This version of the form is not currently in use and is provided for reference only. Download this version of

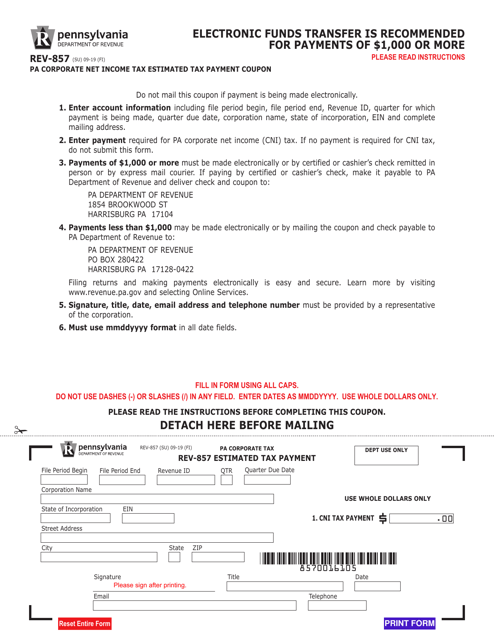

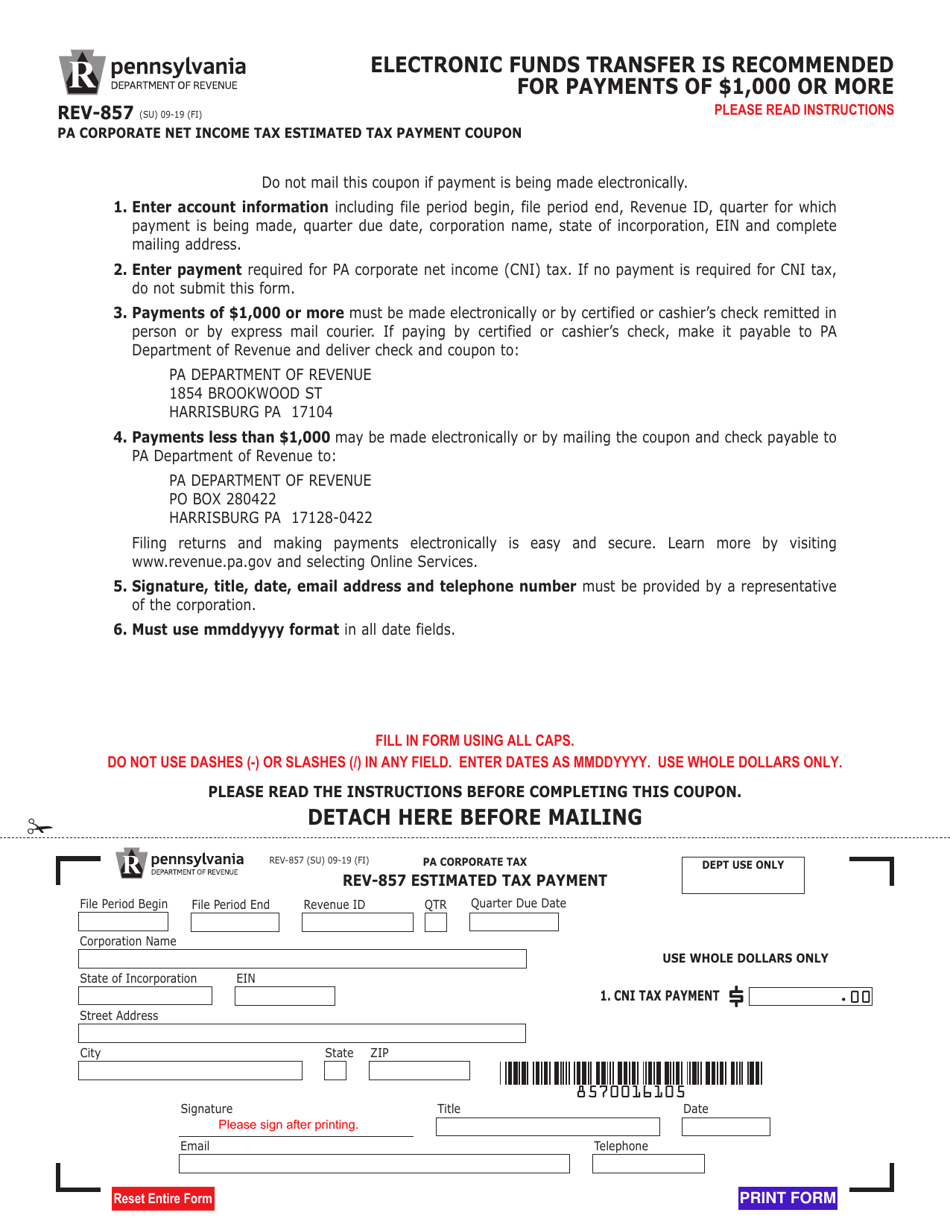

Form REV-857

for the current year.

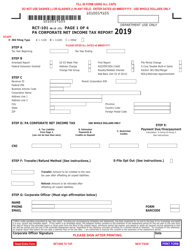

Form REV-857 Pa Corporate Net Income Tax Estimated Tax Payment Coupon - Pennsylvania

What Is Form REV-857?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-857?

A: Form REV-857 is the Pennsylvania Corporate Net Income Tax Estimated Tax Payment Coupon.

Q: What is the purpose of Form REV-857?

A: Form REV-857 is used to make estimated tax payments for the Pennsylvania Corporate Net Income Tax.

Q: Who needs to file Form REV-857?

A: Corporations that are subject to the Pennsylvania Corporate Net Income Tax and are required to make estimated tax payments need to file Form REV-857.

Q: When is Form REV-857 due?

A: Form REV-857 must be filed and the estimated tax payment must be made by the due dates specified by the Pennsylvania Department of Revenue.

Q: Is Form REV-857 for individuals or businesses?

A: Form REV-857 is specifically for corporations subject to the Pennsylvania Corporate Net Income Tax.

Q: What information is required on Form REV-857?

A: Form REV-857 requires you to provide your corporation's name, address, tax year, estimated tax payment amount, and other related information.

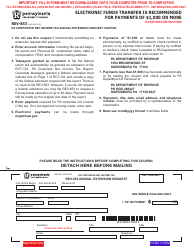

Q: Can I file Form REV-857 electronically?

A: Yes, you can file Form REV-857 electronically through the Pennsylvania Department of Revenue's e-TIDES system.

Q: Are there any penalties for not filing Form REV-857?

A: Yes, failure to file Form REV-857 or make timely estimated tax payments may result in penalties and interest charges.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-857 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.