This version of the form is not currently in use and is provided for reference only. Download this version of

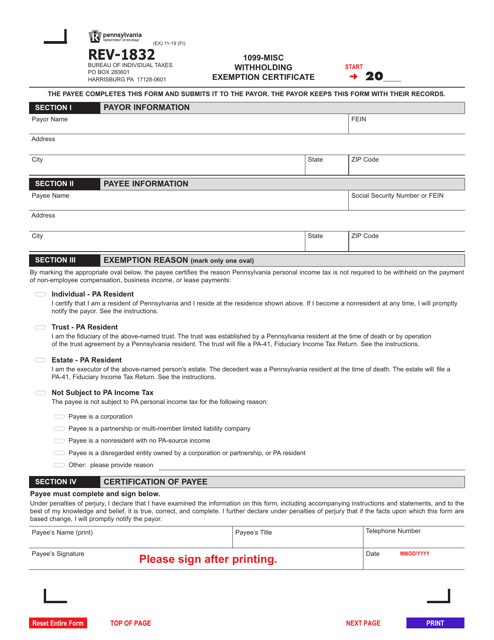

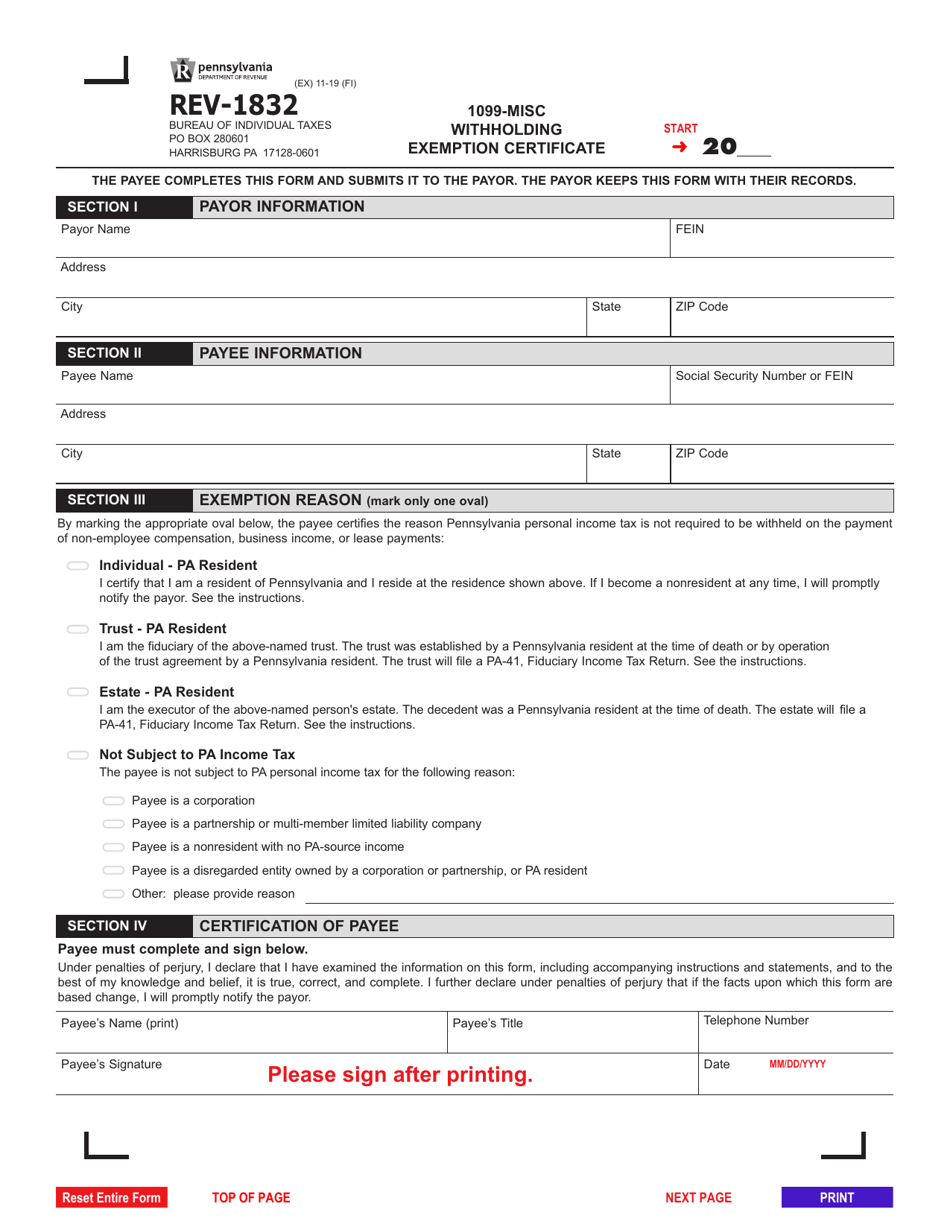

Form REV-1832

for the current year.

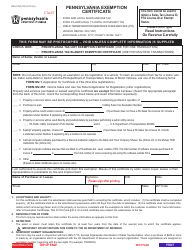

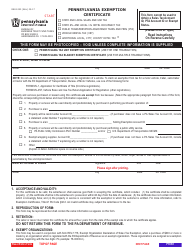

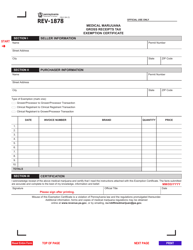

Form REV-1832 1099-misc Withholding Exemption Certificate - Pennsylvania

What Is Form REV-1832?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1832?

A: Form REV-1832 is a 1099-MISC Withholding Exemption Certificate specific to Pennsylvania.

Q: What is the purpose of Form REV-1832?

A: The purpose of Form REV-1832 is to claim exemption from withholding on certain payments made to you as an independent contractor or freelancer in Pennsylvania.

Q: Who needs to file Form REV-1832?

A: If you are a resident of Pennsylvania and you want to claim exemption from withholding on certain payments, you need to file Form REV-1832.

Q: What kind of payments are covered by Form REV-1832?

A: Form REV-1832 covers payments made to you as an independent contractor or freelancer, such as fees for professional services, rent, royalties, and commissions.

Q: How do I complete Form REV-1832?

A: To complete Form REV-1832, you need to provide your personal information, indicate the type of income for which you are claiming exemption, and sign the form.

Form Details:

- Released on November 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1832 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.