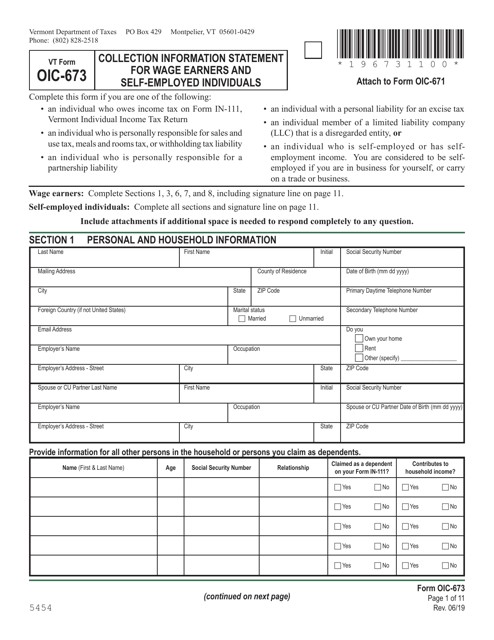

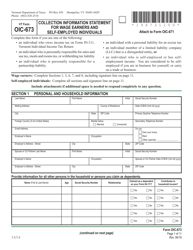

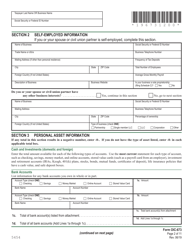

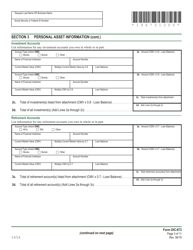

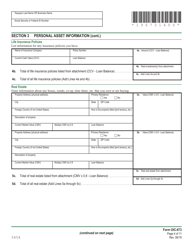

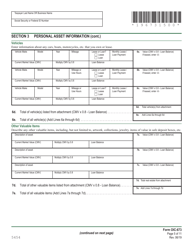

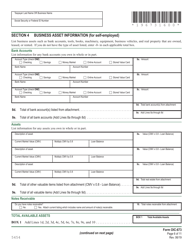

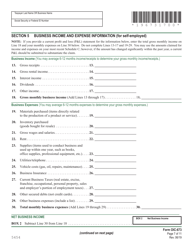

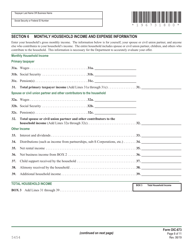

