This version of the form is not currently in use and is provided for reference only. Download this version of

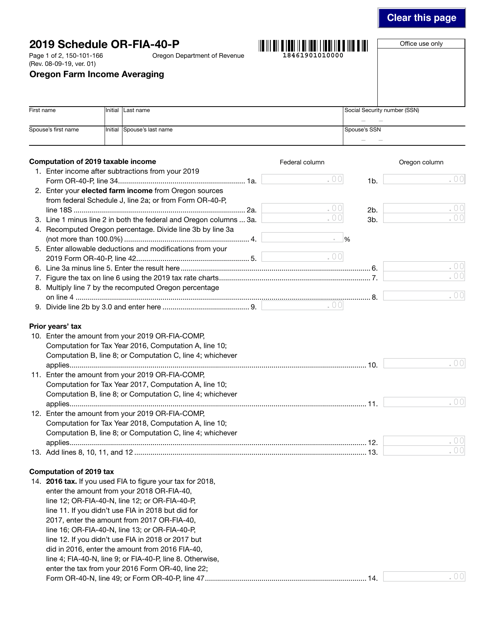

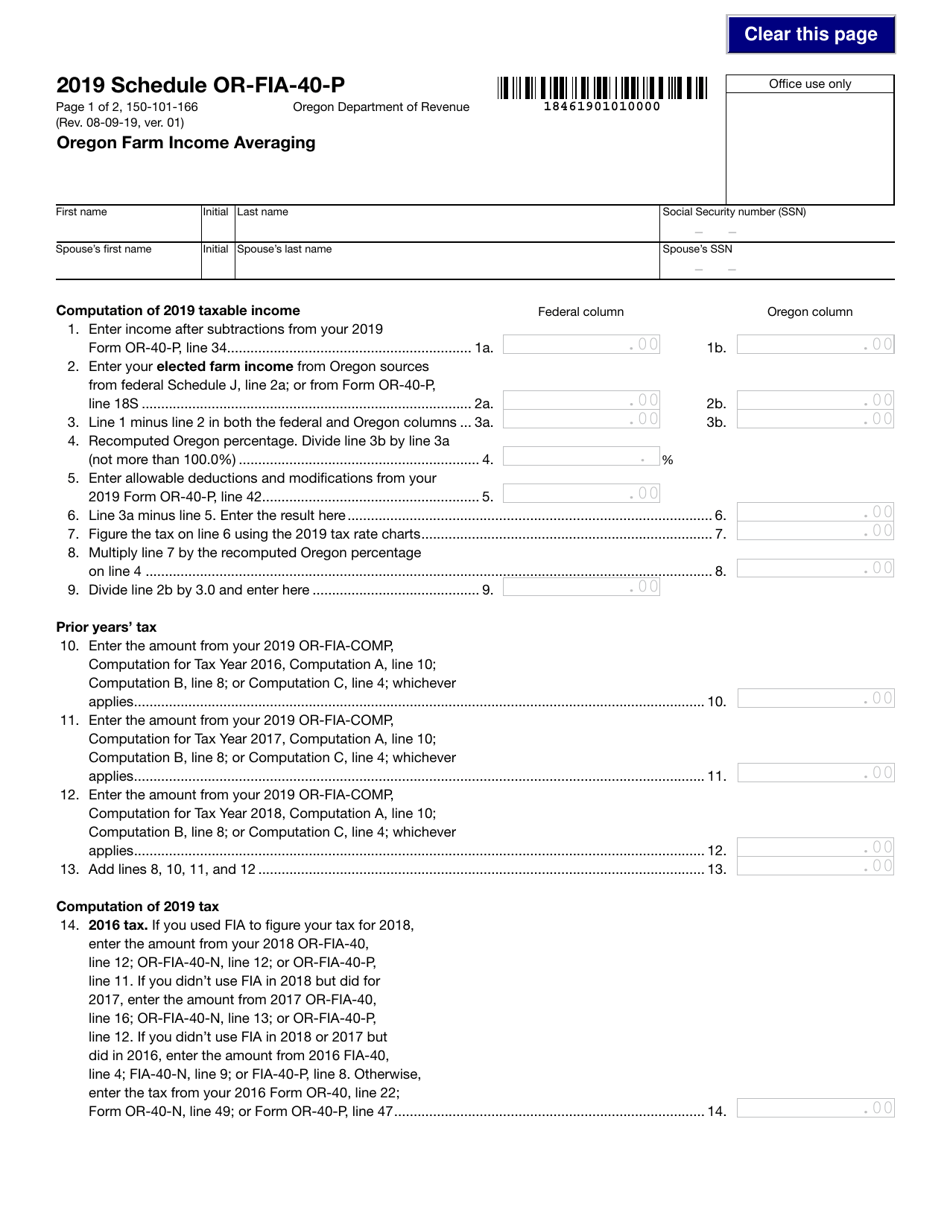

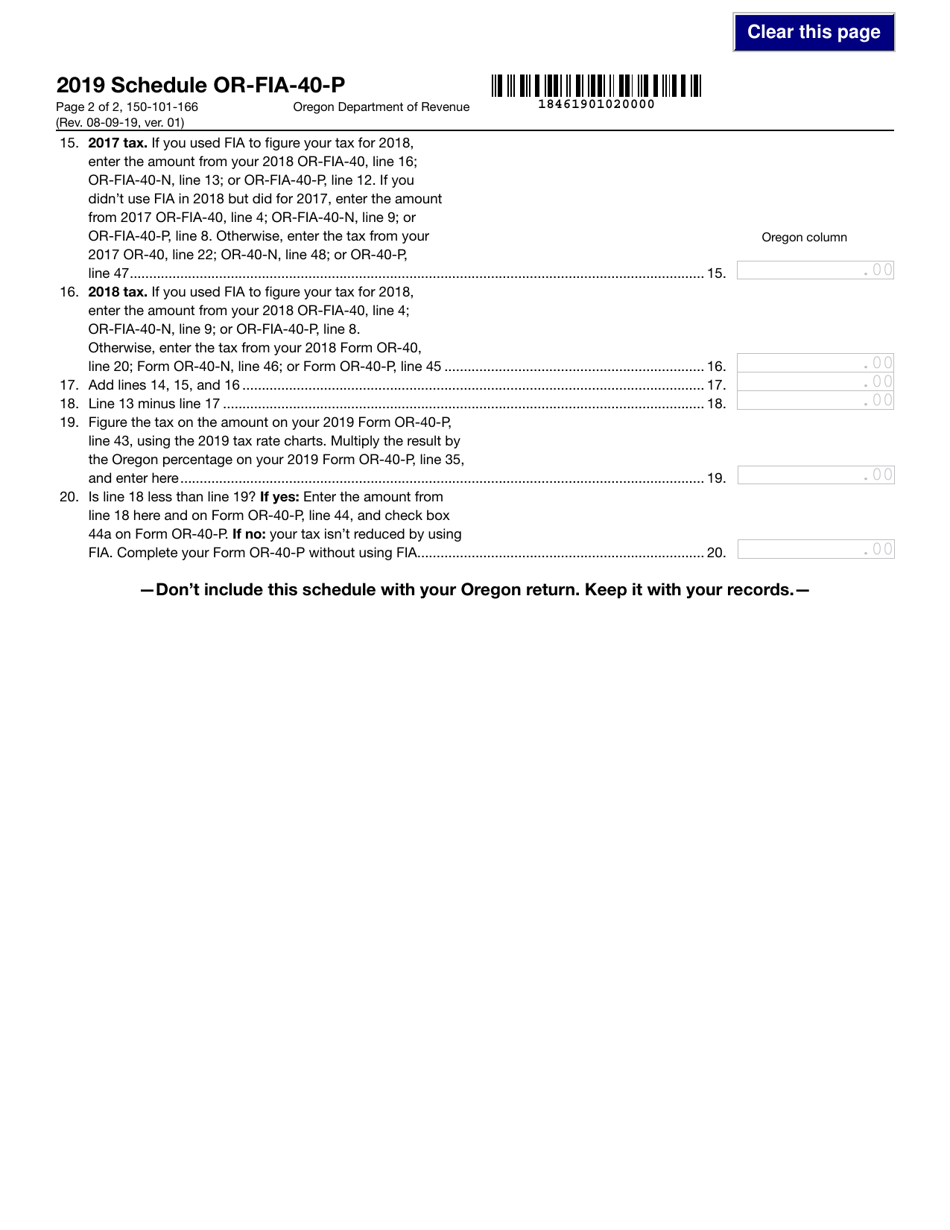

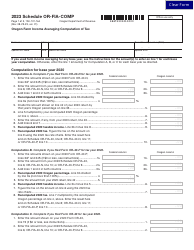

Form 150-101-166 Schedule OR-FIA-40-P

for the current year.

Form 150-101-166 Schedule OR-FIA-40-P Oregon Farm Income Averaging - Oregon

What Is Form 150-101-166 Schedule OR-FIA-40-P?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-166?

A: Form 150-101-166 is the Oregon Farm Income Averaging Schedule.

Q: What is Schedule OR-FIA-40-P?

A: Schedule OR-FIA-40-P is the specific schedule within Form 150-101-166 for Oregon Farm Income Averaging.

Q: What is Oregon Farm Income Averaging?

A: Oregon Farm Income Averaging is a method used by farmers in Oregon to reduce their tax liability by averaging their farm income over a period of years.

Q: How does Oregon Farm Income Averaging work?

A: Farmers can elect to average their income for tax purposes by using Schedule OR-FIA-40-P. This allows them to spread out the income over several years, potentially lowering their tax rate.

Q: Who can use Form 150-101-166 Schedule OR-FIA-40-P?

A: Form 150-101-166 Schedule OR-FIA-40-P is specifically designed for farmers in Oregon who want to take advantage of income averaging.

Q: Is using Oregon Farm Income Averaging beneficial?

A: Using Oregon Farm Income Averaging can be beneficial for farmers as it allows them to potentially reduce their tax liability by spreading out their income over several years.

Q: Are there any eligibility requirements for Oregon Farm Income Averaging?

A: Yes, farmers must meet certain eligibility requirements to use Oregon Farm Income Averaging, as outlined in the instructions for Form 150-101-166 Schedule OR-FIA-40-P.

Q: Can I use Oregon Farm Income Averaging if I am not a farmer?

A: No, Oregon Farm Income Averaging is specifically designed for farmers and cannot be used by individuals who are not engaged in farming activities.

Q: Are there any limitations to Oregon Farm Income Averaging?

A: Yes, there are limitations to Oregon Farm Income Averaging, including a maximum number of years that can be averaged and certain restrictions on the types of farming activities that qualify.

Form Details:

- Released on August 9, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-166 Schedule OR-FIA-40-P by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.