This version of the form is not currently in use and is provided for reference only. Download this version of

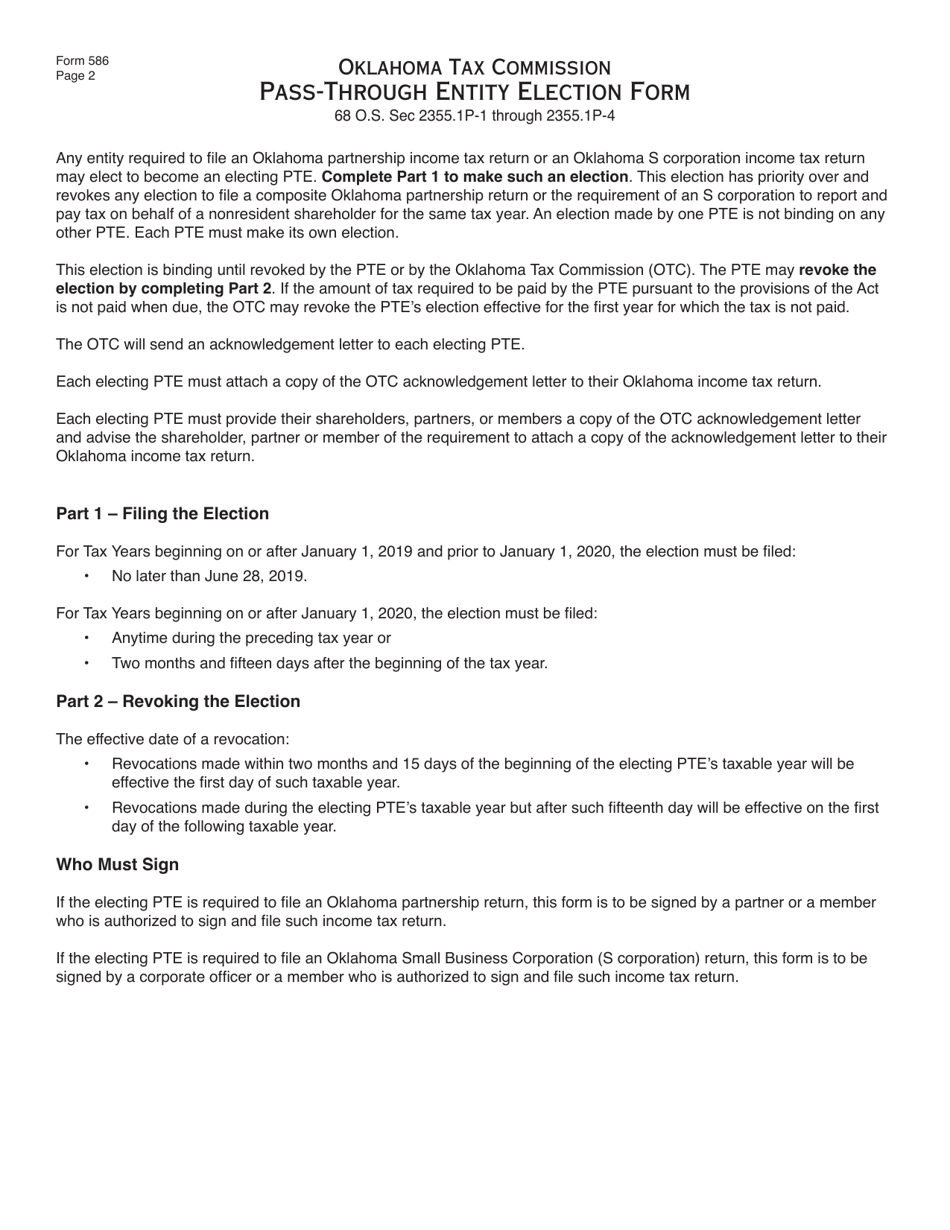

Form 586

for the current year.