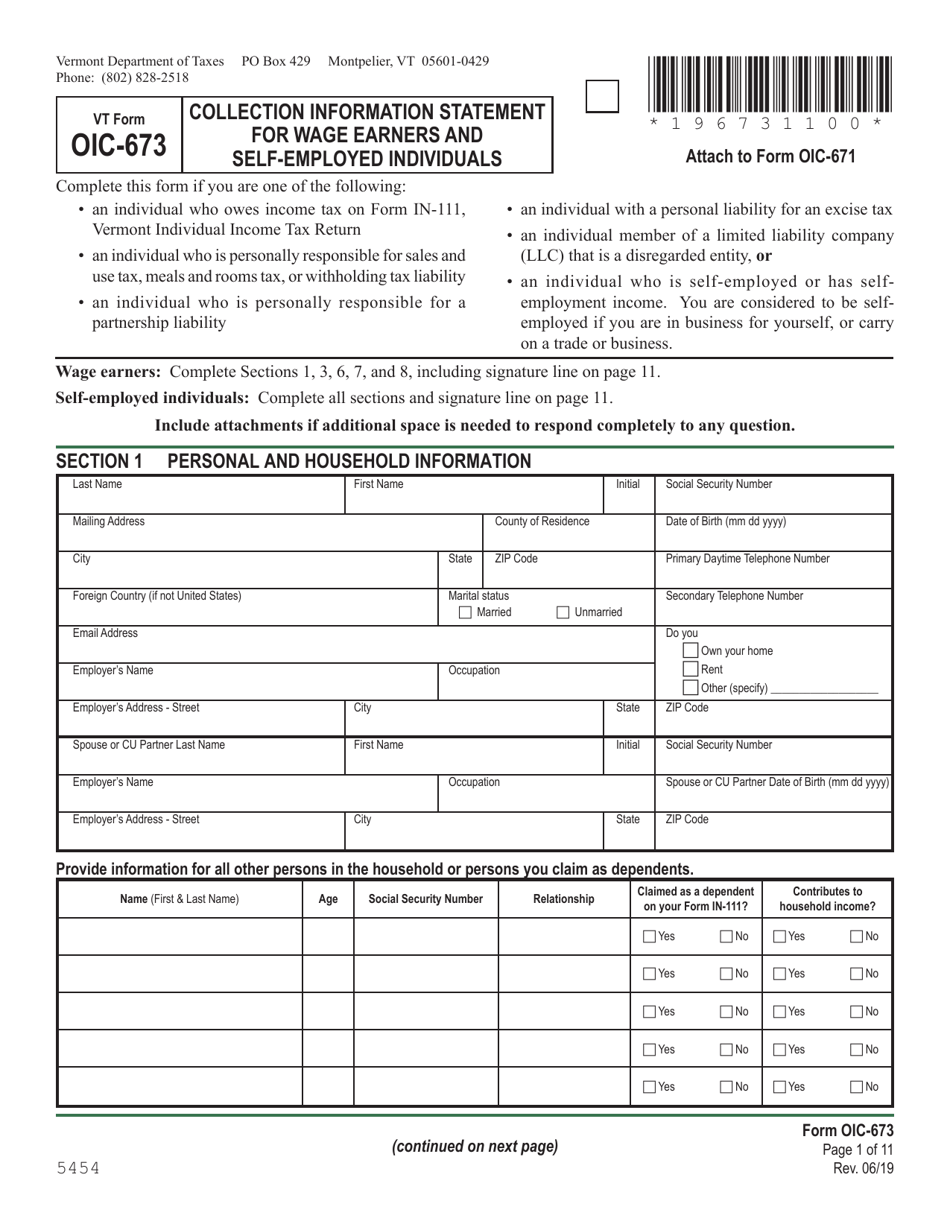

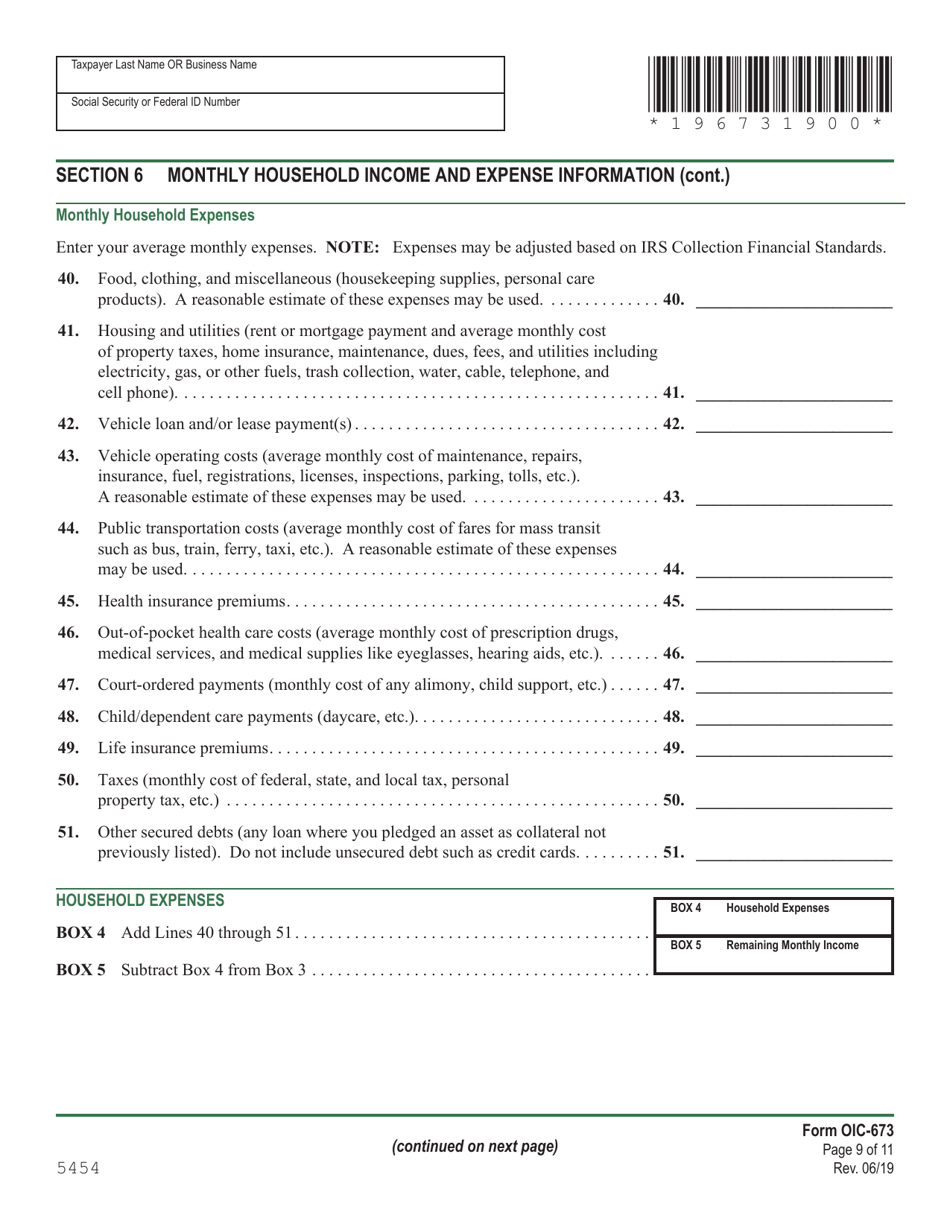

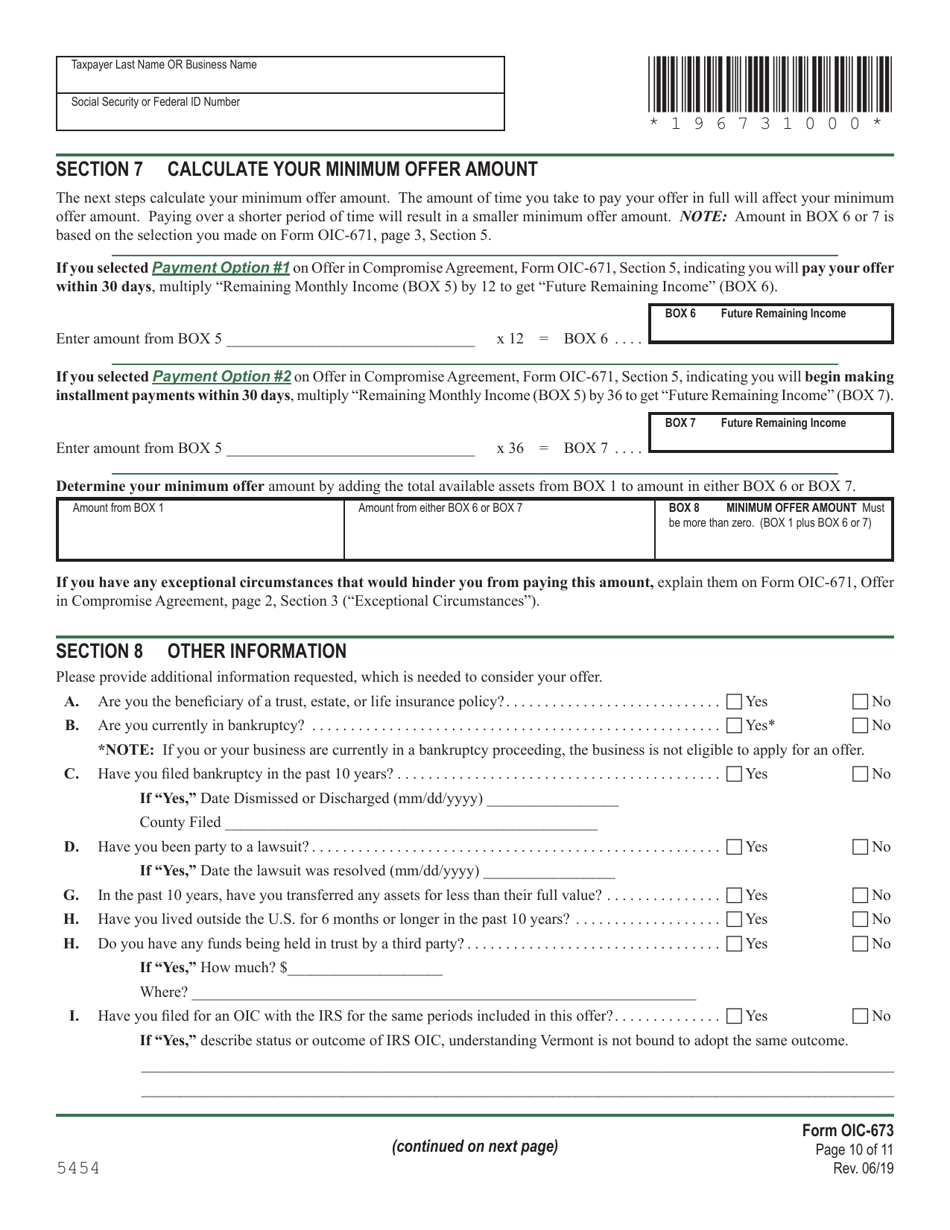

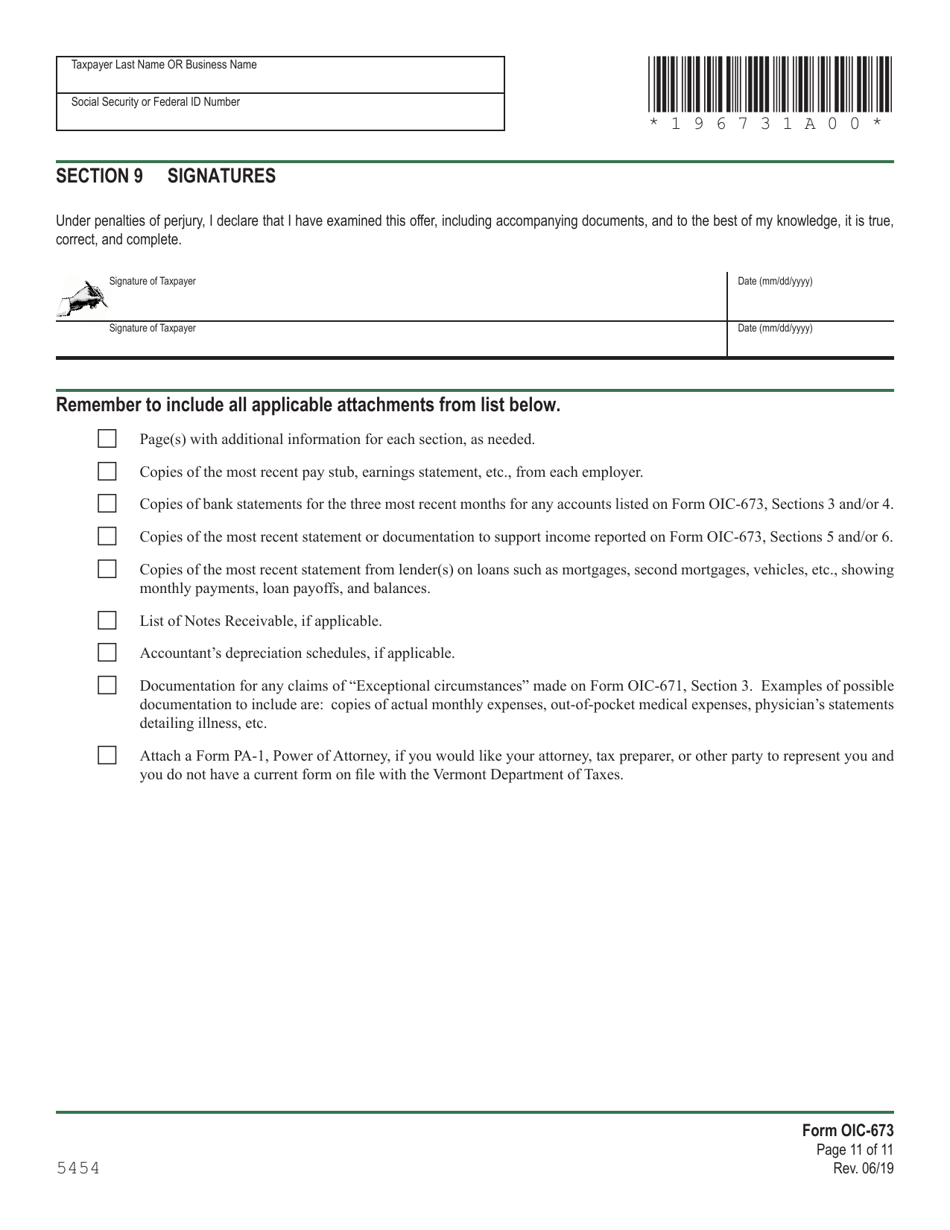

VT Form OIC-673 Collection Information Statement for Wage Earners and Self-employed Individuals - Vermont

What Is VT Form OIC-673?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is VT Form OIC-673?

A: VT Form OIC-673 is the Collection Information Statement for Wage Earners and Self-employed Individuals in Vermont.

Q: Who needs to complete VT Form OIC-673?

A: VT Form OIC-673 needs to be completed by wage earners and self-employed individuals in Vermont.

Q: What is the purpose of VT Form OIC-673?

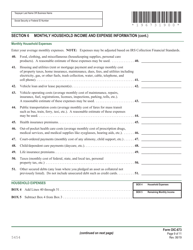

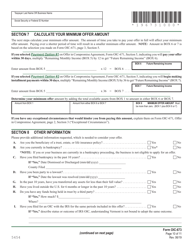

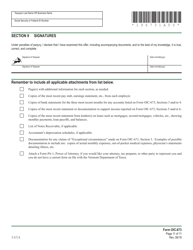

A: The purpose of VT Form OIC-673 is to gather information about an individual's financial situation to determine their ability to pay off tax debt.

Q: Are there any fees associated with submitting VT Form OIC-673?

A: No, there are no fees associated with submitting VT Form OIC-673.

