This version of the form is not currently in use and is provided for reference only. Download this version of

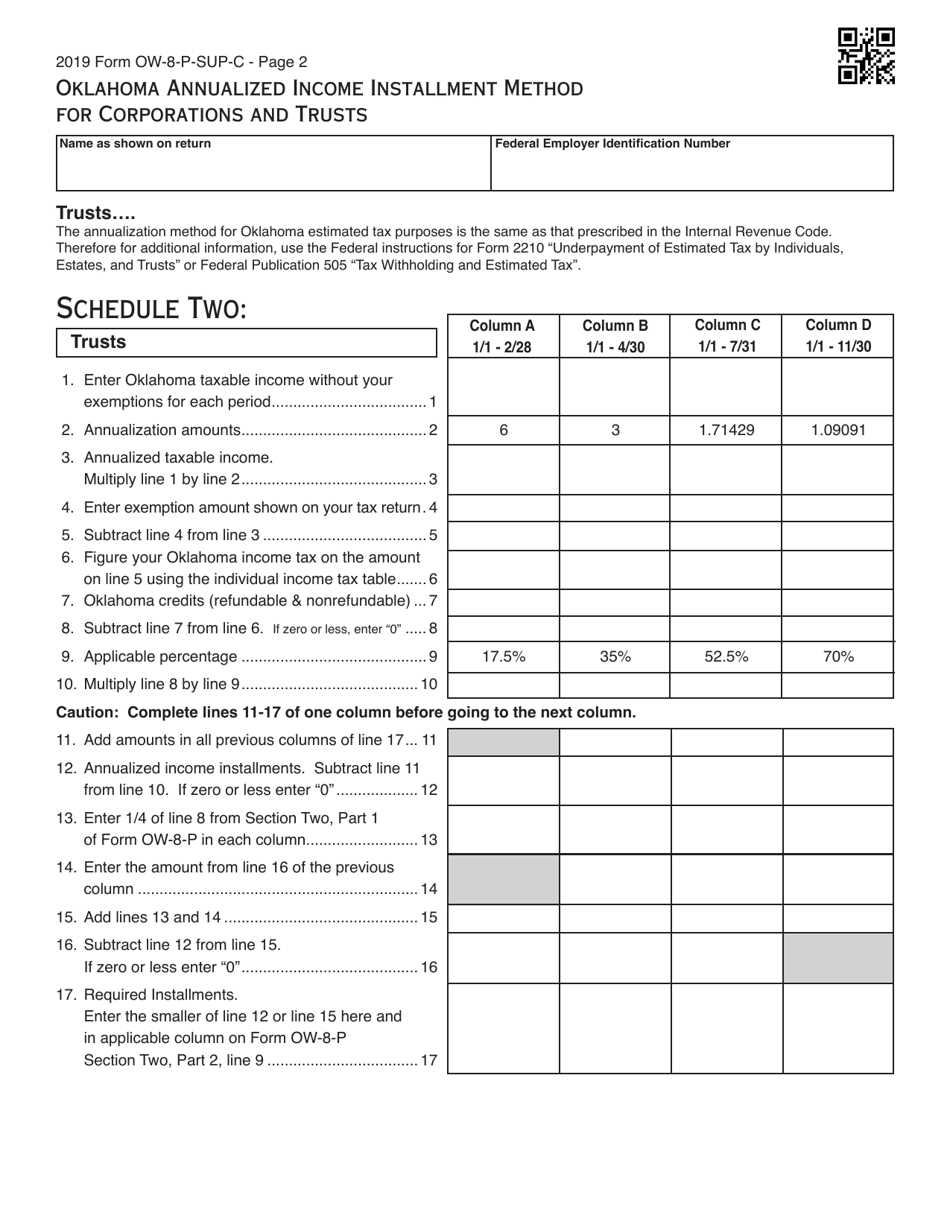

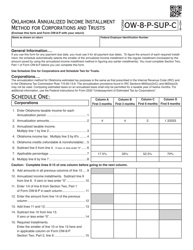

Form OW-8-P-SUP-C

for the current year.

