This version of the form is not currently in use and is provided for reference only. Download this version of

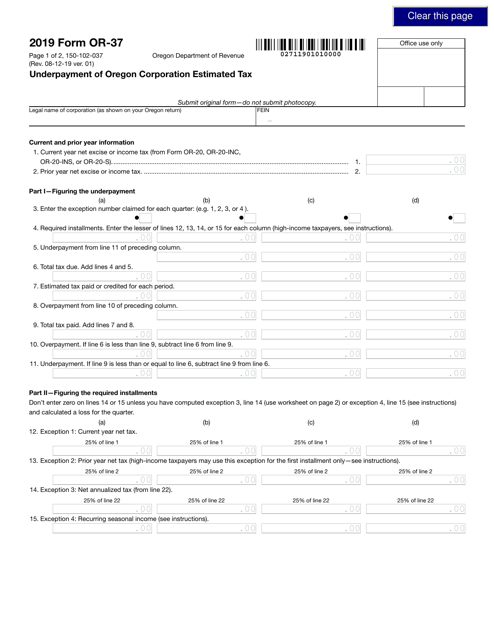

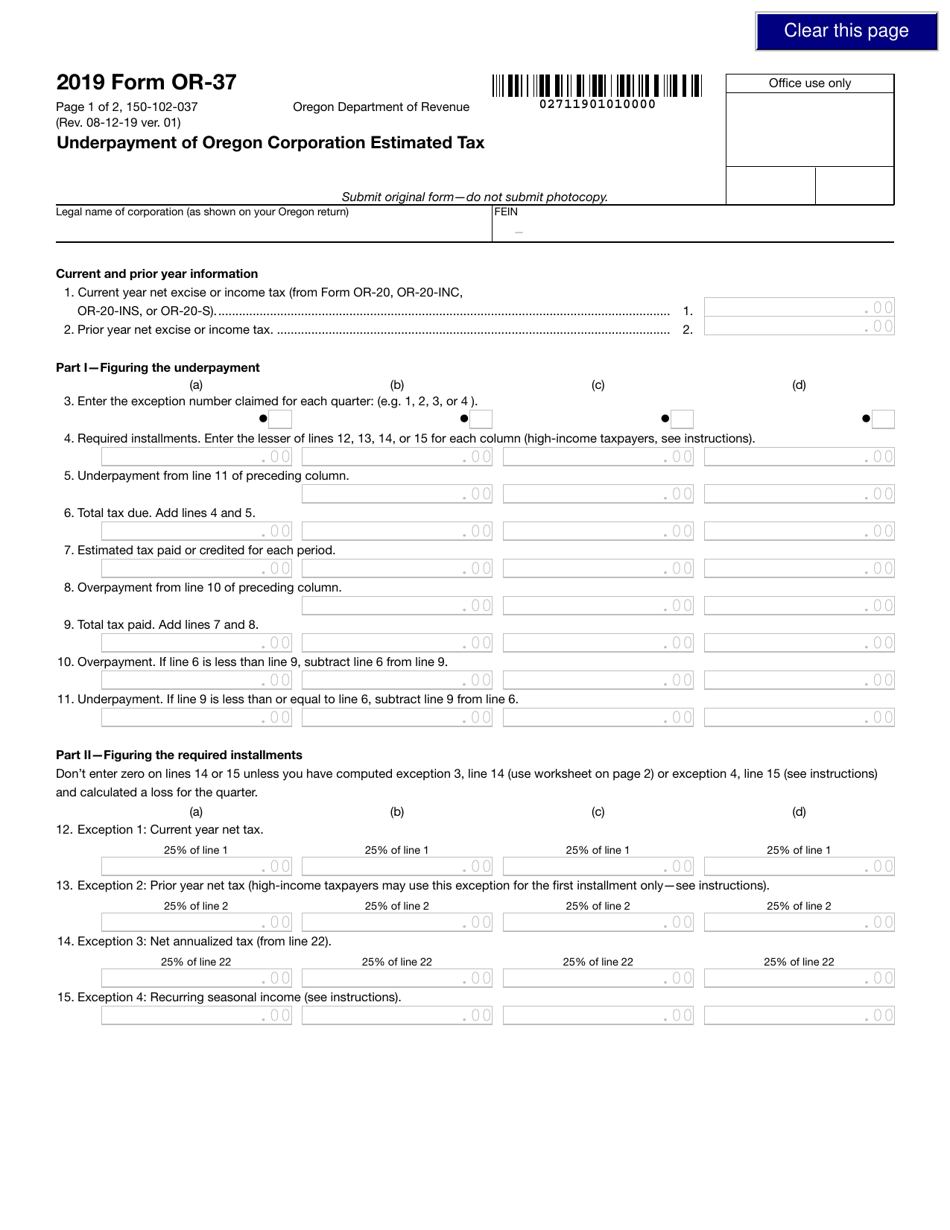

Form OR-37 (150-102-037)

for the current year.

