This version of the form is not currently in use and is provided for reference only. Download this version of

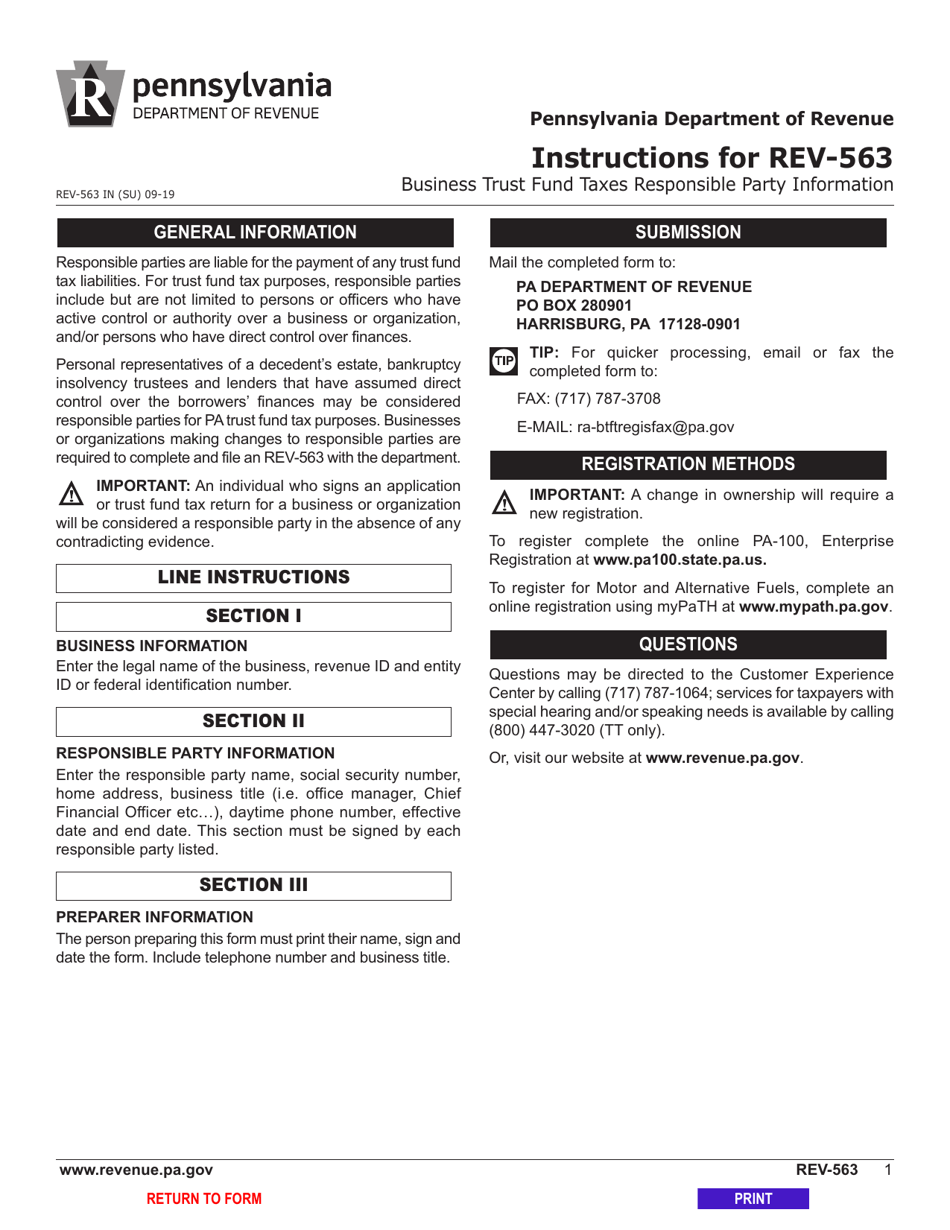

Form REV-563

for the current year.

