This version of the form is not currently in use and is provided for reference only. Download this version of

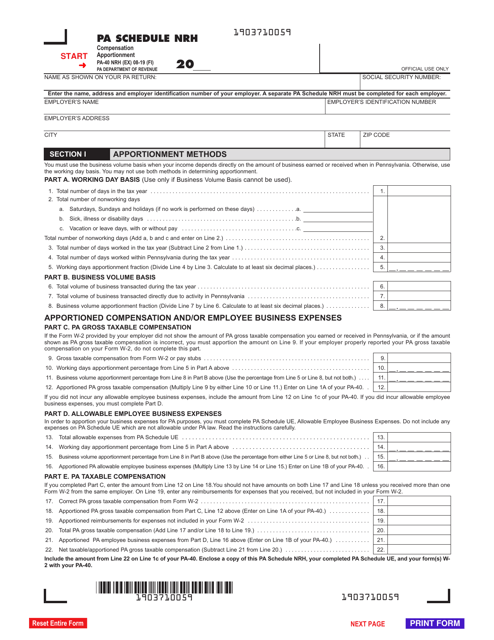

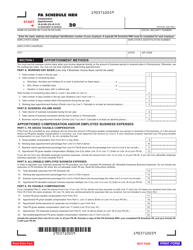

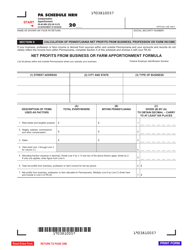

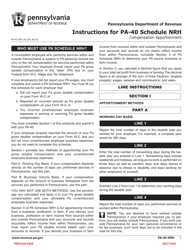

Form PA-40 Schedule NRH

for the current year.

Form PA-40 Schedule NRH Compensation Apportionment - Pennsylvania

What Is Form PA-40 Schedule NRH?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pa Schedule F - Farm Income and Expenses. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule NRH?

