This version of the form is not currently in use and is provided for reference only. Download this version of

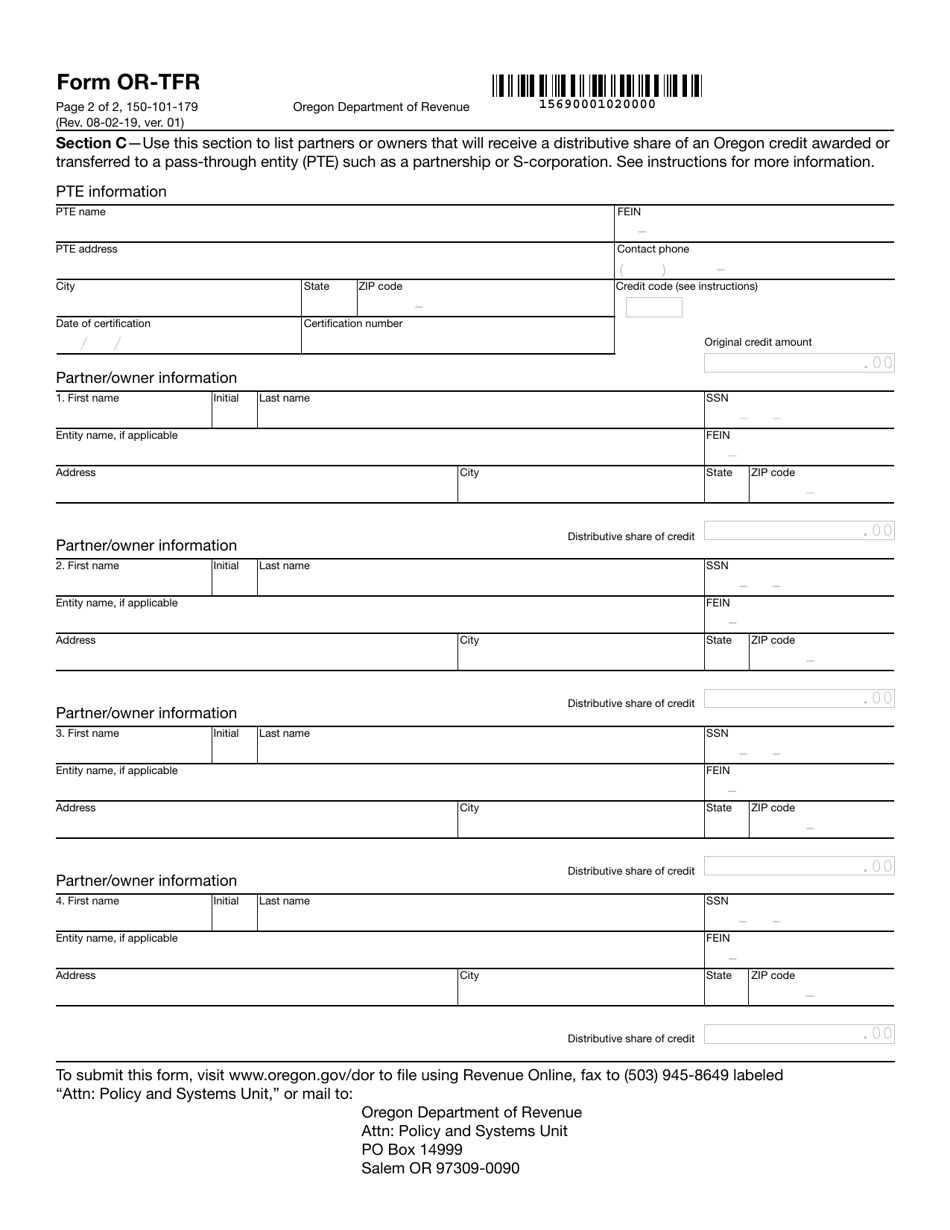

Form OR-TFR (150-101-179)

for the current year.