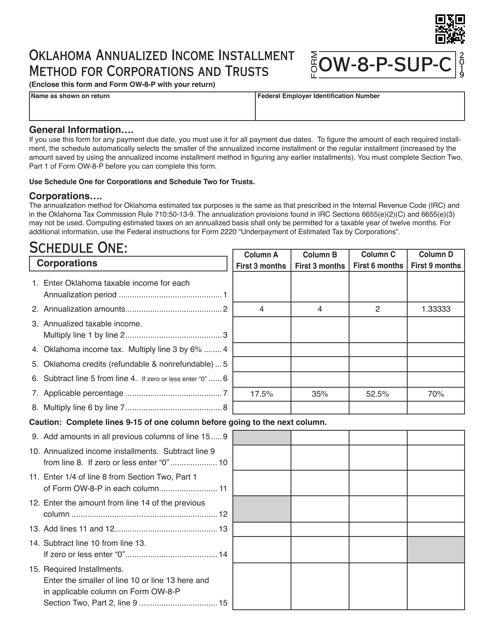

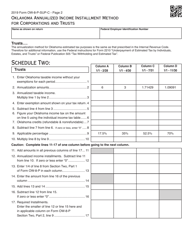

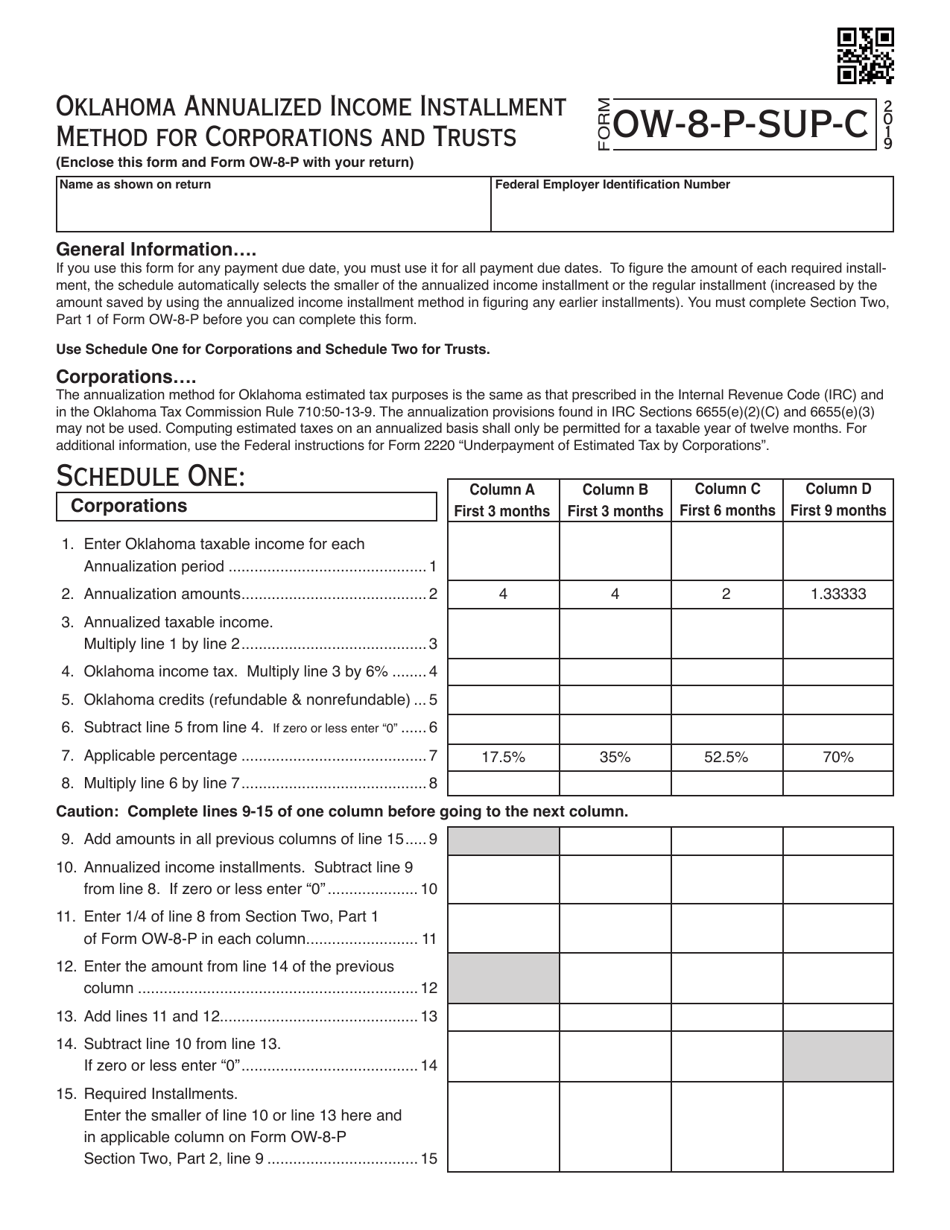

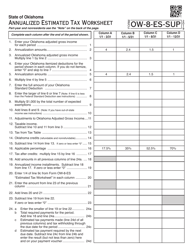

Form OW-8-P-SUP-C Oklahoma Annualized Income Installment Methods for Corporations and Trusts - Oklahoma

What Is Form OW-8-P-SUP-C?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OW-8-P-SUP-C?

A: Form OW-8-P-SUP-C is a form used by corporations and trusts in Oklahoma to calculate and report annualized income installment methods.

Q: Who needs to file Form OW-8-P-SUP-C?

A: Corporations and trusts in Oklahoma who are required to make estimated tax payments based on their annualized income must file Form OW-8-P-SUP-C.

Q: What is the purpose of Form OW-8-P-SUP-C?

A: The purpose of Form OW-8-P-SUP-C is to calculate and report the estimated tax payments for corporations and trusts in Oklahoma.

Q: What are annualized income installment methods?

A: Annualized income installment methods are methods used to calculate and make estimated tax payments throughout the year based on the corporation or trust's income accrued during different periods.

Form Details:

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OW-8-P-SUP-C by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.