This version of the form is not currently in use and is provided for reference only. Download this version of

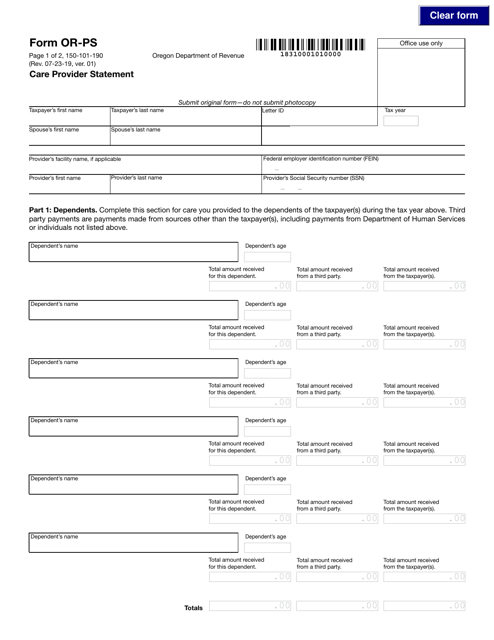

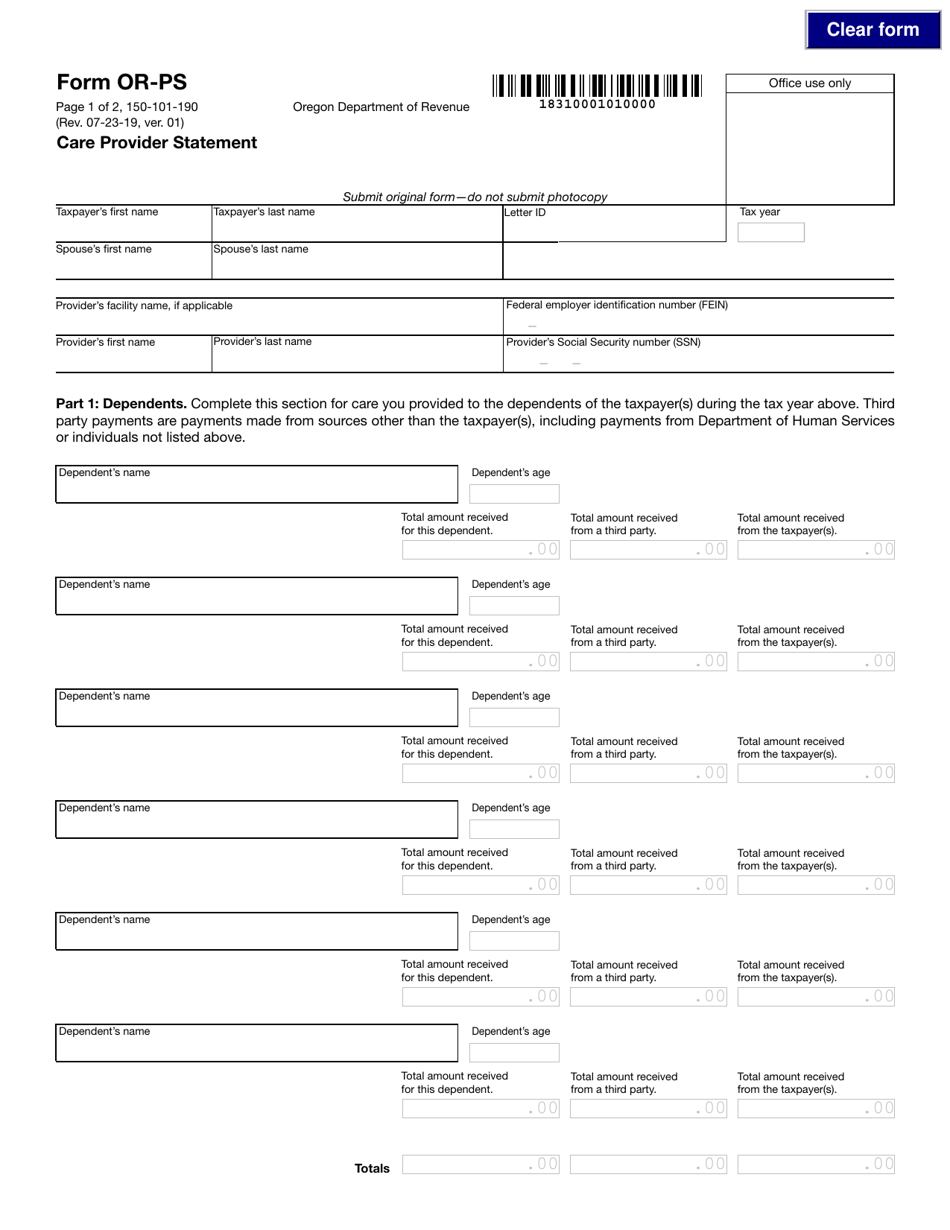

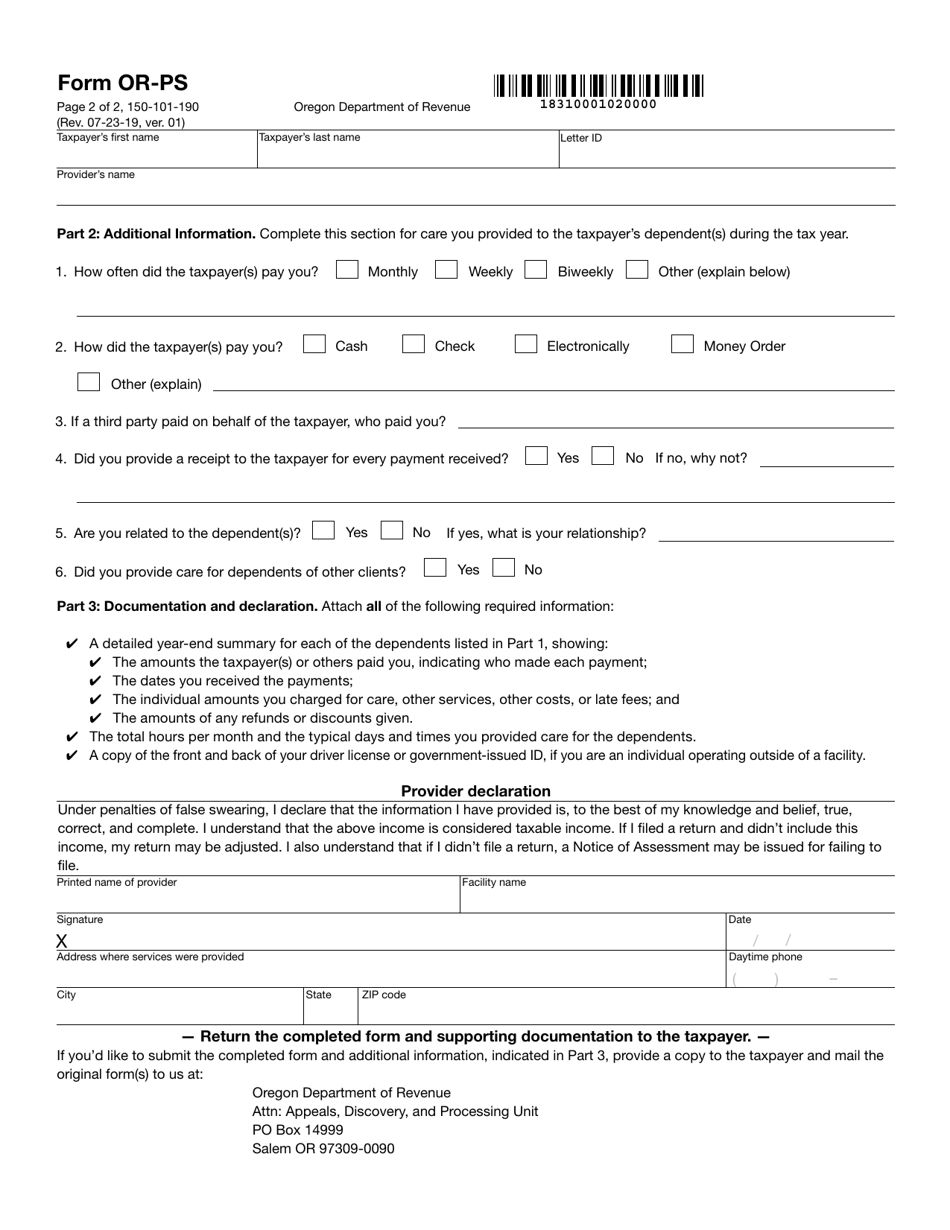

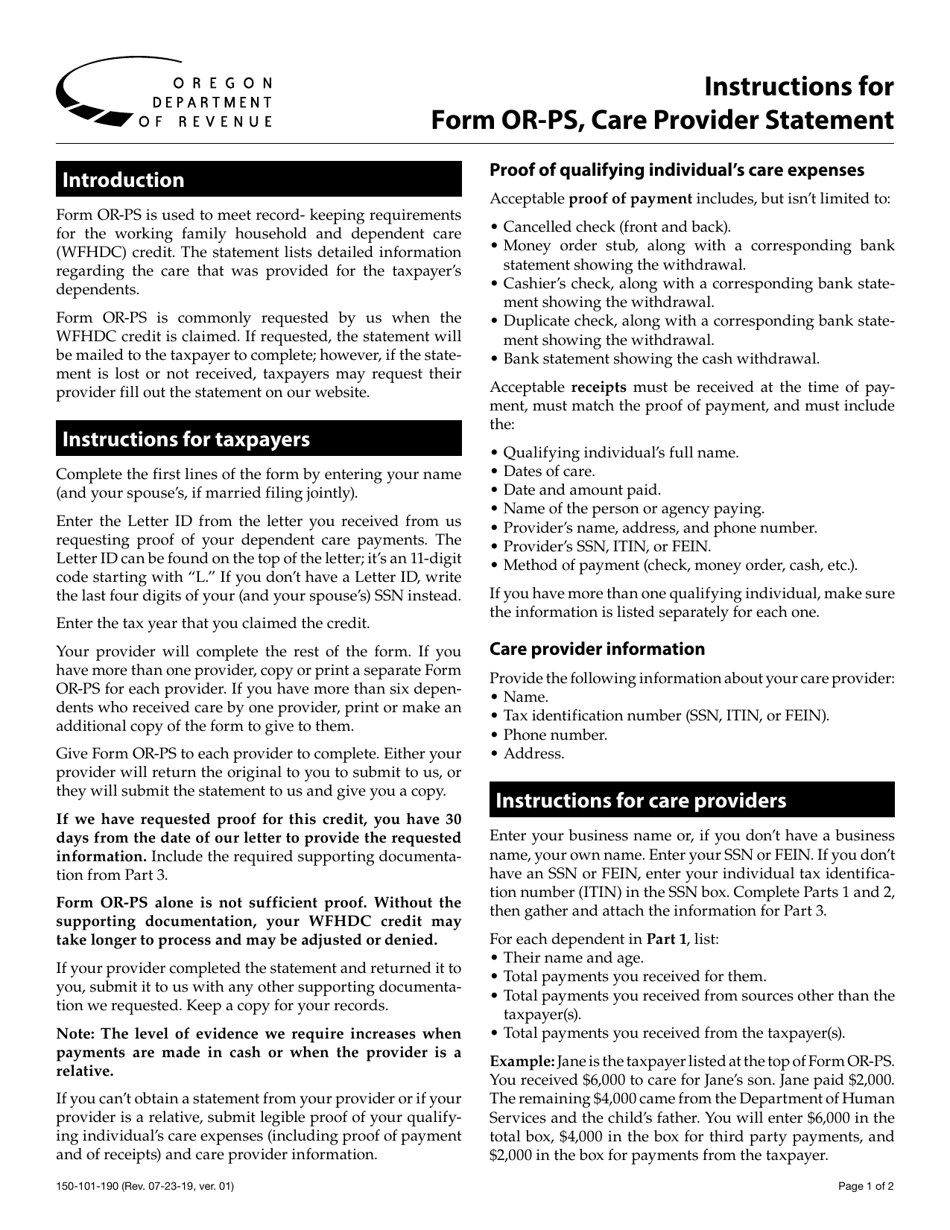

Form OR-PS (150-101-190)

for the current year.

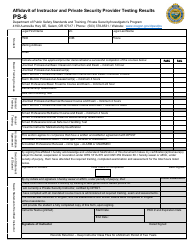

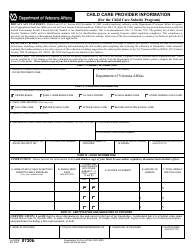

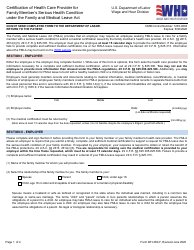

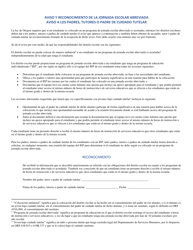

Form OR-PS (150-101-190) Care Provider Statement - Oregon

What Is Form OR-PS (150-101-190)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-PS (150-101-190)?

A: Form OR-PS (150-101-190) is the Care Provider Statement used in Oregon.

Q: What is the purpose of Form OR-PS?

