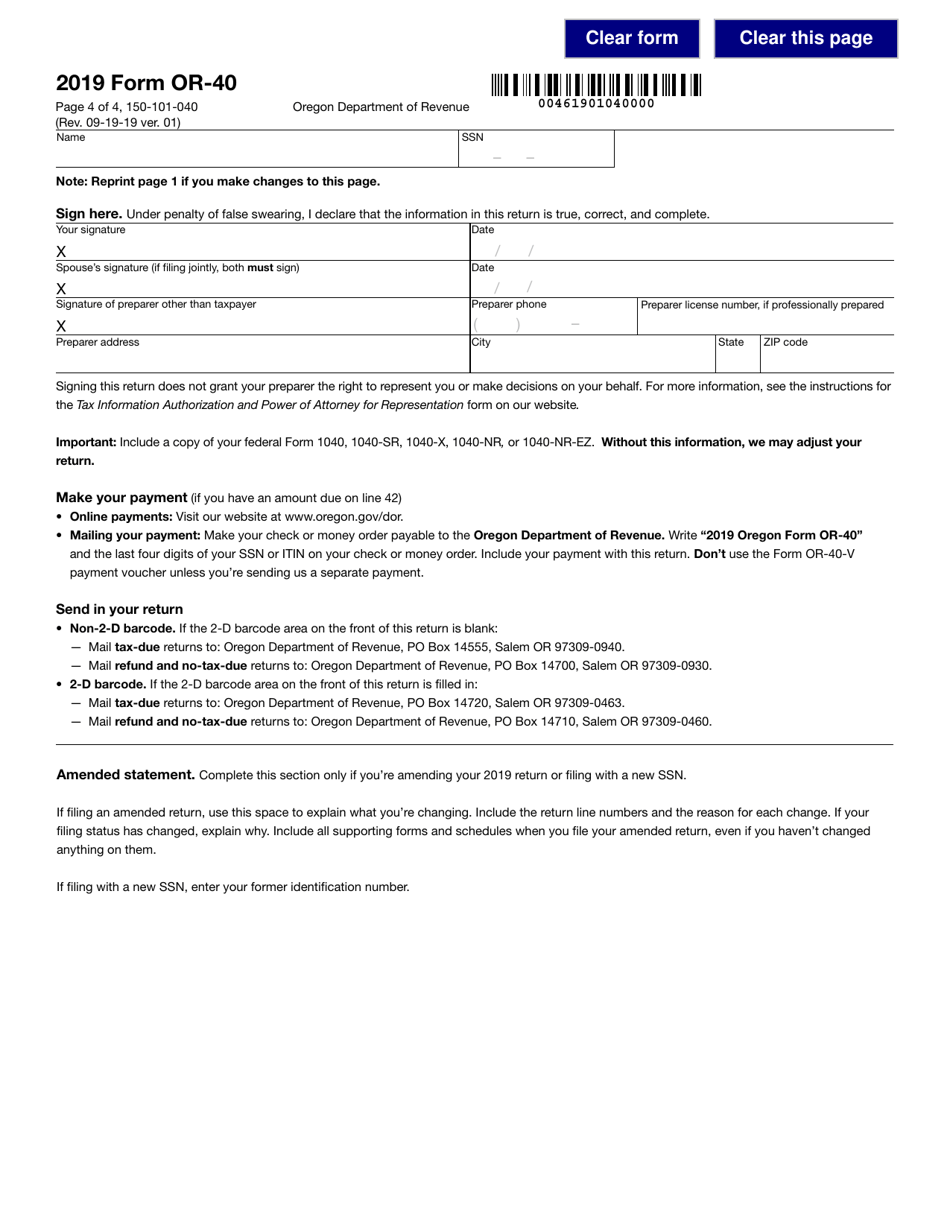

This version of the form is not currently in use and is provided for reference only. Download this version of

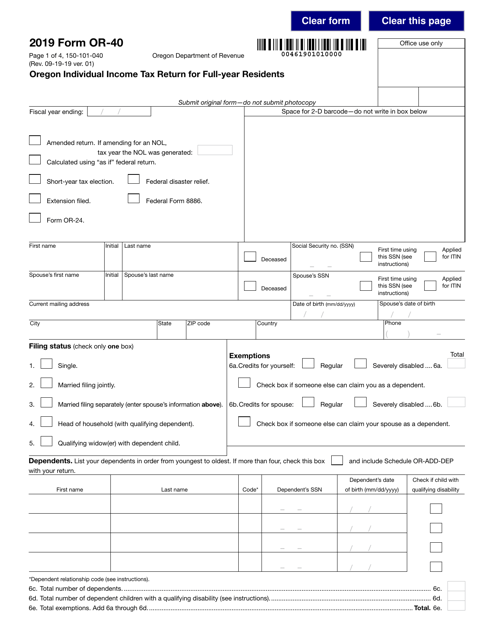

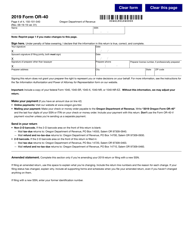

Form OR-40 (150-101-040)

for the current year.

