This version of the form is not currently in use and is provided for reference only. Download this version of

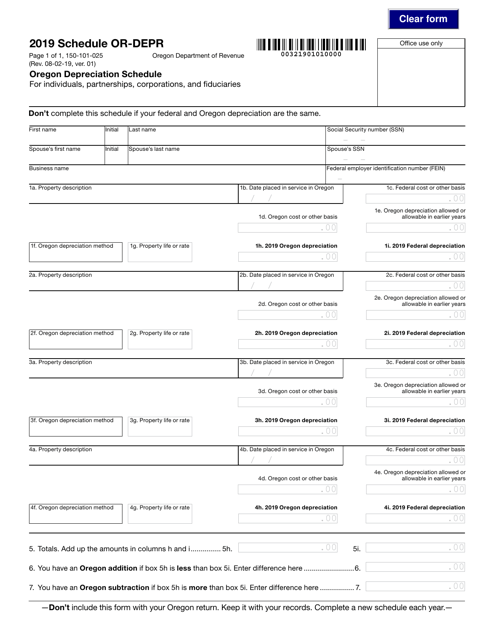

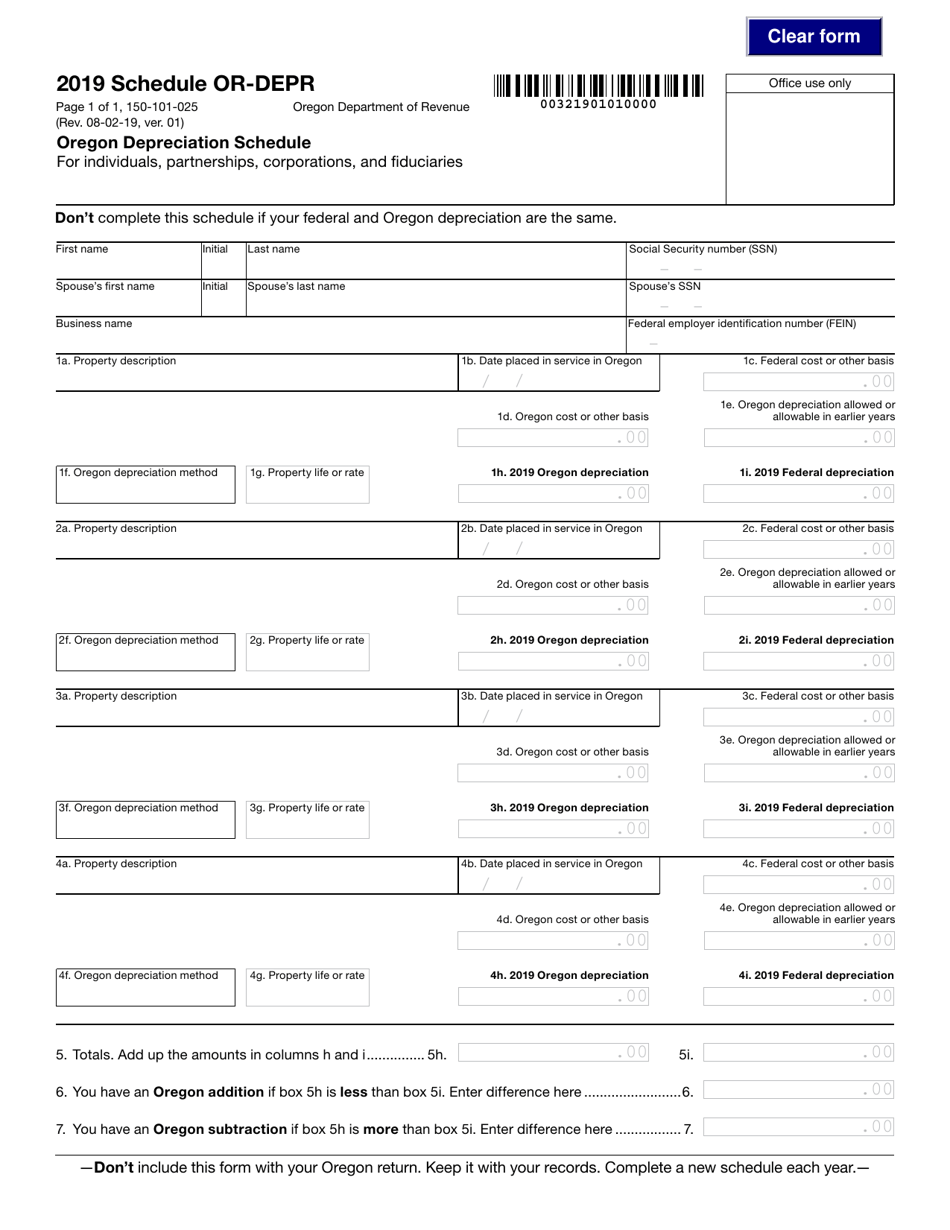

Form 150-101-025 Schedule OR-DEPR

for the current year.

