This version of the form is not currently in use and is provided for reference only. Download this version of

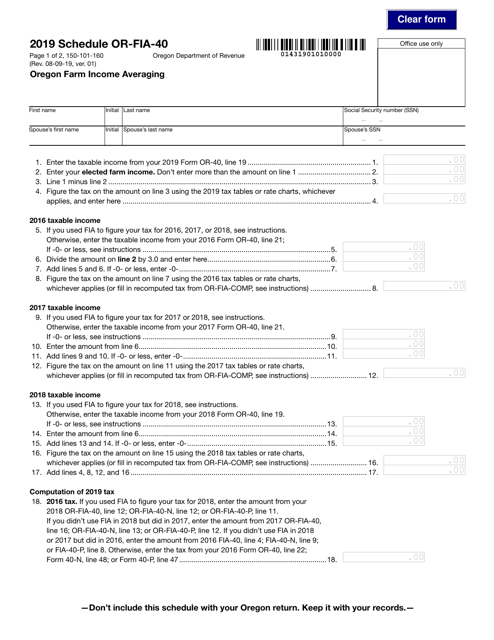

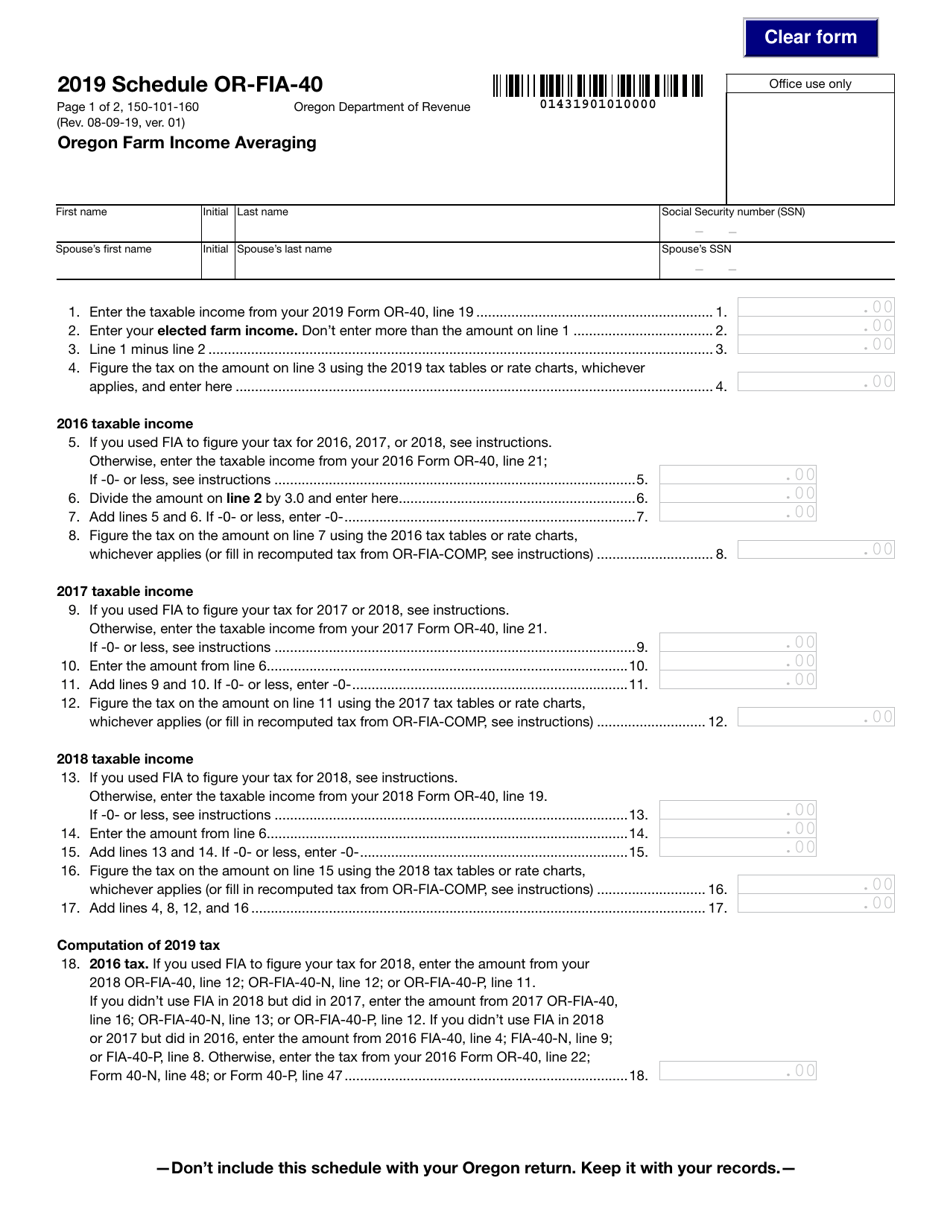

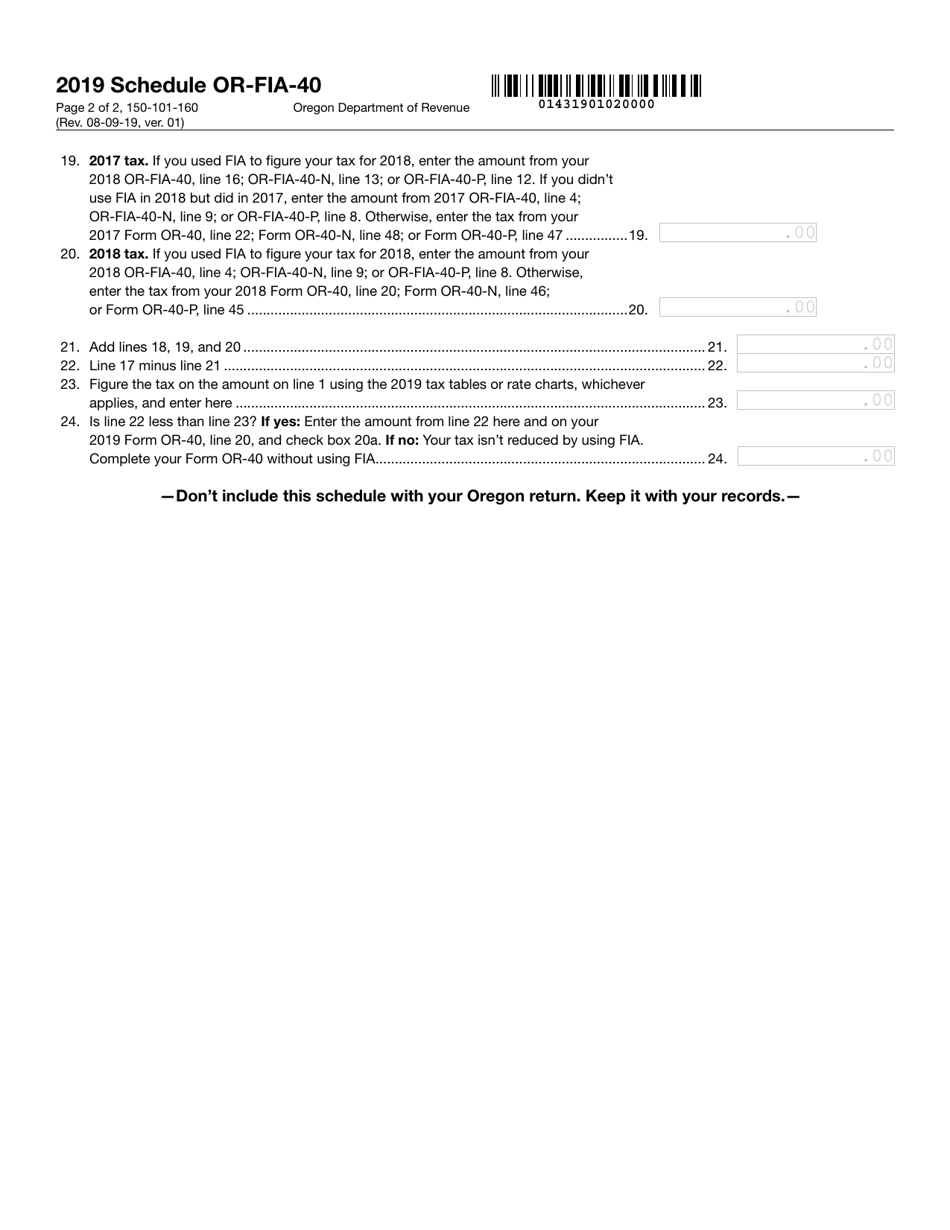

