This version of the form is not currently in use and is provided for reference only. Download this version of

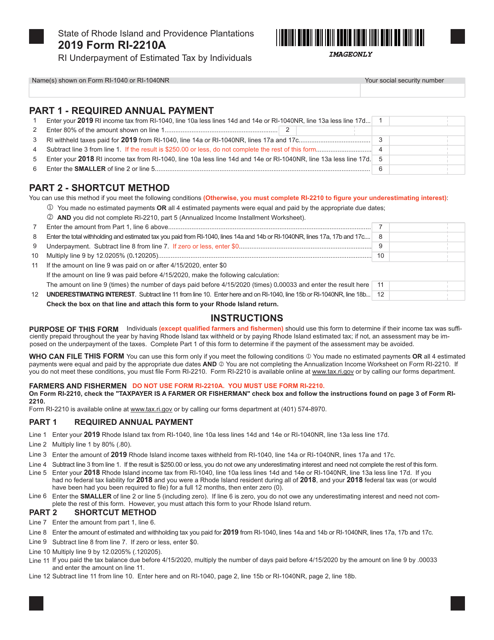

Form RI-2210A

for the current year.

Form RI-2210A Ri Underpayment of Estimated Tax by Individuals - Rhode Island

What Is Form RI-2210A?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RI-2210A?

A: Form RI-2210A is a tax form used by individuals in Rhode Island to calculate and pay any underpayment of estimated tax.

Q: Who needs to file Form RI-2210A?

A: Individuals in Rhode Island who have underpaid their estimated tax for the year may need to file Form RI-2210A.

Q: When is Form RI-2210A due?

A: Form RI-2210A is generally due on the same date as your Rhode Island individual income tax return, which is usually April 15th.

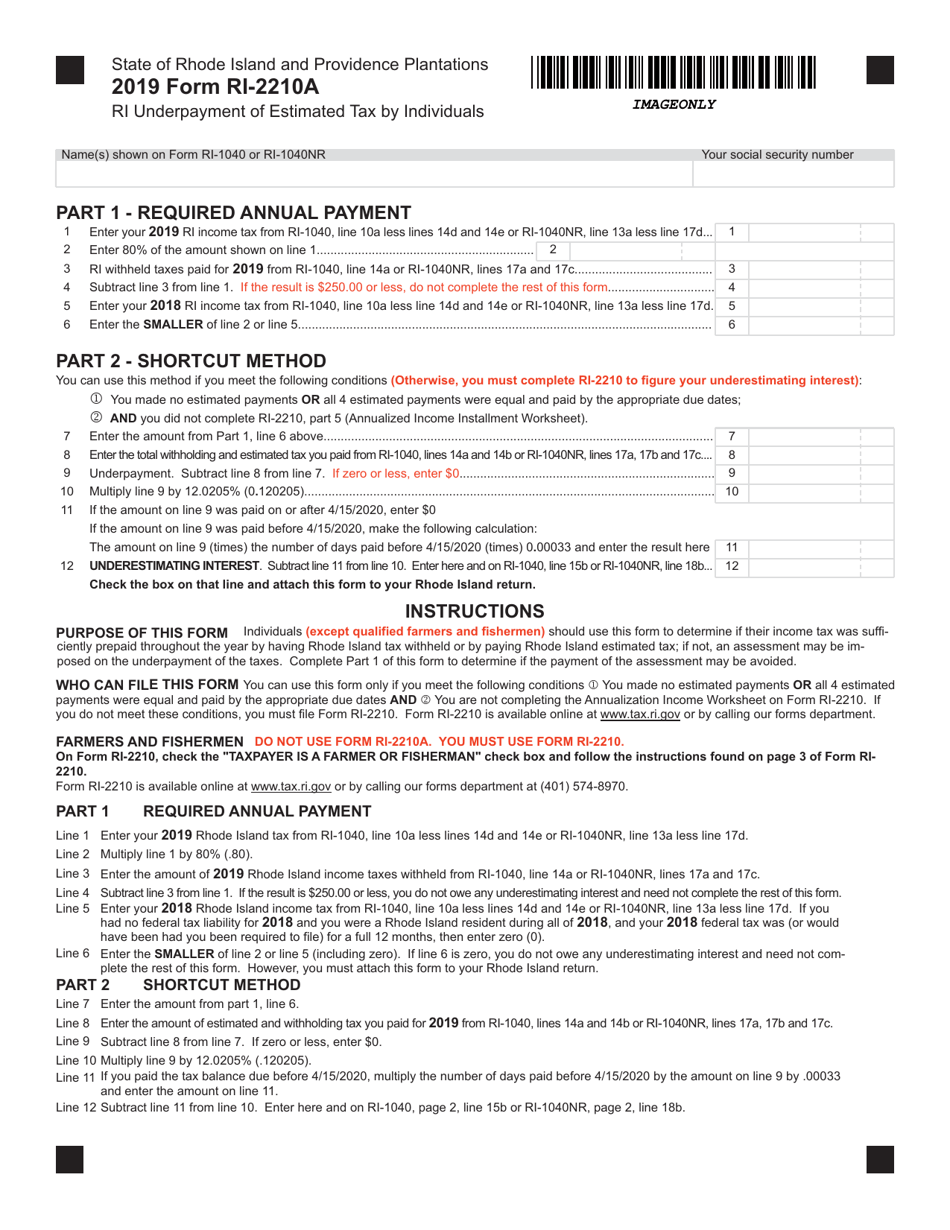

Q: How do I fill out Form RI-2210A?

A: You will need to enter information about your estimated tax payments and any penalties or interest due. The form provides instructions on how to complete it.

Q: What happens if I don't file Form RI-2210A?

A: If you had underpaid your estimated tax and do not file Form RI-2210A, you may be subject to penalties and interest on the underpayment.

Q: Are there any exceptions to filing Form RI-2210A?

A: There are exceptions to filing Form RI-2210A if you meet certain criteria, such as having no tax liability in the previous year or having a Rhode Island tax liability of less than $250.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-2210A by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.