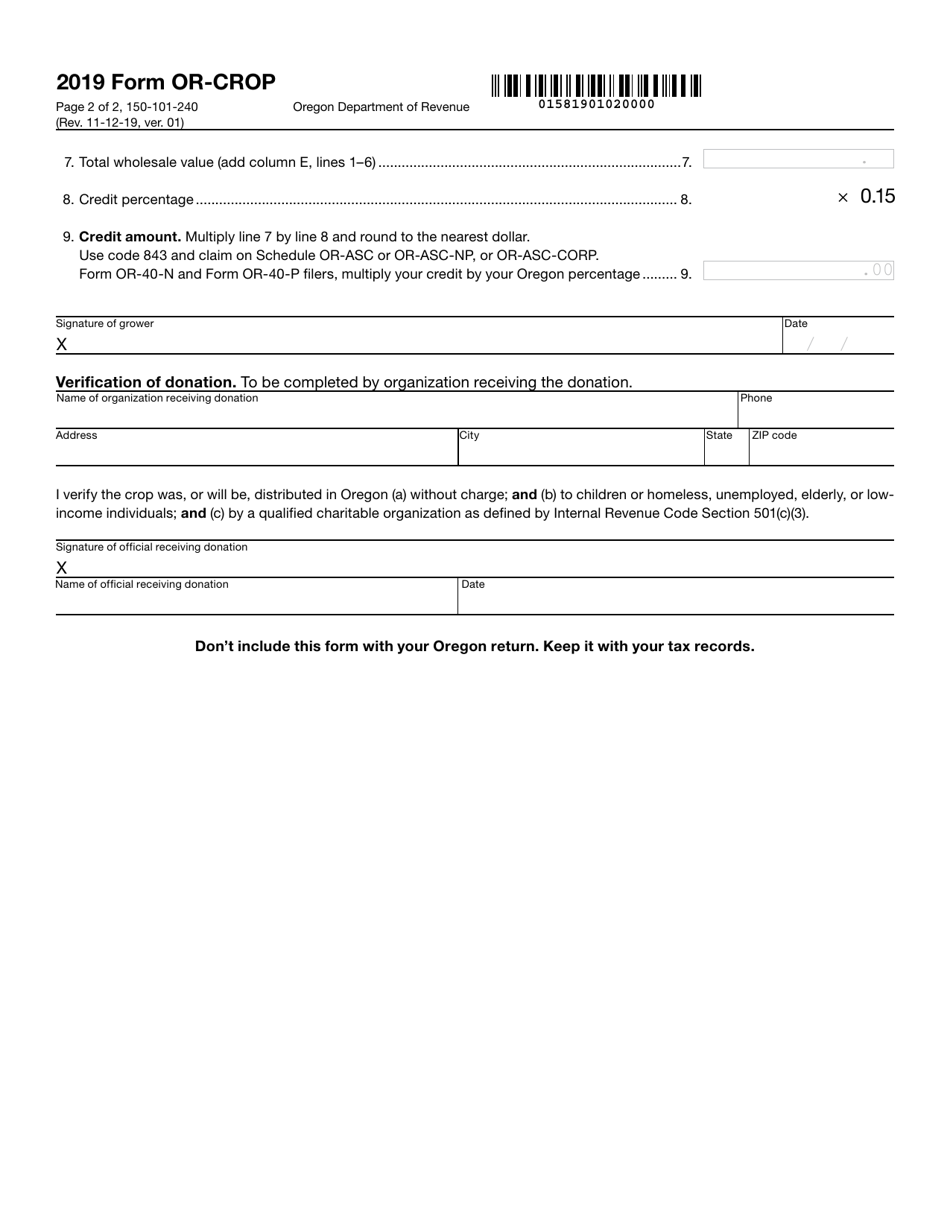

This version of the form is not currently in use and is provided for reference only. Download this version of

