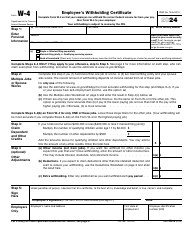

This version of the form is not currently in use and is provided for reference only. Download this version of

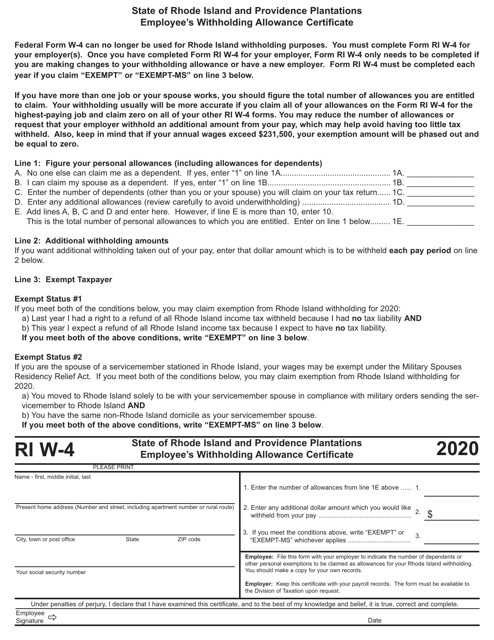

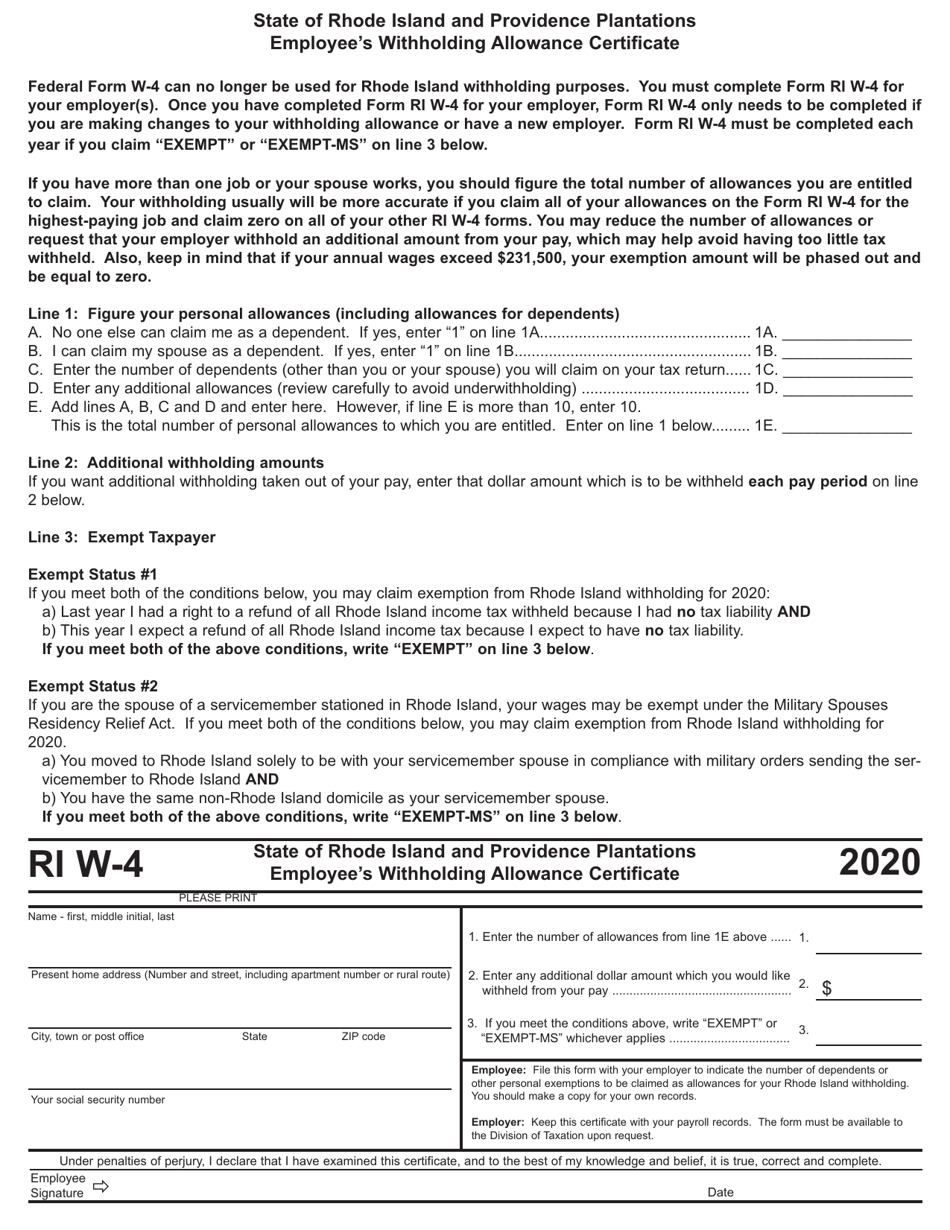

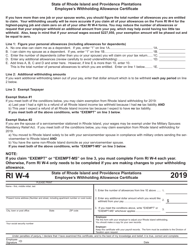

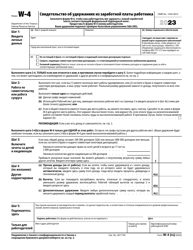

Form RI W-4

for the current year.

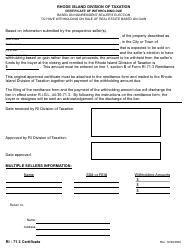

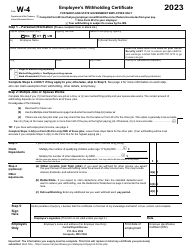

Form RI W-4 Employee's Withholding Allowance Certificate - Rhode Island

What Is Form RI W-4?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RI W-4 Employee's Withholding Allowance Certificate?

A: The RI W-4 is a form used by employees in Rhode Island to indicate their withholding allowances for state income tax purposes.

Q: Why do I need to fill out the RI W-4 form?

A: You need to fill out the RI W-4 form to ensure that the correct amount of state income tax is withheld from your paycheck.

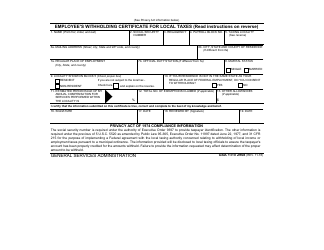

Q: How do I fill out the RI W-4 form?

A: You need to provide your personal information, indicate your filing status, and enter the number of withholding allowances you want to claim.

Q: What is a withholding allowance?

A: A withholding allowance is a number that reduces the amount of your paycheck that is subject to state income tax withholding.

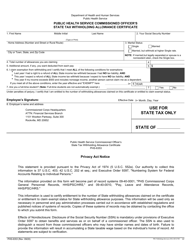

Q: Can I claim more or fewer withholding allowances than I am eligible for?

A: Yes, you can claim more or fewer withholding allowances than you are eligible for, but this may result in either under withholding or over withholding of state income tax.

Q: When should I update my RI W-4 form?

A: You should update your RI W-4 form whenever there is a change in your personal or financial situation that may affect your state income tax withholding.

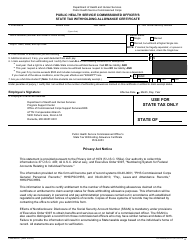

Q: What happens if I don't fill out the RI W-4 form?

A: If you don't fill out the RI W-4 form, your employer will withhold state income tax based on the default withholding rate, which may not be the correct amount for your circumstances.

Q: Can I change my withholding allowances during the year?

A: Yes, you can change your withholding allowances during the year by submitting a new RI W-4 form to your employer.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI W-4 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.