This version of the form is not currently in use and is provided for reference only. Download this version of

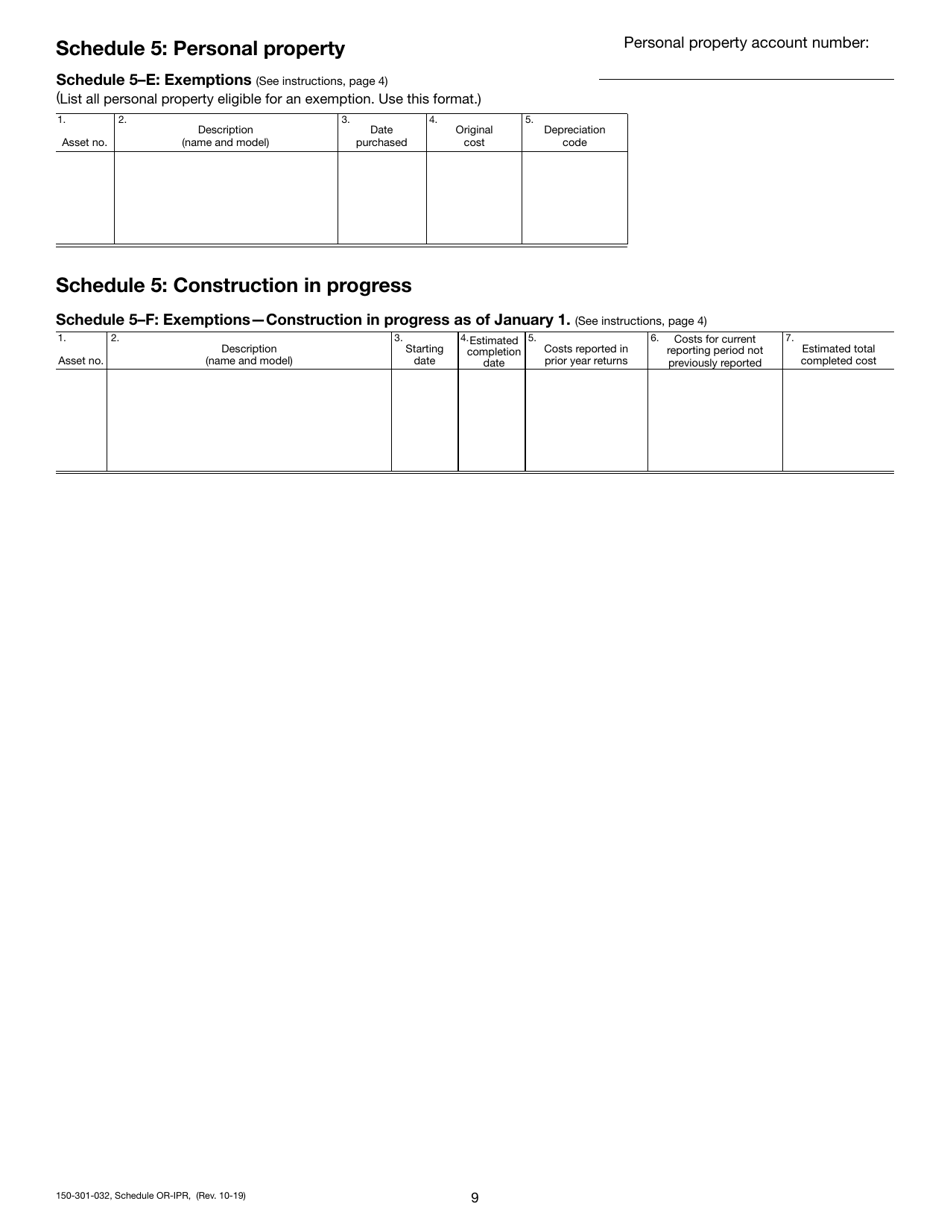

Form 150-301-032 Schedule OR-IPR

for the current year.

