This version of the form is not currently in use and is provided for reference only. Download this version of

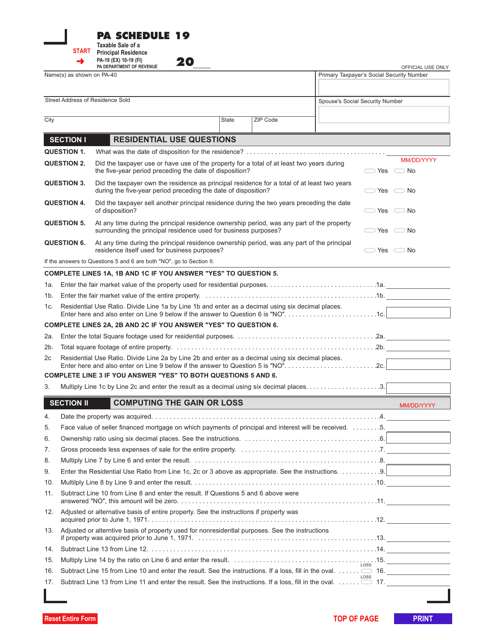

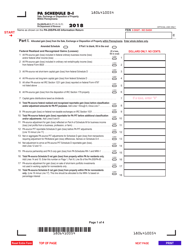

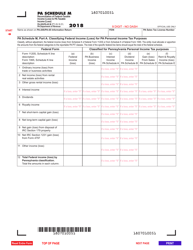

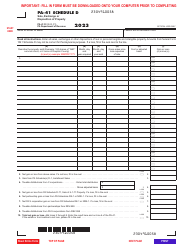

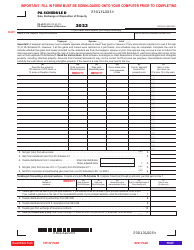

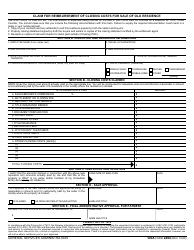

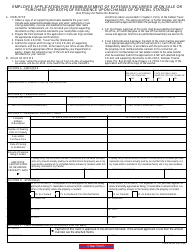

Form PA-19 Schedule 19

for the current year.

