This version of the form is not currently in use and is provided for reference only. Download this version of

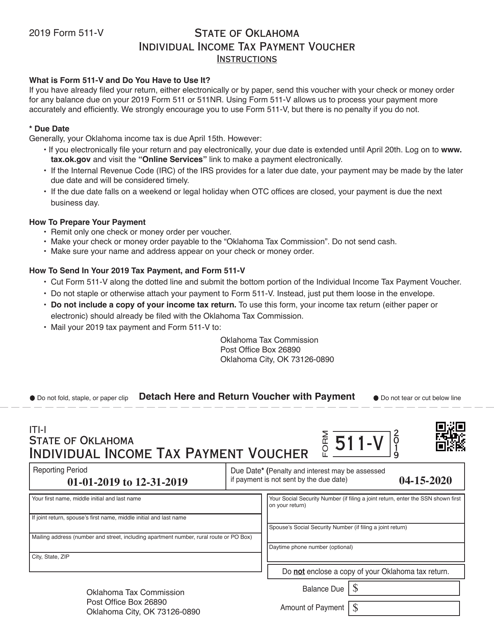

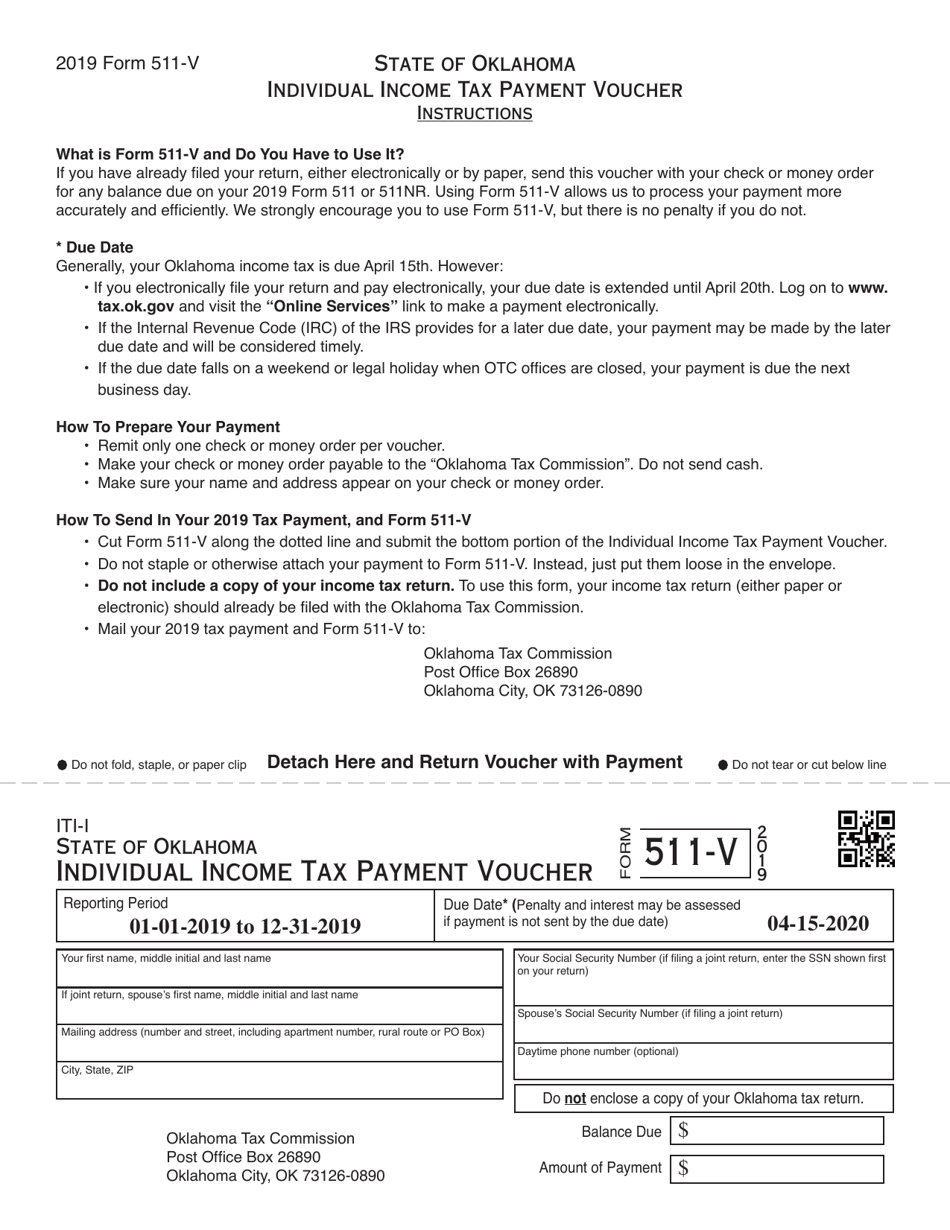

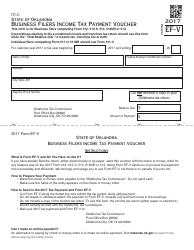

Form 511-V

for the current year.

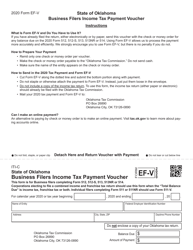

Form 511-V Individual Income Tax Payment Voucher - Oklahoma

What Is Form 511-V?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

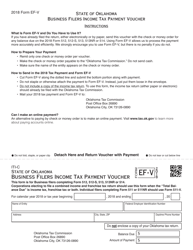

Q: What is Form 511-V?

A: Form 511-V is an Individual Income Tax Payment Voucher for the state of Oklahoma.

Q: Who needs to file Form 511-V?

A: Individuals who need to make a payment for their Oklahoma state income taxes can use Form 511-V.

Q: What is the purpose of Form 511-V?

A: The purpose of Form 511-V is to provide a voucher for taxpayers to include with their payment when they owe additional income tax to Oklahoma.

Q: When is Form 511-V due?

A: Form 511-V is due on the same date as the individual income tax return, which is typically April 15th.

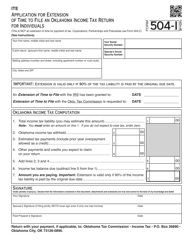

Q: What should I do if I made a mistake on Form 511-V?

A: If you made a mistake on Form 511-V, you should correct the error and submit a revised voucher with the correct information.

Q: Is Form 511-V the same as the income tax return?

A: No, Form 511-V is not the same as the income tax return. It is only used for submitting a payment.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 511-V by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.