55 form?

A: The DTA MH55 form is a Certification of Tax Reduction Due to Manufactured Home Homestead Exemption in Ohio.

Q: What is the purpose of the DTA MH55 form?

A: The purpose of the DTA MH55 form is to certify and apply for a tax reduction for a manufactured home through the Homestead Exemption program in Ohio.

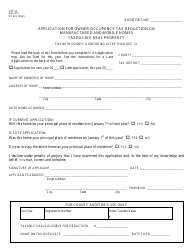

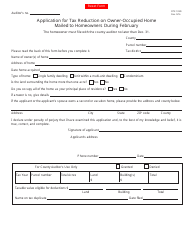

Q: Who needs to fill out the DTA MH55 form?

A: Owners of manufactured homes in Ohio who wish to claim a tax reduction through the Homestead Exemption program need to fill out the DTA MH55 form.

Q: What is the Homestead Exemption program?

A: The Homestead Exemption program in Ohio provides tax reductions for qualifying homeowners, including owners of manufactured homes.

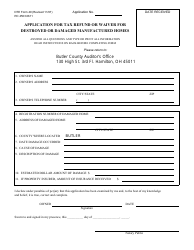

Q: What information is required on the DTA MH55 form?

A: The DTA MH55 form requires information about the homeowner, the manufactured home, and supporting documents to verify eligibility.

Q: Are there any deadlines for submitting the DTA MH55 form?

A: Yes, the DTA MH55 form must be submitted to the county auditor's office by the first Monday in June of each year to be eligible for tax reductions for that year.

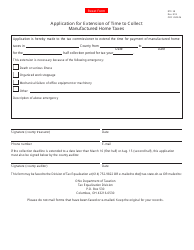

Q: What happens after submitting the DTA MH55 form?

A: After submitting the DTA MH55 form, the county auditor will review the application and determine the eligibility for the tax reduction.

Q: How much tax reduction can be obtained through the Homestead Exemption program?

A: The tax reduction amount can vary depending on factors such as the value of the manufactured home and the homeowner's income.

Q: Can I apply for the Homestead Exemption program if I rent a manufactured home?

A: No, the Homestead Exemption program is only available to homeowners of manufactured homes in Ohio.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTA MH55 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.