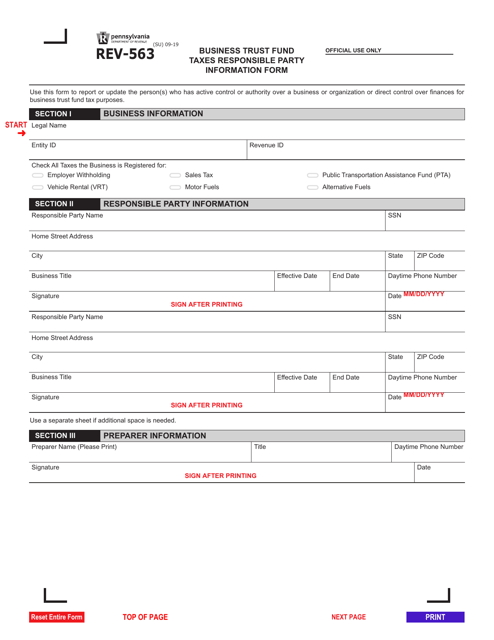

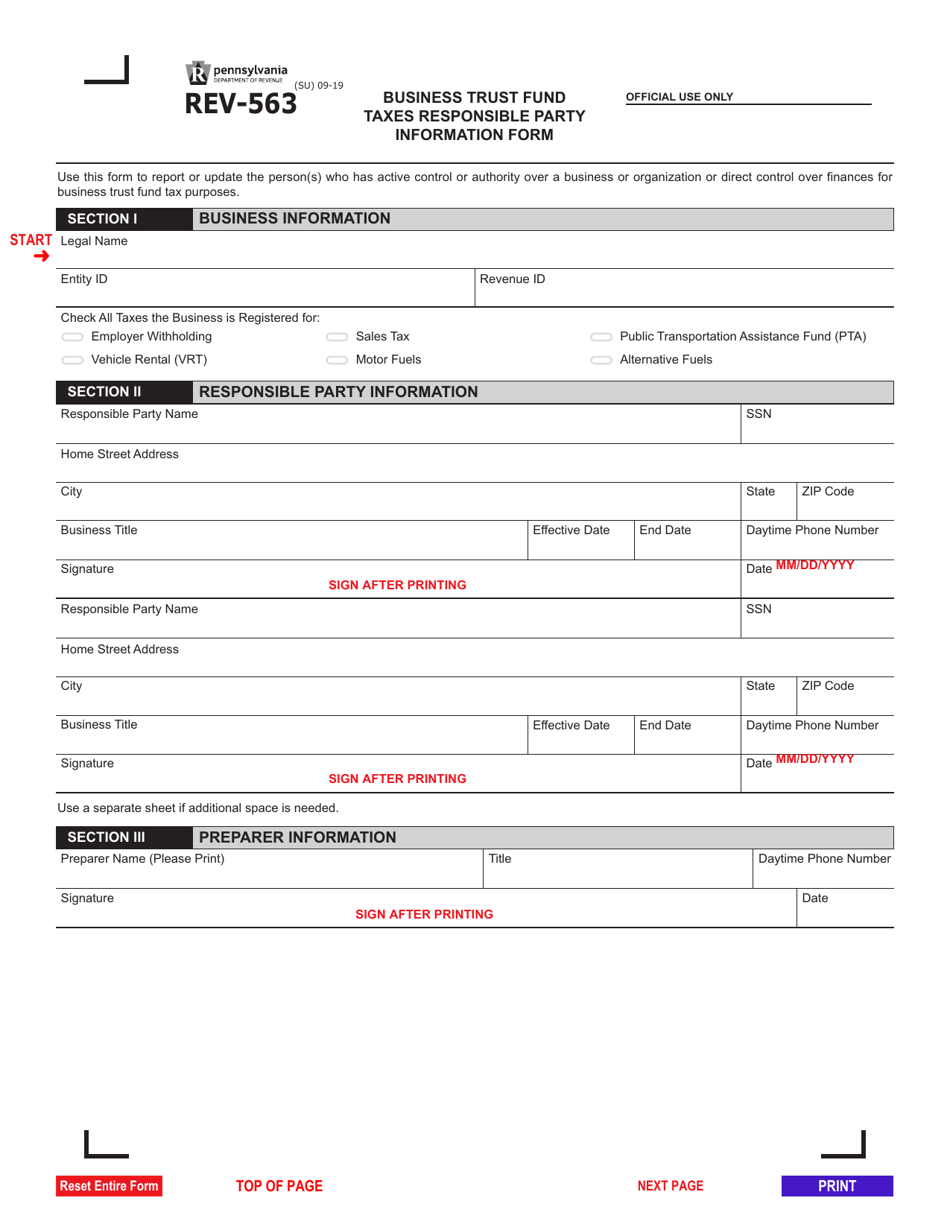

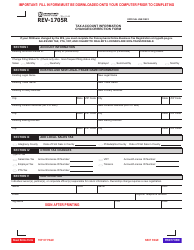

Form REV-563 Business Trust Fund Taxes Responsible Party Information Form - Pennsylvania

What Is Form REV-563?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-563?

A: Form REV-563 is the Business Trust Fund Taxes Responsible Party Information Form in Pennsylvania.

Q: What is the purpose of Form REV-563?

A: The purpose of Form REV-563 is to provide information about the responsible party for business trust fund taxes in Pennsylvania.

Q: Who needs to fill out Form REV-563?

A: Anyone who is the responsible party for business trust fund taxes in Pennsylvania needs to fill out Form REV-563.

Q: What information do I need to provide on Form REV-563?

A: On Form REV-563, you need to provide information such as your name, address, social security number or employer identification number, and details about the business trust.

Q: When do I need to submit Form REV-563?

A: Form REV-563 needs to be submitted within 20 days of the creation, acquisition, or assumed responsibility of the business trust.

Q: Are there any penalties for not filing Form REV-563?

A: Yes, failing to file Form REV-563 or providing false information may result in penalties or legal action.

Q: Is Form REV-563 specific to businesses in Pennsylvania?

A: Yes, Form REV-563 is specific to businesses in Pennsylvania that are required to pay business trust fund taxes.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-563 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.