This version of the form is not currently in use and is provided for reference only. Download this version of

Form 567-A

for the current year.

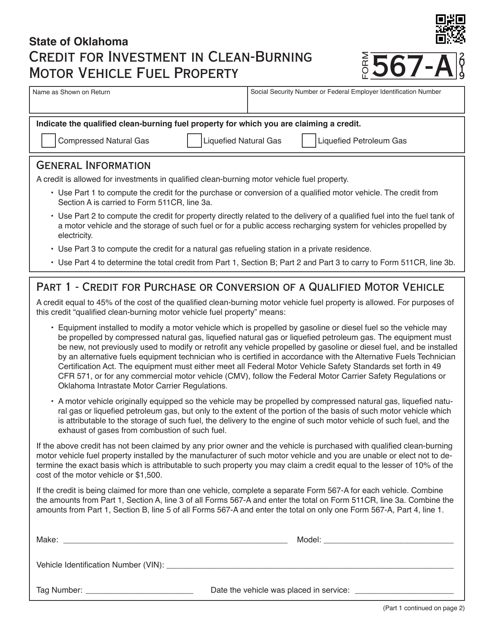

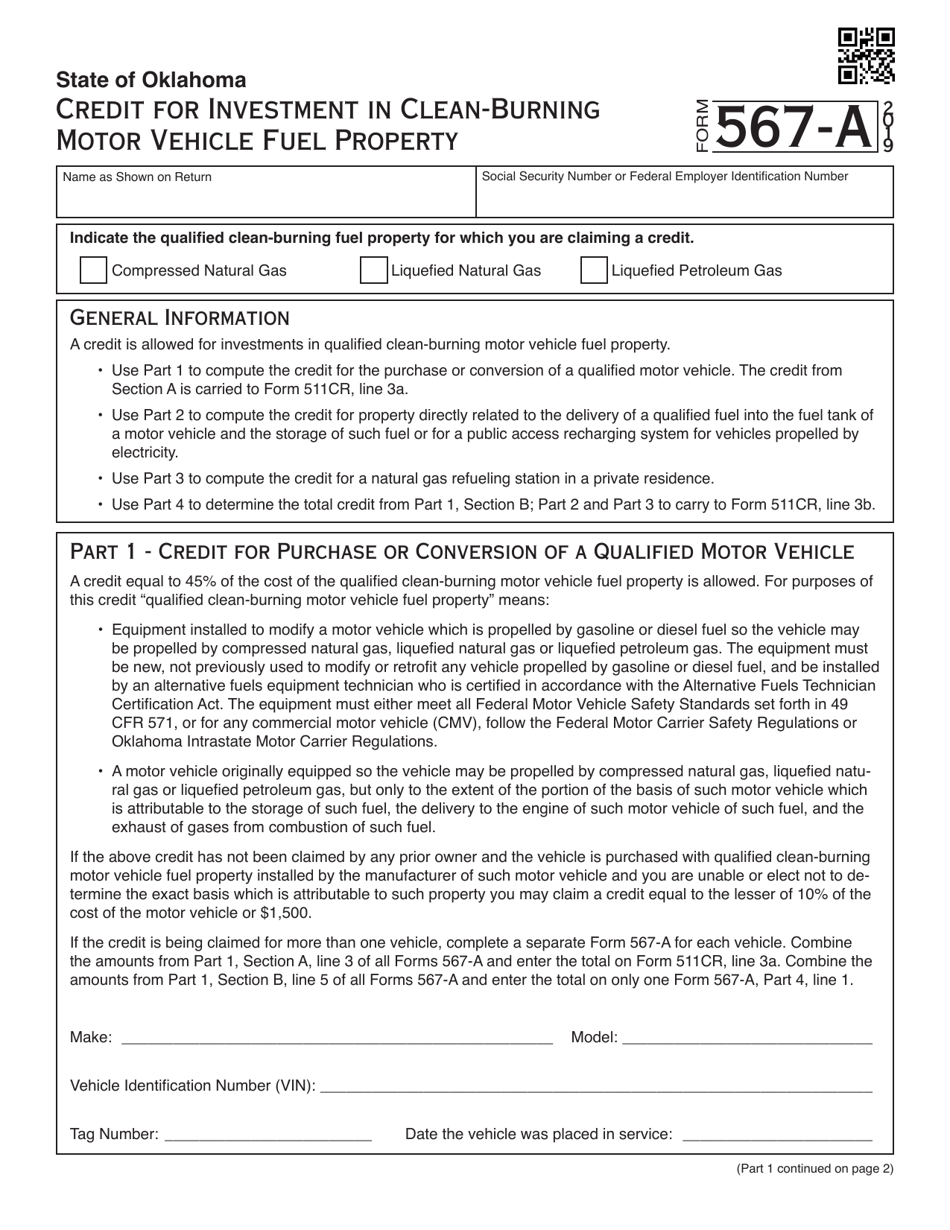

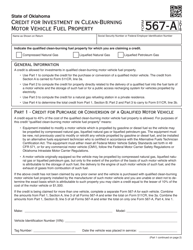

Form 567-A Credit for Investment in Clean-Burning Motor Vehicle Fuel Property - Oklahoma

What Is Form 567-A?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 567-A?