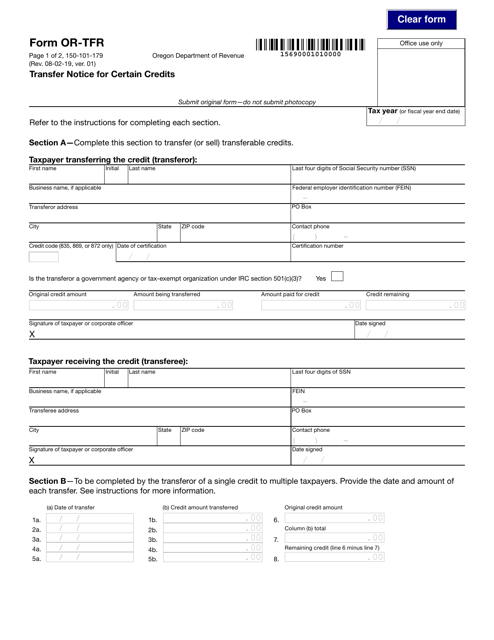

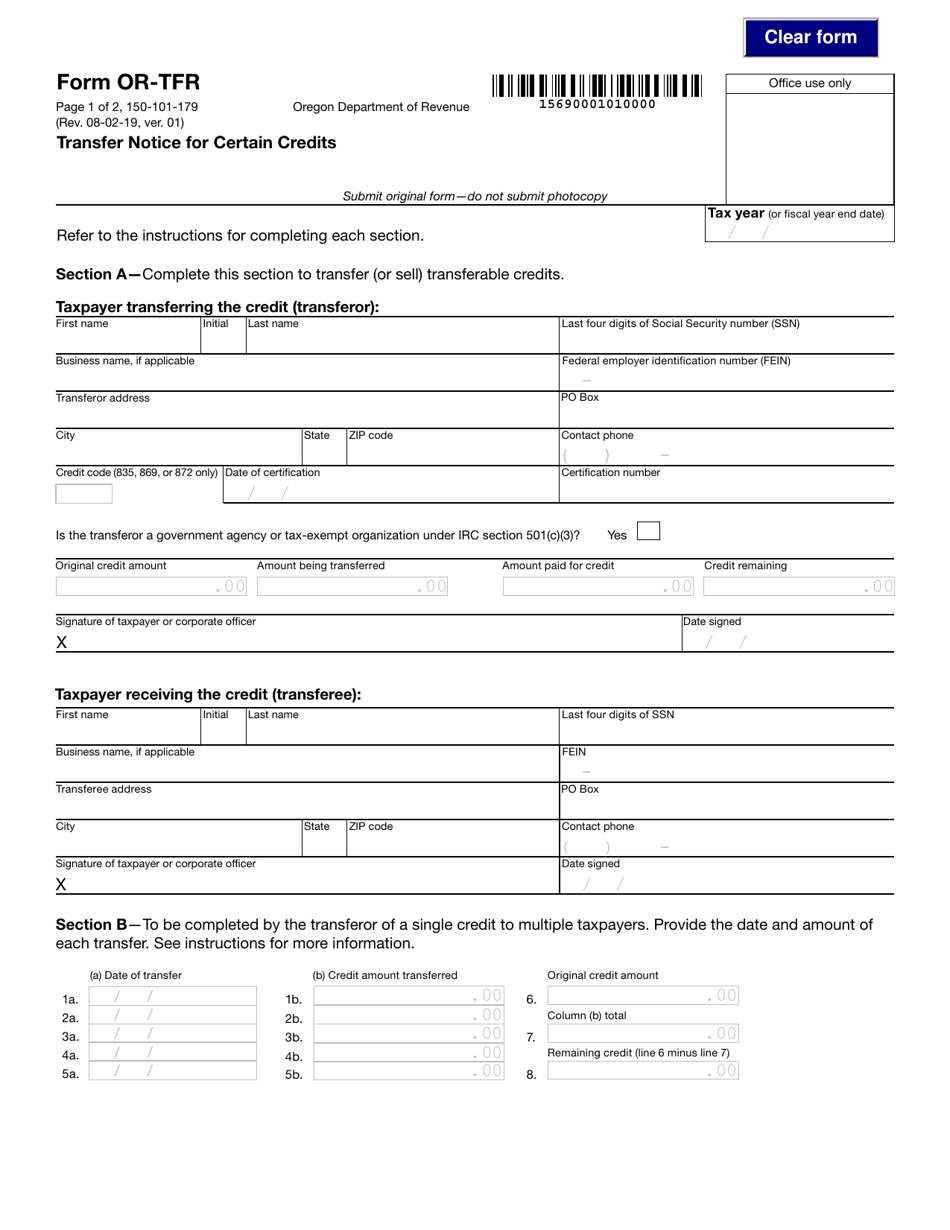

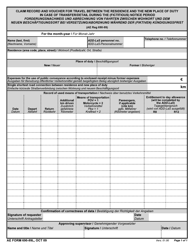

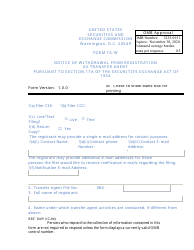

Form OR-TFR (150-101-179) Transfer Notice for Certain Credits - Oregon

What Is Form OR-TFR (150-101-179)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is OR-TFR (150-101-179)?

