This version of the form is not currently in use and is provided for reference only. Download this version of

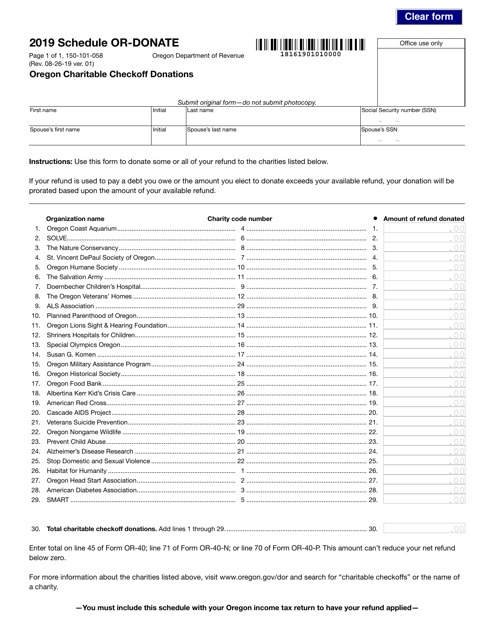

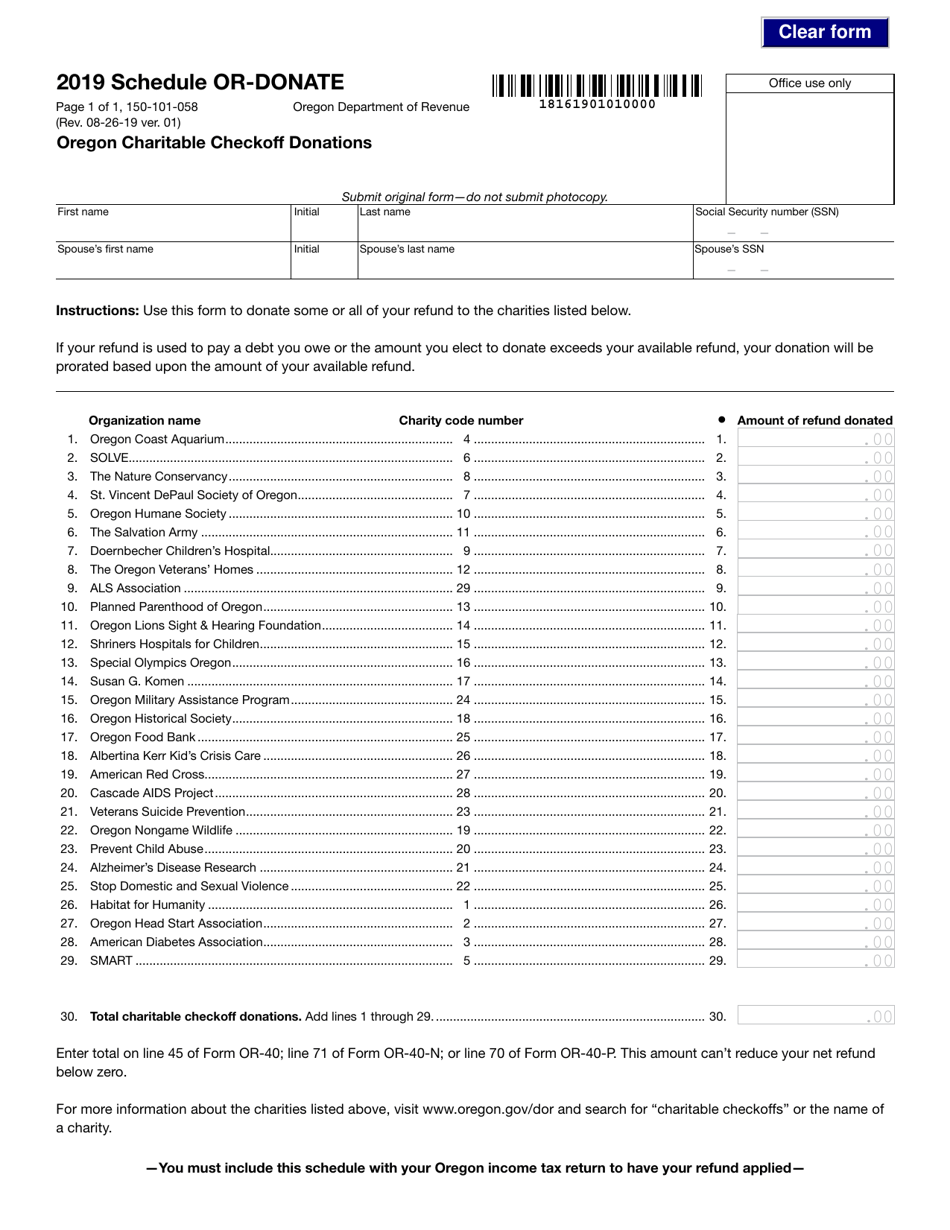

Form 150-101-058 Schedule OR-DONATE

for the current year.

Form 150-101-058 Schedule OR-DONATE Oregon Charitable Checkoff Donations - Oregon

What Is Form 150-101-058 Schedule OR-DONATE?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-058?

A: Form 150-101-058 is a schedule used in Oregon to report charitable checkoff donations.

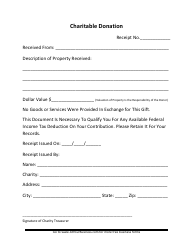

Q: What is a charitable checkoff donation?

A: A charitable checkoff donation is a voluntary contribution made by individuals on their tax return to support specific charitable causes.

Q: What is the purpose of Form 150-101-058?

A: The purpose of Form 150-101-058 is to itemize and report the charitable checkoff donations made by the taxpayer.

Q: Do I have to fill out Form 150-101-058?

A: You only need to fill out Form 150-101-058 if you made charitable checkoff donations and want to itemize and report them on your tax return.

Q: When is the deadline for filing Form 150-101-058?

A: The deadline for filing Form 150-101-058 is the same as the deadline for filing your Oregon state tax return.

Q: Can I claim a tax deduction for charitable checkoff donations?

A: Yes, you may be eligible to claim a tax deduction for charitable checkoff donations on your federal and/or state tax return.

Q: Are there any specific requirements for claiming a tax deduction for charitable checkoff donations?

A: Yes, there are specific requirements and limitations for claiming a tax deduction for charitable checkoff donations. You should consult the instructions for Form 150-101-058 or seek professional tax advice for more information.

Q: Can I make charitable checkoff donations to specific causes?

A: Yes, charitable checkoff donations can be made to specific causes or funds listed on Form 150-101-058.

Q: Are there any limits on the amount of charitable checkoff donations I can make?

A: There may be limits on the amount of charitable checkoff donations you can make, depending on the specific cause or fund. Consult the instructions for Form 150-101-058 or seek professional tax advice for more information.

Form Details:

- Released on August 26, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-058 Schedule OR-DONATE by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.