This version of the form is not currently in use and is provided for reference only. Download this version of

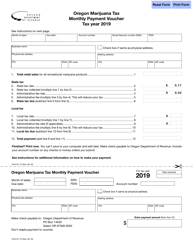

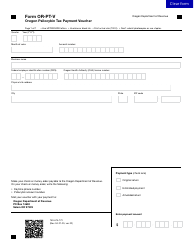

Form OR-OTC-V (150-211-053)

for the current year.

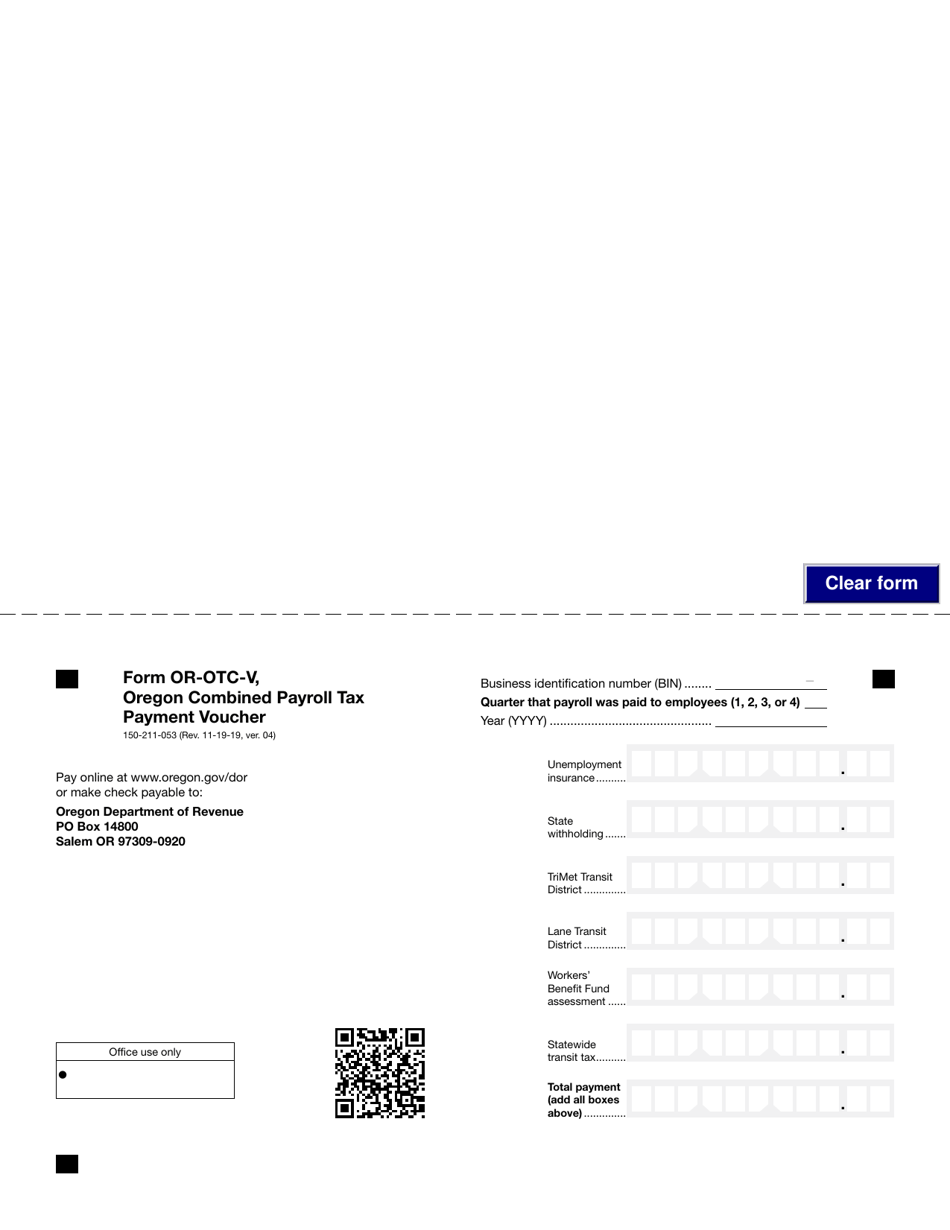

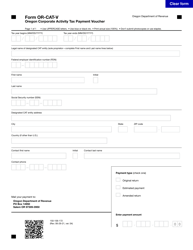

Form OR-OTC-V (150-211-053) Oregon Combined Payroll Tax Payment Voucher - Oregon

What Is Form OR-OTC-V (150-211-053)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-OTC-V?

A: Form OR-OTC-V is the Oregon Combined Payroll Tax Payment Voucher.

Q: What is the purpose of Form OR-OTC-V?

A: The purpose of Form OR-OTC-V is to make payroll tax payments in Oregon.