A: OR-TFR (150-101-179) is the Transfer Notice for Certain Credits form for Oregon.

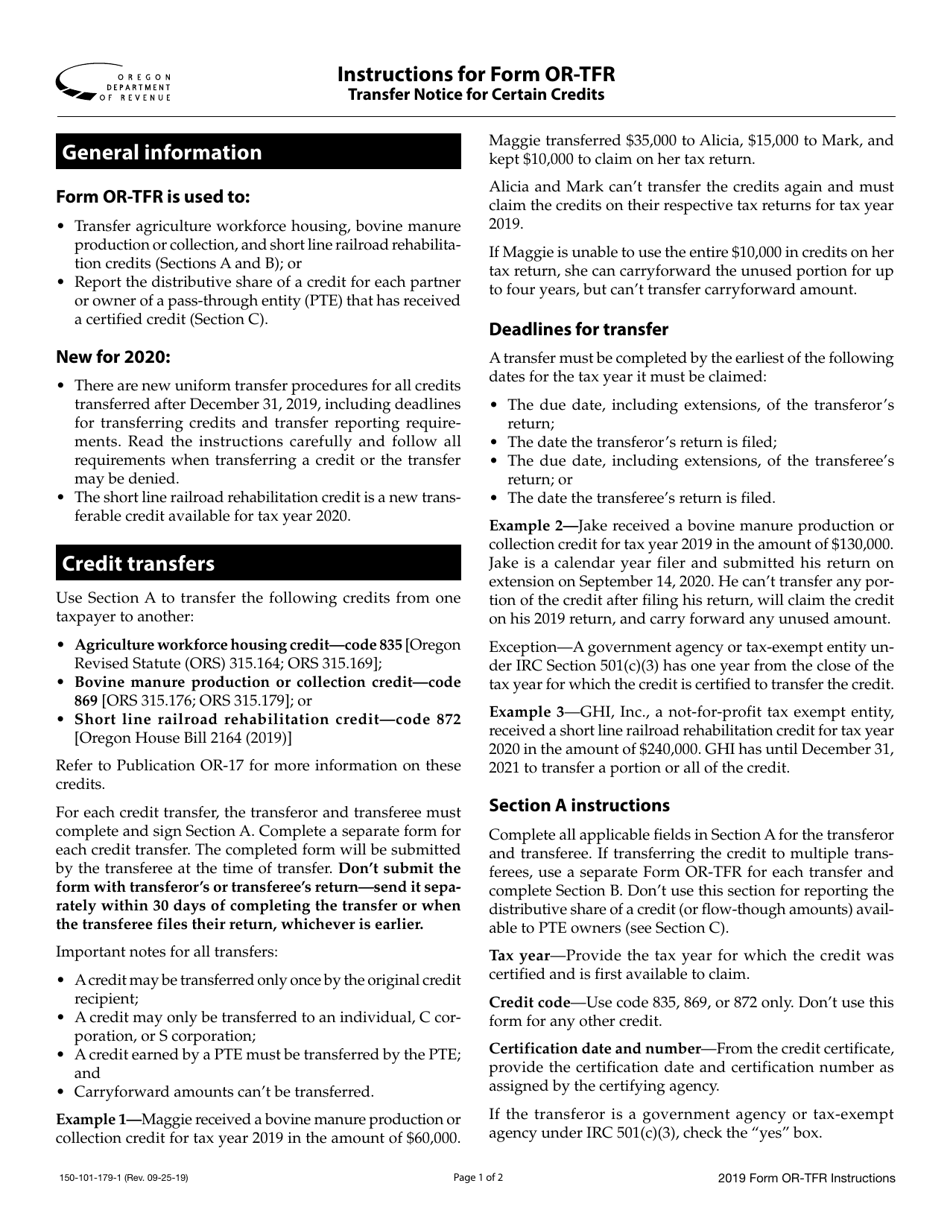

Q: What is the purpose of OR-TFR?

A: OR-TFR is used to transfer certain tax credits earned in Oregon.

Q: Who needs to use OR-TFR?

A: Individuals and businesses who have earned tax credits in Oregon and want to transfer them to another taxpayer.