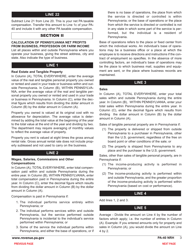

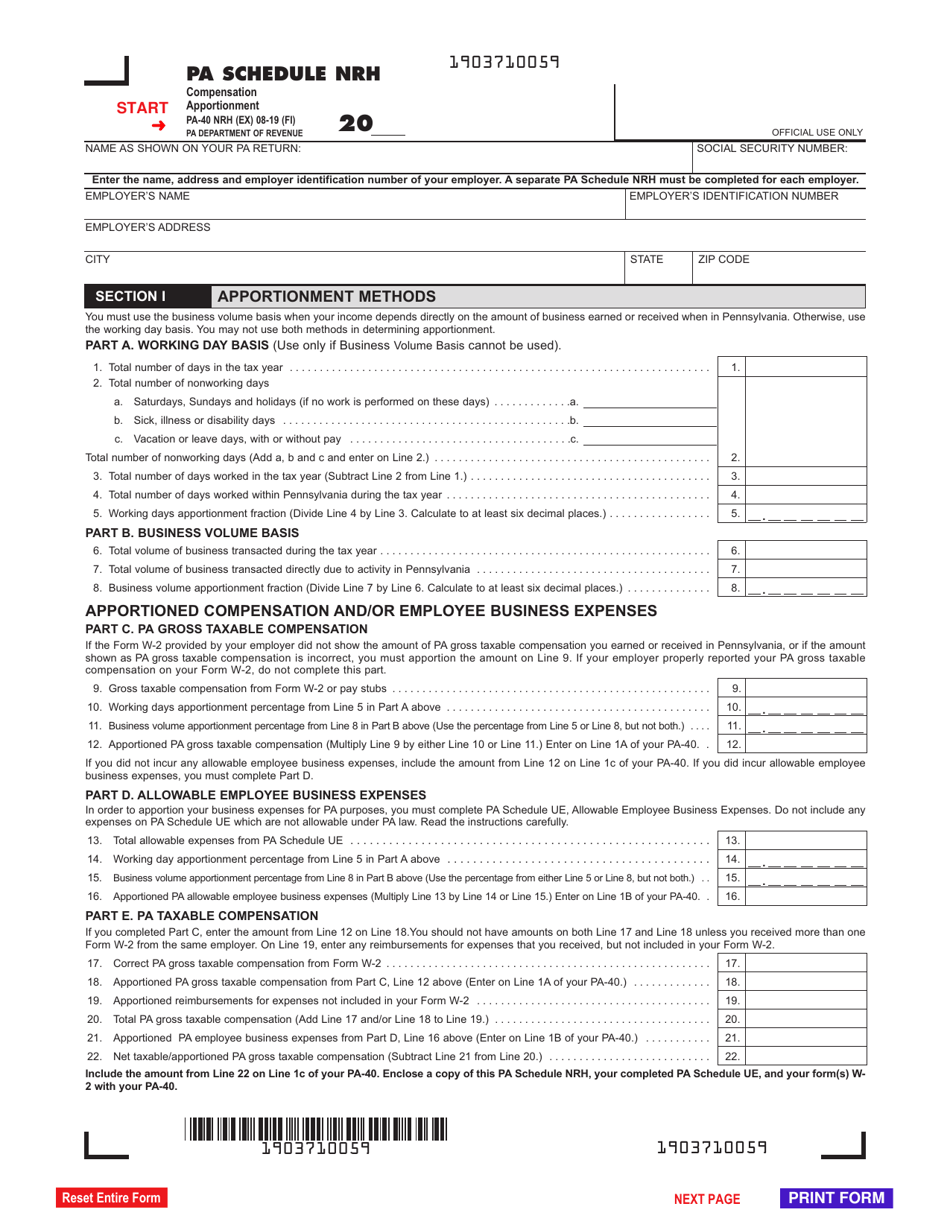

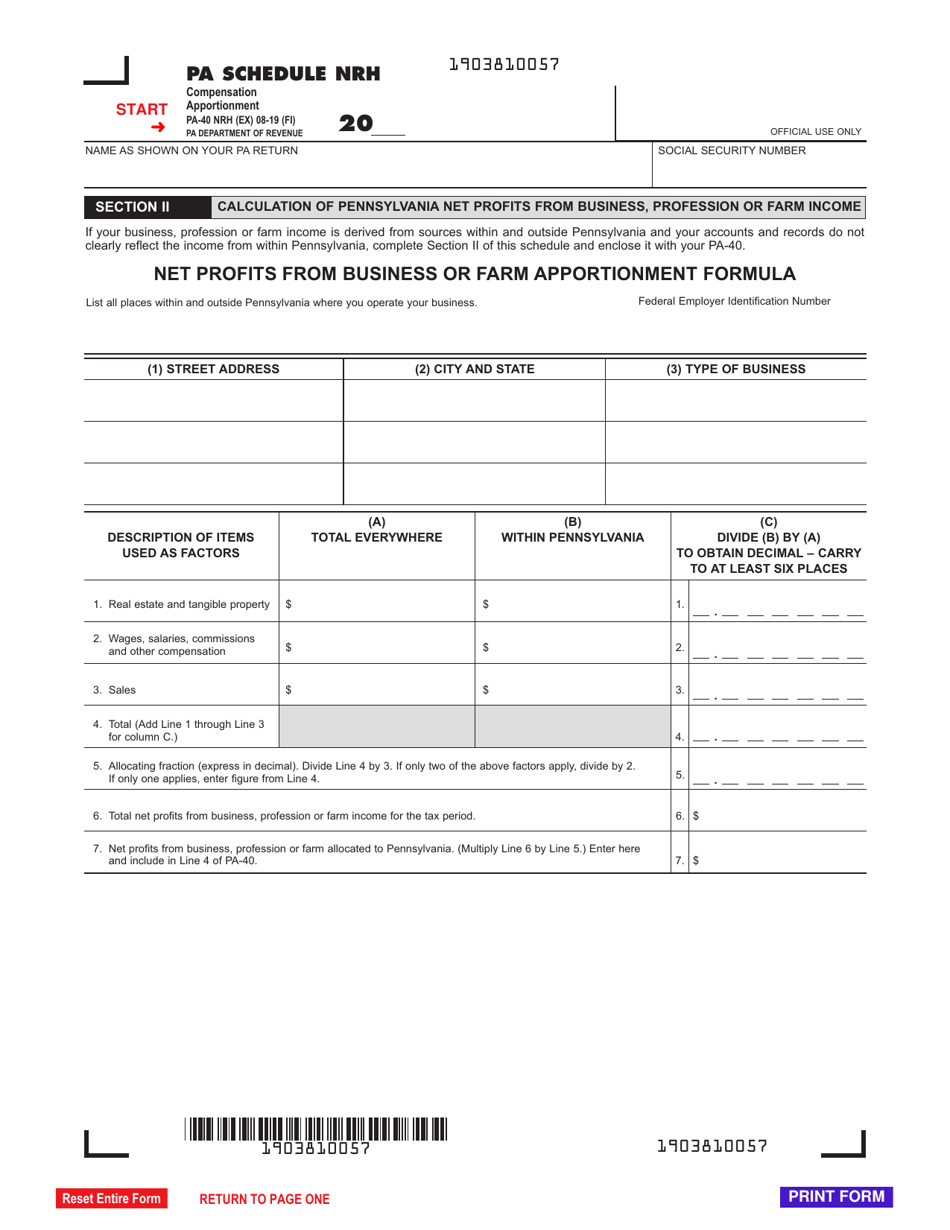

A: Form PA-40 Schedule NRH is a form used in Pennsylvania to report compensation apportionment for nonresident individuals.

Q: Who needs to file Form PA-40 Schedule NRH?

A: Nonresident individuals who have income from Pennsylvania sources need to file Form PA-40 Schedule NRH.

Q: What is compensation apportionment?

A: Compensation apportionment is the process of determining how much of a nonresident's income is subject to Pennsylvania income tax.

Q: What information is required on Form PA-40 Schedule NRH?

A: Form PA-40 Schedule NRH requires information about the nonresident's total compensation, compensation received from Pennsylvania sources, and the apportionment percentage.

Q: How is the apportionment percentage calculated?

A: The apportionment percentage is calculated by dividing the compensation received from Pennsylvania sources by the nonresident's total compensation.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule NRH by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.