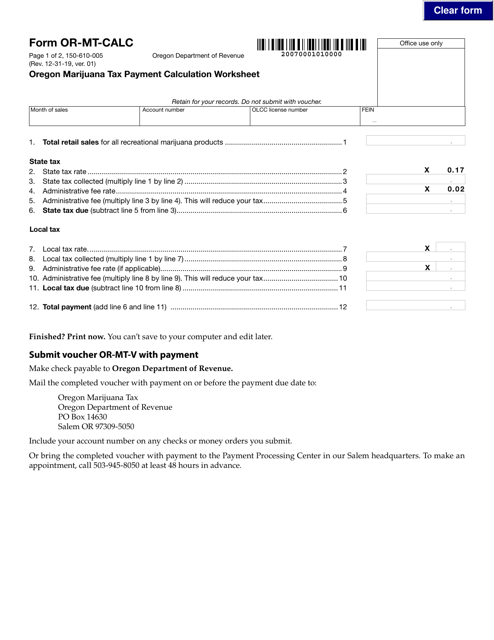

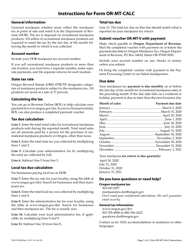

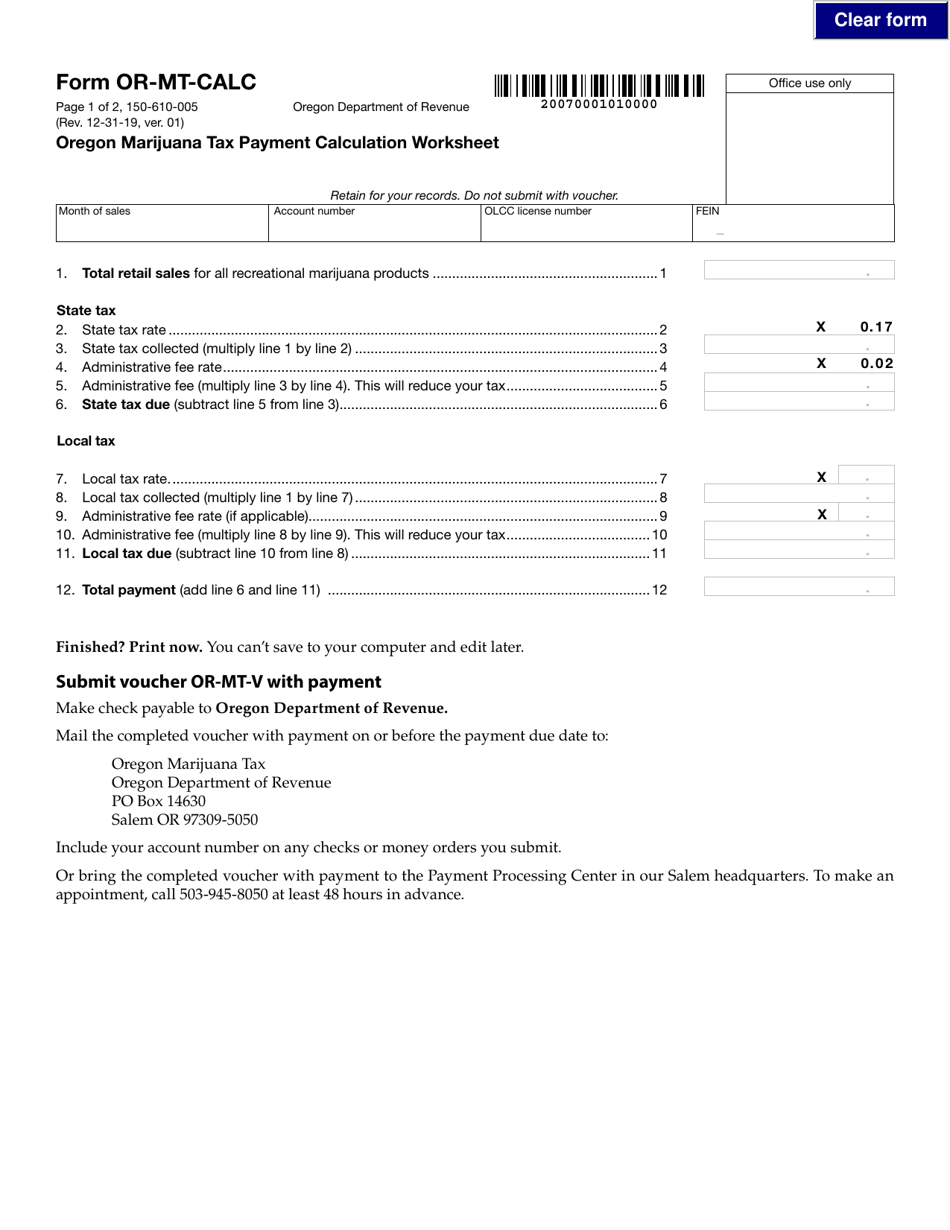

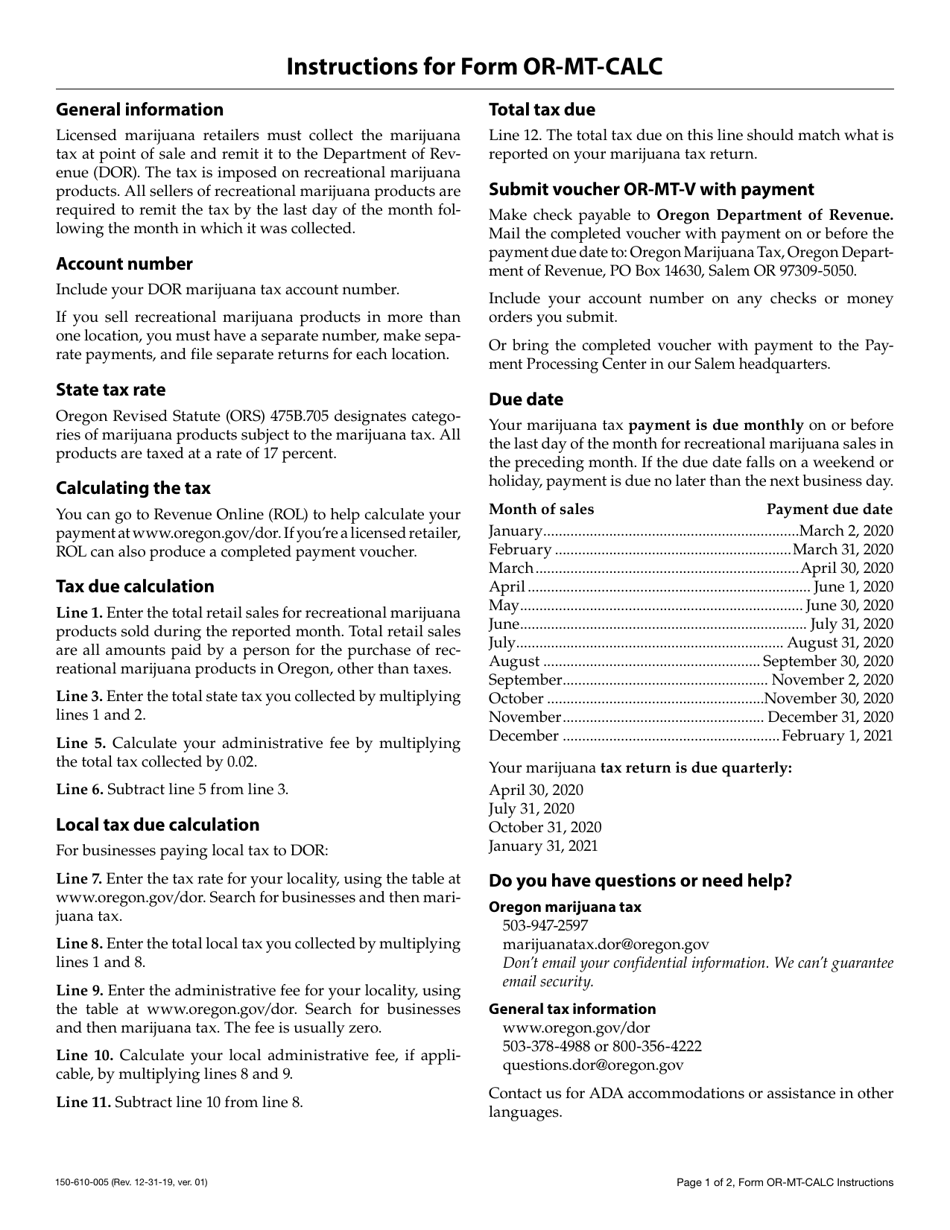

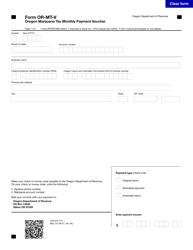

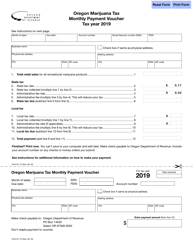

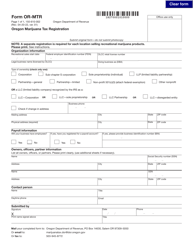

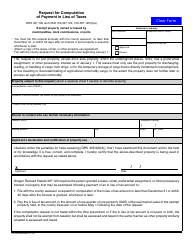

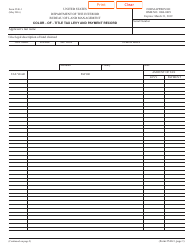

Form OR-MT-CALC (150-610-005) Oregon Marijuana Tax Payment Calculation Worksheet - Oregon

What Is Form OR-MT-CALC (150-610-005)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OR-MT-CALC?

A: OR-MT-CALC is the Oregon Marijuana Tax Payment Calculation Worksheet.

Q: What is it used for?

A: It is used for calculating the amount of tax owed for marijuana sales in Oregon.

Q: Who needs to use OR-MT-CALC?

A: Oregon businesses that sell marijuana are required to use OR-MT-CALC to calculate their tax payment.

Q: What is the purpose of the worksheet?

A: The purpose of OR-MT-CALC is to help businesses determine the correct amount of tax to remit to the state.

Form Details:

- Released on December 31, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-MT-CALC (150-610-005) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.