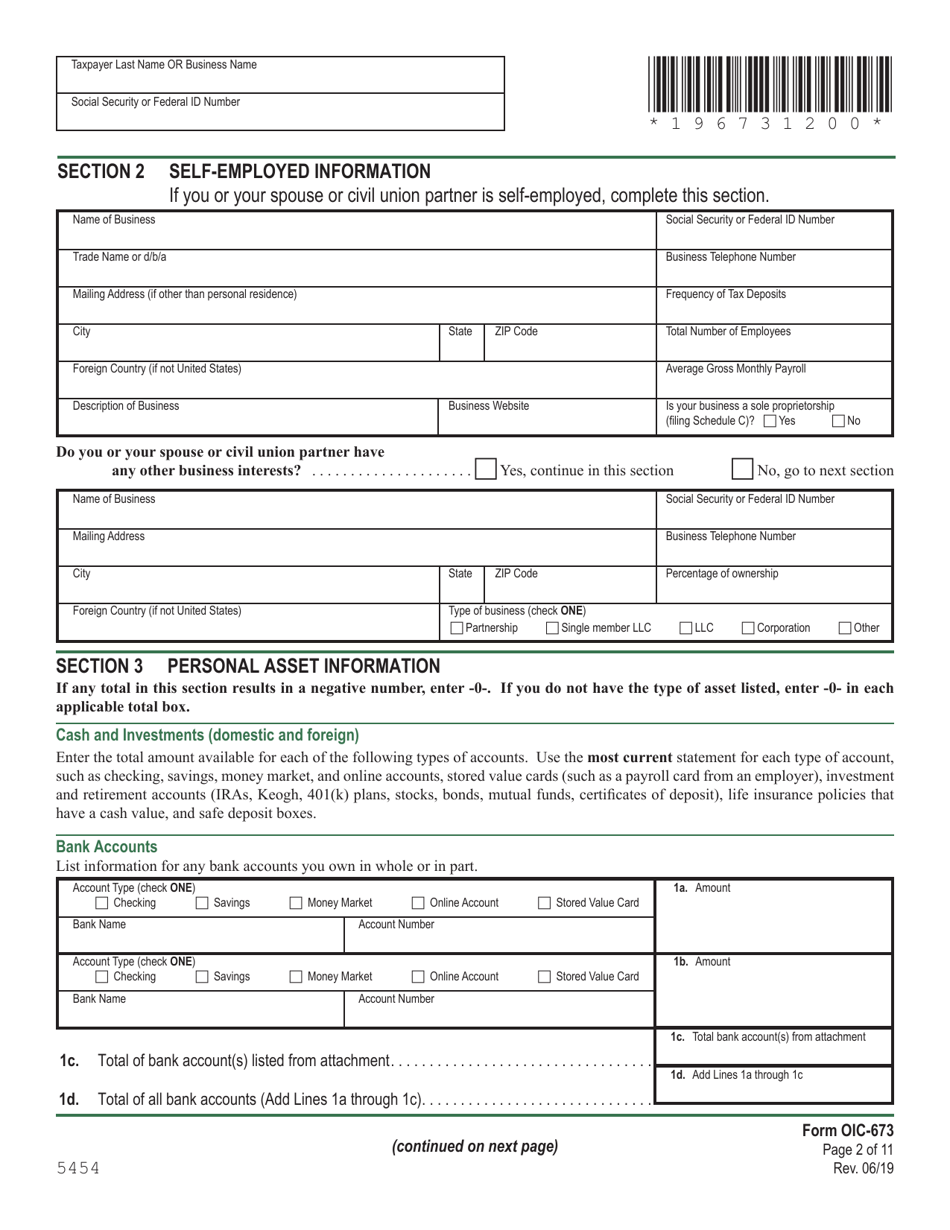

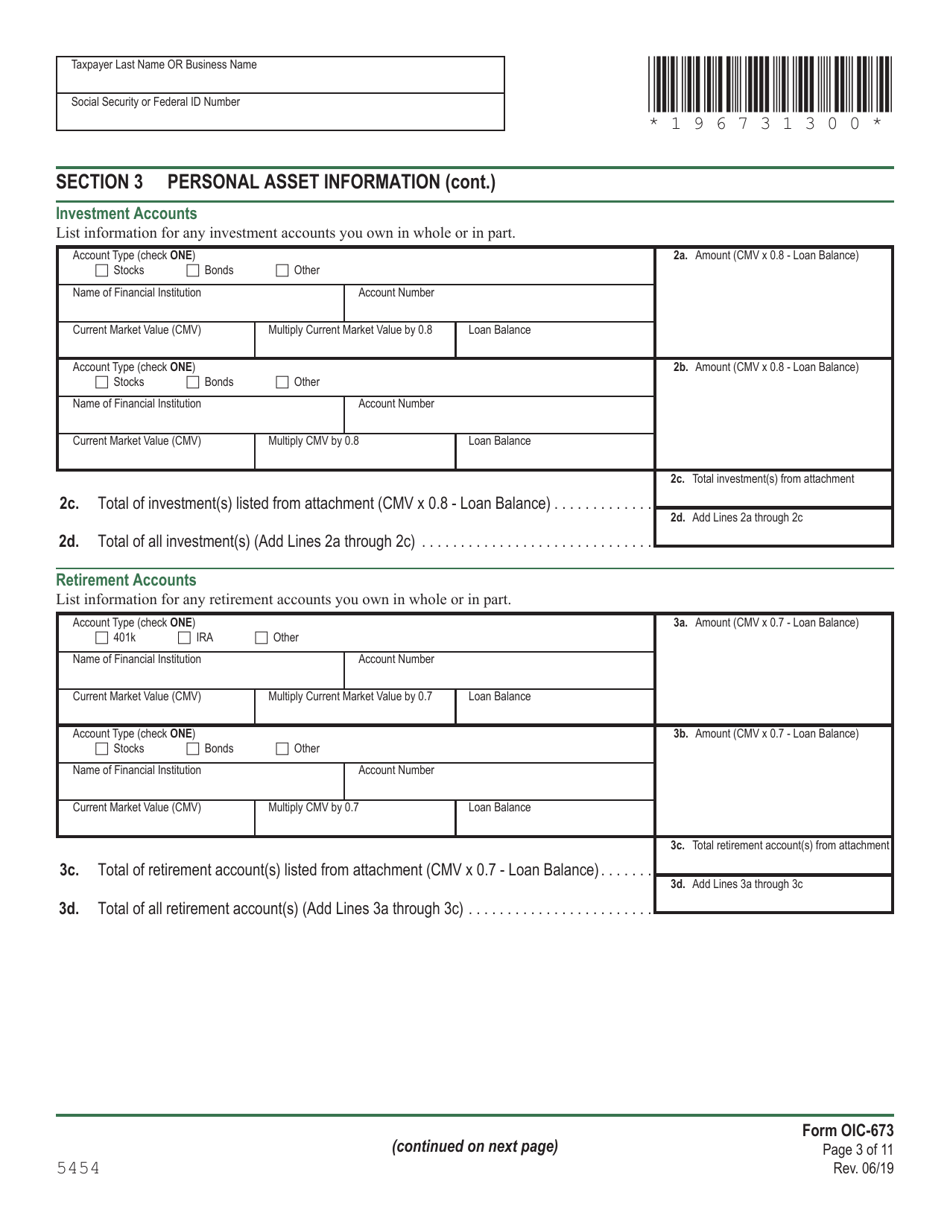