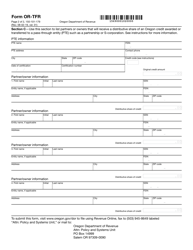

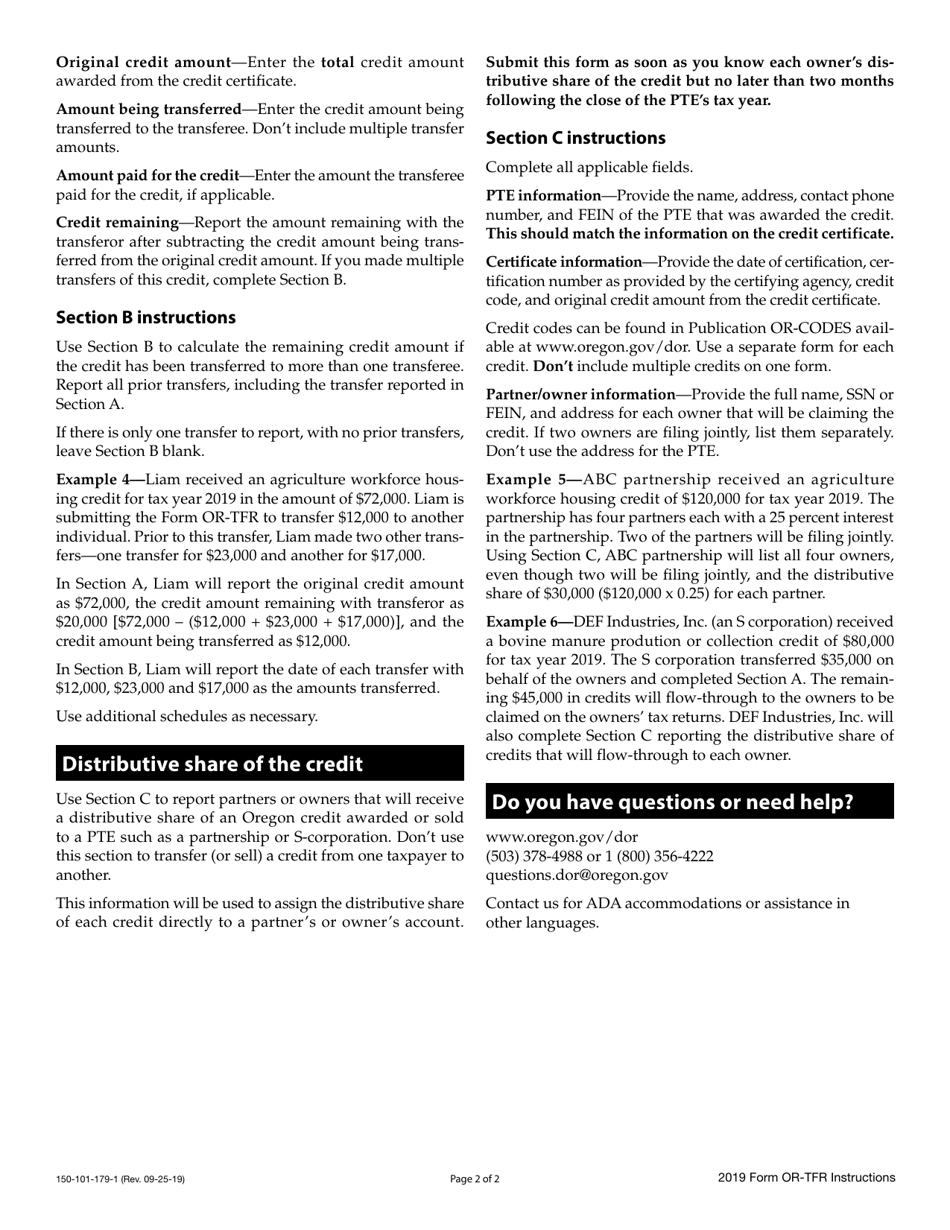

Q: What information is required on OR-TFR?

A: The form requires information about both the transferring taxpayer and the receiving taxpayer, as well as details about the credits being transferred.

Q: Is there a fee for using OR-TFR?

A: There is no fee for using OR-TFR.

Q: Are there any limitations on transferring tax credits with OR-TFR?

A: Yes, there are certain limitations and restrictions on transferring tax credits using OR-TFR. It is important to review the instructions and guidelines provided with the form.

Q: What should I do if I have questions about OR-TFR?

A: If you have questions or need assistance with OR-TFR, you can contact the Oregon Department of Revenue or consult with a tax professional.

Form Details:

- Released on August 2, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-TFR (150-101-179) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.