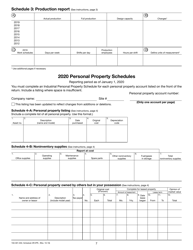

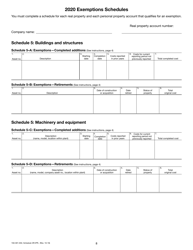

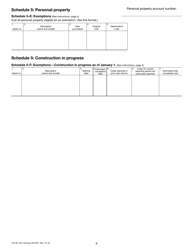

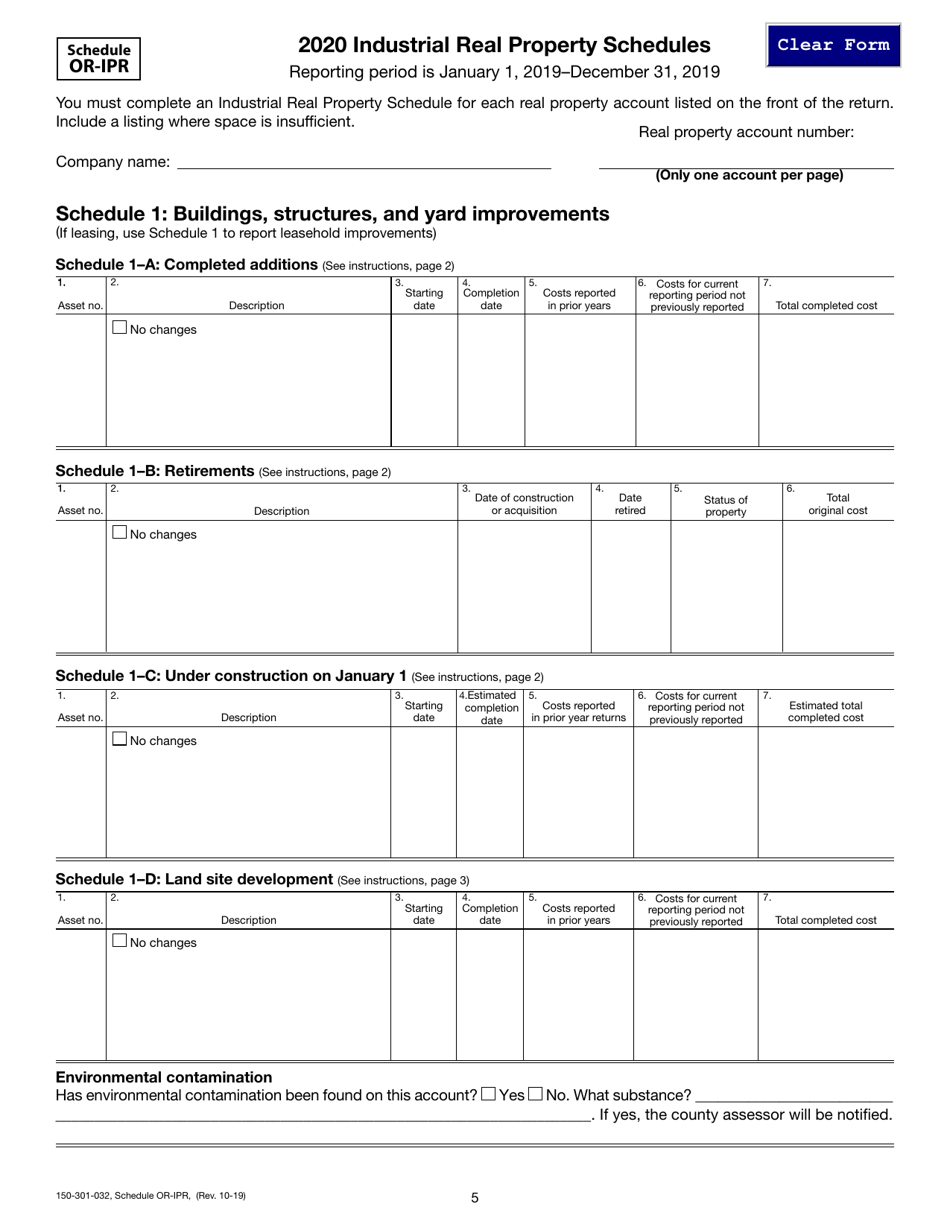

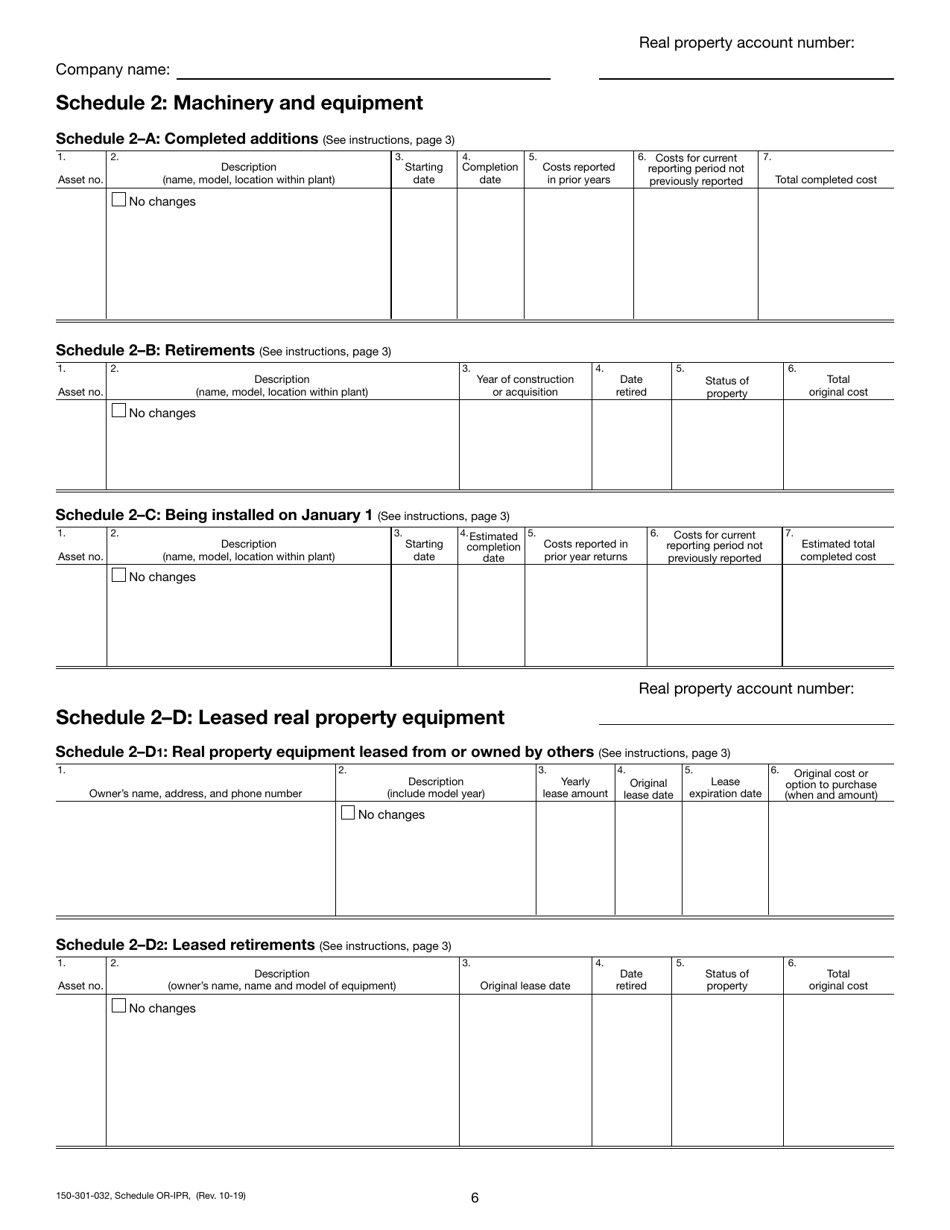

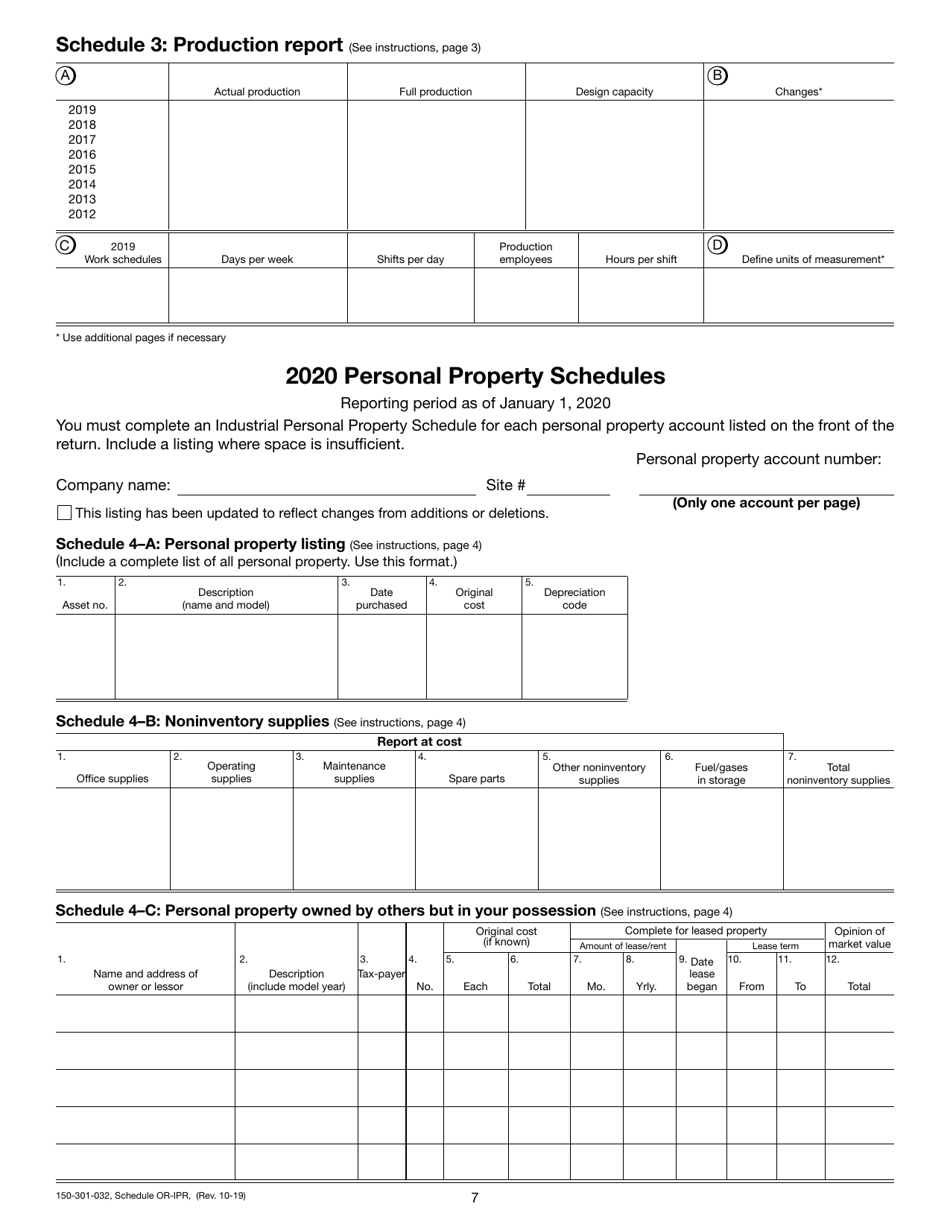

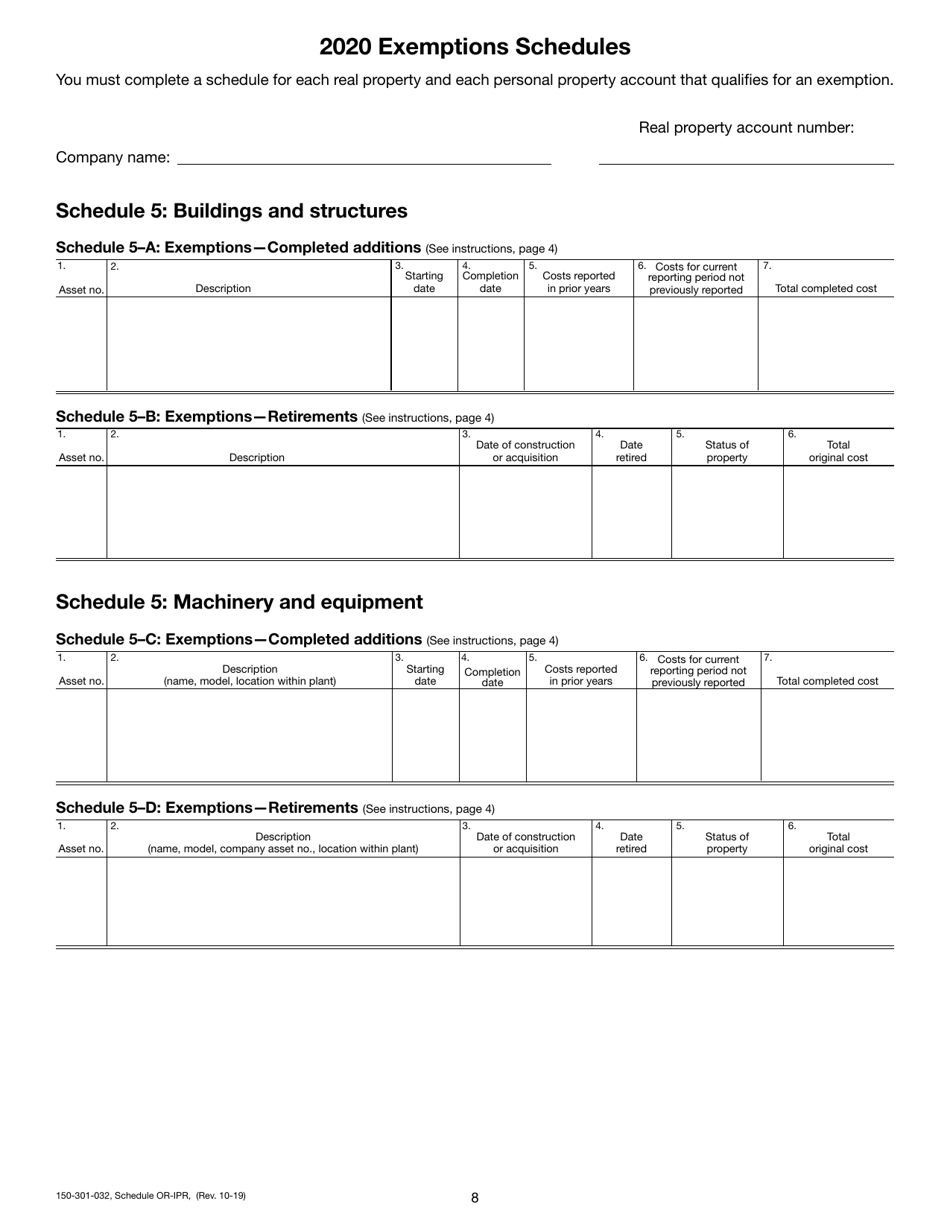

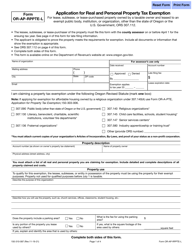

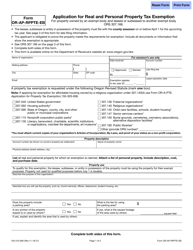

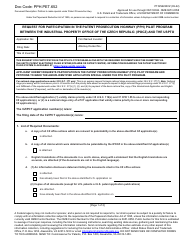

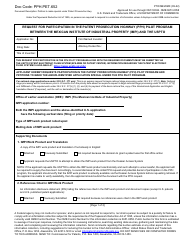

Form 150-301-032 Schedule OR-IPR Industrial Real Property Schedules - Oregon

