This version of the form is not currently in use and is provided for reference only. Download this version of

Form OR-24 (150-101-734)

for the current year.

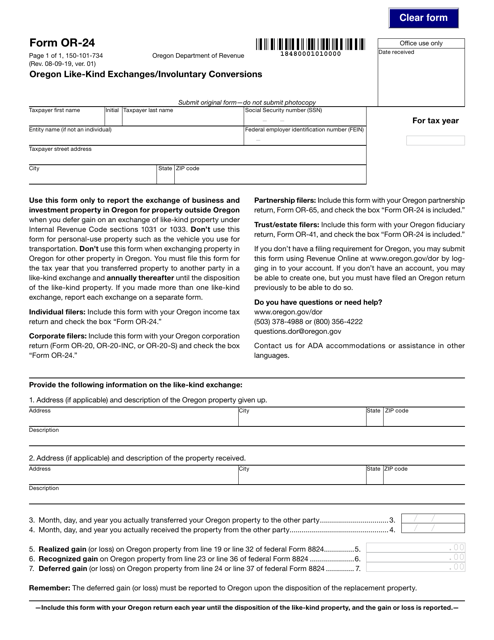

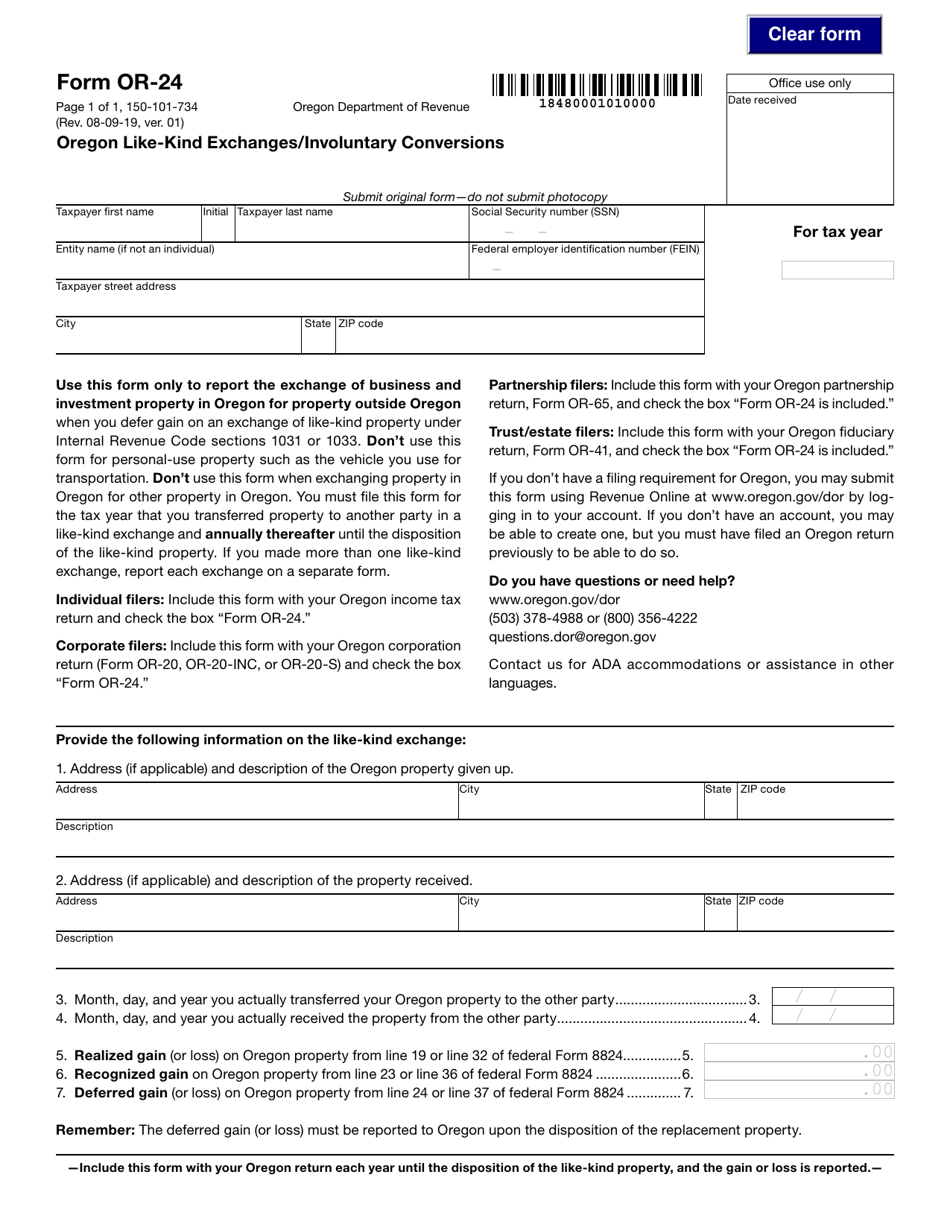

Form OR-24 (150-101-734) Oregon Like-Kind Exchanges / Involuntary Conversions - Oregon

What Is Form OR-24 (150-101-734)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-24?

A: Form OR-24 is a tax form specific to Oregon that is used for reporting Like-Kind Exchanges and Involuntary Conversions.

Q: What is a Like-Kind Exchange?

A: A Like-Kind Exchange refers to the exchange of property held for business or investment purposes that is of the same nature or character, resulting in the deferral of capital gains taxes.

Q: What is an Involuntary Conversion?

A: An Involuntary Conversion refers to the loss or destruction of property due to theft, casualty, condemnation, or certain other circumstances, resulting in the deferral of capital gains taxes.

Q: Who needs to file Form OR-24?

A: Any taxpayer in Oregon who has engaged in a Like-Kind Exchange or experienced an Involuntary Conversion of property may need to file Form OR-24.

Form Details:

- Released on August 9, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-24 (150-101-734) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.