Form STW20008-A Tire Recycling Fee Return - Oklahoma

What Is Form STW20008-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form STW20008-A?

A: Form STW20008-A is the Tire Recycling Fee Return specific to Oklahoma.

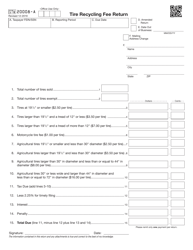

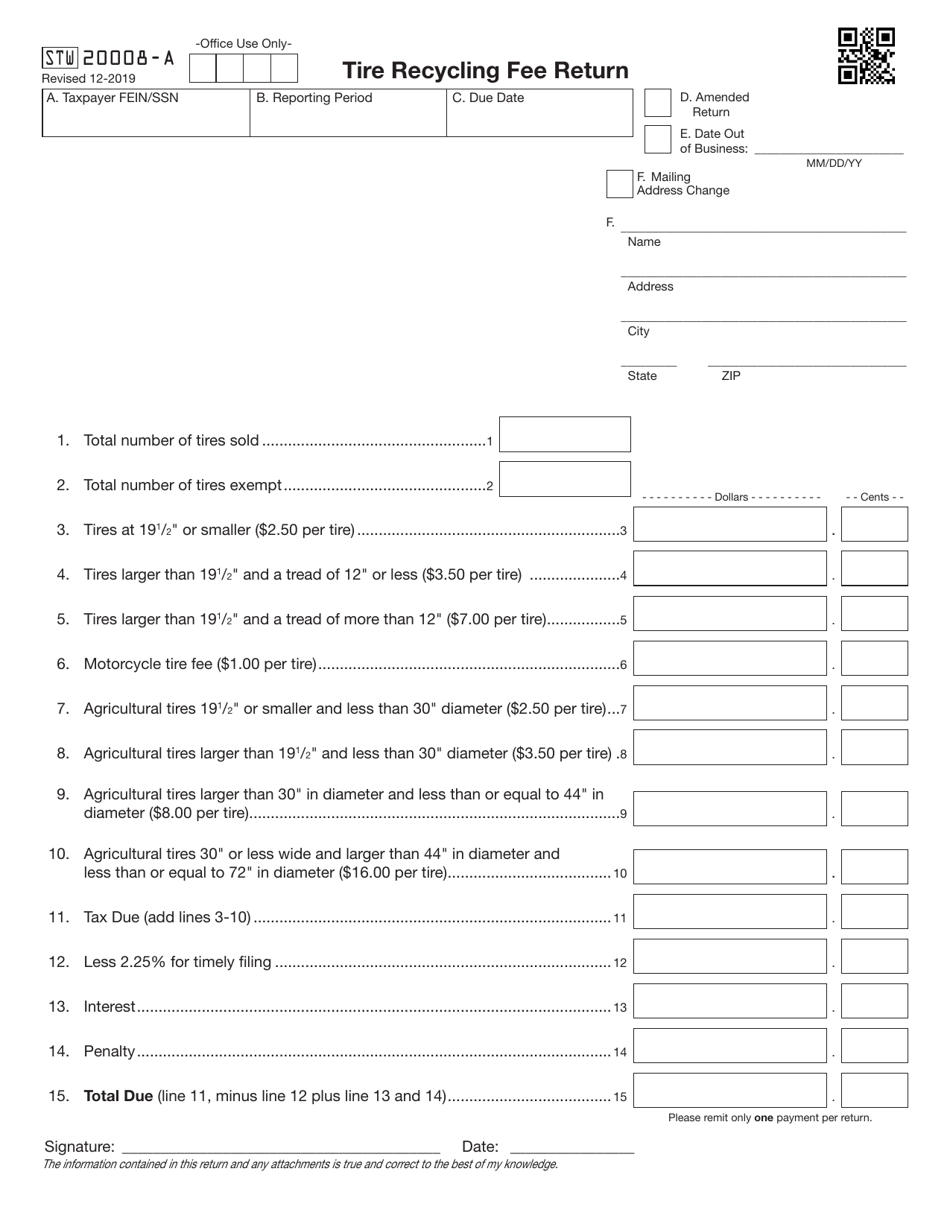

Q: What is the purpose of Form STW20008-A?

A: The purpose of Form STW20008-A is to report and remit the tire recycling fee imposed by the state of Oklahoma.