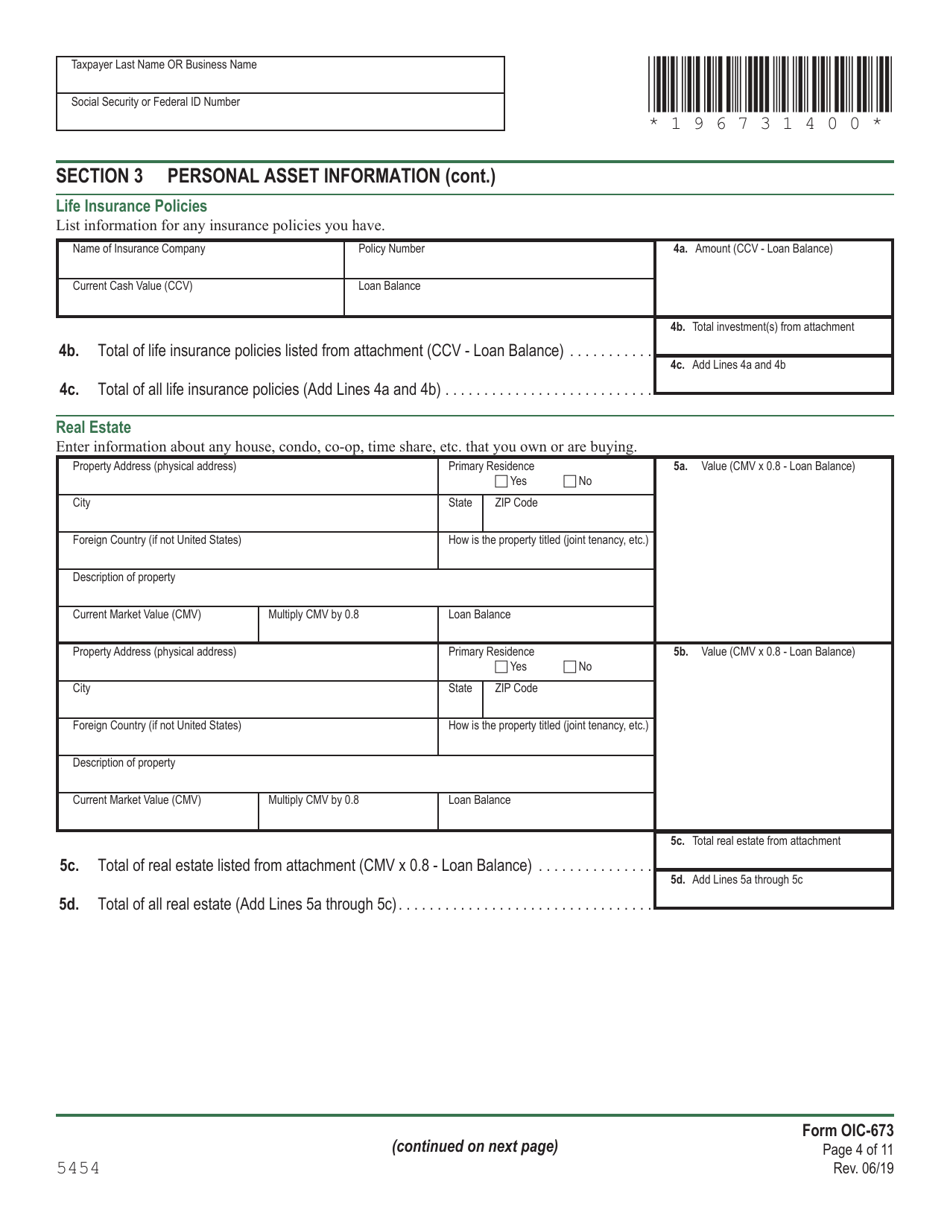

Q: What documents or information do I need to complete VT Form OIC-673?

