This version of the form is not currently in use and is provided for reference only. Download this version of

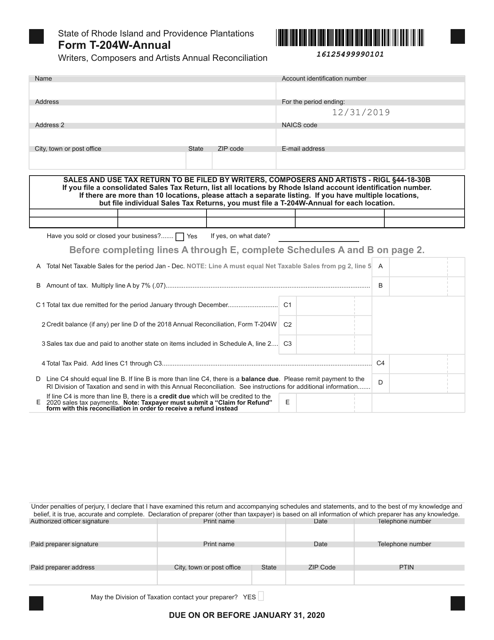

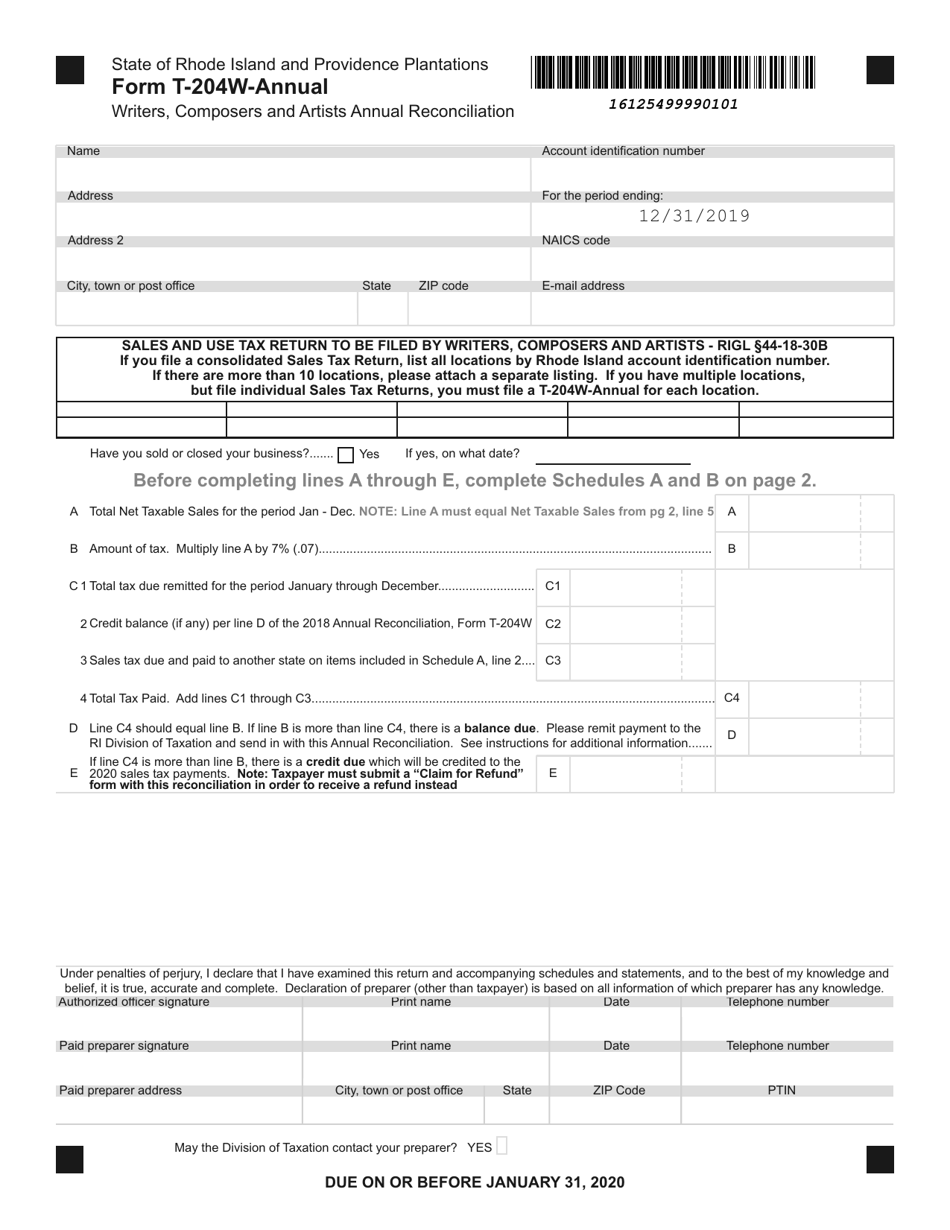

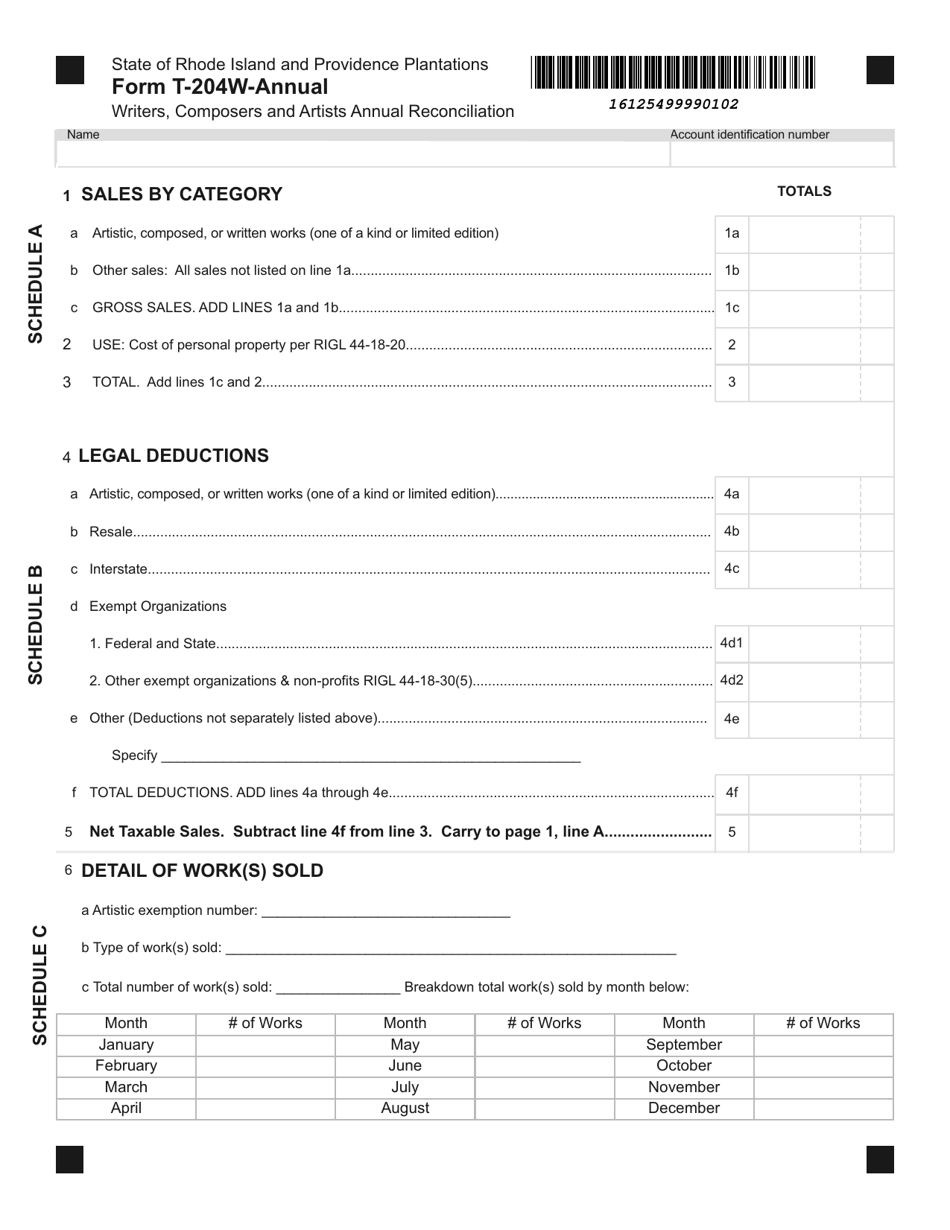

Form T-204W-ANNUAL

for the current year.

Form T-204W-ANNUAL Writers, Composers and Artists Annual Reconciliation - Rhode Island

What Is Form T-204W-ANNUAL?

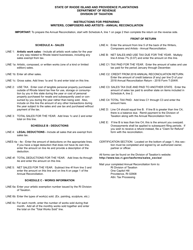

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-204W?

A: Form T-204W is the Writers, Composers, and Artists Annual Reconciliation form for residents of Rhode Island.

Q: Who needs to file Form T-204W?

A: Residents of Rhode Island who are writers, composers, or artists need to file Form T-204W.

Q: What is the purpose of Form T-204W?

A: Form T-204W is used to reconcile the income tax withheld from payments made to writers, composers, and artists in Rhode Island.

Q: When is Form T-204W due?

A: Form T-204W is due on or before April 15th of each year.

Q: Are there any penalties for not filing Form T-204W?

A: Yes, failure to file Form T-204W may result in penalties and interest on any unpaid taxes.

Q: Do I need to include supporting documents with Form T-204W?

A: No, supporting documents are not required when filing Form T-204W.

Q: What should I do if I have more than one type of income?

A: If you have more than one type of income as a writer, composer, or artist, you should combine all income on Form T-204W.

Q: Can I e-file Form T-204W?

A: No, Form T-204W cannot be e-filed and must be mailed to the Rhode Island Division of Taxation.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form T-204W-ANNUAL by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.