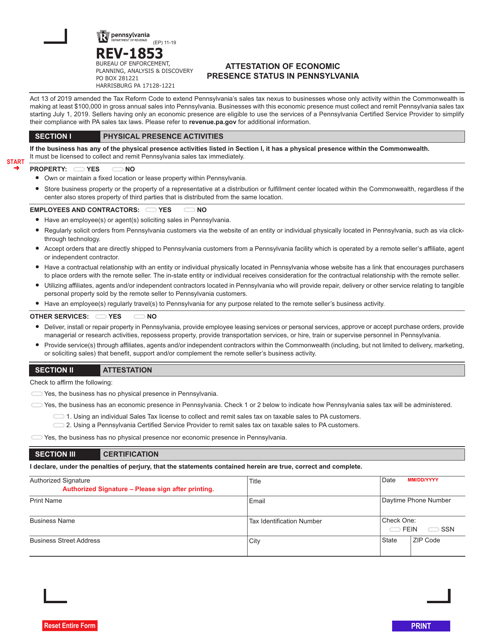

Form REV-1853 Attestation of Economic Presence Status in Pennsylvania - Pennsylvania

What Is Form REV-1853?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1853?

A: Form REV-1853 is the Attestation of Economic Presence Status in Pennsylvania.

Q: What is the purpose of Form REV-1853?

A: The purpose of Form REV-1853 is to certify the economic presence status of a business.

Q: Who needs to file Form REV-1853?

A: Businesses that have economic presence in Pennsylvania need to file Form REV-1853.

Q: What is meant by economic presence?

A: Economic presence refers to a business having a substantial connection with the state of Pennsylvania, such as having sales or employees in the state.

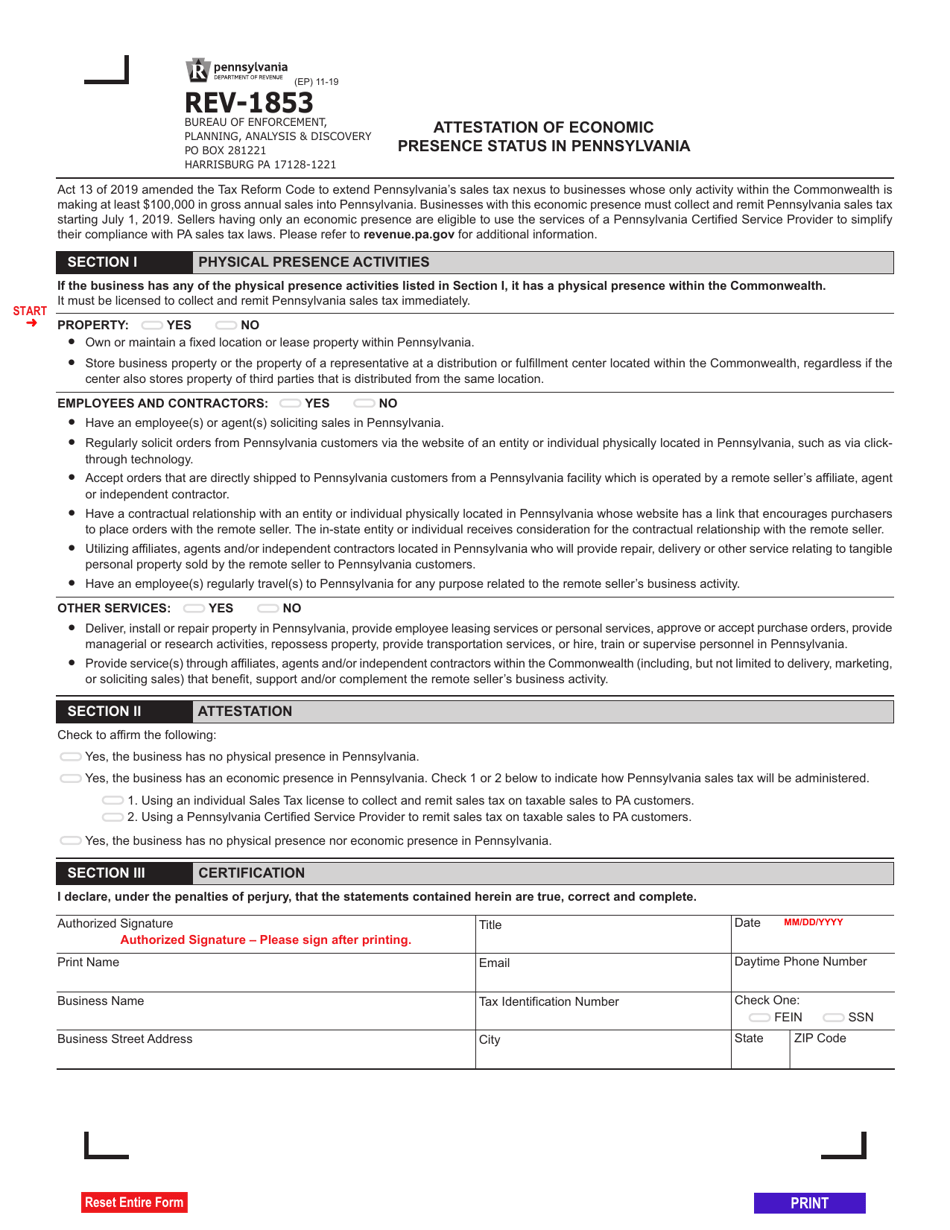

Q: What information is required on Form REV-1853?

A: Form REV-1853 requires information about the business, including its name, address, federal identification number, and details about its economic presence in Pennsylvania.

Q: When is Form REV-1853 due?

A: Form REV-1853 is generally due on or before the due date of the business's Pennsylvania tax return.

Q: Are there any penalties for not filing Form REV-1853?

A: Failure to file Form REV-1853 or providing false or incomplete information may result in penalties and interest.

Q: Can Form REV-1853 be filed electronically?

A: Yes, Form REV-1853 can be filed electronically using the Pennsylvania Department of Revenue's e-TIDES system.

Q: Is Form REV-1853 only for businesses located in Pennsylvania?

A: No, businesses located outside of Pennsylvania but with economic presence in the state are also required to file Form REV-1853.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1853 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.