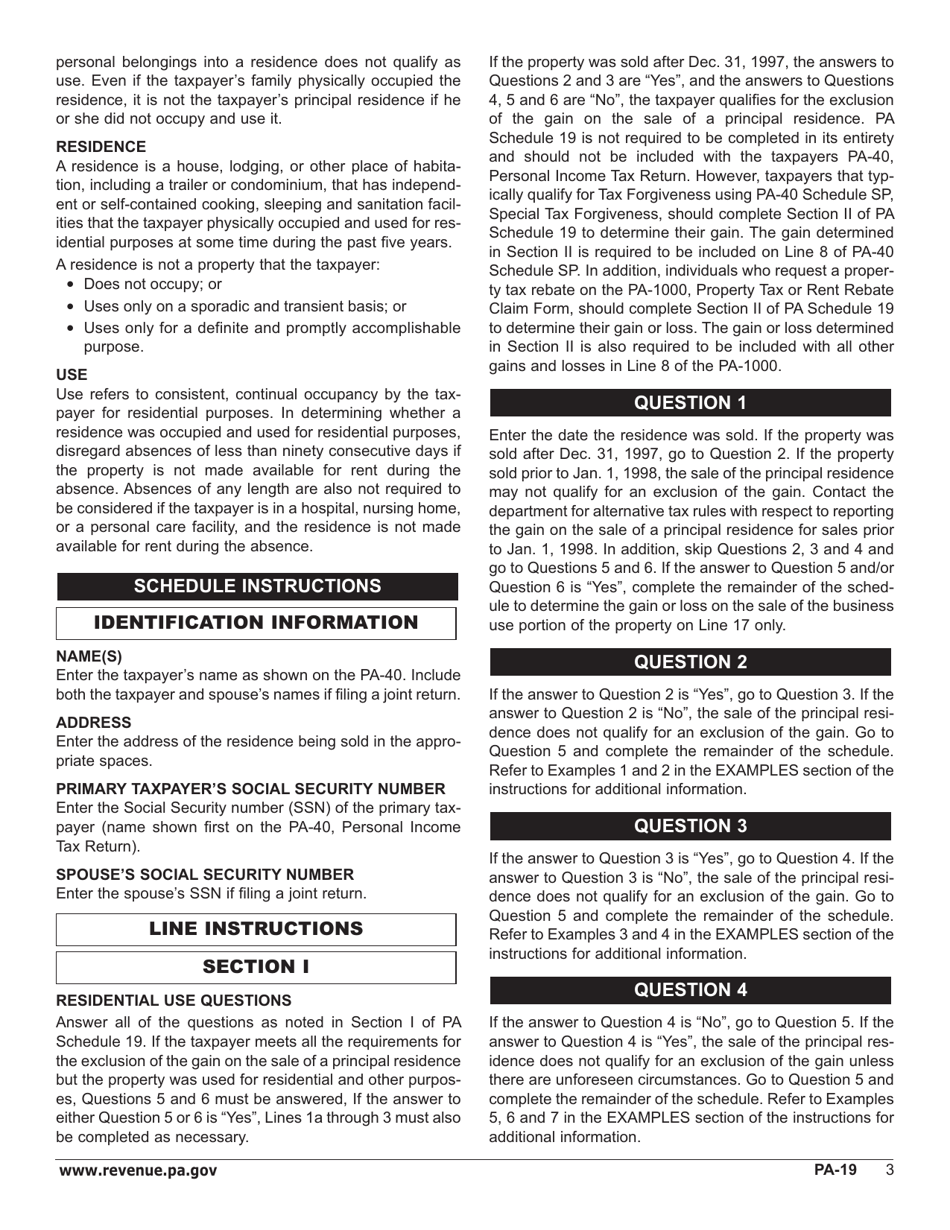

Form PA-19 Schedule 19 Taxable Sale of a Principal