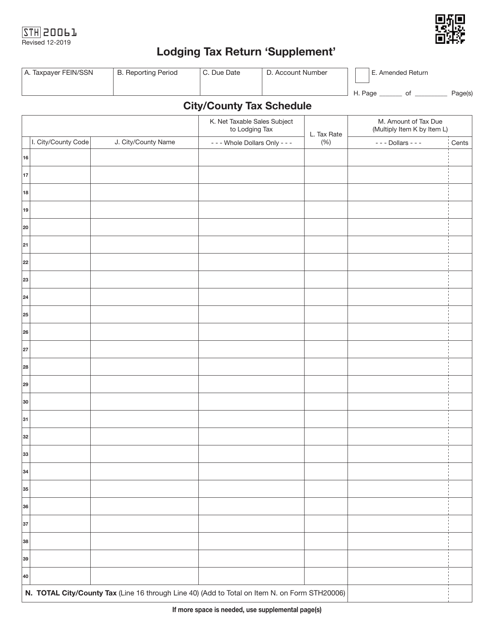

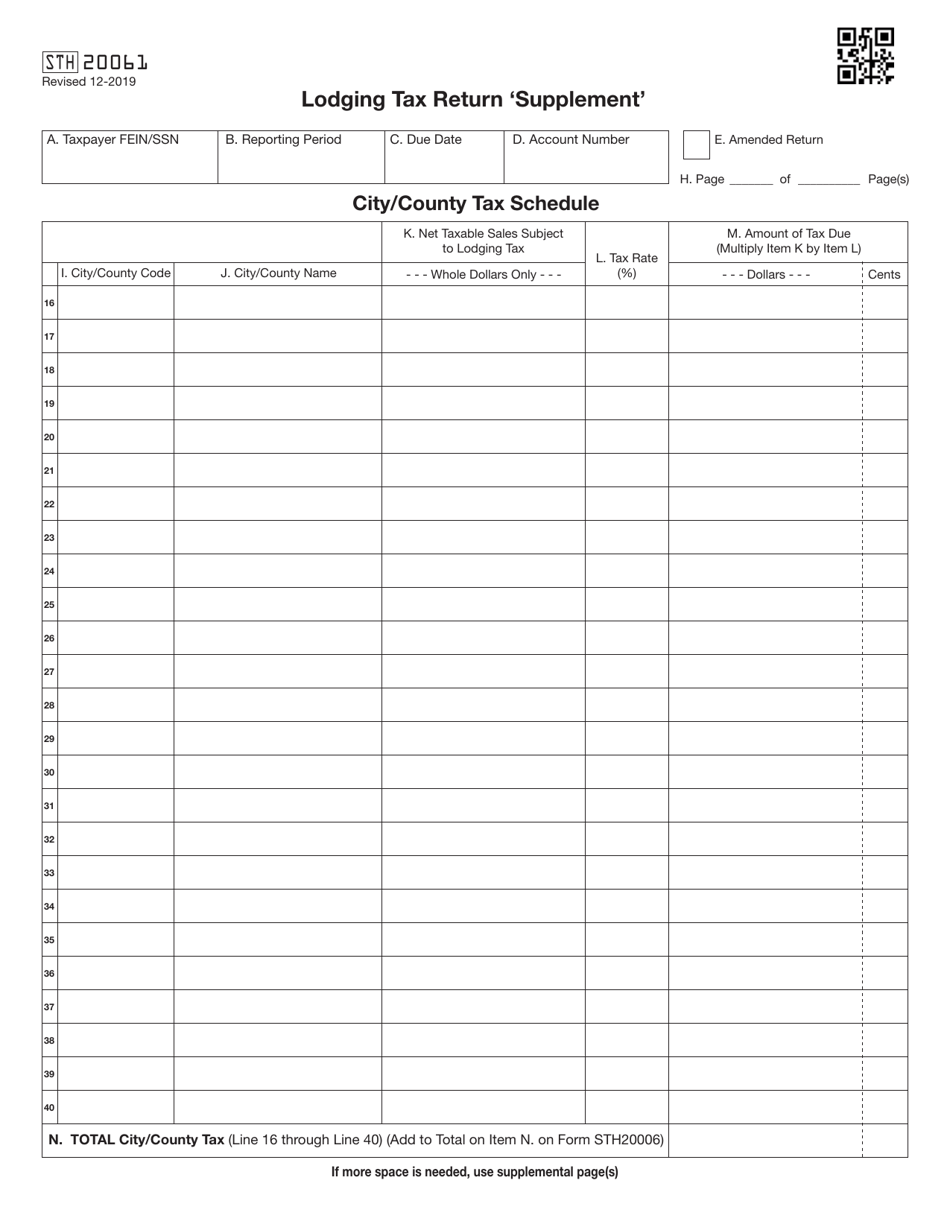

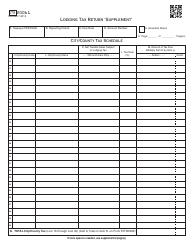

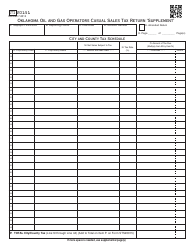

Form STH20061 Lodging Tax Return 'supplement' - Oklahoma

What Is Form STH20061?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form STH20061 Lodging Tax Return supplement?