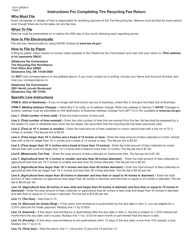

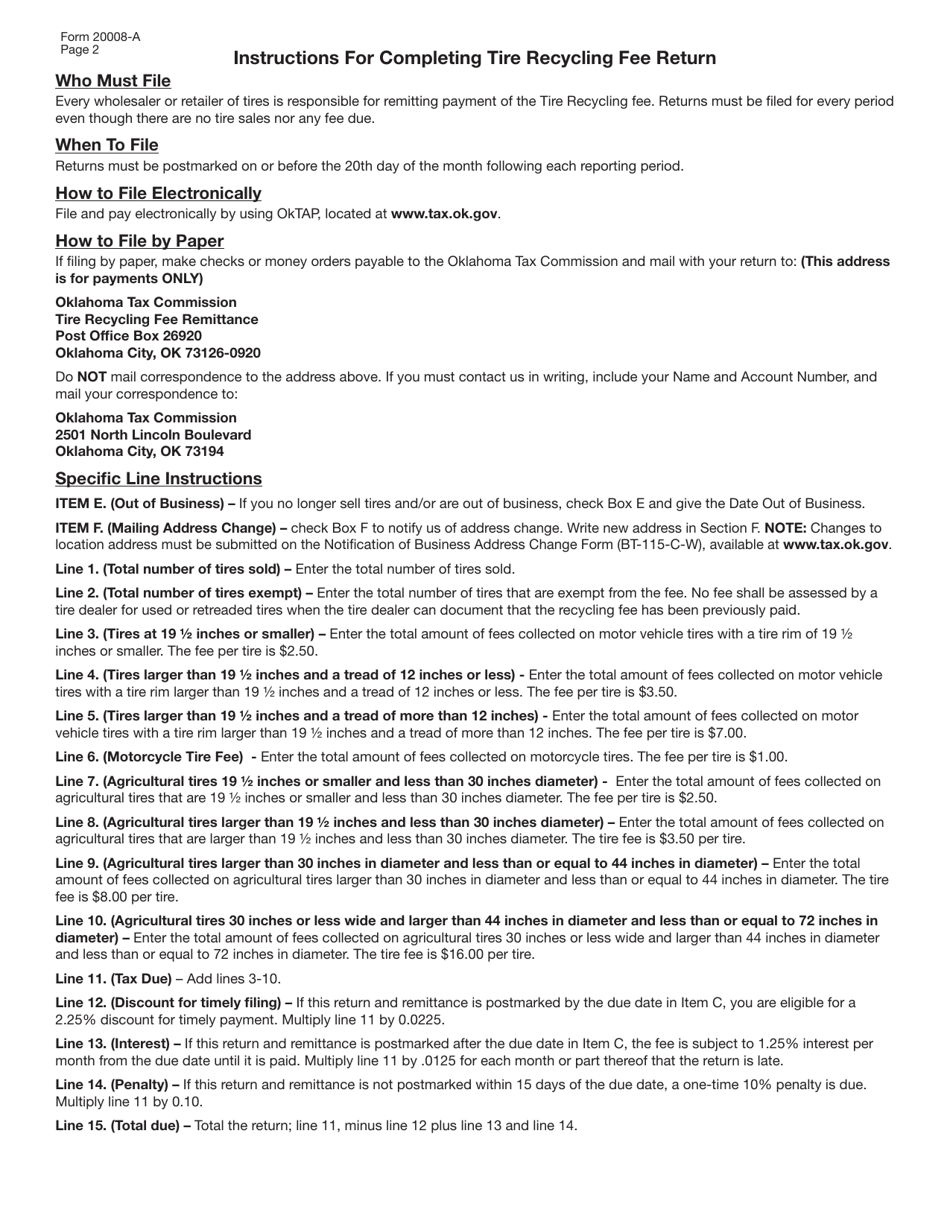

Q: Who needs to file Form STW20008-A?

A: Any person or business engaged in selling new tires in Oklahoma needs to file Form STW20008-A.

Q: When is Form STW20008-A due?

A: Form STW20008-A is due on a quarterly basis, with the due dates being April 30, July 31, October 31, and January 31.

Q: Is there a penalty for late filing or non-filing of Form STW20008-A?

A: Yes, there are penalties for late filing or non-filing of Form STW20008-A, including a $50 penalty for each return that is not filed on time.

Q: Are there any exemptions to the tire recycling fee?

A: Yes, there are exemptions to the tire recycling fee, such as tires sold directly to the United States government, or sales made to a licensee under the Oklahoma Used Tire Recycling Act.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STW20008-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.