This version of the form is not currently in use and is provided for reference only. Download this version of

Form RI-2210

for the current year.

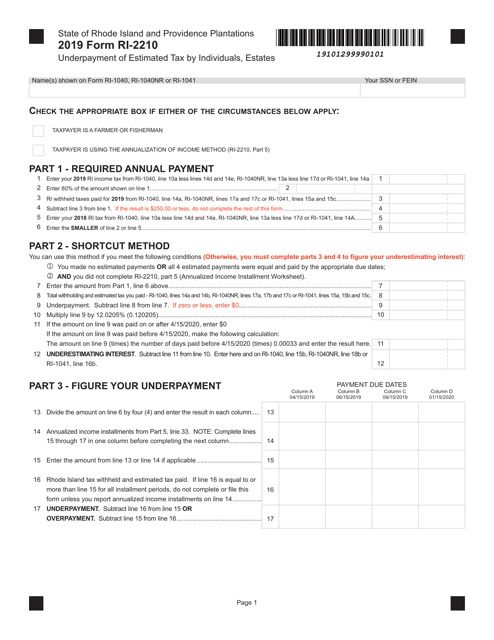

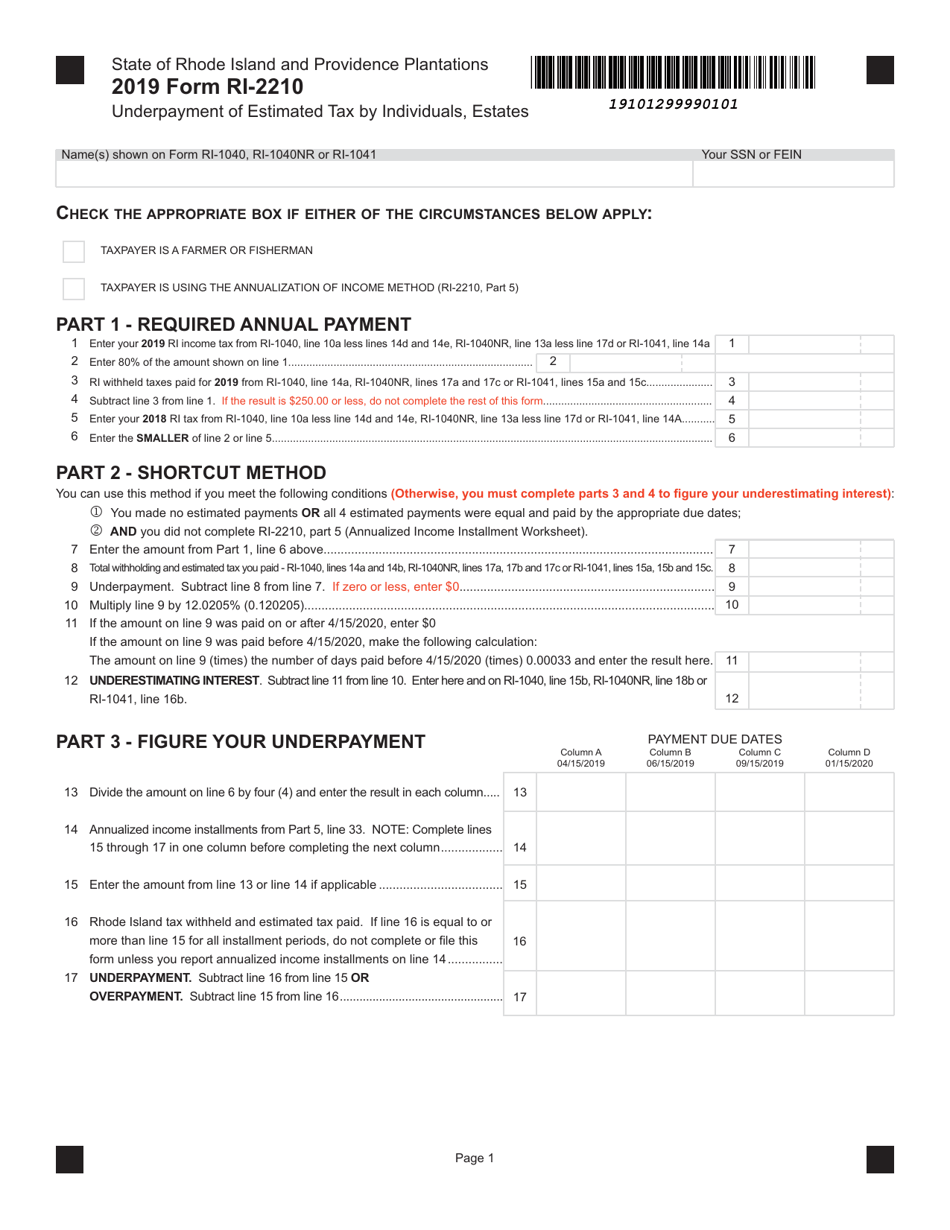

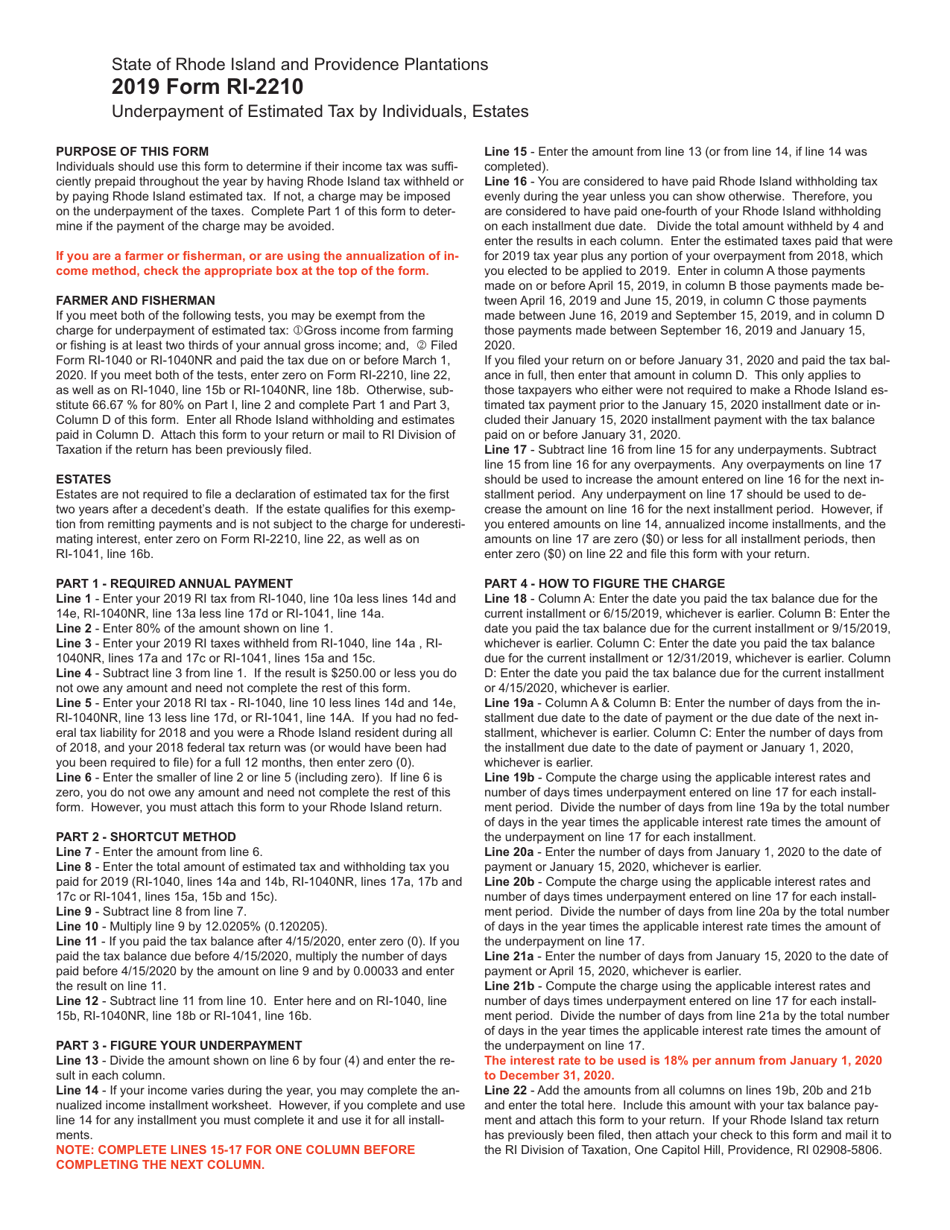

Form RI-2210 Underpayment of Estimated Tax by Individuals, Estates - Rhode Island

What Is Form RI-2210?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-2210?

A: Form RI-2210 is a form used in Rhode Island to calculate and report the underpayment of estimated tax by individuals and estates.

Q: Who needs to file Form RI-2210?

A: Individuals and estates in Rhode Island need to file Form RI-2210 if they have underpaid their estimated tax during the tax year.

Q: How do I know if I have underpaid my estimated tax?

A: You can determine if you have underpaid your estimated tax by comparing the amount of tax you paid throughout the year to the required minimum payments.

Q: When is Form RI-2210 due?