A: The Form STH20061 Lodging Tax Return supplement is an additional form that supplements the regular lodging tax return in Oklahoma.

Q: Who needs to file the Form STH20061 Lodging Tax Return supplement?

A: Anyone who is required to file a lodging tax return in Oklahoma may also need to file the Form STH20061 Lodging Tax Return supplement.

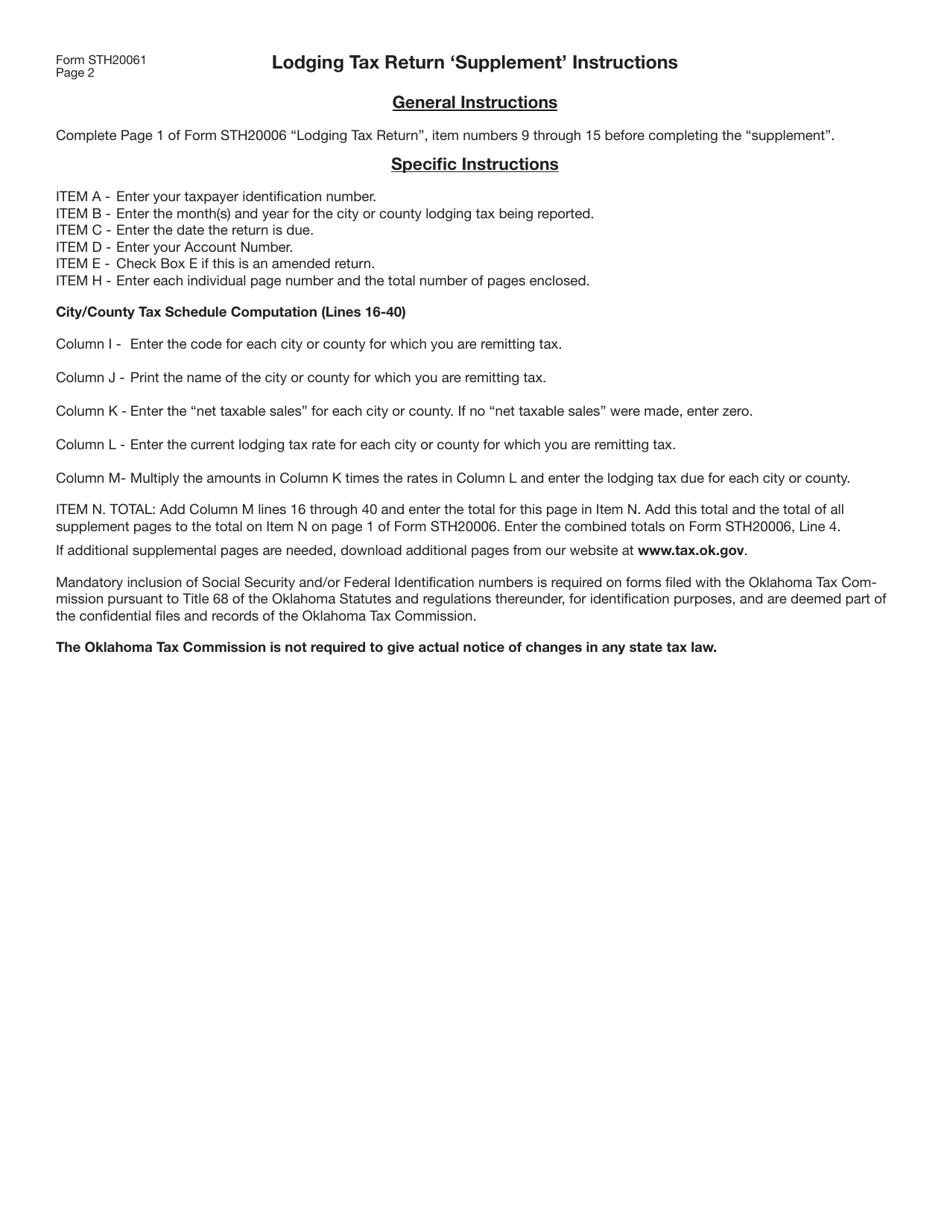

Q: What information is required on the Form STH20061 Lodging Tax Return supplement?

A: The Form STH20061 Lodging Tax Return supplement requires additional information related to the lodging tax return, such as the tax year, account number, and reporting period.

Q: Is there a deadline for filing the Form STH20061 Lodging Tax Return supplement?

A: Yes, the filing deadline for the Form STH20061 Lodging Tax Return supplement is the same as the regular lodging tax return deadline in Oklahoma.

Q: What happens if I don't file the Form STH20061 Lodging Tax Return supplement?

A: Failure to file the Form STH20061 Lodging Tax Return supplement may result in penalties and interest being assessed by the Oklahoma Tax Commission.

Q: Are there any exemptions or deductions available on the Form STH20061 Lodging Tax Return supplement?

A: The Form STH20061 Lodging Tax Return supplement does not provide any specific exemptions or deductions. However, you should consult the instructions or contact the Oklahoma Tax Commission for more information.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form STH20061 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.