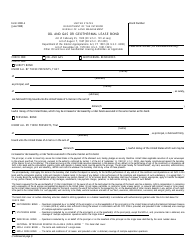

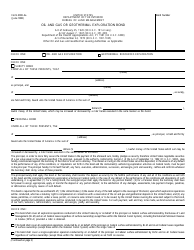

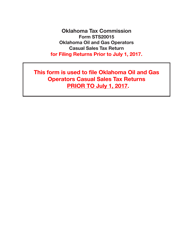

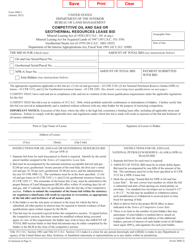

Form STS-20015-A Oklahoma Oil and Gas Operators Casual Sales Tax Return (For Filing Returns After July 1, 2017) - Oklahoma

What Is Form STS-20015-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

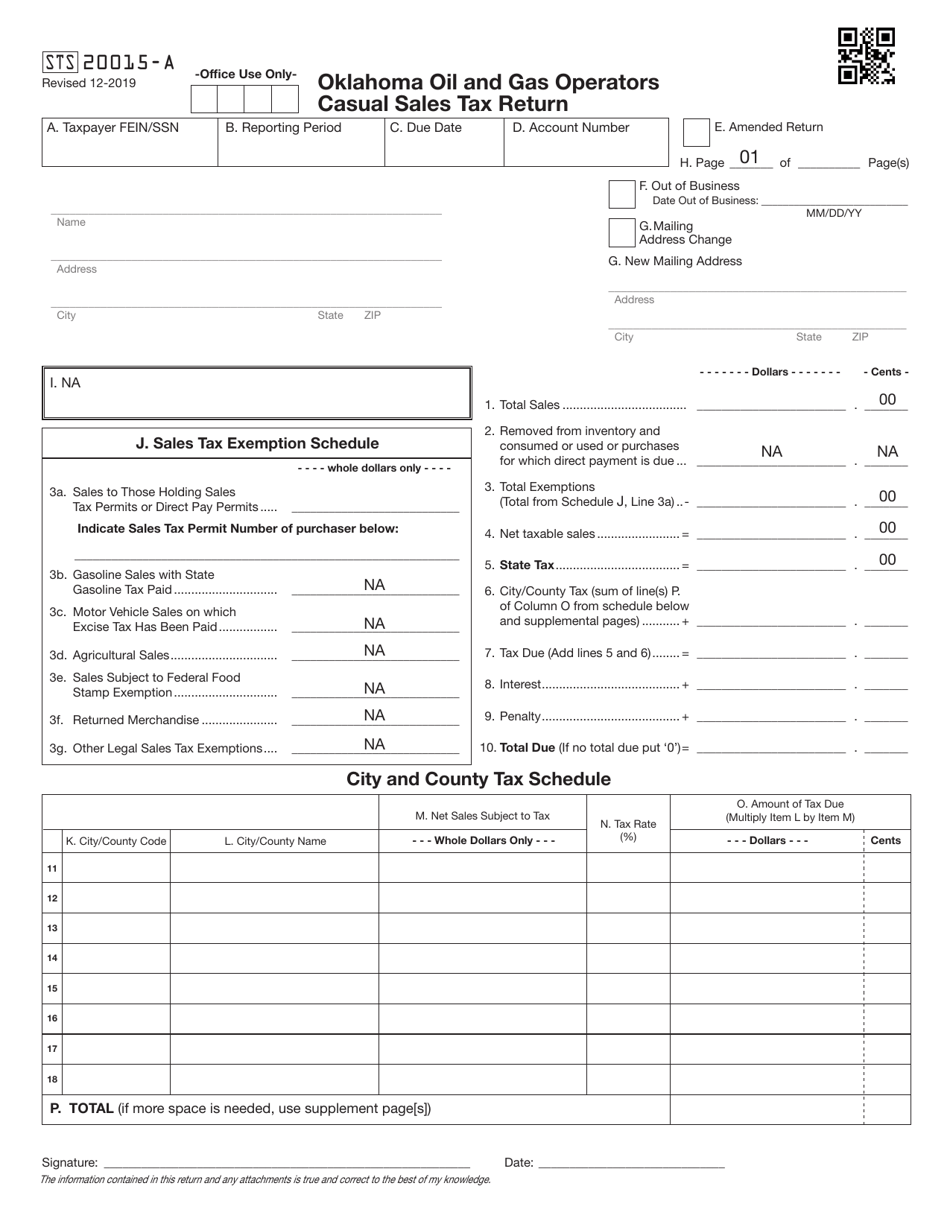

Q: What is Form STS-20015-A?

A: Form STS-20015-A is the Oklahoma Oil and Gas Operators Casual Sales Tax Return.

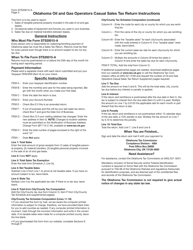

Q: Who needs to file Form STS-20015-A?

A: Oil and gas operators in Oklahoma who engage in casual sales need to file Form STS-20015-A.

Q: What is the purpose of Form STS-20015-A?

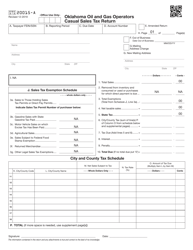

A: The purpose of Form STS-20015-A is to report and remit sales tax on casual sales of oil and gas in Oklahoma.

Q: When should Form STS-20015-A be filed?

A: Form STS-20015-A should be filed for returns after July 1, 2017.

Q: Is Form STS-20015-A only applicable for sales in Oklahoma?

A: Yes, Form STS-20015-A is specifically for sales within the state of Oklahoma.

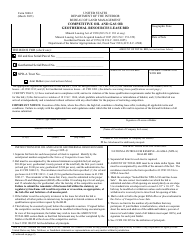

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STS-20015-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.