Residence - Pennsylvania

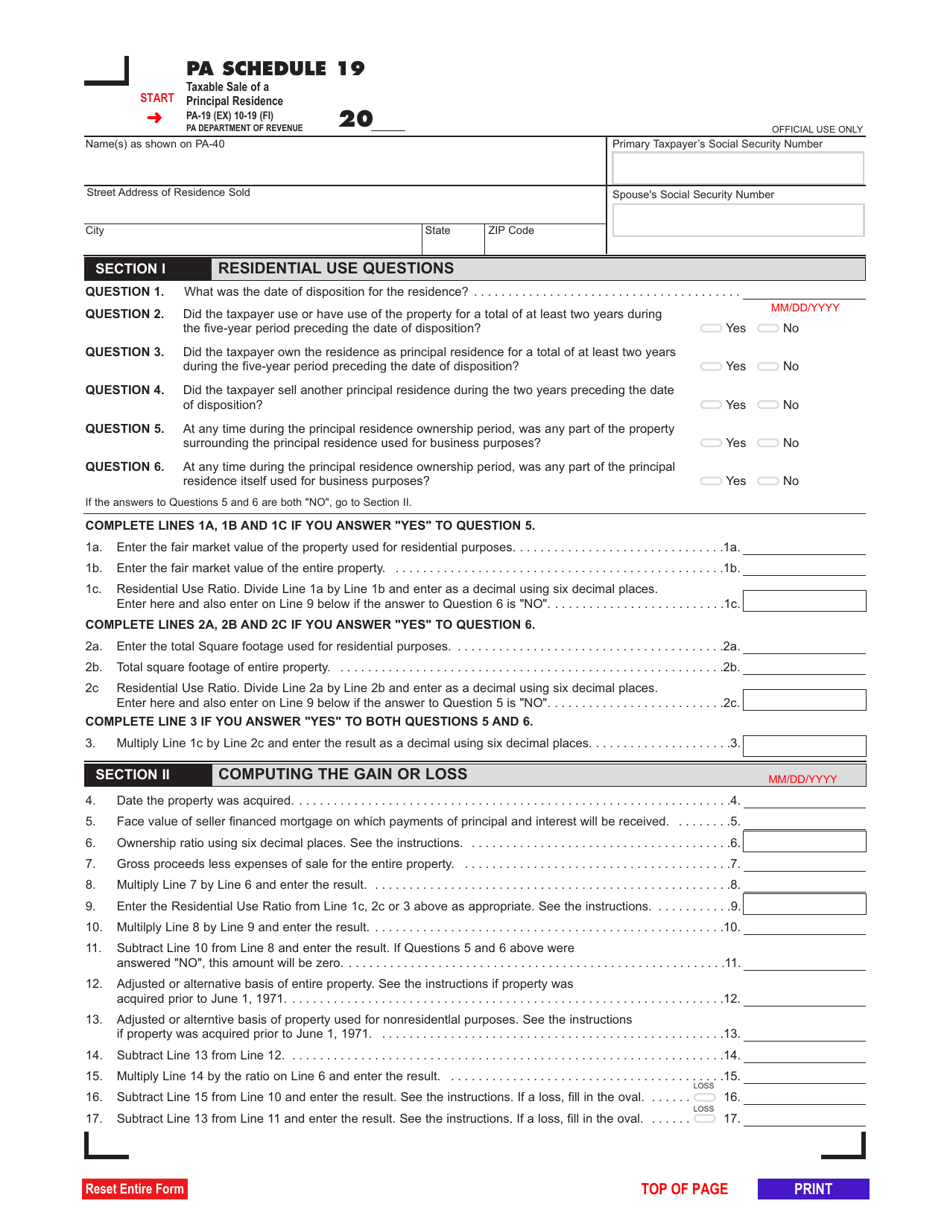

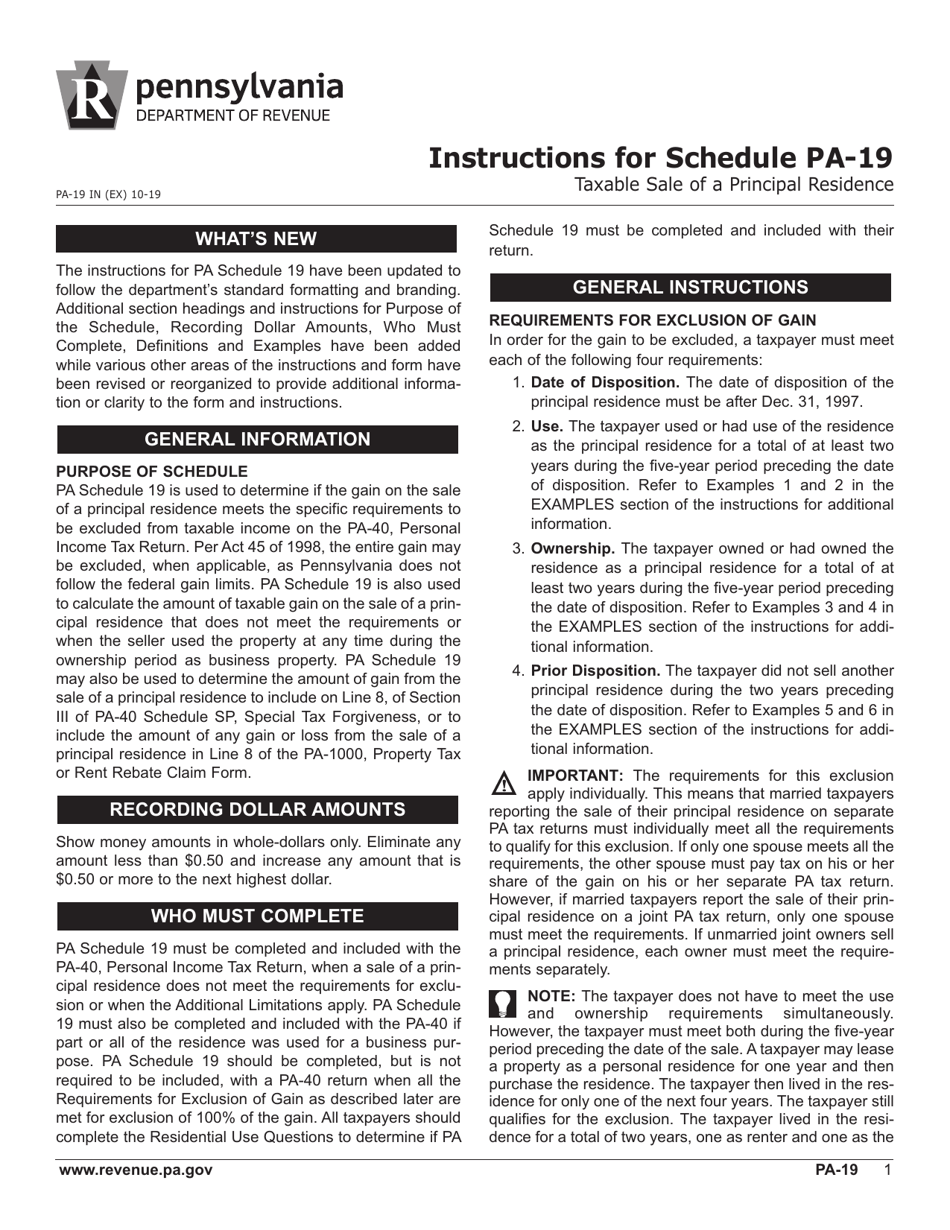