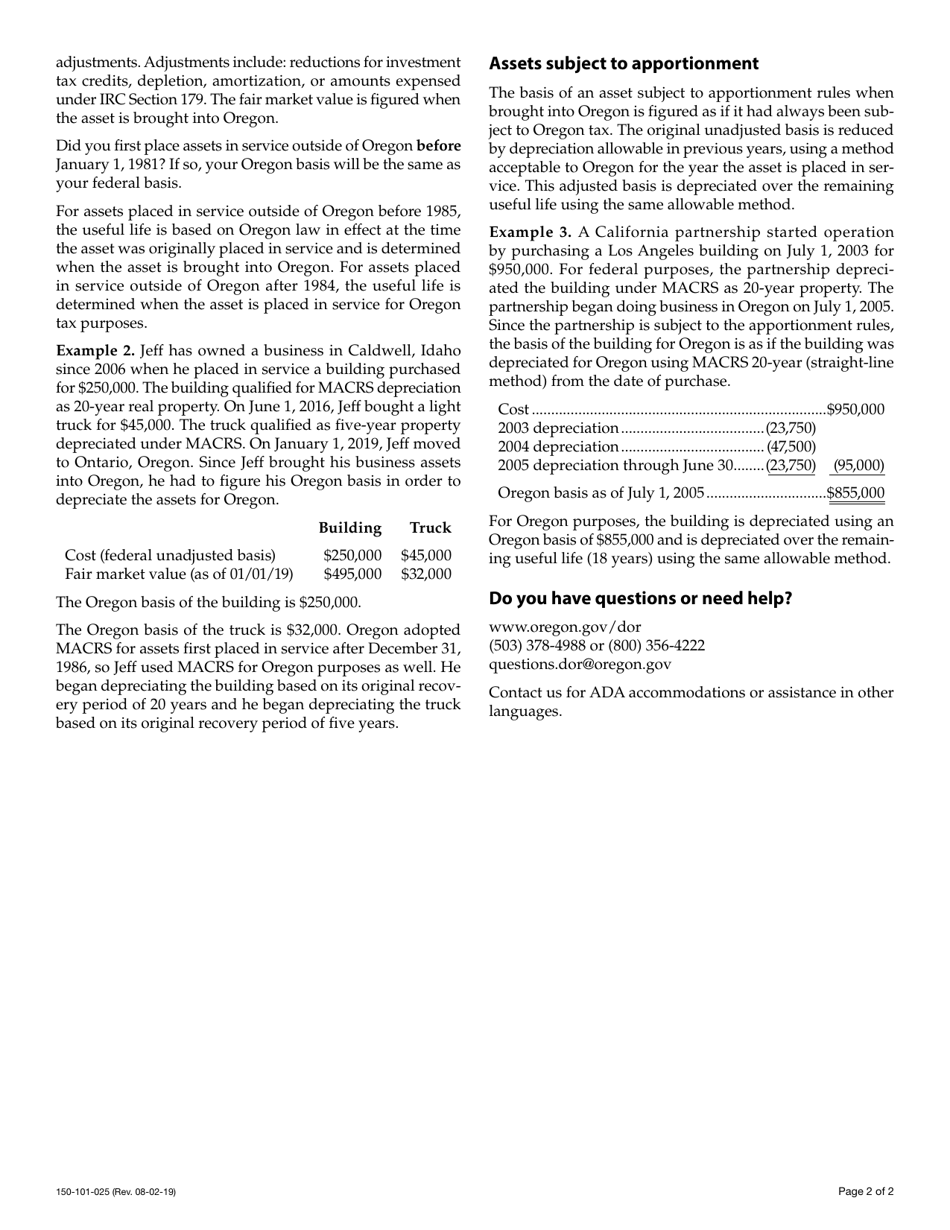

Form 150-101-025 Schedule OR-DEPR Oregon Depreciation Schedule - Oregon

What Is Form 150-101-025 Schedule OR-DEPR?

