This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule M

for the current year.

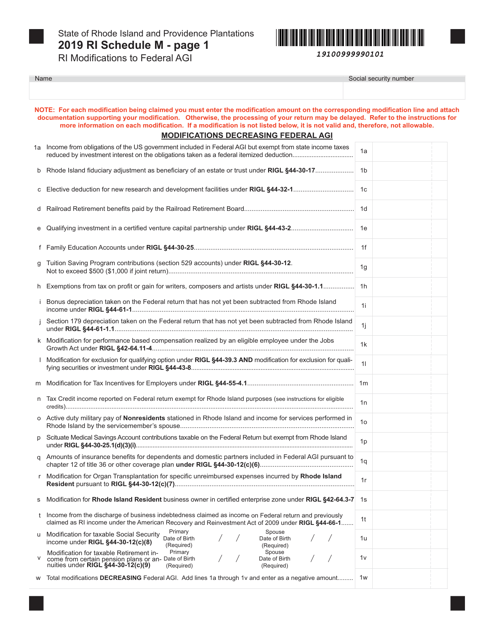

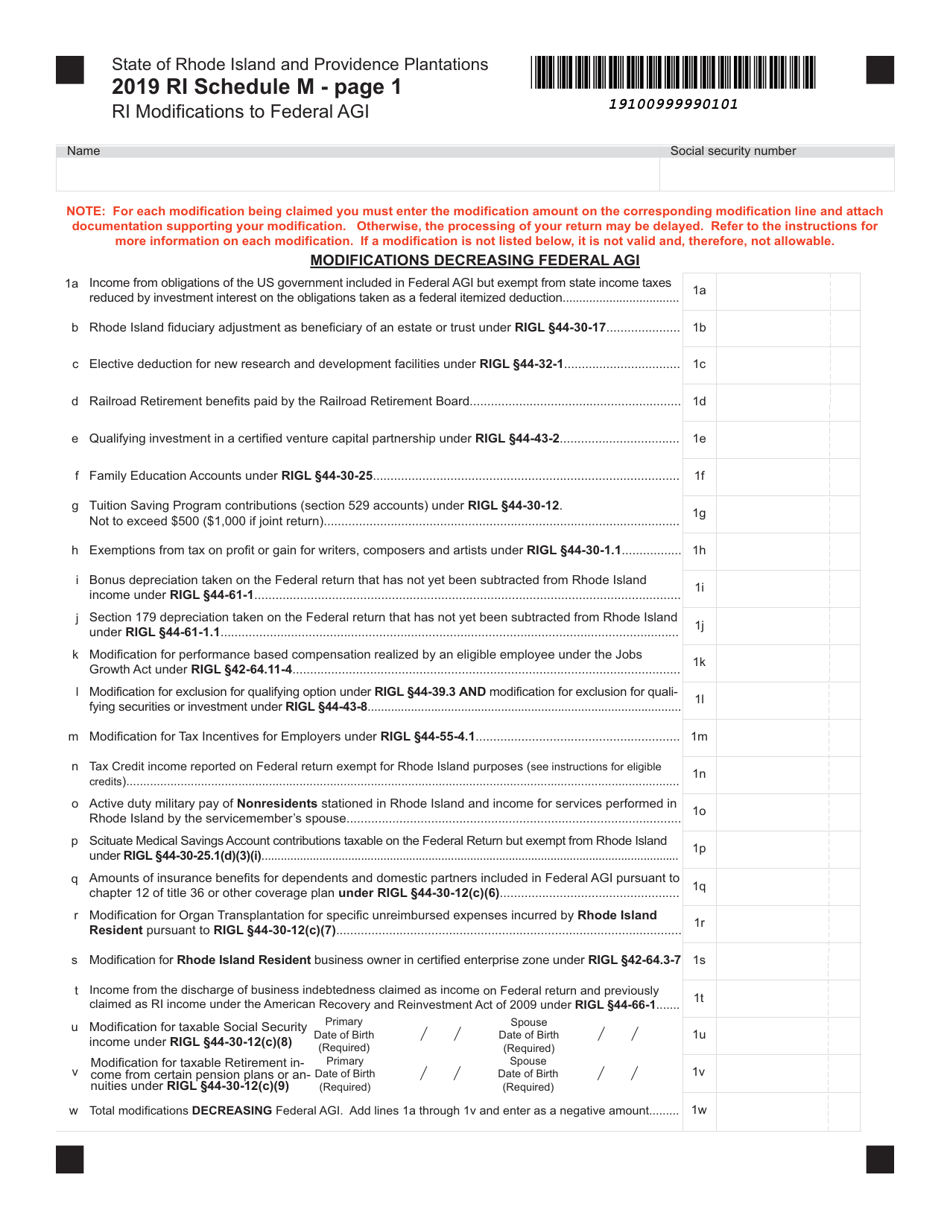

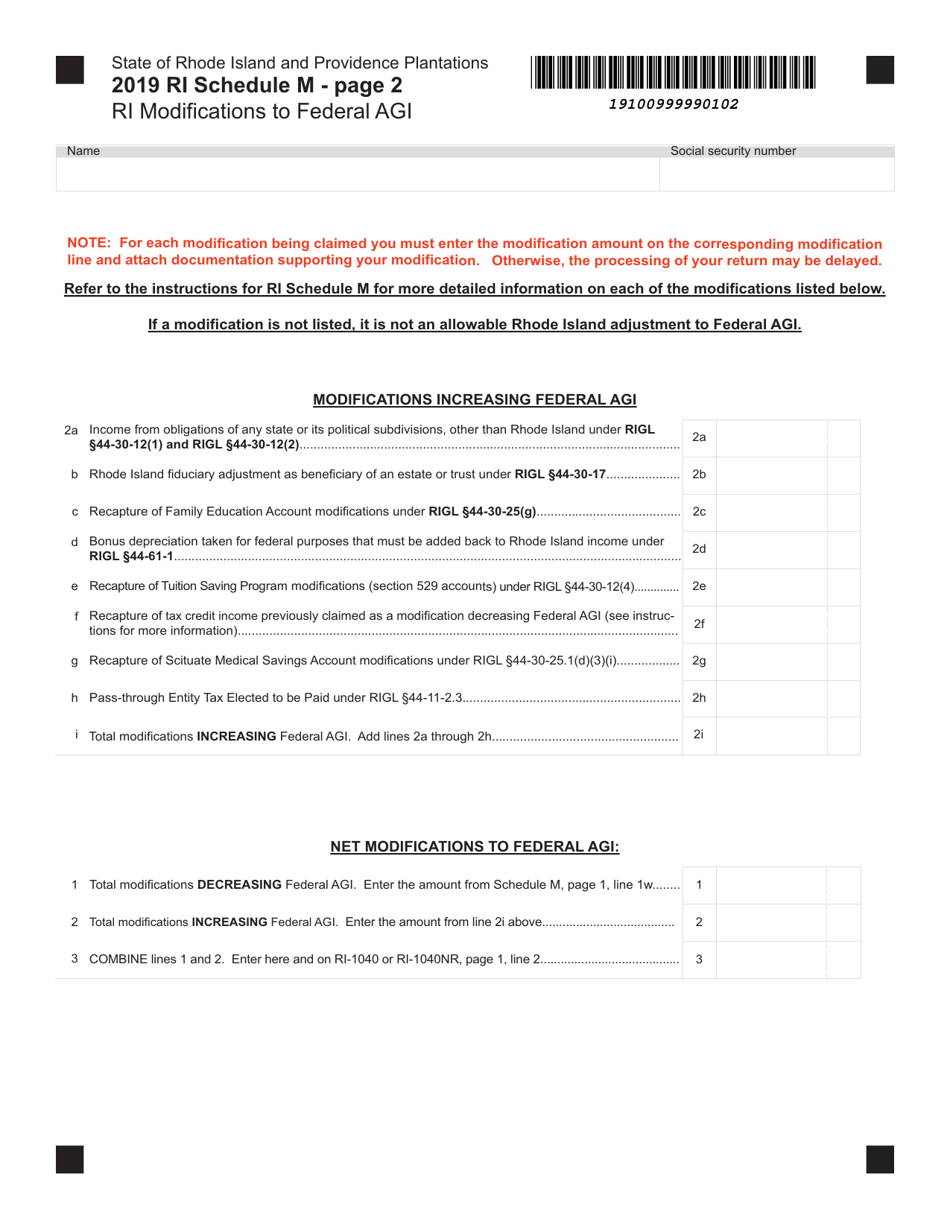

Schedule M Ri(modifications to Federal Agi - Rhode Island

What Is Schedule M?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M-RI?

A: Schedule M-RI is a form used in Rhode Island to report modifications to your federal adjusted gross income (AGI).

Q: What is the purpose of Schedule M-RI?

A: The purpose of Schedule M-RI is to calculate your Rhode Island taxable income by adjusting your federal AGI for state-specific modifications.

Q: What types of modifications are included in Schedule M-RI?

A: Schedule M-RI includes modifications related to Rhode Island-specific tax laws, such as additions or subtractions to your federal AGI.

Q: Do I need to file Schedule M-RI?

A: If you need to make modifications to your federal AGI for Rhode Island tax purposes, you will need to file Schedule M-RI.

Q: When is Schedule M-RI due?

A: The due date for Schedule M-RI is the same as the due date for your Rhode Island state income tax return, which is typically April 15th, or the next business day if it falls on a weekend or holiday.

Q: Is there a penalty for not filing Schedule M-RI?

A: If you are required to file Schedule M-RI and fail to do so, you may face penalties, such as additional taxes and interest.

Q: Are the modifications on Schedule M-RI the same every year?

A: No, the modifications on Schedule M-RI may change from year to year based on updates to Rhode Island tax laws.

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule M by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.