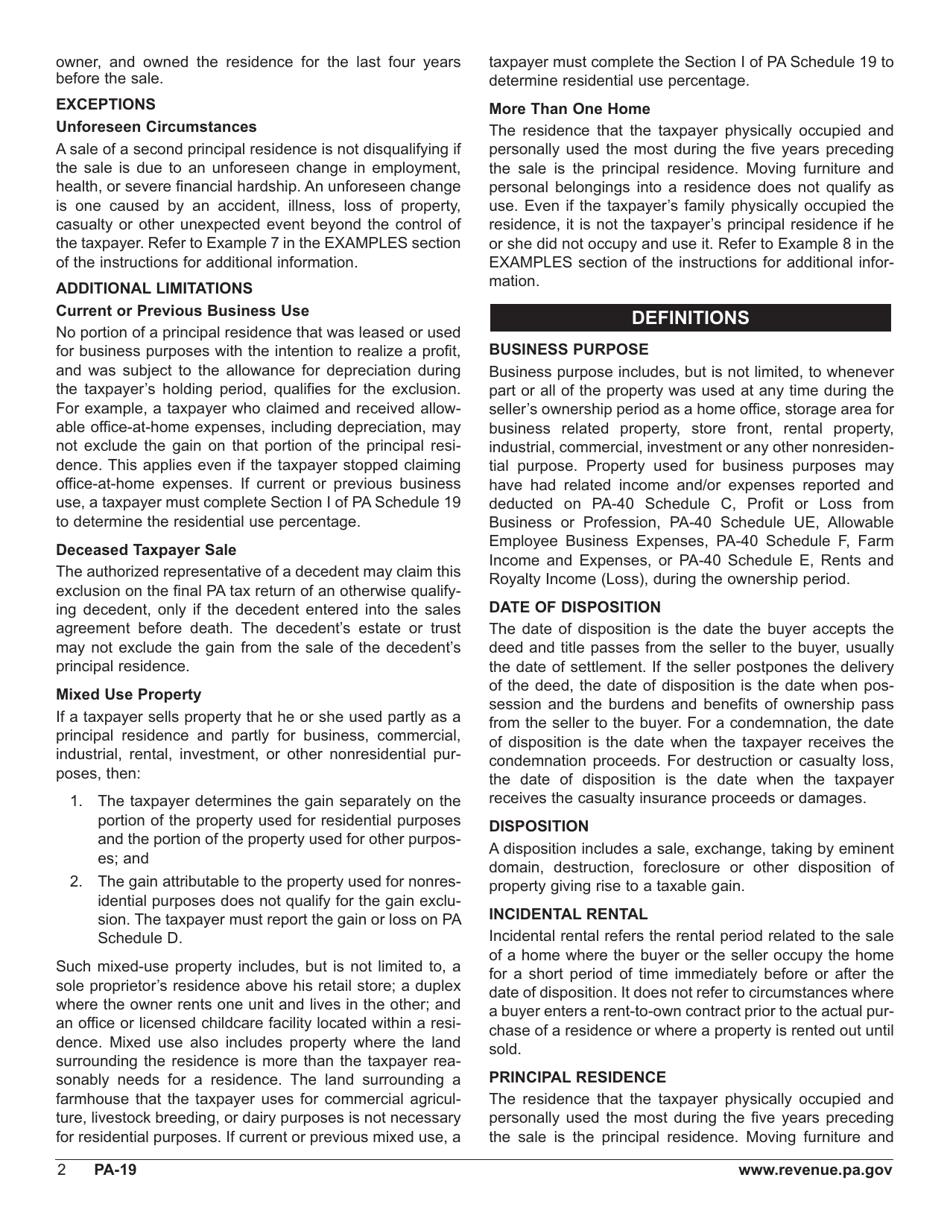

What Is Form PA-19 Schedule 19?