Form OR-40 (150-101-040) Oregon Individual Income Tax Return for Full-Year Residents - Oregon

What Is Form OR-40 (150-101-040)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-40?

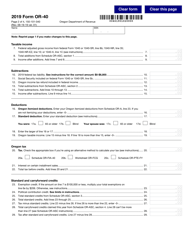

A: Form OR-40 is the Oregon Individual Income Tax Return for full-year residents of Oregon.

Q: Who needs to file Form OR-40?

A: Full-year residents of Oregon who need to report their income and claim any eligible deductions or credits should file Form OR-40.

Q: When is the deadline to file Form OR-40?

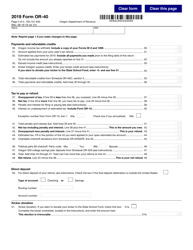

A: The deadline to file Form OR-40 is usually April 15th, but it may vary depending on weekends and holidays.

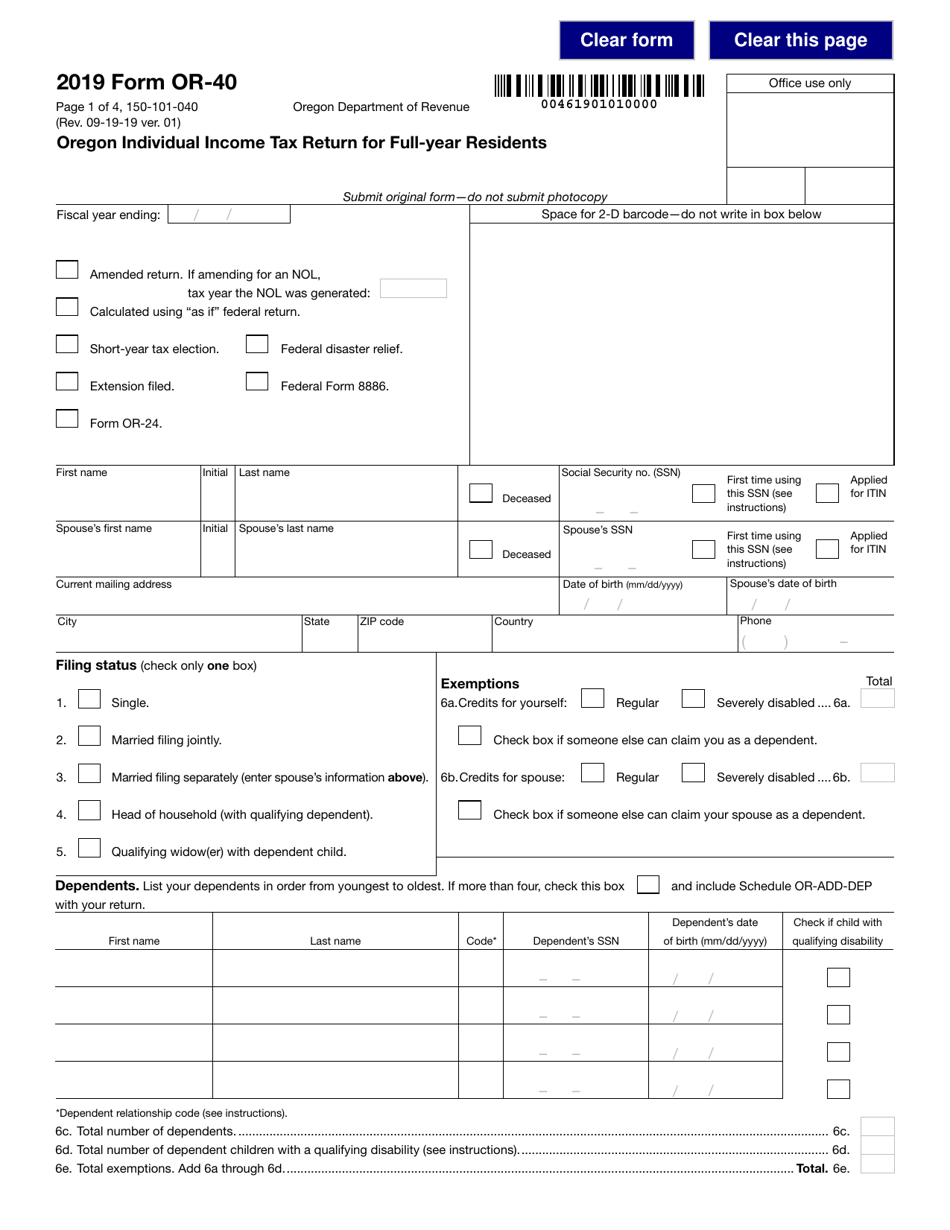

