This version of the form is not currently in use and is provided for reference only. Download this version of

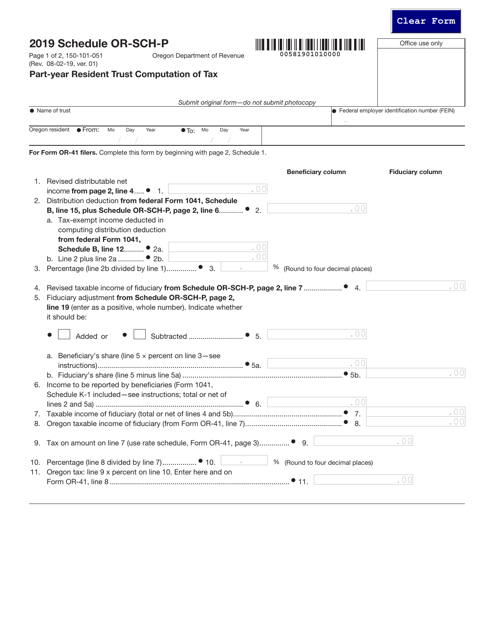

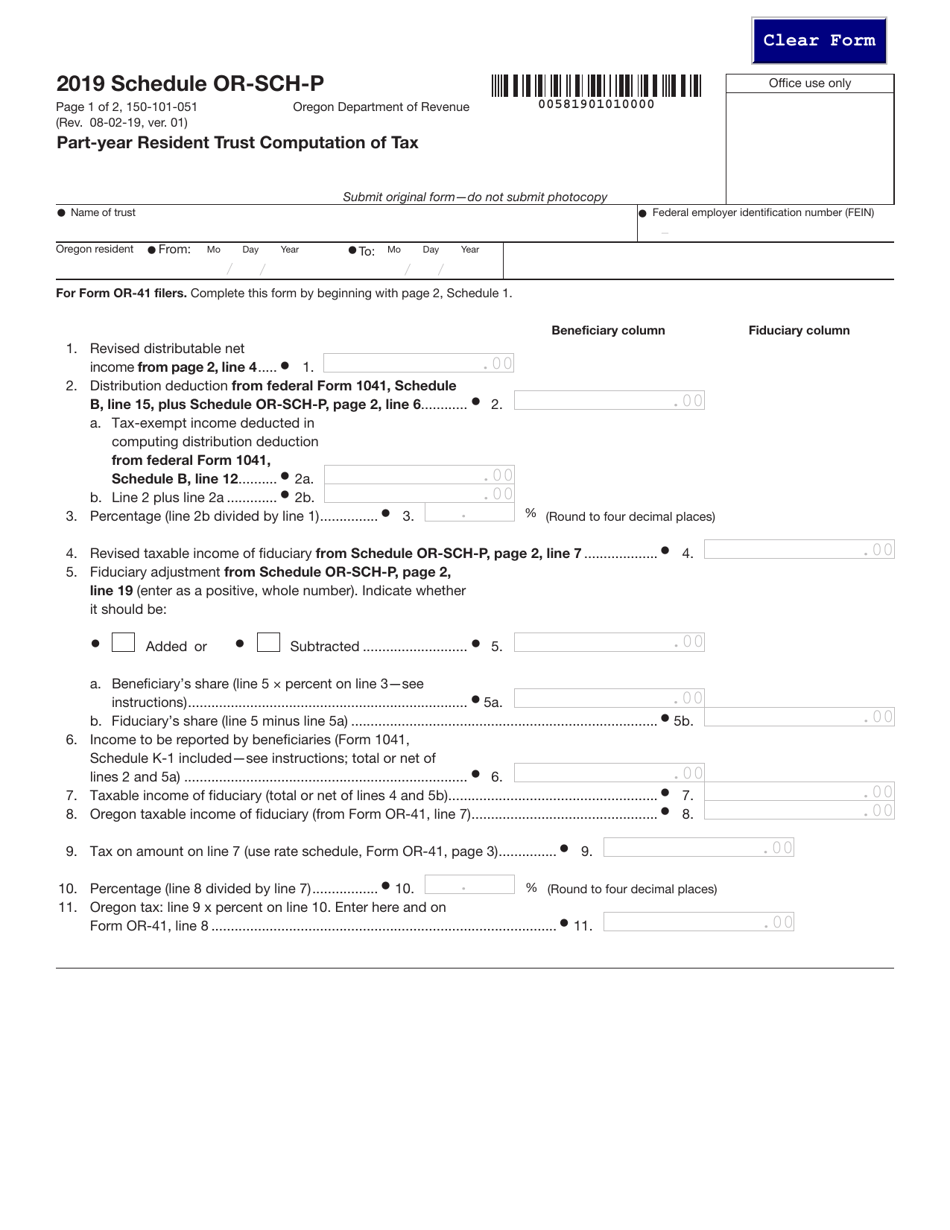

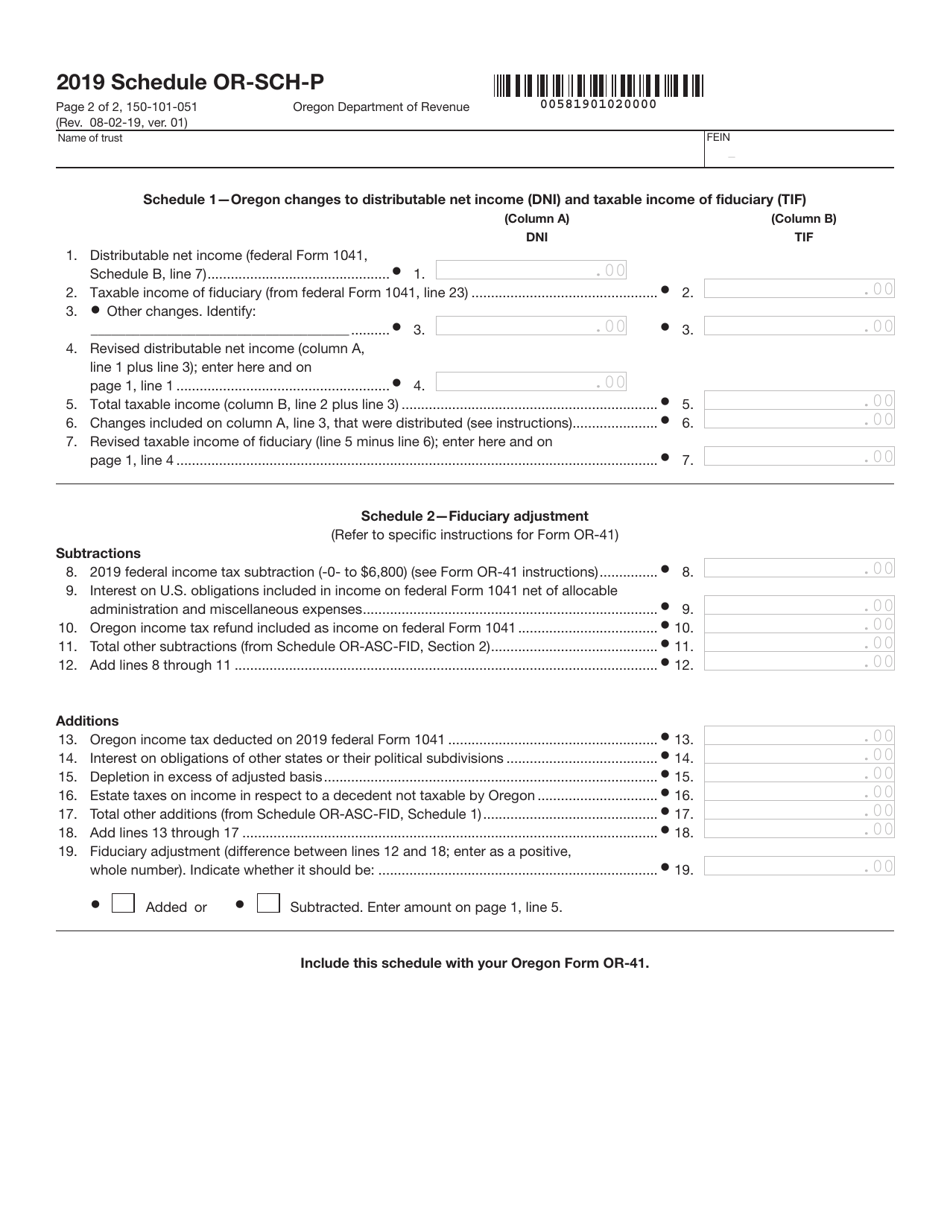

Form 150-101-051 Schedule OR-SCH-P

for the current year.

Form 150-101-051 Schedule OR-SCH-P Part-Year Resident Trust Computation of Tax - Oregon

What Is Form 150-101-051 Schedule OR-SCH-P?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-051?

A: Form 150-101-051 is a tax form used in Oregon for the computation of tax for part-year resident trusts.

Q: Who should use Form 150-101-051?

A: Form 150-101-051 should be used by part-year resident trusts in Oregon to calculate their tax liability.

Q: What is a part-year resident trust?

A: A part-year resident trust refers to a trust that was only a resident of Oregon for a portion of the tax year.

Q: What is the purpose of Part-Year Resident Trust Computation of Tax Form?

A: The purpose of Form 150-101-051 is to help part-year resident trusts in Oregon calculate their tax liability based on their income and deductions during the tax year.

Form Details:

- Released on August 2, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-051 Schedule OR-SCH-P by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.