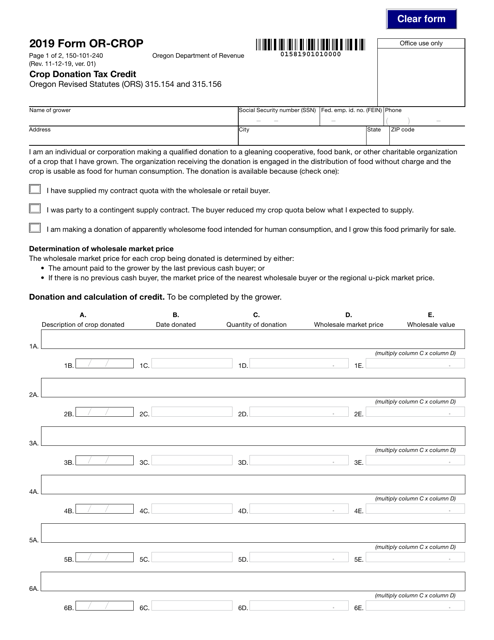

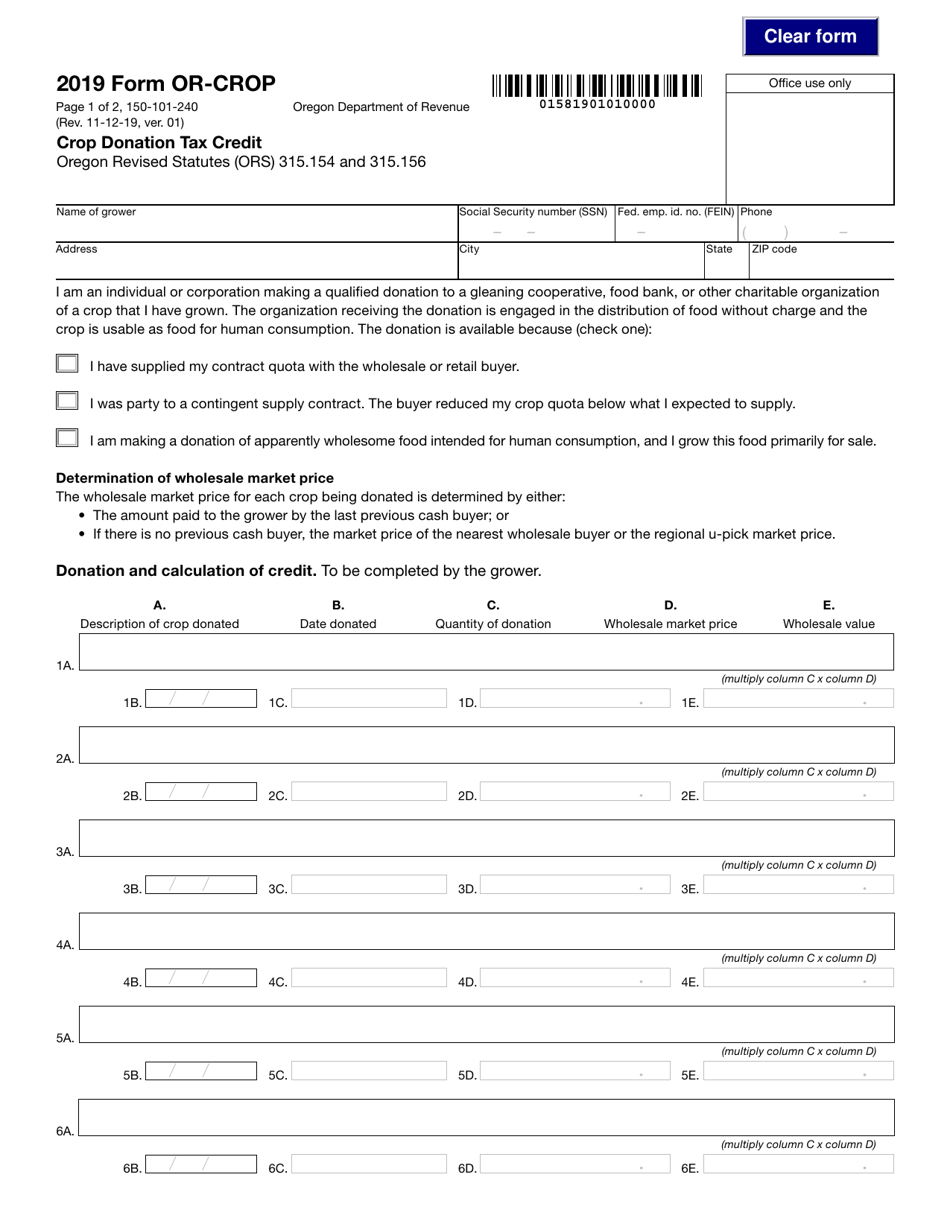

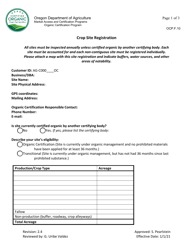

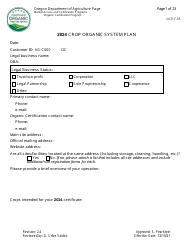

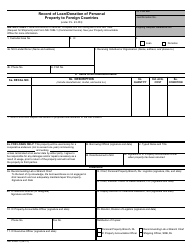

Form OR-CROP (150-101-240)

for the current year.

Form OR-CROP (150-101-240) Crop Donation Tax Credit - Oregon

What Is Form OR-CROP (150-101-240)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