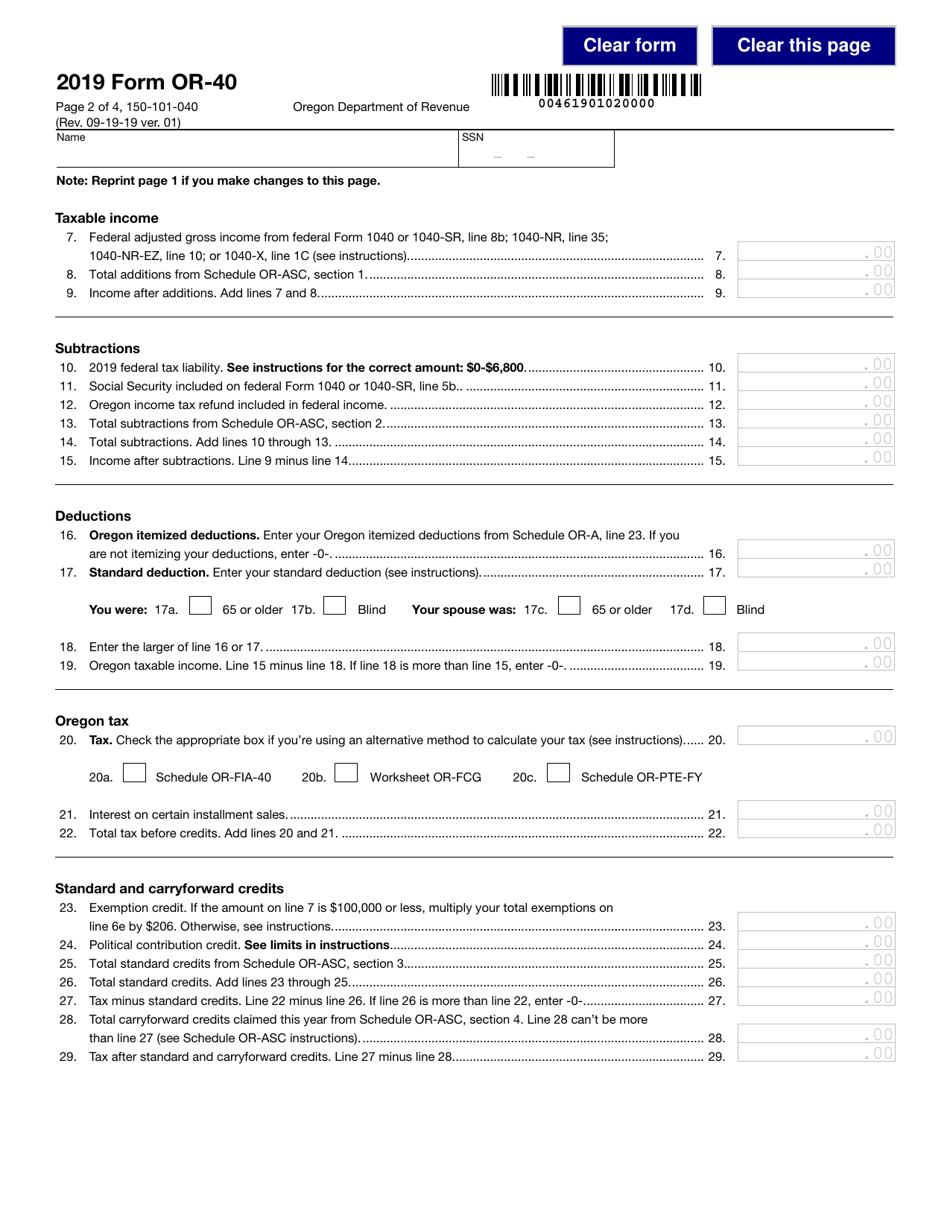

Q: What should I include with Form OR-40?

A: You should include any required supporting documentation such as W-2 forms, 1099 forms, and schedules detailing deductions or credits.

Q: Is there a penalty for filing Form OR-40 late?

A: Yes, if you file Form OR-40 late, you may be subject to penalties and interest on any unpaid tax owed.

Q: What if I need an extension to file Form OR-40?

A: You can request an extension to file Form OR-40, but any tax owed must still be paid by the original deadline to avoid penalties and interest.

Form Details:

- Released on September 19, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-40 (150-101-040) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.