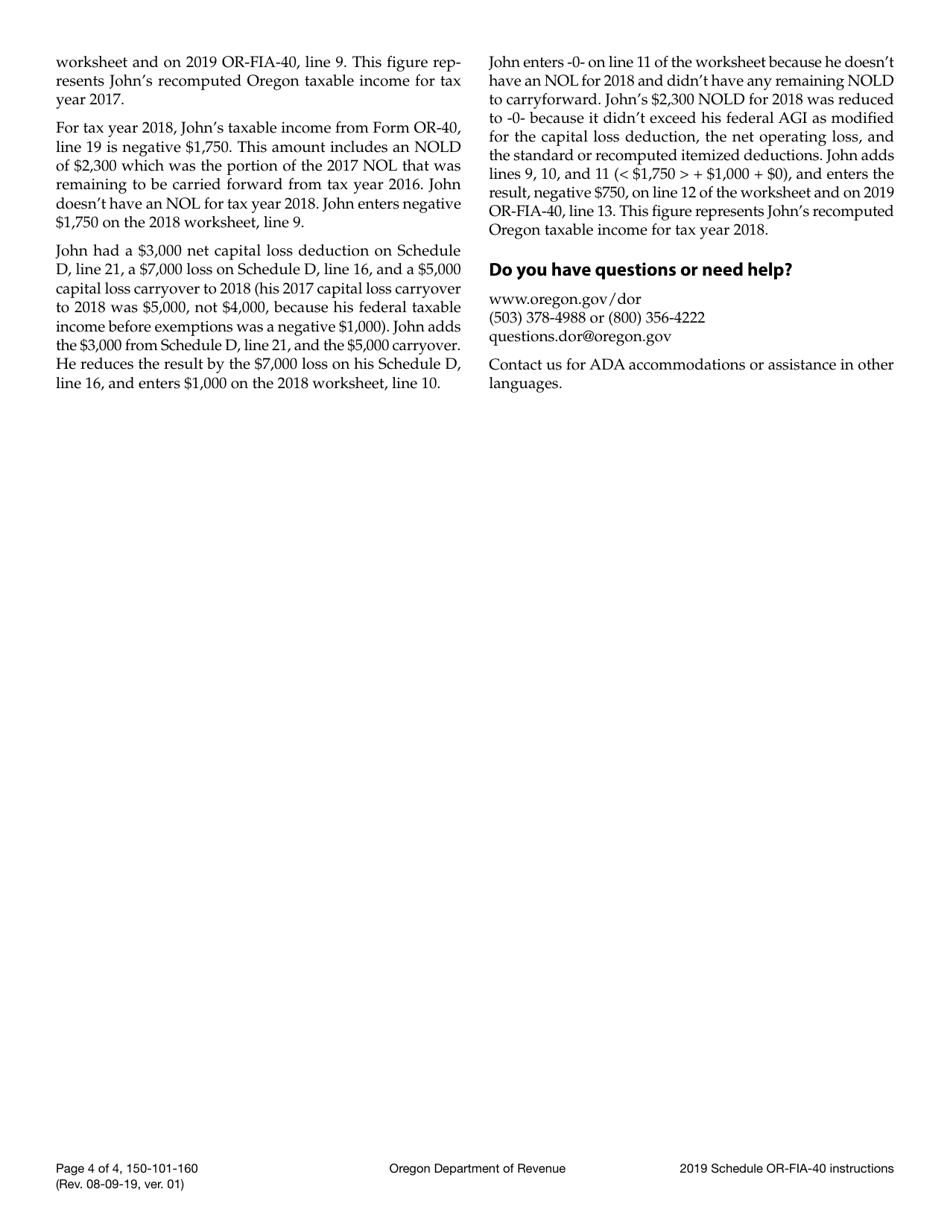

Form 150-101-160 Schedule OR-FIA-40

for the current year.

