This version of the form is not currently in use and is provided for reference only. Download this version of

Form RI-1040V

for the current year.

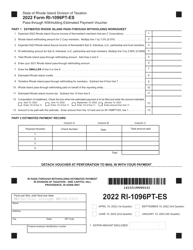

Form RI-1040V Rhode Island Return Payment Voucher - Rhode Island

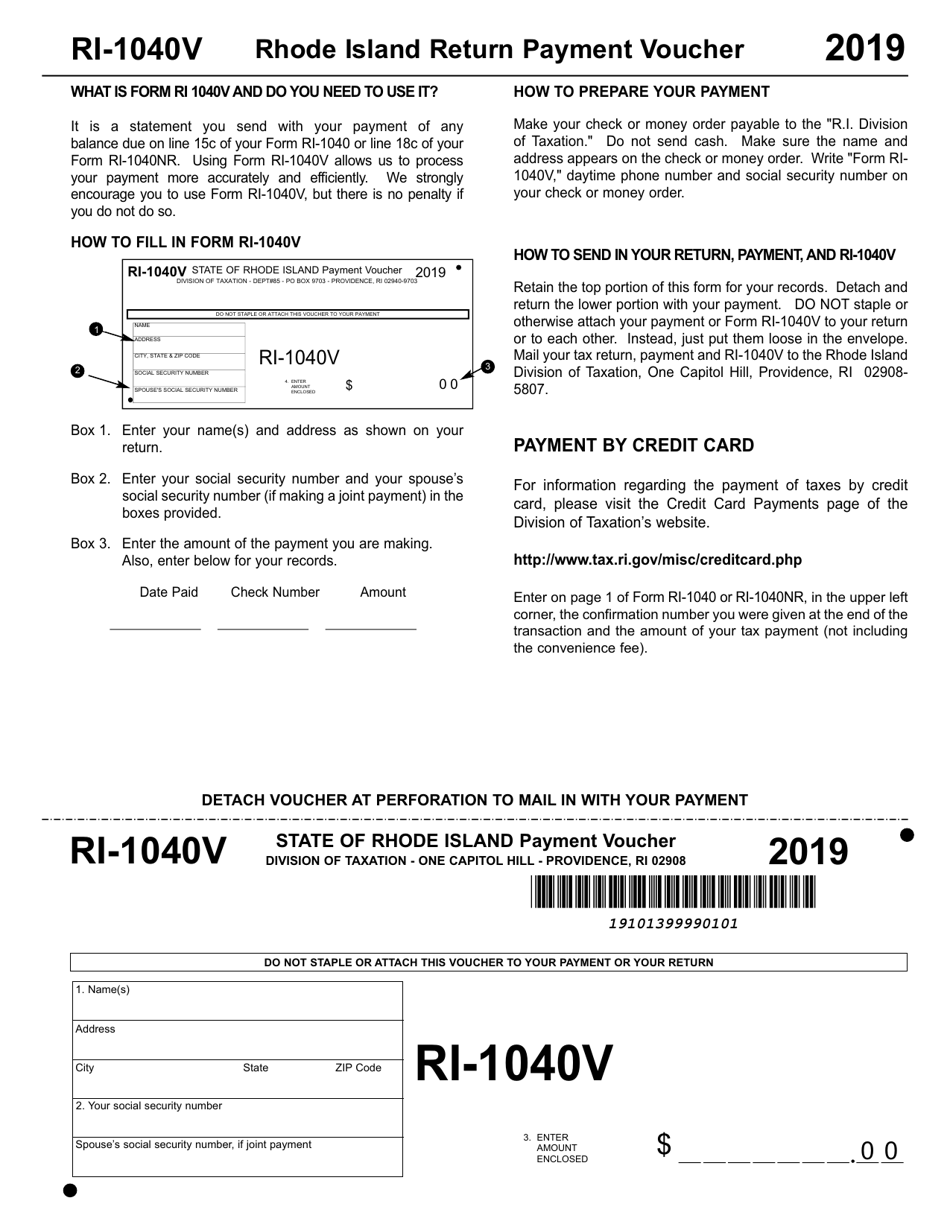

What Is Form RI-1040V?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

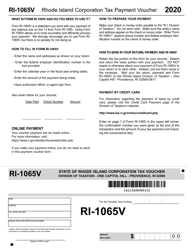

Q: What is Form RI-1040V?

A: Form RI-1040V is the Rhode Island Return Payment Voucher.

Q: What is the purpose of Form RI-1040V?

A: The purpose of Form RI-1040V is to make a payment for your Rhode Island state tax return.

Q: Do I need to fill out Form RI-1040V?

A: You need to fill out Form RI-1040V only if you are making a payment for your Rhode Island state tax return.

Q: How do I fill out Form RI-1040V?

A: Enter your name, address, and Social Security number on Form RI-1040V. Then, enter the payment amount and attach a check or money order payable to the 'Rhode Island Division of Taxation'.

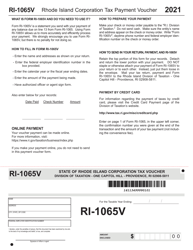

Form Details:

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RI-1040V by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.