This version of the form is not currently in use and is provided for reference only. Download this version of

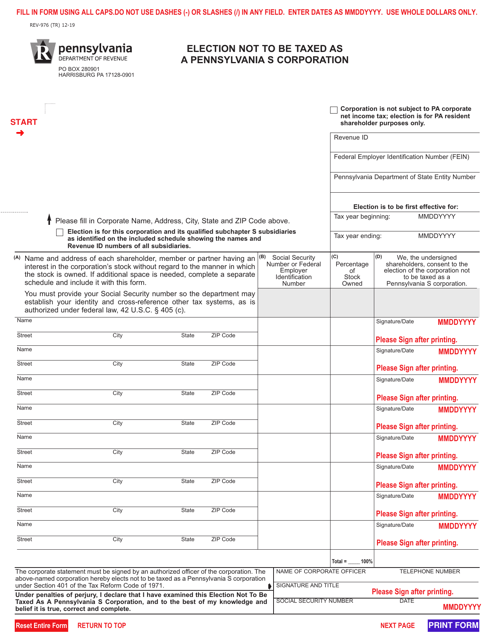

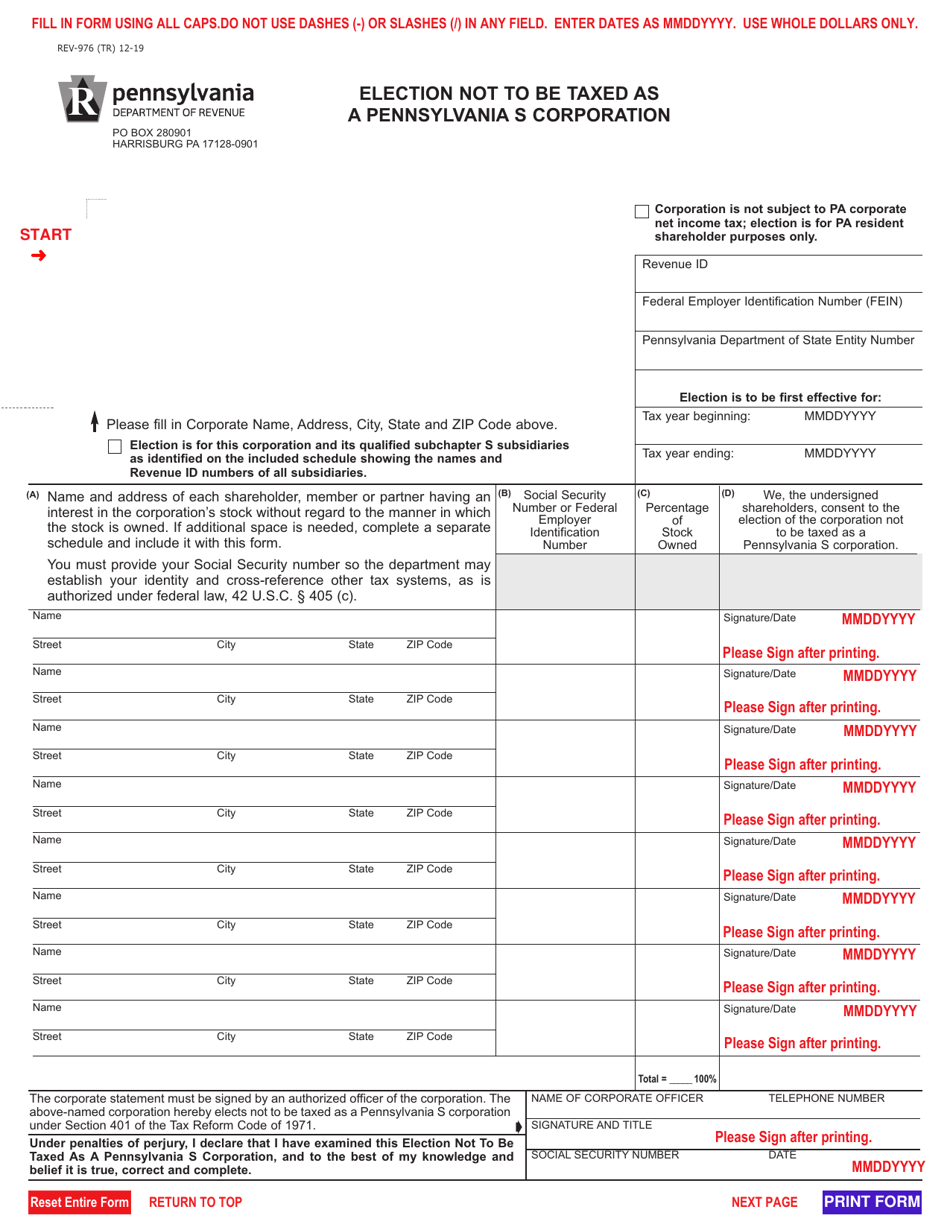

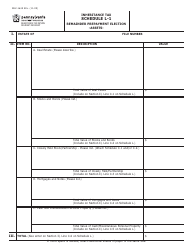

Form REV-976

for the current year.

Form REV-976 Election Not to Be Taxed as a Pennsylvania S Corporation - Pennsylvania

What Is Form REV-976?

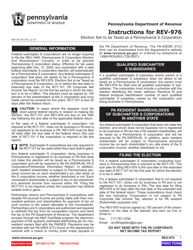

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-976?

A: Form REV-976 is a tax form used in the state of Pennsylvania.

Q: What does Form REV-976 allow?

A: Form REV-976 allows a corporation in Pennsylvania to elect not to be taxed as an S corporation.

Q: How does Form REV-976 work?

A: By filing Form REV-976, a corporation can choose to be taxed as a regular corporation instead of being treated as an S corporation.

Q: What are the benefits of electing not to be taxed as an S corporation in Pennsylvania?

A: There may be certain tax benefits for a corporation in Pennsylvania if it chooses not to be taxed as an S corporation.

Q: Is Form REV-976 applicable only to Pennsylvania?

A: Yes, Form REV-976 is specific to the state of Pennsylvania and is not applicable in other states.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-976 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.