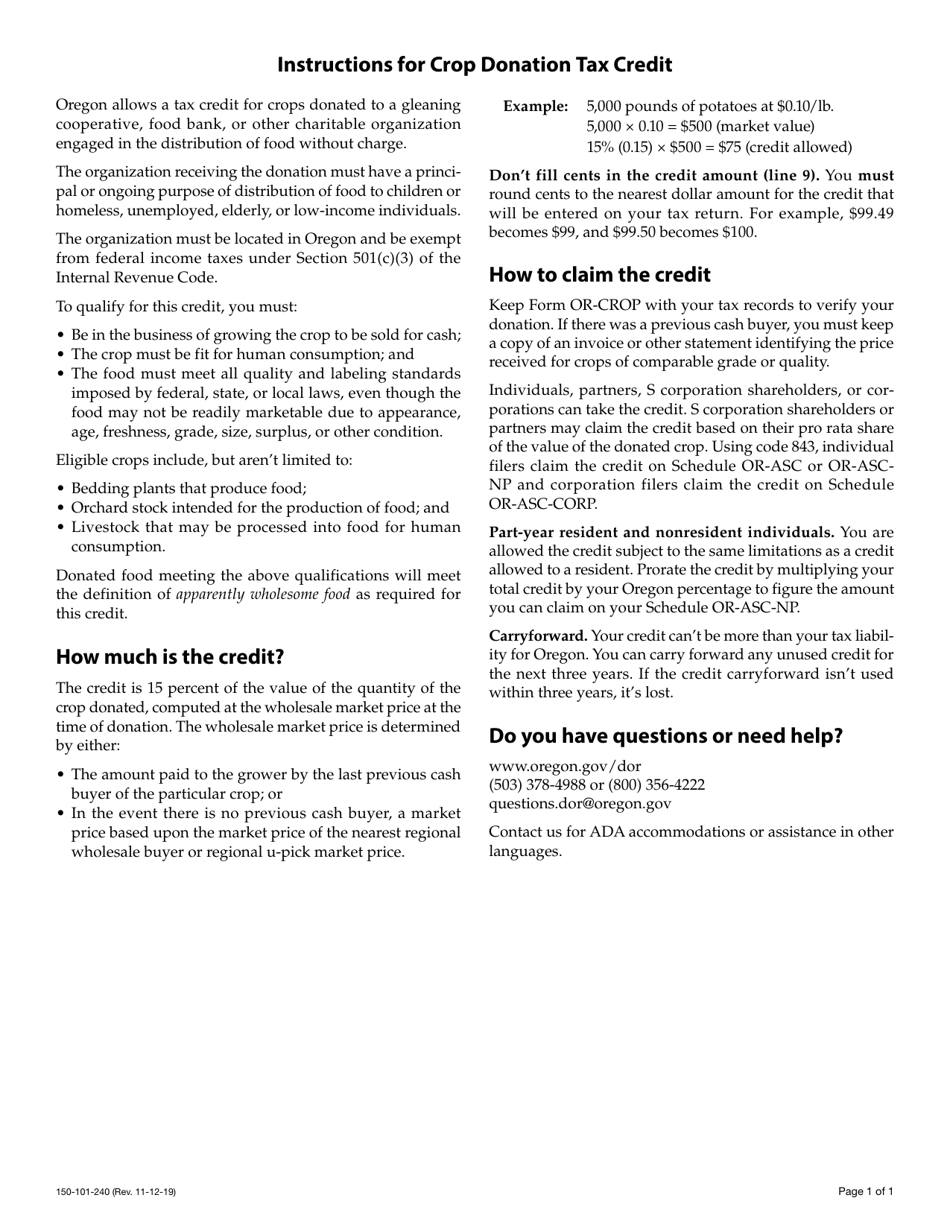

Q: What is the OR-CROP (150-101-240) Crop Donation Tax Credit?

A: The OR-CROP (150-101-240) Crop Donation Tax Credit is a tax credit available in Oregon for farmers who donate crops to qualified organizations.

Q: Who is eligible for the OR-CROP (150-101-240) Crop Donation Tax Credit?

A: Farmers in Oregon who donate crops to qualified charitable organizations are eligible for the OR-CROP (150-101-240) Crop Donation Tax Credit.

Q: What is the benefit of the OR-CROP (150-101-240) Crop Donation Tax Credit?

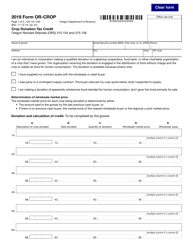

A: The OR-CROP (150-101-240) Crop Donation Tax Credit allows farmers to receive a tax credit of 10% of the fair market value of the crops donated.

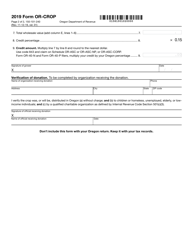

Q: How do farmers claim the OR-CROP (150-101-240) Crop Donation Tax Credit?

A: Farmers can claim the OR-CROP (150-101-240) Crop Donation Tax Credit by completing form OR-CROP (150-101-240) and including it with their Oregon tax return.

Q: What are qualified organizations for the OR-CROP (150-101-240) Crop Donation Tax Credit?

A: Qualified organizations for the OR-CROP (150-101-240) Crop Donation Tax Credit include food banks, nonprofit organizations, and charitable institutions that provide food to people in need.

Q: Is there a limit to the OR-CROP (150-101-240) Crop Donation Tax Credit?

A: Yes, the OR-CROP (150-101-240) Crop Donation Tax Credit is limited to $5,000 per taxpayer, per year.

Form Details:

- Released on November 12, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-CROP (150-101-240) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.