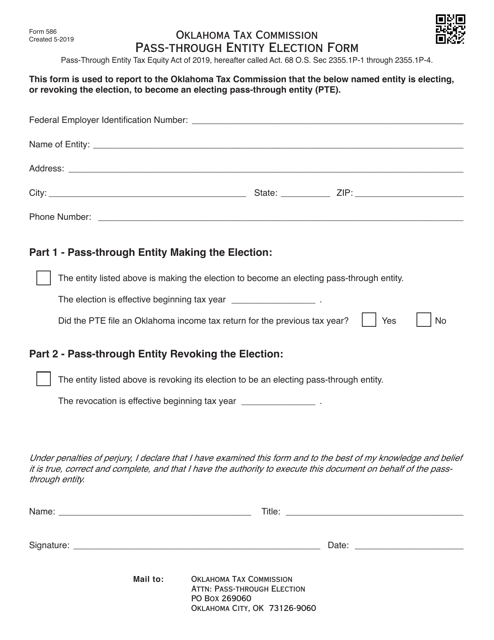

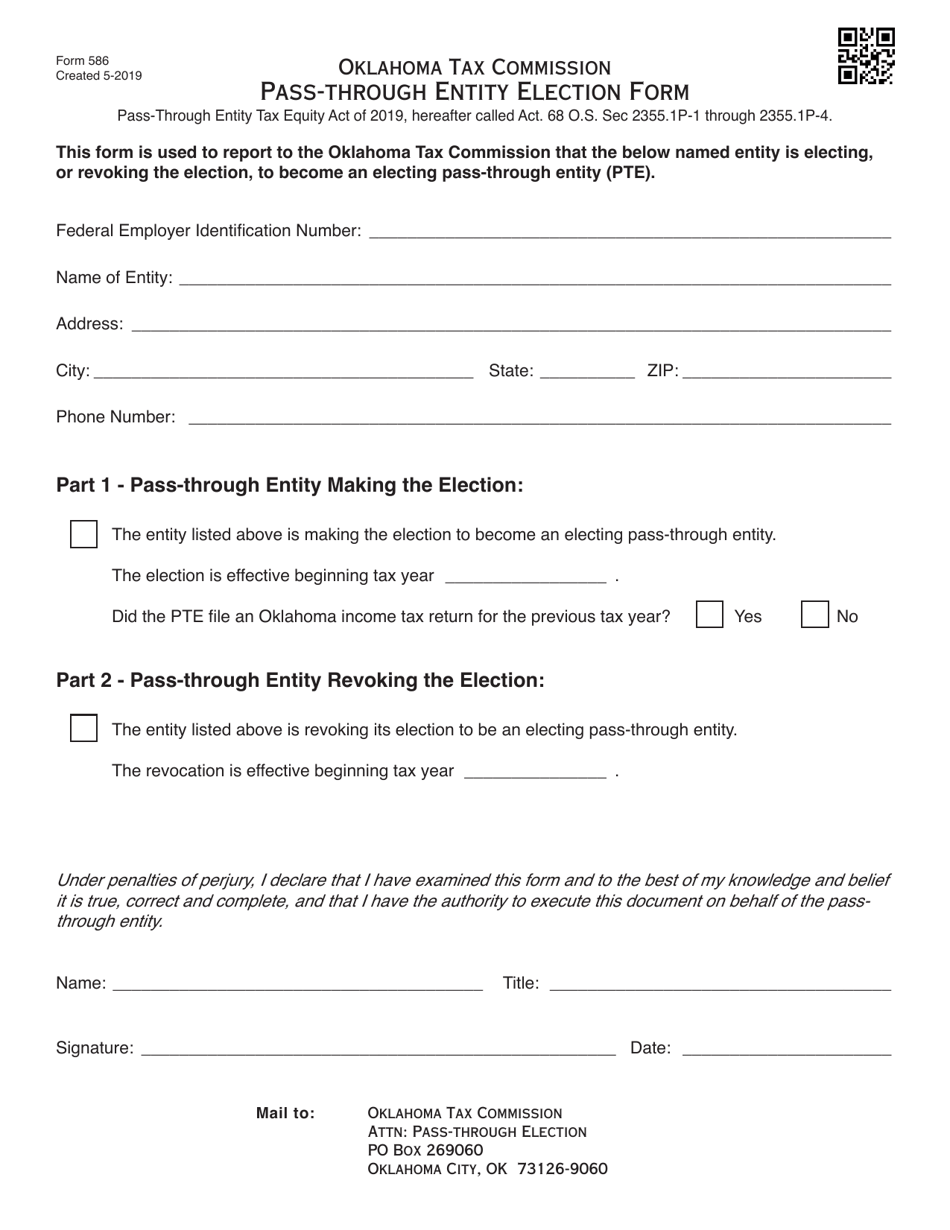

Form 586 Pass-Through Entity Election Form - Oklahoma

What Is Form 586?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 586?

A: Form 586 is the Pass-Through Entity Election Form.

Q: What is a pass-through entity?

A: A pass-through entity is a business structure that passes its income and tax liabilities to its owners or shareholders.

Q: Who should use Form 586?

A: Form 586 should be used by pass-through entities in Oklahoma who want to elect to be taxed at the entity level.

Q: What is the purpose of Form 586?

A: The purpose of Form 586 is to make an election for a pass-through entity to be taxed at the entity level in Oklahoma.

Q: Is filing Form 586 mandatory?

A: No, filing Form 586 is optional for pass-through entities in Oklahoma.

Q: When should Form 586 be filed?

A: Form 586 should be filed by the due date of the pass-through entity's tax return, which is typically the 15th day of the 4th month after the end of the tax year.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 586 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.