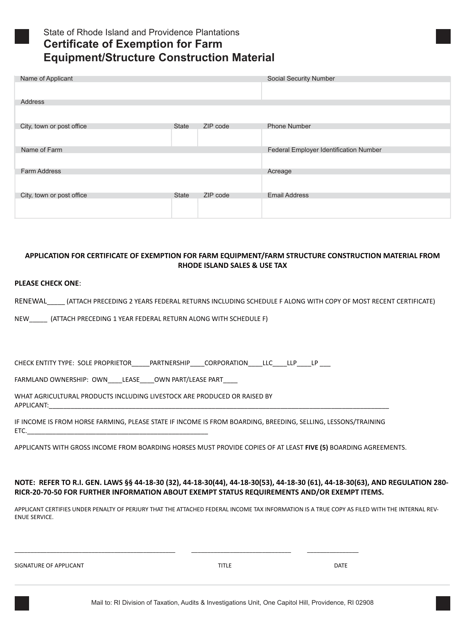

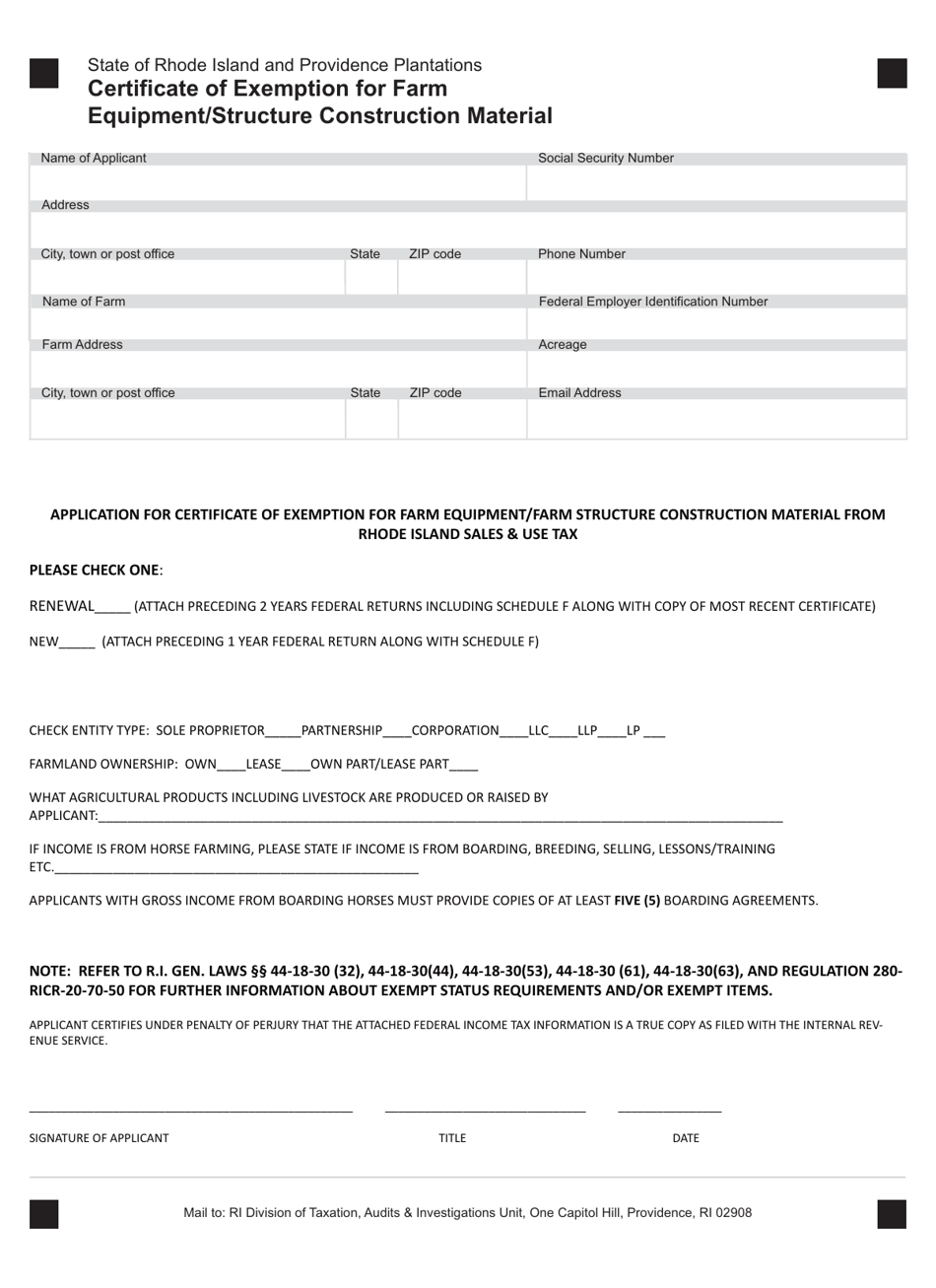

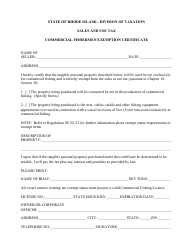

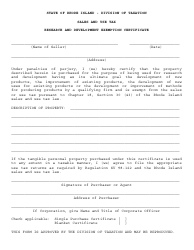

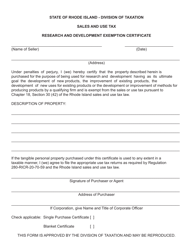

Certificate of Exemption for Farm Equipment / Structure Construction Material - Rhode Island

Certificate of Exemption for Farm Equipment/Structure Construction Material is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is a Certificate of Exemption for Farm Equipment/Structure Construction Material?

A: A Certificate of Exemption for Farm Equipment/Structure Construction Material is a document that allows farmers to purchase building materials and equipment for the construction of farm structures without paying sales tax.

Q: Who is eligible for a Certificate of Exemption for Farm Equipment/Structure Construction Material in Rhode Island?

A: Farmers who own or operate a farm in Rhode Island and engage in agricultural production are eligible for the Certificate of Exemption.

Q: What kind of farm structures can be exempted under this certificate?

A: This certificate can be used for the construction, enlargement, or repair of farm buildings, agricultural storage facilities, greenhouses, and other structures directly used in agricultural production.

Q: How can I obtain a Certificate of Exemption for Farm Equipment/Structure Construction Material?