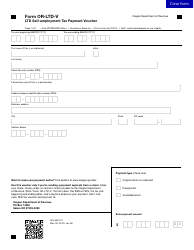

Q: Who needs to use Form OR-OTC-V?

A: Employers who are required to pay payroll taxes in Oregon need to use Form OR-OTC-V.

Q: Are there any specific instructions for filling out Form OR-OTC-V?

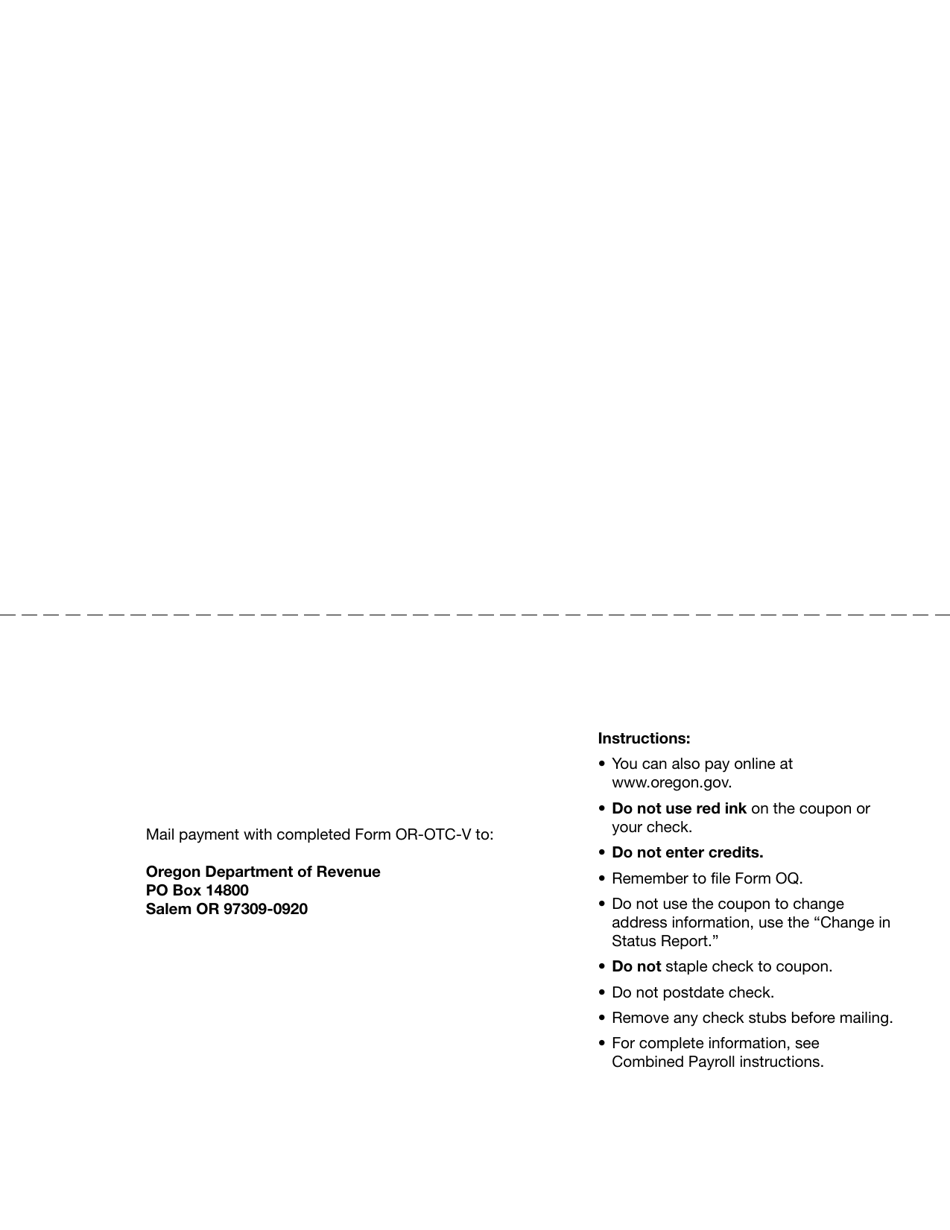

A: Yes, there are instructions provided along with the form. It is important to follow these instructions carefully.

Q: When is Form OR-OTC-V due?

A: Form OR-OTC-V is due on the last day of the month following the end of the quarter.

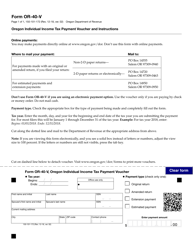

Q: What happens if I don't submit Form OR-OTC-V?

A: Failure to submit Form OR-OTC-V or make the required payroll tax payments may result in penalties and interest charges.

Form Details:

- Released on November 19, 2019;

- The latest edition provided by the Oregon Department of Revenue;

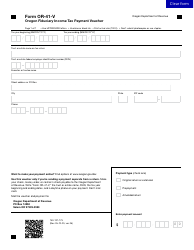

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-OTC-V (150-211-053) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.