A: Form 567-A is a form used to claim credit for investment in clean-burning motor vehicle fuel property in Oklahoma.

Q: What is the purpose of Form 567-A?

A: The purpose of Form 567-A is to allow individuals or businesses to claim a credit for qualified investments made in clean-burning motor vehicle fuel property in Oklahoma.

Q: Who can use Form 567-A?

A: Any individual or business who has made qualified investments in clean-burning motor vehicle fuel property in Oklahoma can use Form 567-A to claim the credit.

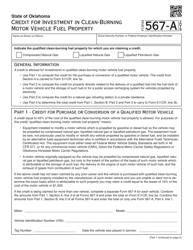

Q: What qualifies as clean-burning motor vehicle fuel property?

A: Clean-burning motor vehicle fuel property includes property used to store, distribute, or dispense clean-burning motor vehicle fuel.

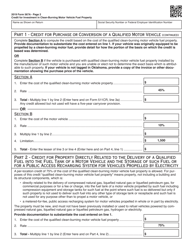

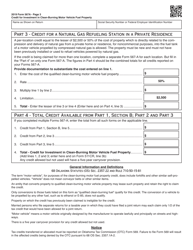

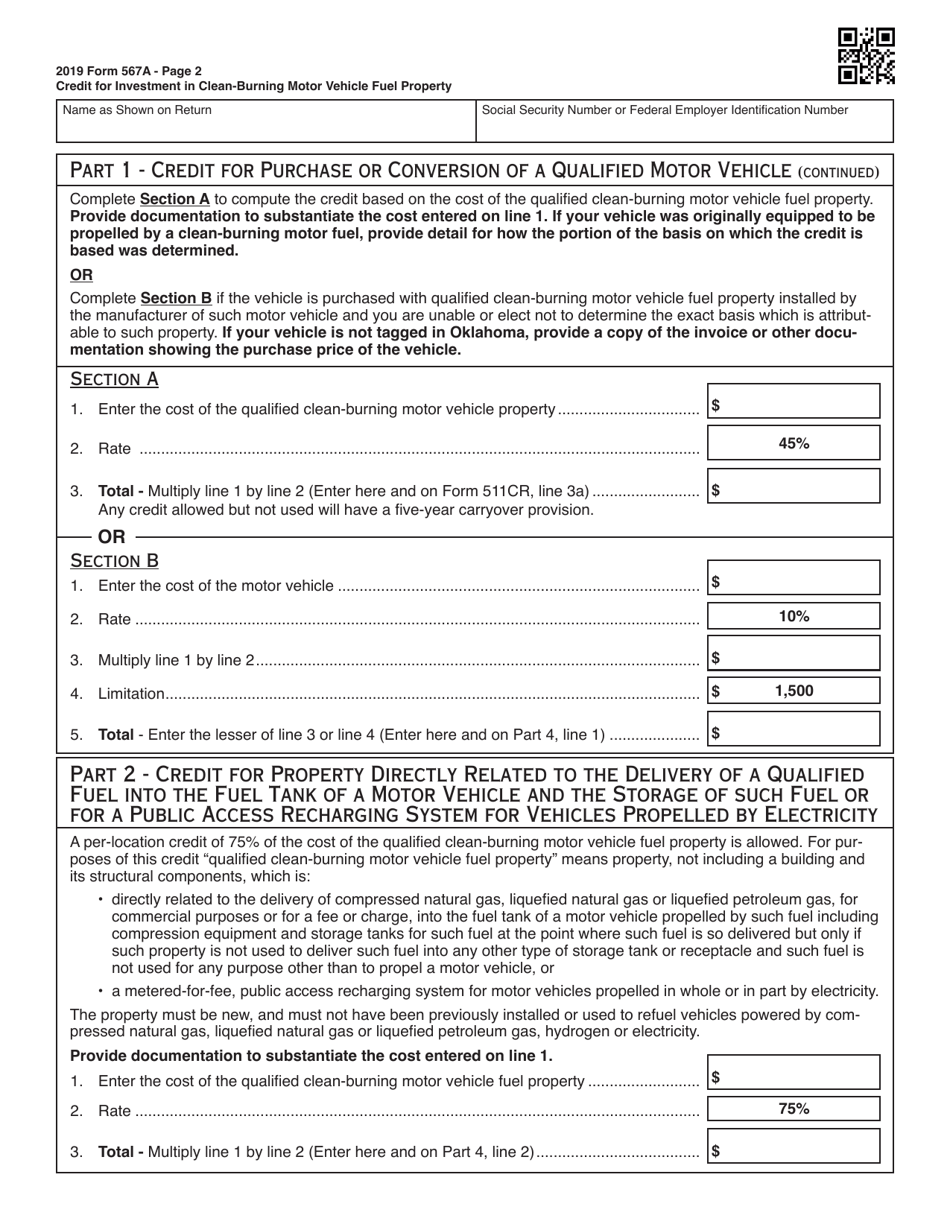