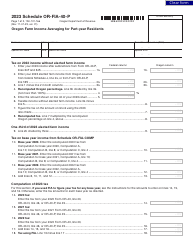

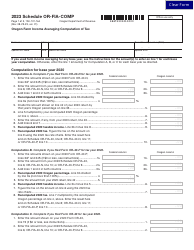

Form 150-101-160 Schedule OR-FIA-40 Oregon Farm Income Averaging - Oregon

What Is Form 150-101-160 Schedule OR-FIA-40?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-160?

A: Form 150-101-160 is a tax form used in Oregon.

Q: What is Schedule OR-FIA-40?

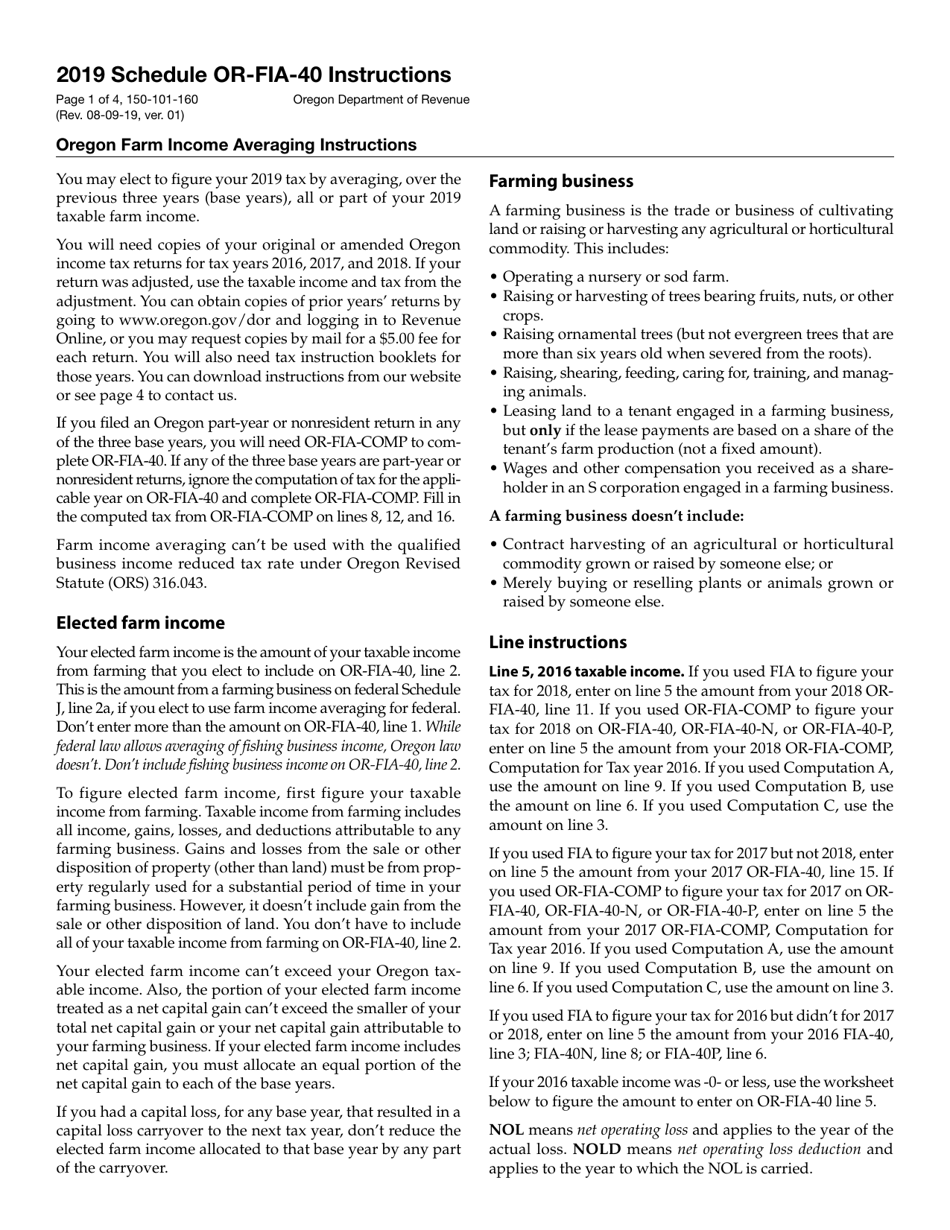

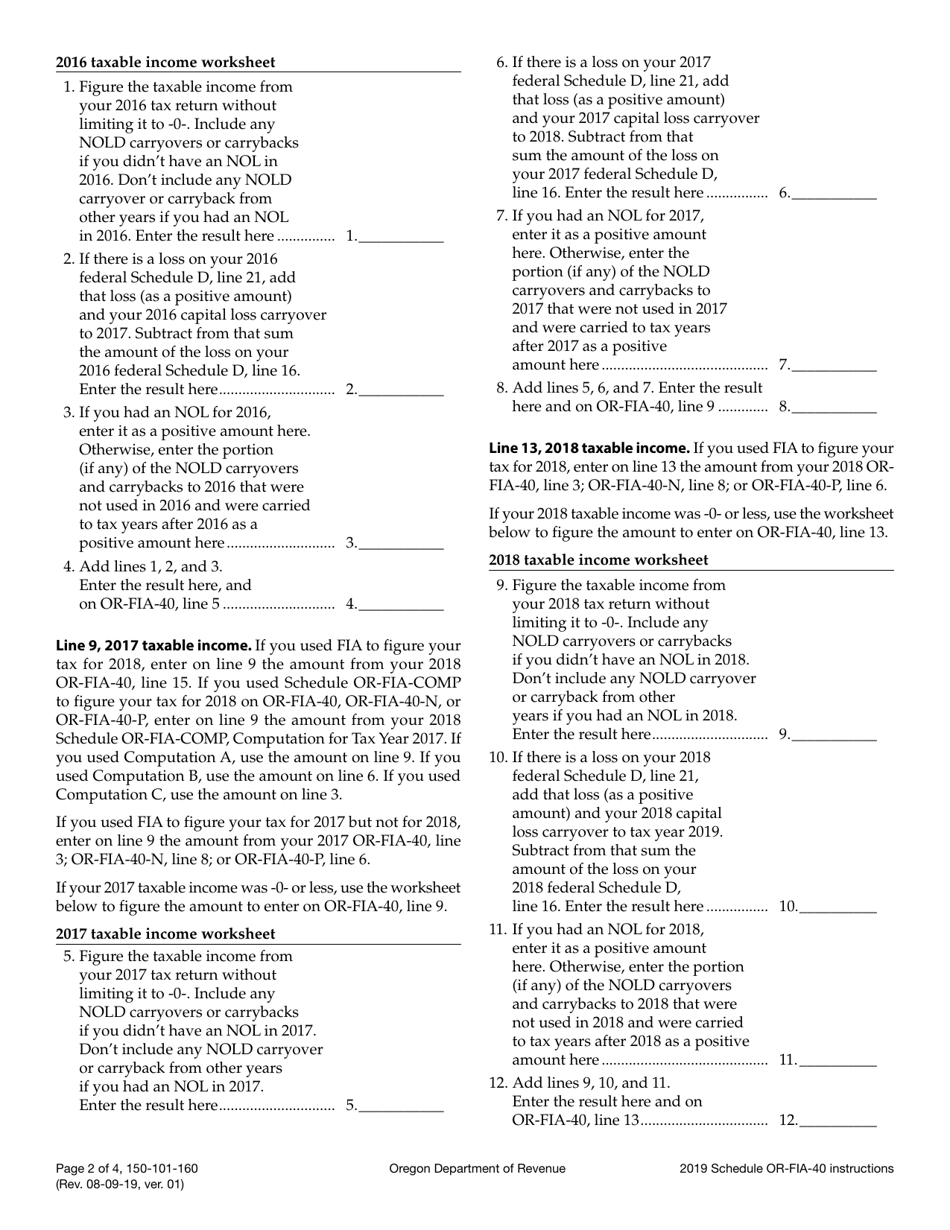

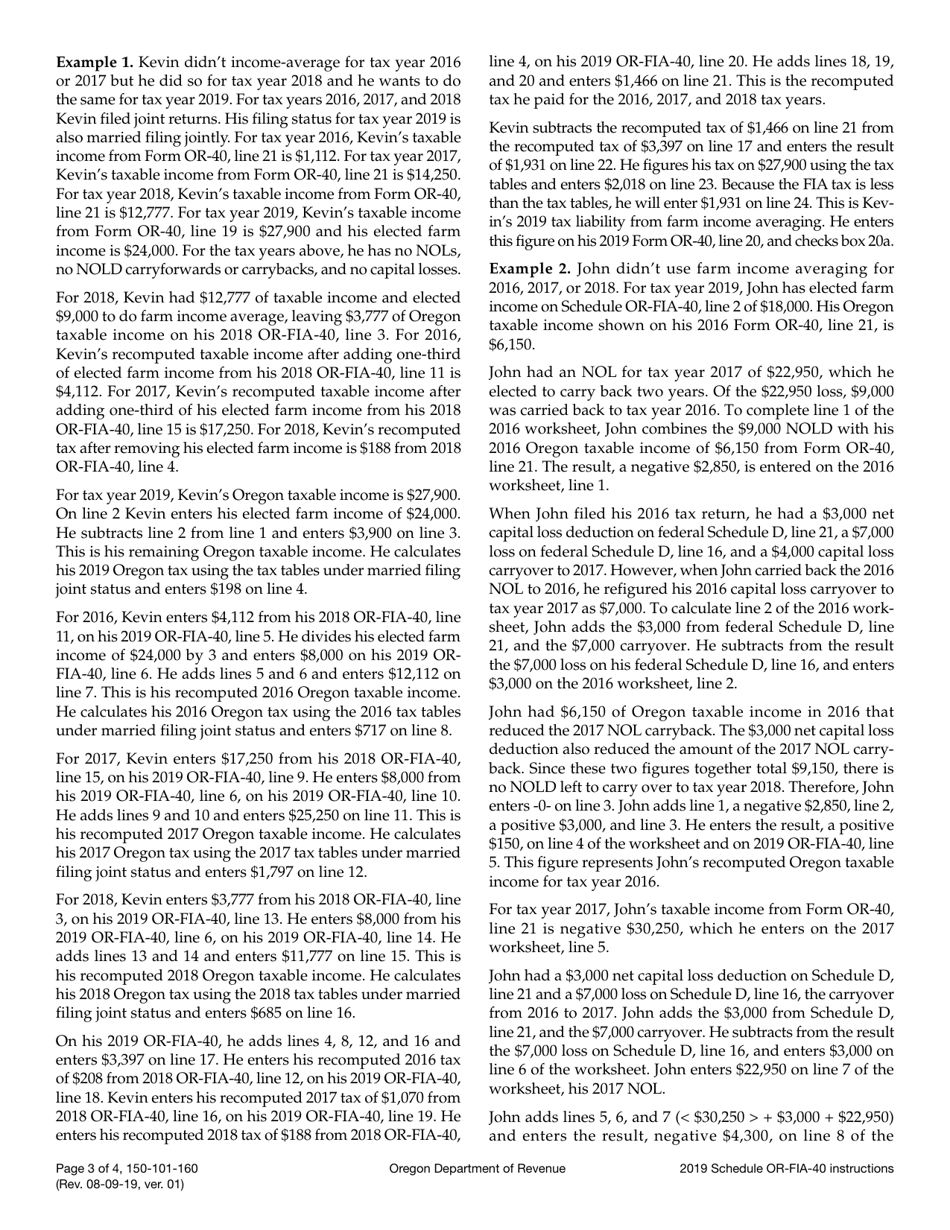

A: Schedule OR-FIA-40 is a part of Form 150-101-160 used for Oregon Farm Income Averaging.

Q: What is Oregon Farm Income Averaging?

A: Oregon Farm Income Averaging is a method to even out income fluctuations for farmers in Oregon.

Q: Who should use Schedule OR-FIA-40?

A: Schedule OR-FIA-40 should be used by farmers in Oregon who want to average their income.

Q: Why would farmers use income averaging?

A: Farmers use income averaging to reduce the impact of variable income on their tax liability.

Q: Are there any eligibility requirements for using Oregon Farm Income Averaging?

A: Yes, there are eligibility requirements to qualify for Oregon Farm Income Averaging. You must be a farmer in Oregon and meet certain income criteria.

Form Details:

- Released on August 9, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-160 Schedule OR-FIA-40 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.