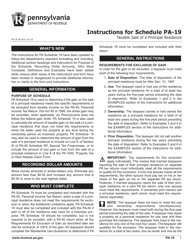

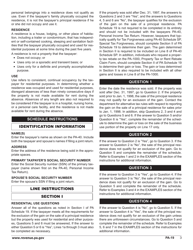

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-19?

A: Form PA-19 is a tax form used in Pennsylvania.

Q: What is Schedule 19?

A: Schedule 19 is a part of Form PA-19.

Q: What does Schedule 19 cover?

A: Schedule 19 covers taxable sales of a principal residence in Pennsylvania.

Q: What is a taxable sale of a principal residence?

A: A taxable sale of a principal residence refers to the sale of a home that may be subject to taxation.

Q: Who needs to file Form PA-19 Schedule 19?

A: Individuals who have made a taxable sale of their principal residence in Pennsylvania need to file Form PA-19 Schedule 19.

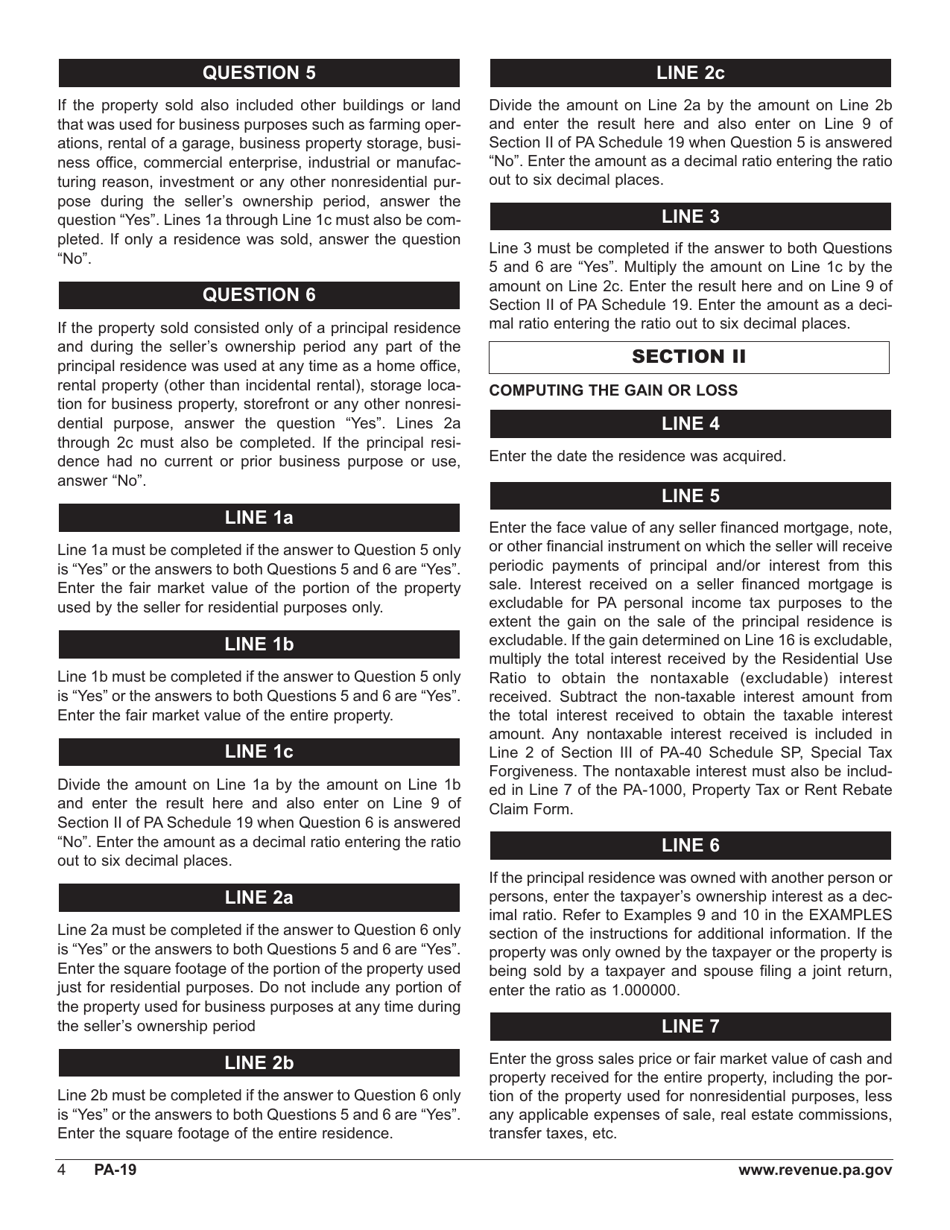

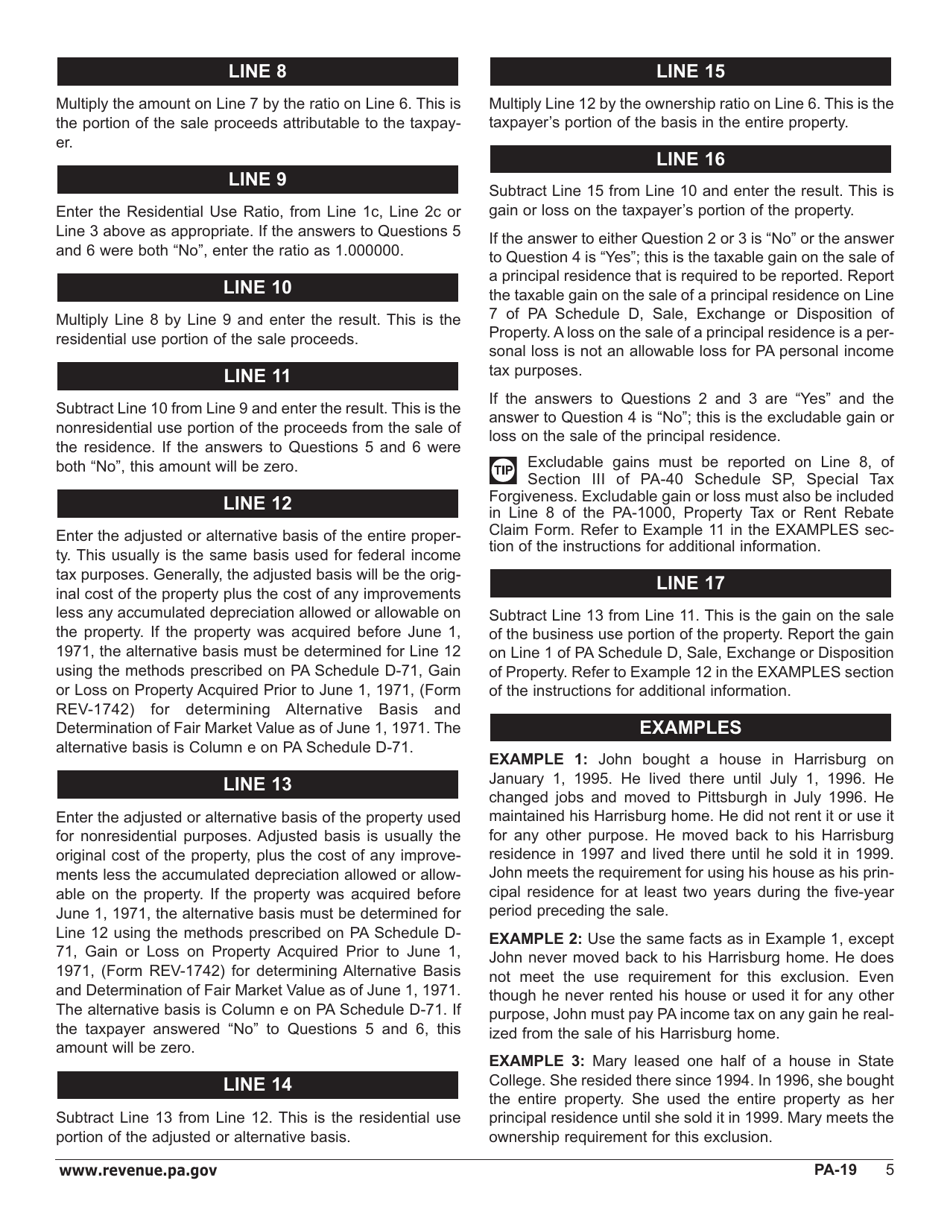

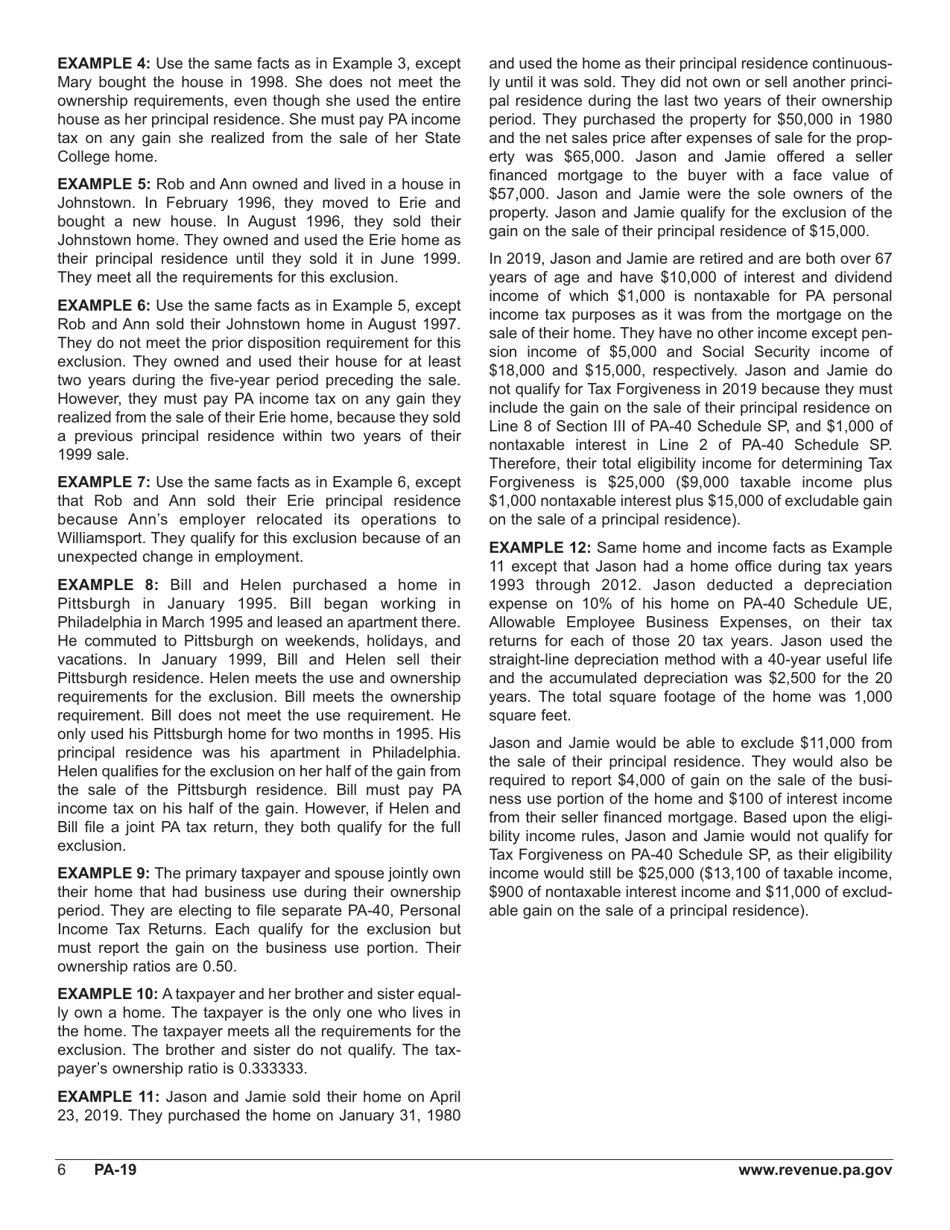

Q: What information is required on Schedule 19?

A: Schedule 19 requires information about the sale of the principal residence, such as the selling price and any allowable deductions.

Q: Is there a deadline for filing Form PA-19 Schedule 19?

A: Yes, Form PA-19 Schedule 19 must be filed by the due date of your Pennsylvania income tax return.

Q: What happens if I don't file Form PA-19 Schedule 19?

A: Failure to file Form PA-19 Schedule 19 may result in penalties and interest.

Q: Can I e-file Form PA-19 Schedule 19?

A: Yes, you can e-file Form PA-19 Schedule 19 if you are filing your Pennsylvania income tax return electronically.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-19 Schedule 19 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.