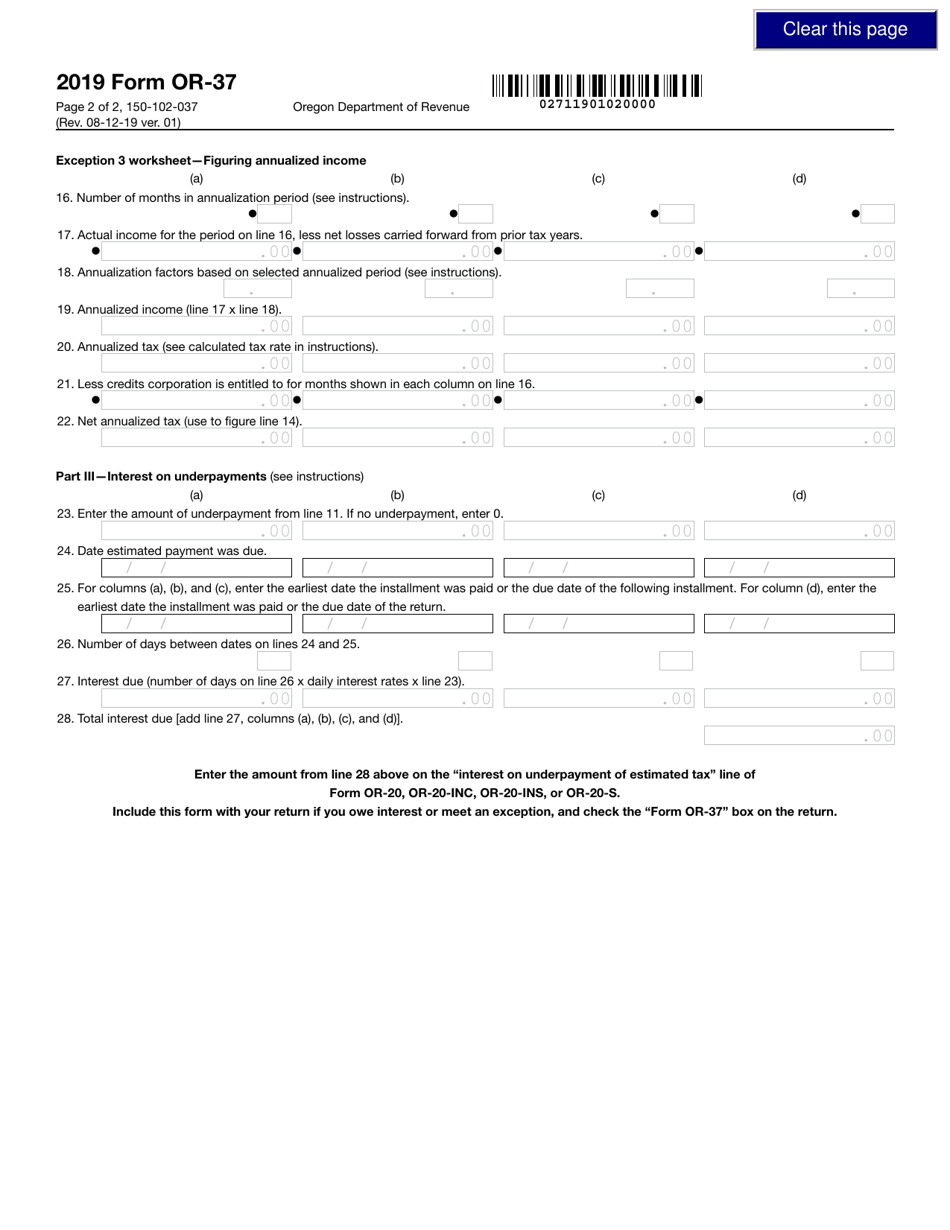

Form OR-37 (150-102-037) Underpayment of Oregon Corporation Estimated Tax - Oregon

What Is Form OR-37 (150-102-037)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-37?

A: Form OR-37 is a form used to report and calculate the underpayment of estimated tax by an Oregon Corporation.

Q: What is the purpose of Form OR-37?

A: The purpose of Form OR-37 is to determine if an Oregon Corporation has underpaid their estimated tax and calculate any penalties or interest owed.

Q: Who needs to file Form OR-37?

A: Oregon Corporations who have underpaid their estimated tax are required to file Form OR-37.

Q: How do you fill out Form OR-37?

A: To fill out Form OR-37, you will need to provide information from your Oregon corporation tax return, including the total tax liability and the amounts of estimated tax paid.

Q: When is Form OR-37 due?

A: Form OR-37 is generally due on or before the 15th day of the month following the close of the corporation's tax year.

Q: Are there any penalties for late filing of Form OR-37?

A: Yes, there may be penalties for late filing of Form OR-37. It is important to file the form on time to avoid penalties and interest charges.

Q: Can Form OR-37 be filed electronically?

A: No, currently electronic filing is not available for Form OR-37. It must be filed by mail or in person.

Form Details:

- Released on August 12, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-37 (150-102-037) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.