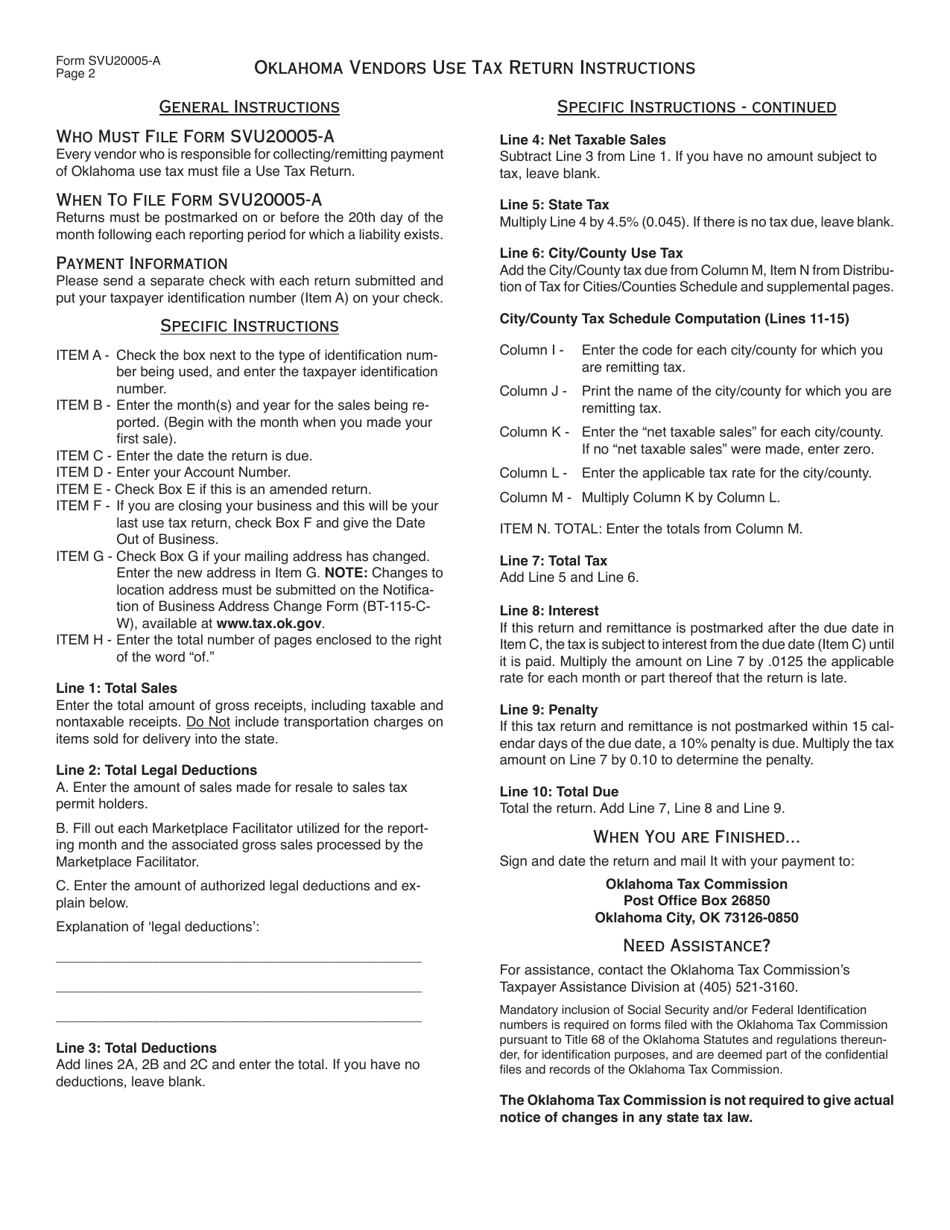

Form SVU20005-A Oklahoma Vendor Use Tax Return (For Filing Returns After July 1, 2017) - Oklahoma

What Is Form SVU20005-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the SVU20005-A Oklahoma Vendor Use Tax Return?