A: To obtain this certificate, you need to complete an application form provided by the Rhode Island Division of Taxation and submit it to the Division along with supporting documentation.

Q: What supporting documentation do I need to provide with the application?

A: You may need to provide documentation such as proof of farm ownership or operation, a description of the agricultural production activities, and a list of materials or equipment to be purchased.

Q: Can I use the Certificate of Exemption for personal use or non-farm related construction projects?

A: No, this certificate can only be used for farm-related construction projects and agricultural production purposes.

Q: Do I have to renew the Certificate of Exemption?

A: No, the Certificate of Exemption does not require renewal. Once you have obtained it, you can use it for qualifying purchases as long as you continue to meet the eligibility requirements.

Q: Is there an expiration date on the Certificate of Exemption?

A: No, the Certificate of Exemption does not have an expiration date.

Q: What happens if I misuse the Certificate of Exemption for non-qualifying purchases?

A: Misuse of the Certificate of Exemption may result in penalties and the requirement to pay the sales tax on the non-qualifying purchases.

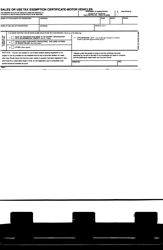

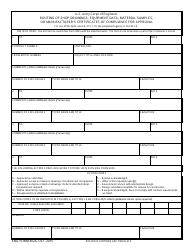

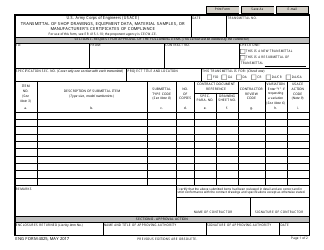

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.