This version of the form is not currently in use and is provided for reference only. Download this version of

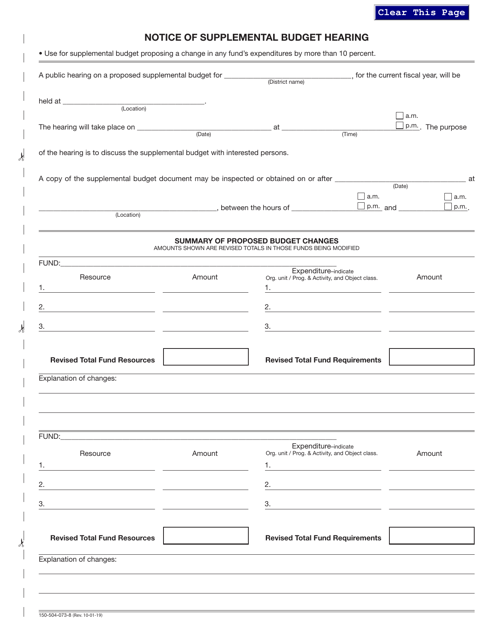

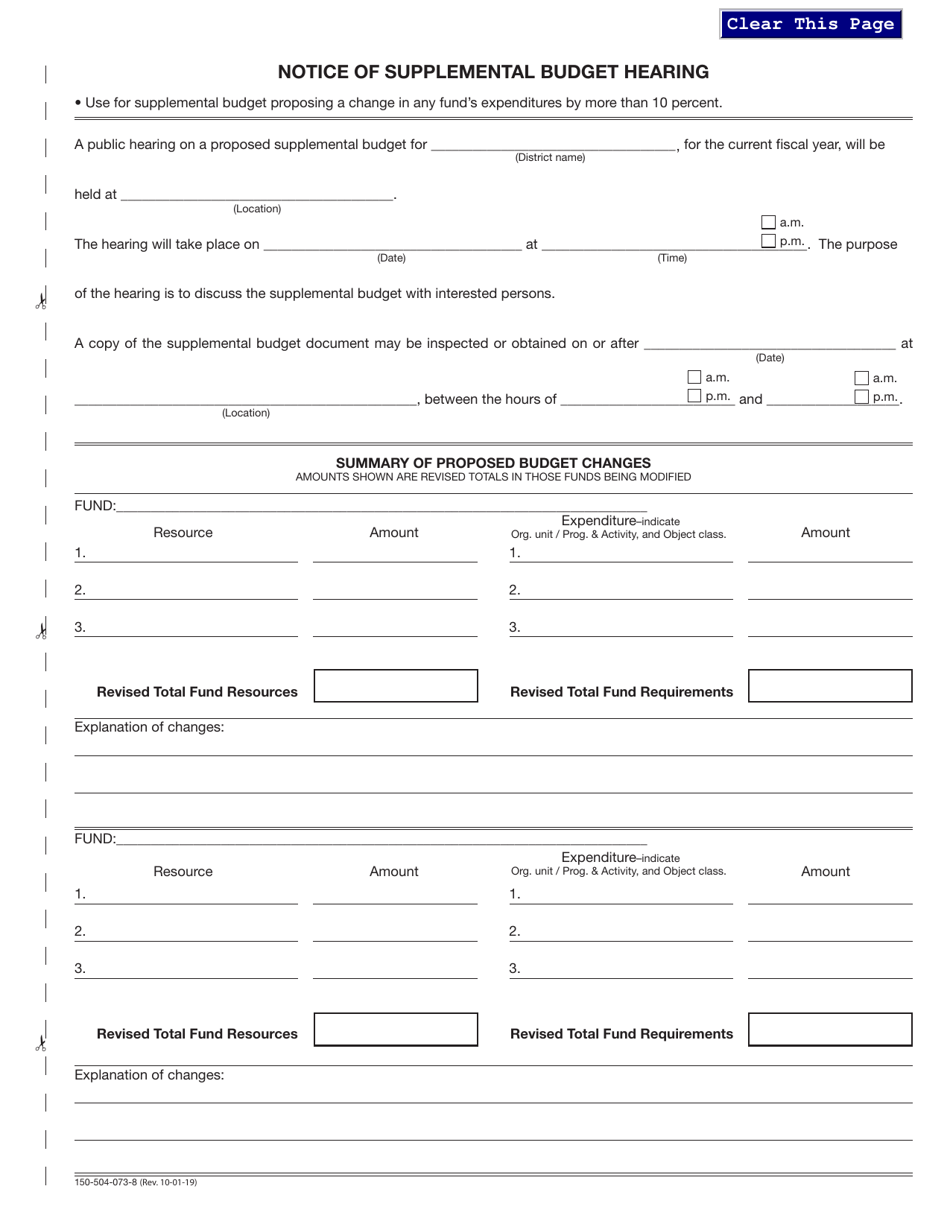

Form 150-504-073-8

for the current year.

