This version of the form is not currently in use and is provided for reference only. Download this version of

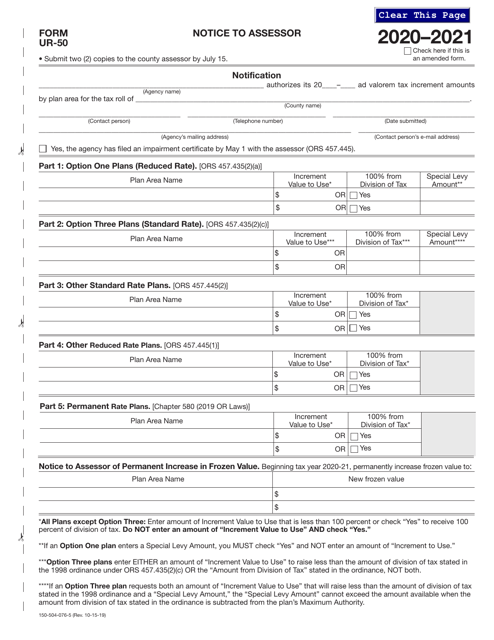

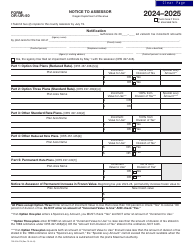

Form UR-50 (150-504-076-5)

for the current year.

Form UR-50 (150-504-076-5) Notice to Assessor - Oregon

What Is Form UR-50 (150-504-076-5)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UR-50 (150-504-076-5)?

A: Form UR-50 (150-504-076-5) is a Notice to Assessor form in Oregon.

Q: Who is the recipient of Form UR-50?

A: The recipient of Form UR-50 is the Assessor in Oregon.

Q: What is the purpose of Form UR-50?

A: The purpose of Form UR-50 is to provide notice to the Assessor regarding changes or additions to property.

Q: When should Form UR-50 be filed?

A: Form UR-50 should be filed within 30 days of the change or addition to the property.

Q: What information is required on Form UR-50?

A: Form UR-50 requires information such as property details, ownership details, and the reason for the change or addition.

Form Details:

- Released on October 15, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UR-50 (150-504-076-5) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.