This version of the form is not currently in use and is provided for reference only. Download this version of

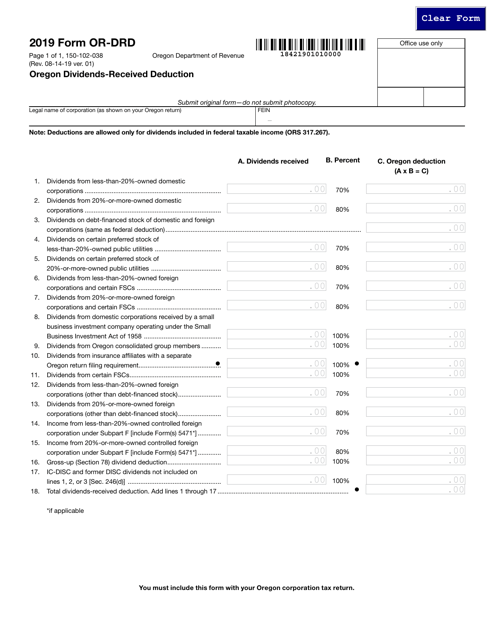

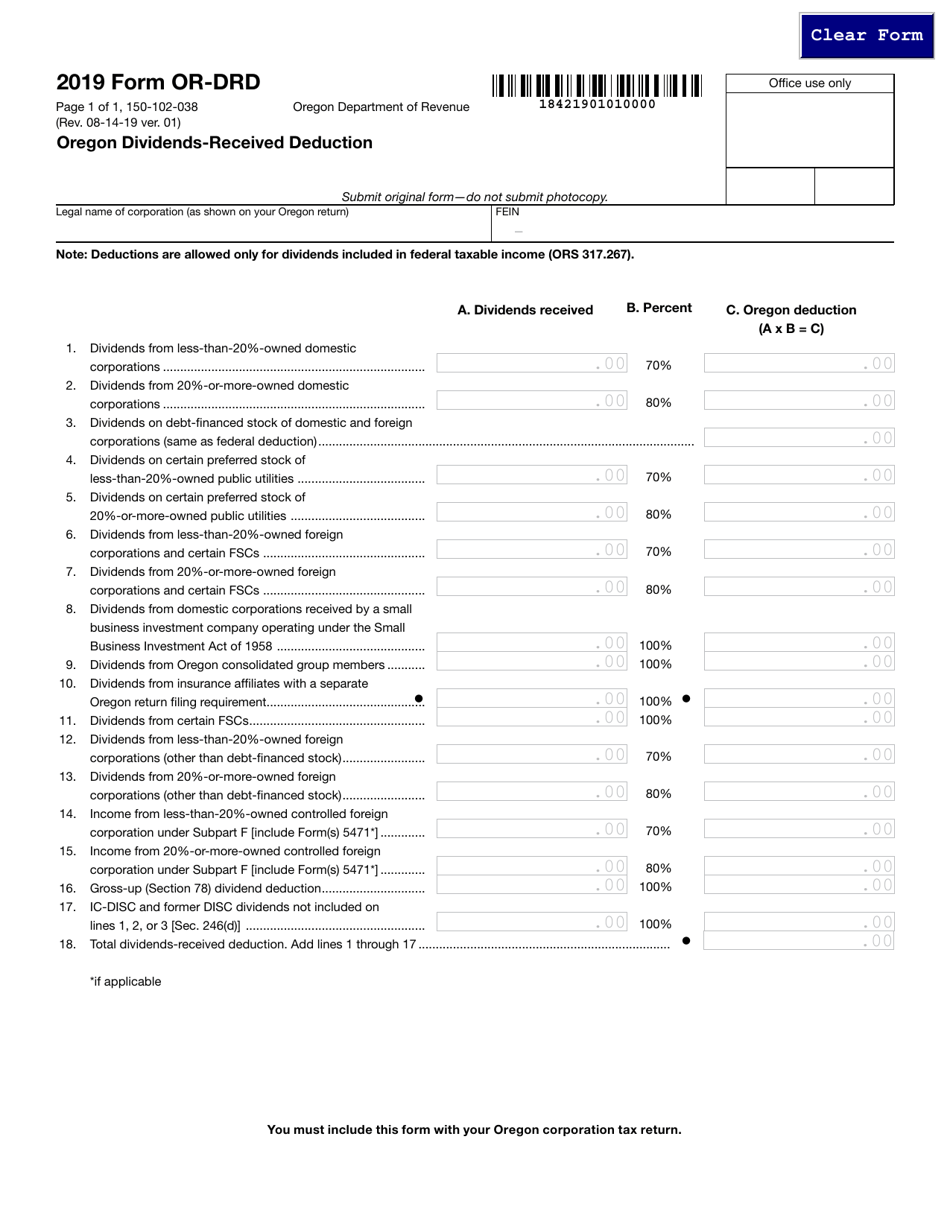

Form OR-DRD (150-102-038)

for the current year.

Form OR-DRD (150-102-038) Oregon Dividends-Received Deduction - Oregon

What Is Form OR-DRD (150-102-038)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-DRD?

A: Form OR-DRD is the Oregon Dividends-Received Deduction form.

Q: What is the purpose of Form OR-DRD?

A: The purpose of Form OR-DRD is to claim the Oregon Dividends-Received Deduction.

Q: What is the Oregon Dividends-Received Deduction?

A: The Oregon Dividends-Received Deduction is a tax deduction for dividends received from certain corporations.

Q: Who is eligible to claim the Oregon Dividends-Received Deduction?

A: Individuals who received qualifying dividends from eligible corporations are eligible to claim the deduction.

Q: How do I complete Form OR-DRD?

A: You need to provide the required information about the qualifying dividends you received and calculate the deduction amount.

Q: Is there a deadline for filing Form OR-DRD?

A: Form OR-DRD should be filed with your Oregon tax return by the tax filing deadline.

Q: Can I claim the Oregon Dividends-Received Deduction if I don't live in Oregon?

A: No, the Oregon Dividends-Received Deduction is only available to Oregon residents.

Form Details:

- Released on August 14, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-DRD (150-102-038) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.