What Is Form 150-301-032 Schedule OR-IPR?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-301-032?

A: Form 150-301-032 is the Schedule OR-IPR Industrial Real Property Schedules for the state of Oregon.

Q: What is the purpose of Form 150-301-032?

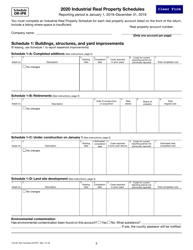

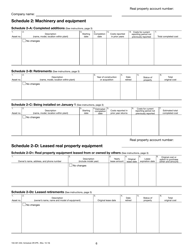

A: The purpose of Form 150-301-032 is to report information about industrial real property in Oregon.

Q: Who needs to fill out Form 150-301-032?

A: Individuals or businesses who own or lease industrial real property in Oregon need to fill out this form.

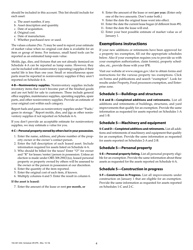

Q: What information is required on Form 150-301-032?

A: The form requires information such as the property description, location, ownership details, and income generated from the property.

Q: How often should Form 150-301-032 be filed?

A: Form 150-301-032 must be filed annually by April 15th.

Q: Are there any penalties for not filing Form 150-301-032?

A: Yes, failure to file or filing late may result in penalties or interest charges.

Q: Can I e-file Form 150-301-032?

A: Yes, you can e-file Form 150-301-032 if you prefer.

Q: Is there a fee to file Form 150-301-032?

A: No, there is no fee to file Form 150-301-032.

Q: Can I claim deductions on Form 150-301-032?

A: Yes, you can claim deductions related to industrial real property expenses on this form.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-301-032 Schedule OR-IPR by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.