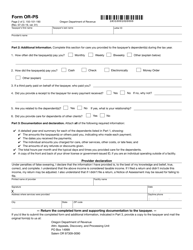

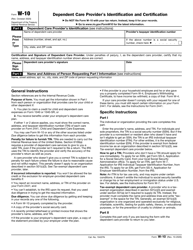

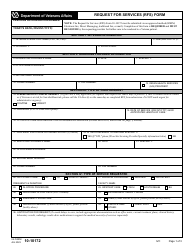

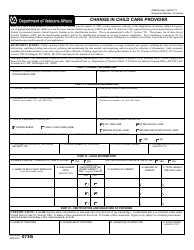

A: The purpose of Form OR-PS is to provide information about the care provider, including their contact information and tax identification number.

Q: Who needs to complete Form OR-PS?

A: Both the care provider and the individual receiving care need to complete Form OR-PS.

Q: What information is required on Form OR-PS?

A: Form OR-PS requires information such as the care provider's name, address, tax identification number, and the name of the individual receiving care.

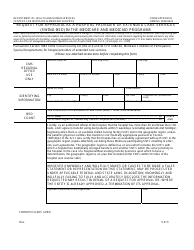

Q: When should I submit Form OR-PS?

A: Form OR-PS should be submitted within 30 days of providing care services or within 30 days of a request from the Oregon Department of Revenue.

Q: Are there any fees associated with submitting Form OR-PS?

A: No, there are no fees associated with submitting Form OR-PS.

Q: What happens if I don't submit Form OR-PS?

A: Failure to submit Form OR-PS may result in penalties or loss of tax benefits.

Q: What other documents do I need to include with Form OR-PS?

A: You may need to include supporting documents such as invoices or receipts with Form OR-PS depending on your specific situation.

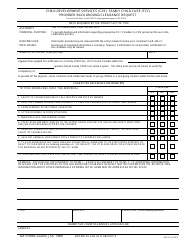

Form Details:

- Released on July 23, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-PS (150-101-190) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.