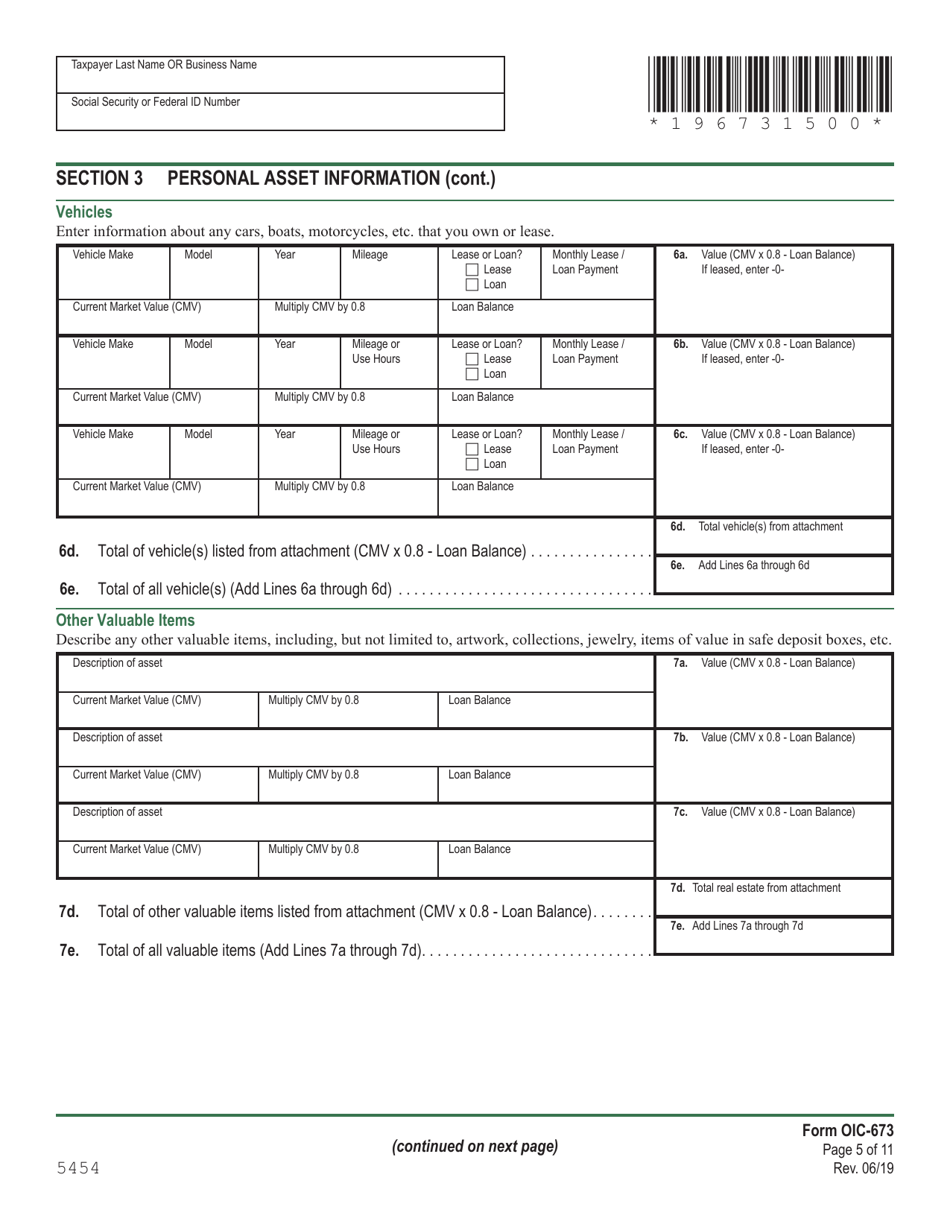

