This version of the form is not currently in use and is provided for reference only. Download this version of

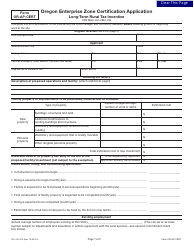

Form 150-102-046 Schedule OR-REZT

for the current year.

Form 150-102-046 Schedule OR-REZT Reservation Enterprise Zone Tax Credit - Oregon

What Is Form 150-102-046 Schedule OR-REZT?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-102-046?

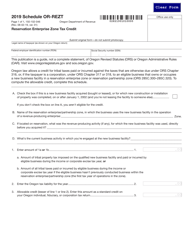

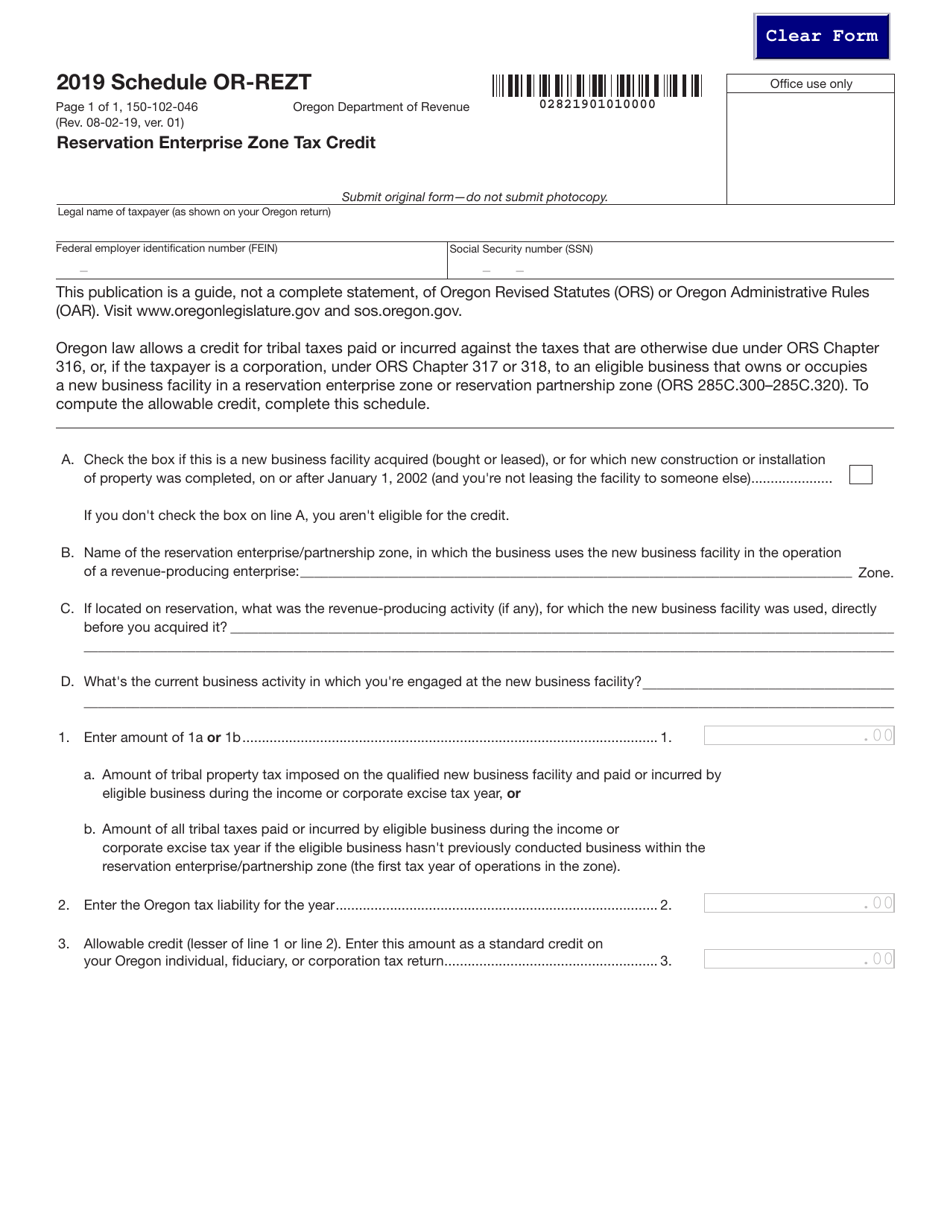

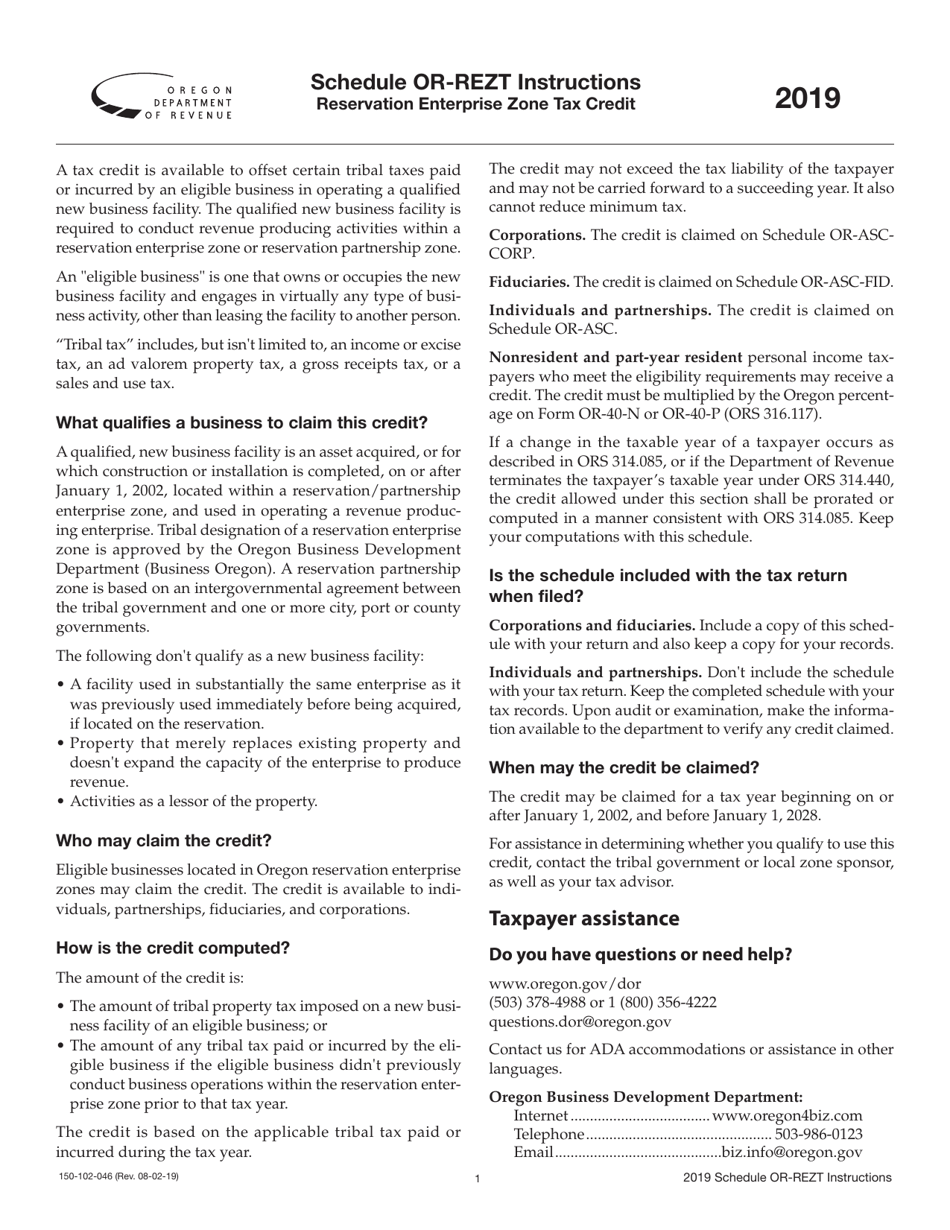

A: Form 150-102-046 is the Schedule OR-REZT used to claim the Reservation Enterprise ZoneTax Credit in Oregon.

Q: What is the Reservation Enterprise Zone Tax Credit?

A: The Reservation Enterprise Zone Tax Credit is a tax incentive offered by the state of Oregon to businesses operating within designated reservation enterprise zones.

Q: How do I claim the Reservation Enterprise Zone Tax Credit?

A: You can claim the Reservation Enterprise Zone Tax Credit by completing Form 150-102-046 Schedule OR-REZT and attaching it to your Oregon state tax return.

Q: Can individuals claim the Reservation Enterprise Zone Tax Credit?

A: No, the Reservation Enterprise Zone Tax Credit is only available to businesses that meet the eligibility criteria.

Form Details:

- Released on August 2, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-046 Schedule OR-REZT by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.