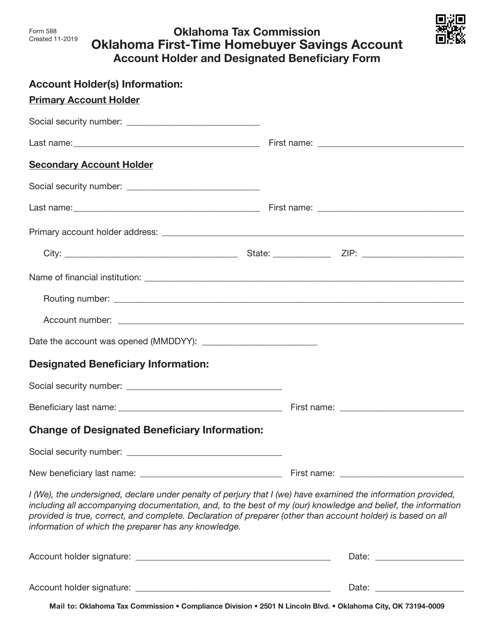

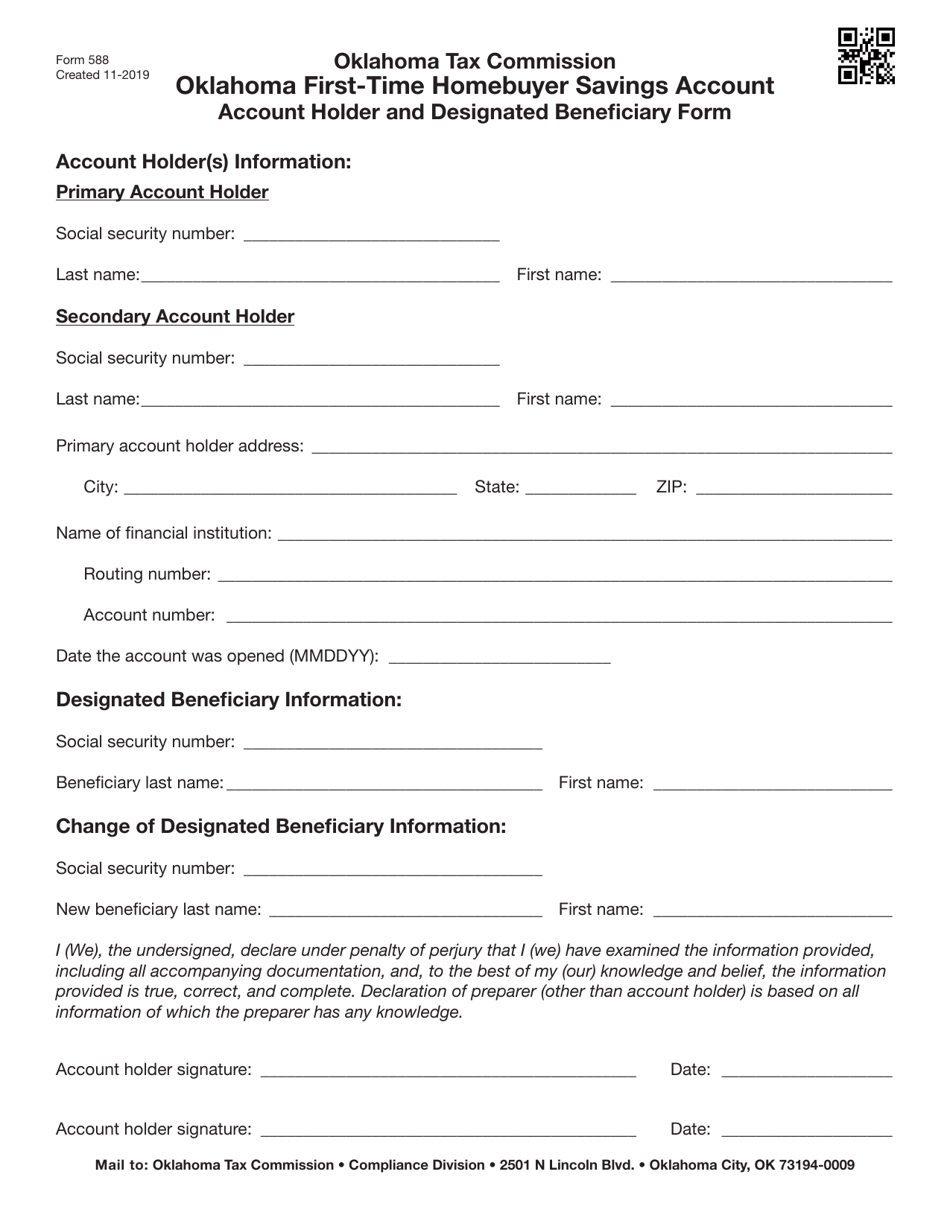

Form 588 Oklahoma First-Time Homebuyer Savings Account - Account Holder and Designated Beneficiary Form - Oklahoma

What Is Form 588?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 588?

A: Form 588 is the Oklahoma First-Time Homebuyer Savings Account - Account Holder and Designated Beneficiary Form.

Q: What is the purpose of Form 588?

A: The purpose of Form 588 is to establish and maintain a First-Time Homebuyer Savings Account in Oklahoma.

Q: Who is the Account Holder?

A: The Account Holder is the individual who opens and contributes to the First-Time Homebuyer Savings Account.

Q: Who is the Designated Beneficiary?

A: The Designated Beneficiary is the individual named by the Account Holder to be the recipient of the funds in the First-Time Homebuyer Savings Account.

Q: What information is required on Form 588?

A: Form 588 requires the Account Holder and Designated Beneficiary's personal information, account details, and contribution information.

Q: Can I use Form 588 for accounts in other states?

A: No, Form 588 is specific to establishing and maintaining a First-Time Homebuyer Savings Account in Oklahoma.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 588 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.