This version of the form is not currently in use and is provided for reference only. Download this version of

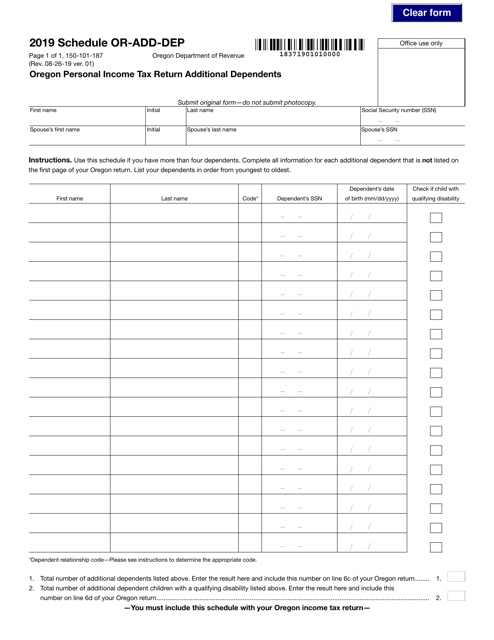

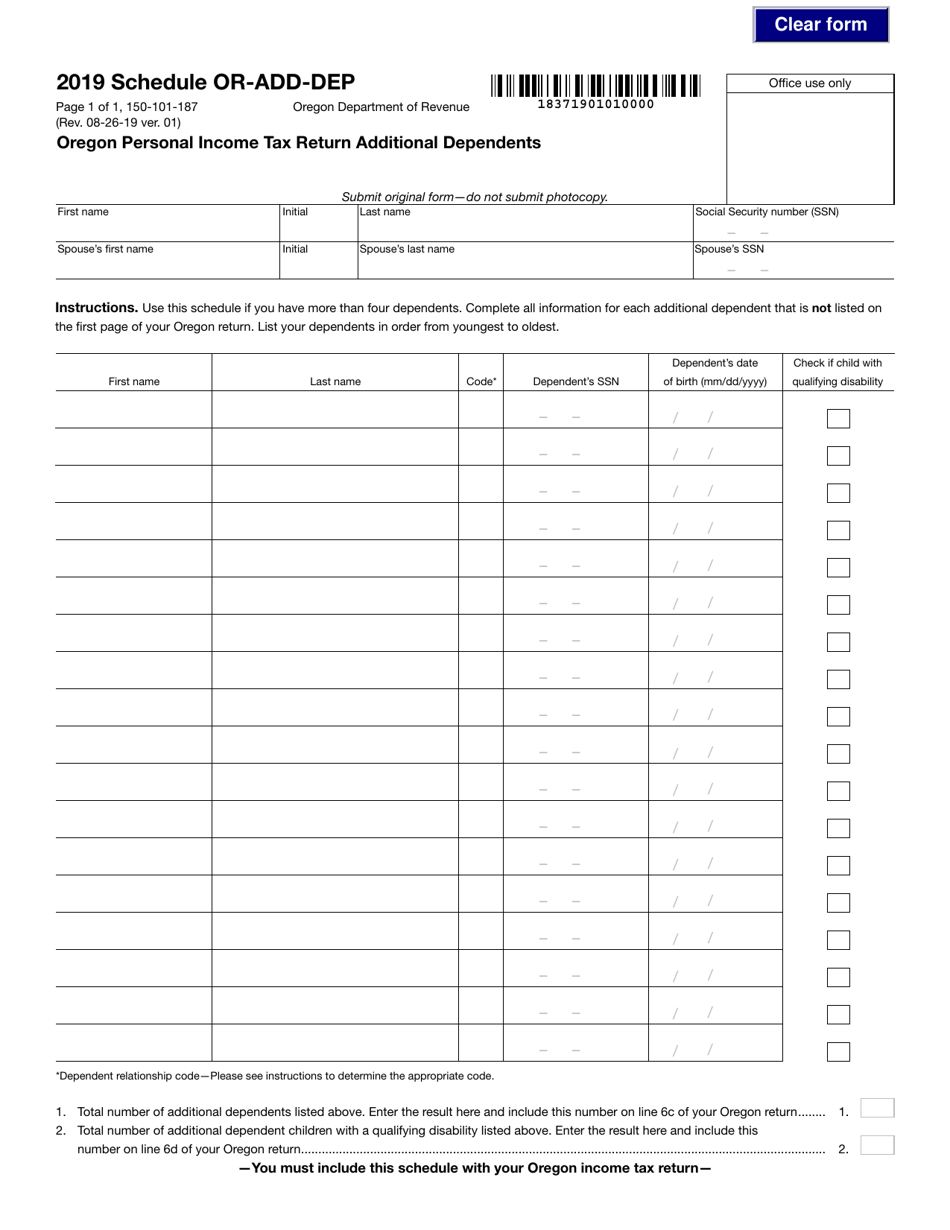

Form 150-101-187 Schedule OR-ADD-DEP

for the current year.

Form 150-101-187 Schedule OR-ADD-DEP Oregon Personal Income Tax Return Additional Dependents - Oregon

What Is Form 150-101-187 Schedule OR-ADD-DEP?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-187?

A: Form 150-101-187 is the Schedule OR-ADD-DEP for the Oregon Personal Income Tax Return.

Q: What is the purpose of Form 150-101-187?

A: The purpose of Form 150-101-187 is to report additional dependents on the Oregon Personal Income Tax Return.

Q: Who needs to file Form 150-101-187?

A: Anyone who has additional dependents to report on their Oregon Personal Income Tax Return needs to file Form 150-101-187.

Q: Are there any fees for filing Form 150-101-187?

A: No, there are no fees for filing Form 150-101-187.

Q: When is the deadline to file Form 150-101-187?

A: The deadline to file Form 150-101-187 is the same as the deadline for the Oregon Personal Income Tax Return, which is usually April 15th.

Q: What information is required to complete Form 150-101-187?

A: To complete Form 150-101-187, you will need to provide information about the additional dependents, such as their names, dates of birth, and relationship to the taxpayer.

Q: Can I claim a deduction for additional dependents on my Oregon Personal Income Tax Return?

A: Yes, you can claim a deduction for additional dependents on your Oregon Personal Income Tax Return by filing Form 150-101-187.

Q: What should I do if I have any questions or need assistance with Form 150-101-187?

A: If you have any questions or need assistance with Form 150-101-187, you can contact the Oregon Department of Revenue for guidance.

Form Details:

- Released on August 26, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-187 Schedule OR-ADD-DEP by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.