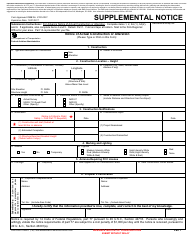

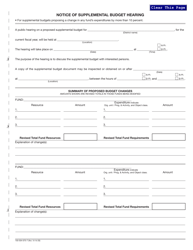

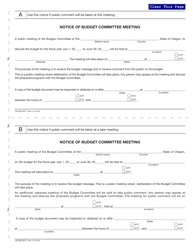

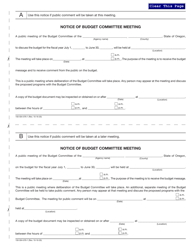

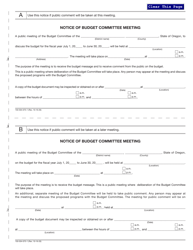

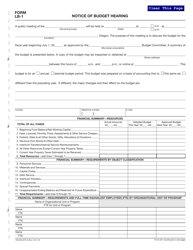

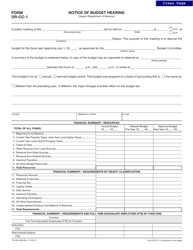

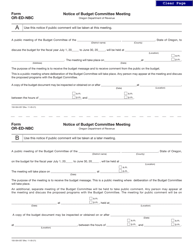

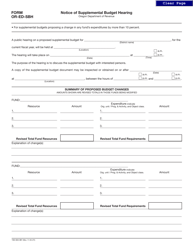

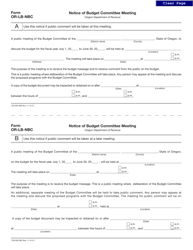

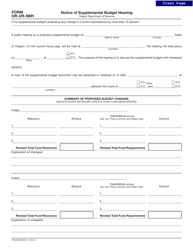

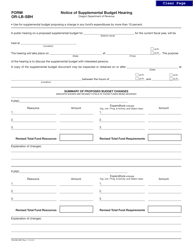

Form 150-504-073-8 Notice of Supplemental Budget Hearing - Oregon

What Is Form 150-504-073-8?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-504-073-8?

A: Form 150-504-073-8 is a notice of supplemental budget hearing in Oregon.

Q: What is a supplemental budget hearing?

A: A supplemental budget hearing is a meeting where additional budgetary appropriations or changes are discussed and approved.

Q: Why is a supplemental budget hearing held?

A: A supplemental budget hearing is held to address any changes or adjustments needed in the existing budget.

Q: Who receives the Form 150-504-073-8?

A: The Form 150-504-073-8 is typically sent to individuals or entities involved in the budgetary process.

Q: What information is included in the Form 150-504-073-8?

A: The Form 150-504-073-8 includes details about the supplemental budget hearing, such as the date, time, and location.

Q: Is attendance mandatory for the supplemental budget hearing?

A: Attendance at the supplemental budget hearing may be mandatory or optional, depending on the role and involvement of the individual or entity.

Q: What should be done if unable to attend the supplemental budget hearing?

A: If unable to attend the supplemental budget hearing, it is advisable to notify the appropriate authorities and provide any necessary input or feedback in writing.

Q: Can the budget be modified during the supplemental budget hearing?

A: Yes, the budget can be modified, adjusted, or supplemented based on the discussions and decisions made during the supplemental budget hearing.

Q: What is the significance of the supplemental budget hearing in Oregon?

A: The supplemental budget hearing in Oregon plays a crucial role in ensuring transparency, accountability, and effective allocation of funds.

Q: Are there any deadlines associated with the Form 150-504-073-8?

A: The Form 150-504-073-8 typically has a deadline for submission or response, which should be followed to ensure compliance with the budgetary process.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-504-073-8 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.