A: Form RI-2210 is due on the same date as your Rhode Island income tax return, which is usually April 15th of the following tax year.

Q: Can I avoid penalties for underpayment of estimated tax?

A: Yes, you can avoid penalties if you meet certain safe harbor provisions, such as paying at least 90% of the current year's tax liability or 100% of the previous year's tax liability.

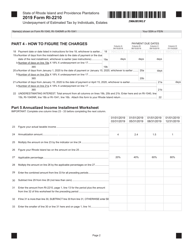

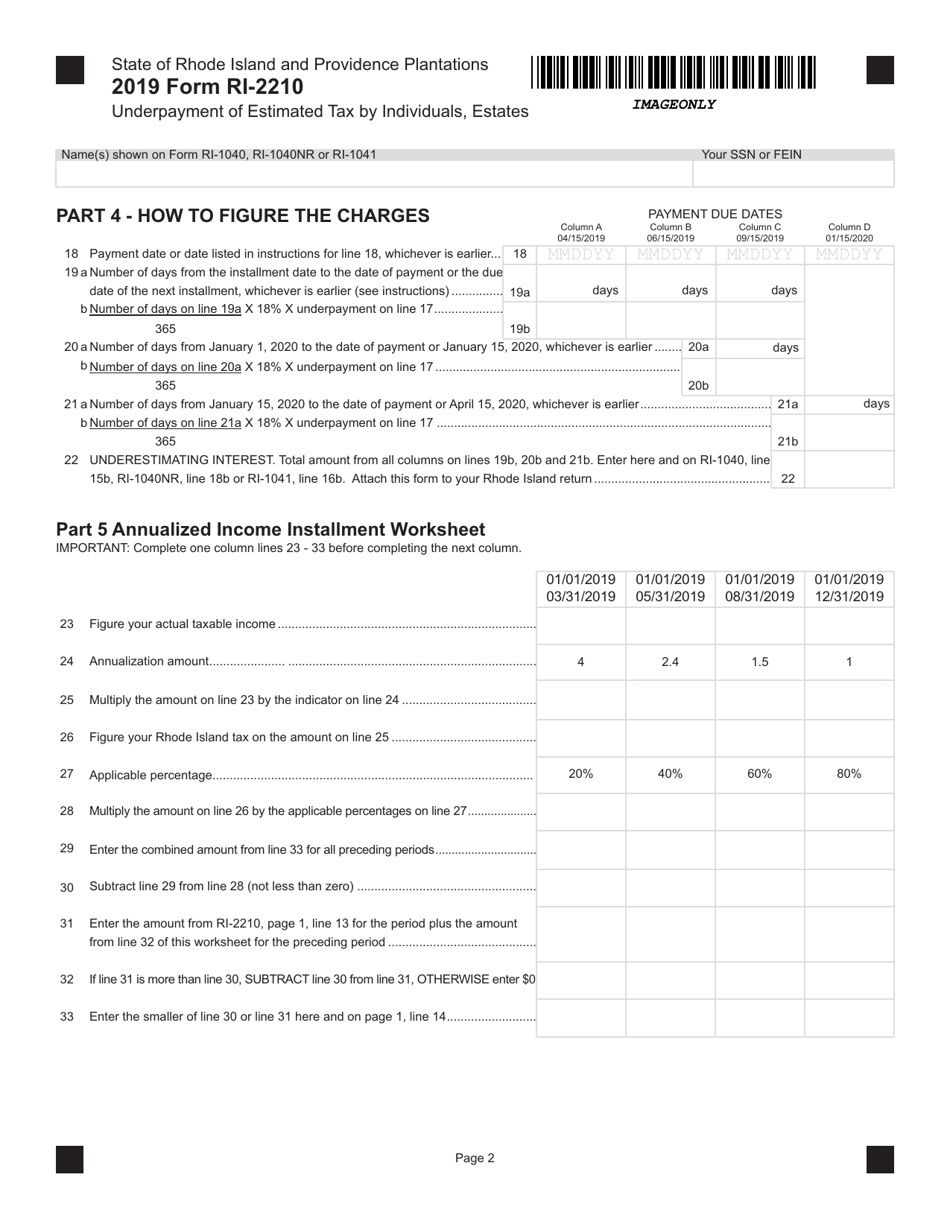

Q: How do I complete Form RI-2210?

A: To complete Form RI-2210, you will need to calculate your underpayment of estimated tax using the provided worksheet and instructions.

Q: Can I e-file Form RI-2210?

A: Currently, Rhode Island does not offer e-filing options for Form RI-2210. You will need to mail the completed form to the Rhode Island Division of Taxation.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-2210 by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.