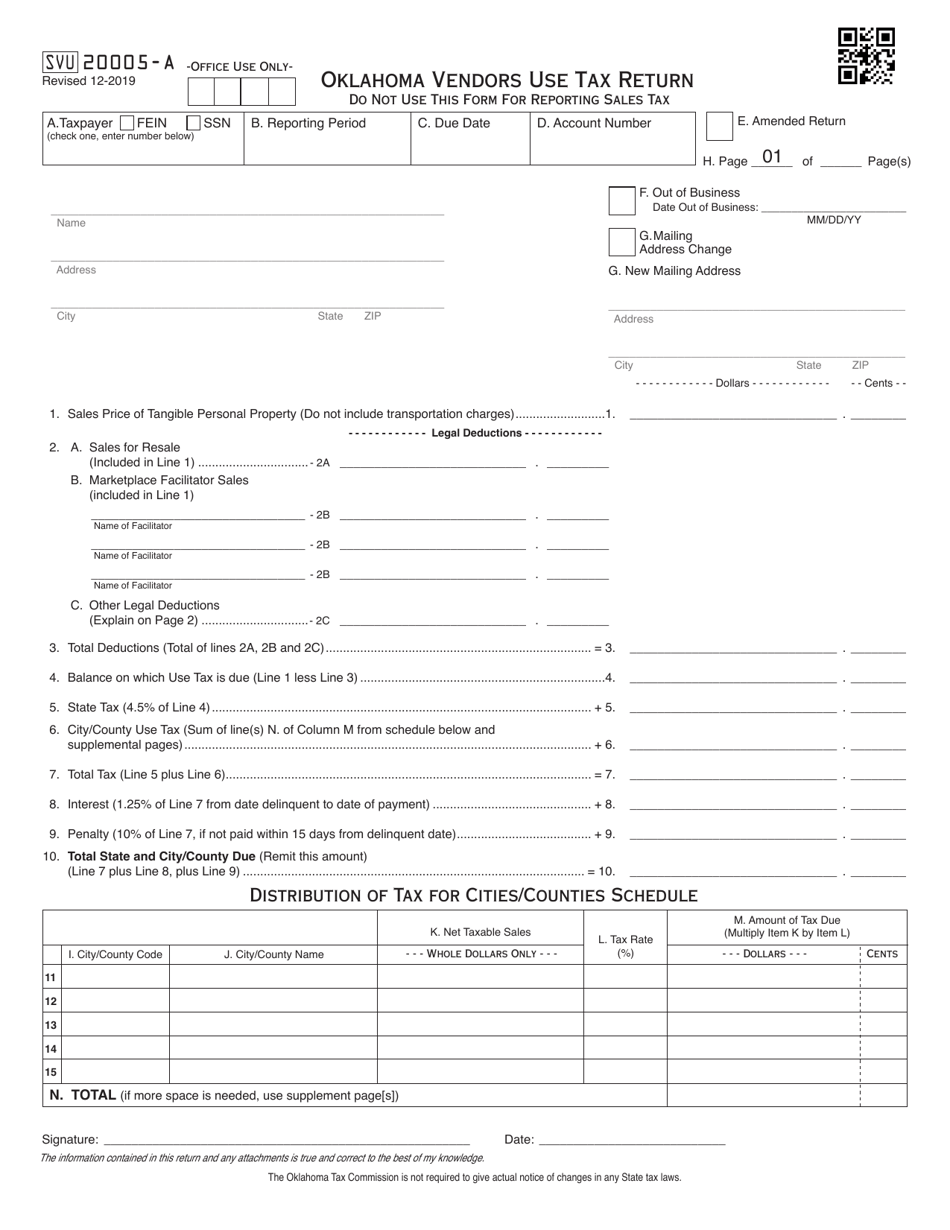

A: The SVU20005-A Oklahoma Vendor Use Tax Return is a form used to report and pay vendor use tax in Oklahoma.

Q: Who needs to file the SVU20005-A Oklahoma Vendor Use Tax Return?

A: Vendors who are not registered for sales tax in Oklahoma and are engaged in business activities that trigger a use tax liability need to file this return.

Q: When should the SVU20005-A Oklahoma Vendor Use Tax Return be filed?

A: This return should be filed after July 1, 2017 and is due on the 20th day of the month following the end of each calendar quarter.

Q: What is vendor use tax?

A: Vendor use tax is a tax imposed on tangible personal property purchased or acquired by a vendor for use, storage, or consumption in Oklahoma when the vendor has not paid sales tax on the purchase.

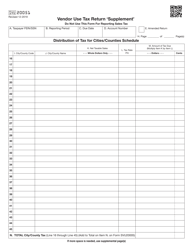

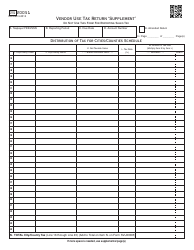

Q: What information is required to complete the SVU20005-A Oklahoma Vendor Use Tax Return?

A: Some of the information needed includes the vendor's information, total sales subject to use tax, purchases subject to use tax, and any exemption or deduction claimed.

Q: Are there any penalties for not filing the SVU20005-A Oklahoma Vendor Use Tax Return?

A: Yes, failure to file the return or pay the tax due may result in penalties, interest, and potential audit by the Oklahoma Tax Commission.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SVU20005-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.