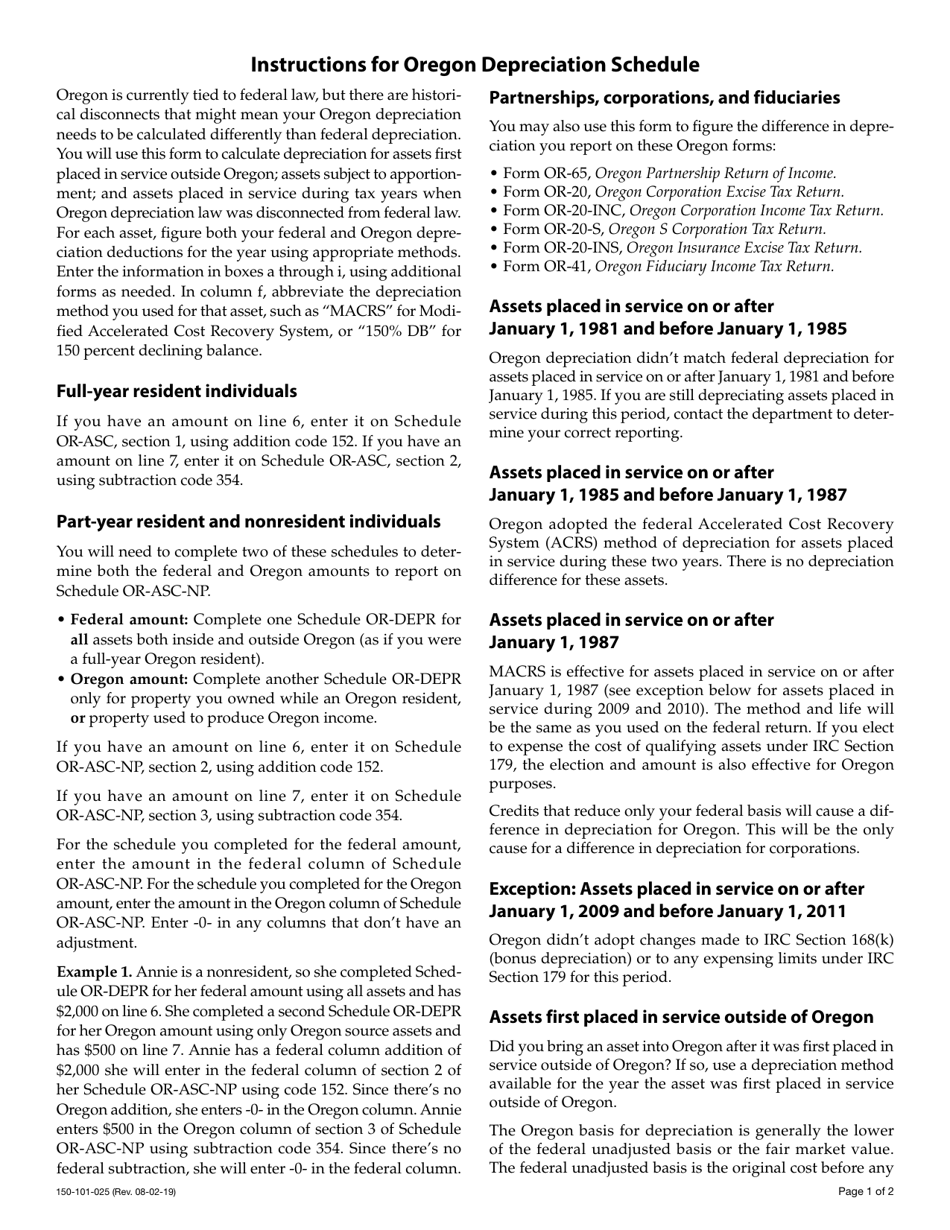

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-025?

A: Form 150-101-025 is the Oregon Depreciation Schedule.

Q: What is the purpose of Form 150-101-025?

A: The purpose of Form 150-101-025 is to calculate depreciation deductions for Oregon tax purposes.

Q: Who needs to file Form 150-101-025?

A: Taxpayers who need to calculate depreciation deductions for Oregon tax purposes need to file Form 150-101-025.

Q: What is the Schedule OR-DEPR?

A: The Schedule OR-DEPR is another name for Form 150-101-025, the Oregon Depreciation Schedule.

Form Details:

- Released on August 2, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-025 Schedule OR-DEPR by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.