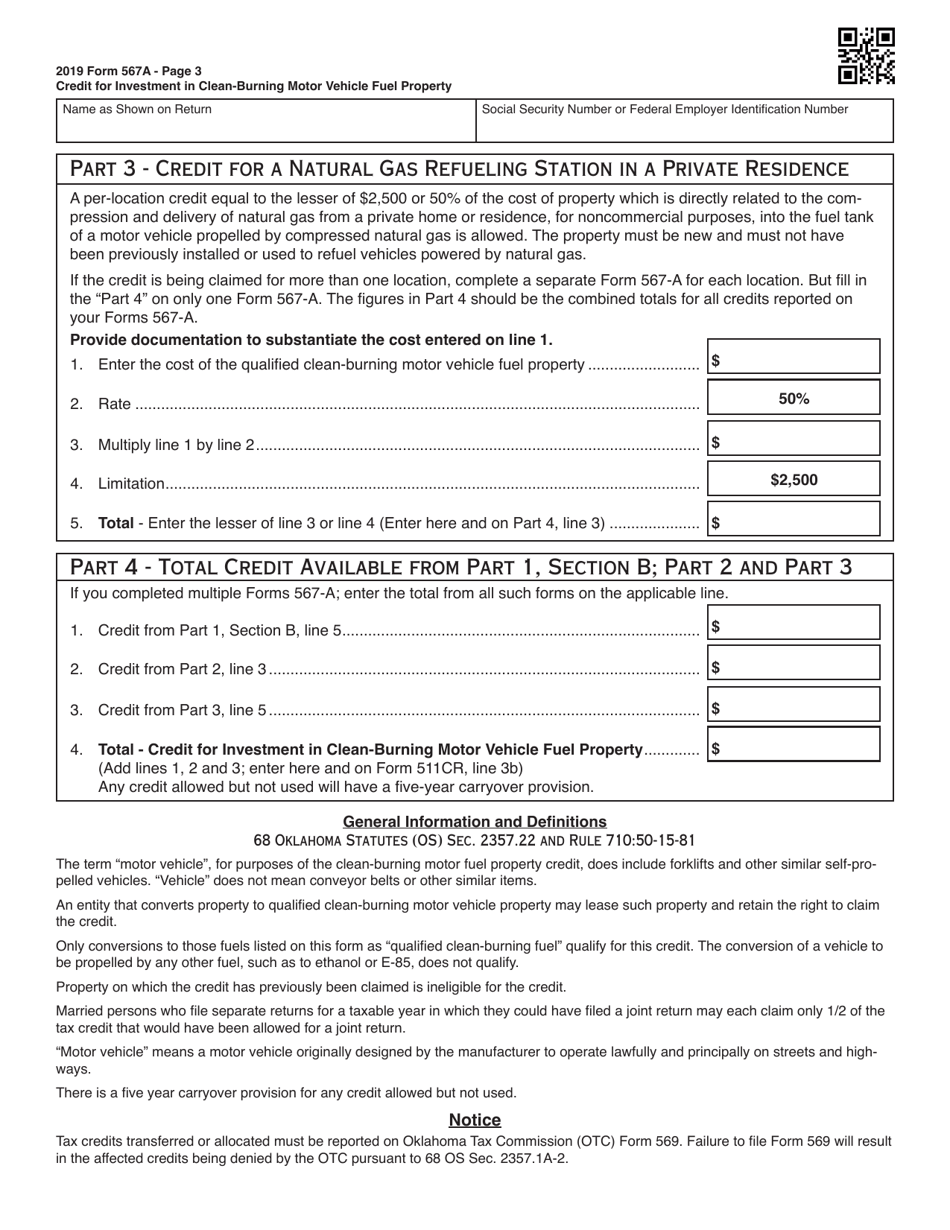

Q: How much credit can be claimed using Form 567-A?

A: The credit amount depends on the type and amount of qualified investments made. Refer to the instructions provided with the form for specific details.

Q: What supporting documents are required when filing Form 567-A?

A: Supporting documents such as invoices, receipts, and proof of payment should be included when filing Form 567-A to substantiate the qualified investments made.

Q: Is there a deadline for filing Form 567-A?

A: Yes, the deadline for filing Form 567-A is usually April 15th of the year following the year in which the investment was made. However, it is recommended to check the specific year's instructions for updated deadline information.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 567-A by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.