This version of the form is not currently in use and is provided for reference only. Download this version of

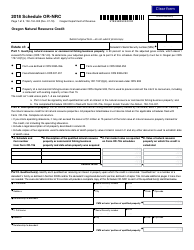

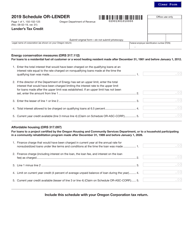

Instructions for Form 150-104-003 Schedule OR-NRC

for the current year.

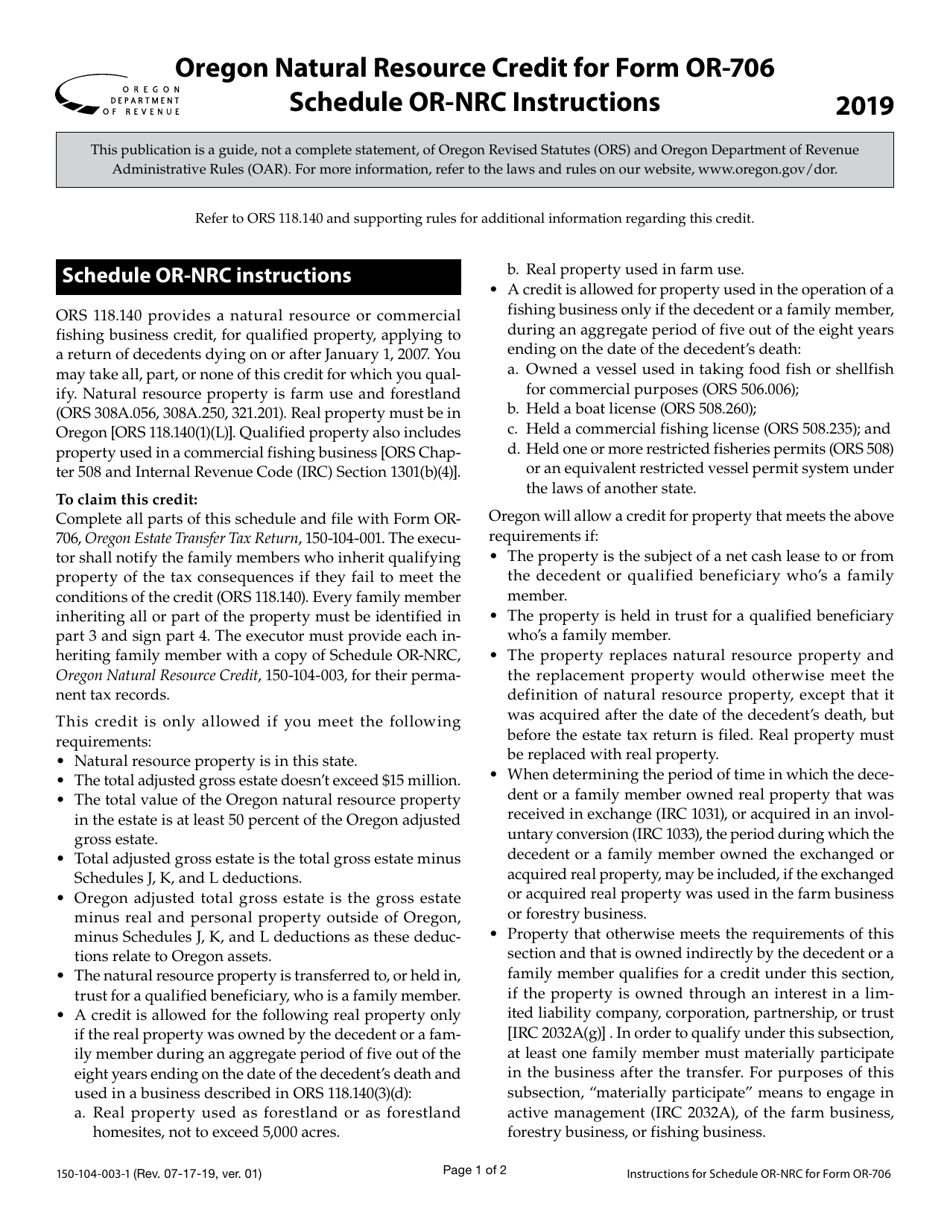

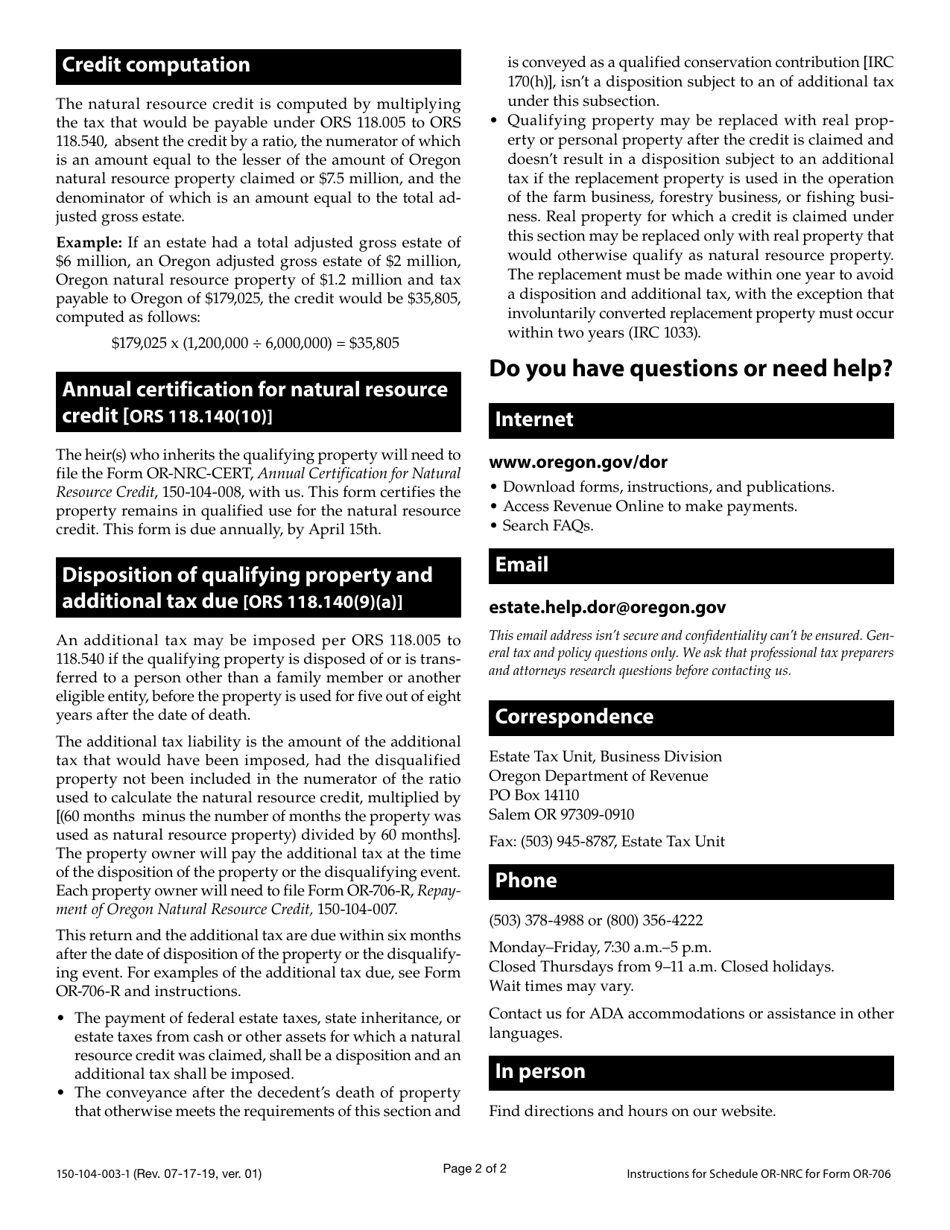

Instructions for Form 150-104-003 Schedule OR-NRC Oregon Natural Resource Credit - Oregon

This document contains official instructions for Form 150-104-003 Schedule OR-NRC, Oregon Natural Resource Credit - a form released and collected by the Oregon Department of Revenue.

FAQ

Q: What is Form 150-104-003?

A: Form 150-104-003 is a tax form for claiming the Oregon Natural Resource Credit.

Q: What is the Oregon Natural Resource Credit?

A: The Oregon Natural Resource Credit is a tax credit aimed at promoting conservation and natural resource stewardship in Oregon.

Q: How do I qualify for the Oregon Natural Resource Credit?

A: To qualify for the credit, you must own or lease qualifying natural resource property in Oregon.

Q: What expenses are eligible for the credit?

A: Expenses related to the conservation, protection, or enhancement of natural resources on your property may be eligible for the credit.

Q: How much is the credit worth?

A: The credit is worth 8% of eligible expenses, up to a maximum of $2,500 per tax year.

Q: How do I claim the Oregon Natural Resource Credit?

A: You can claim the credit by completing Form 150-104-003 and including it with your Oregon state tax return.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are certain limitations and restrictions on the credit, such as a cap on the total amount of credits that can be claimed each year.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.