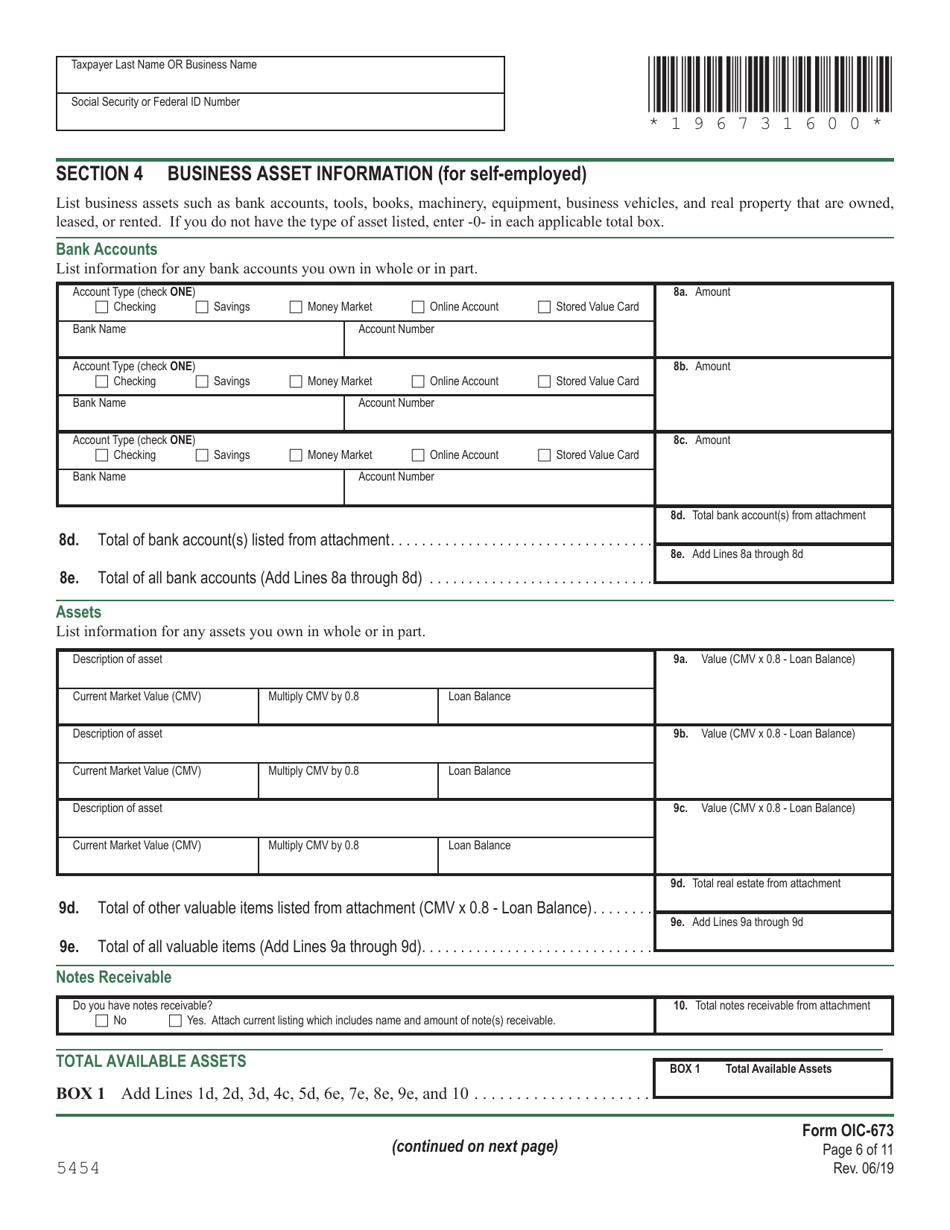

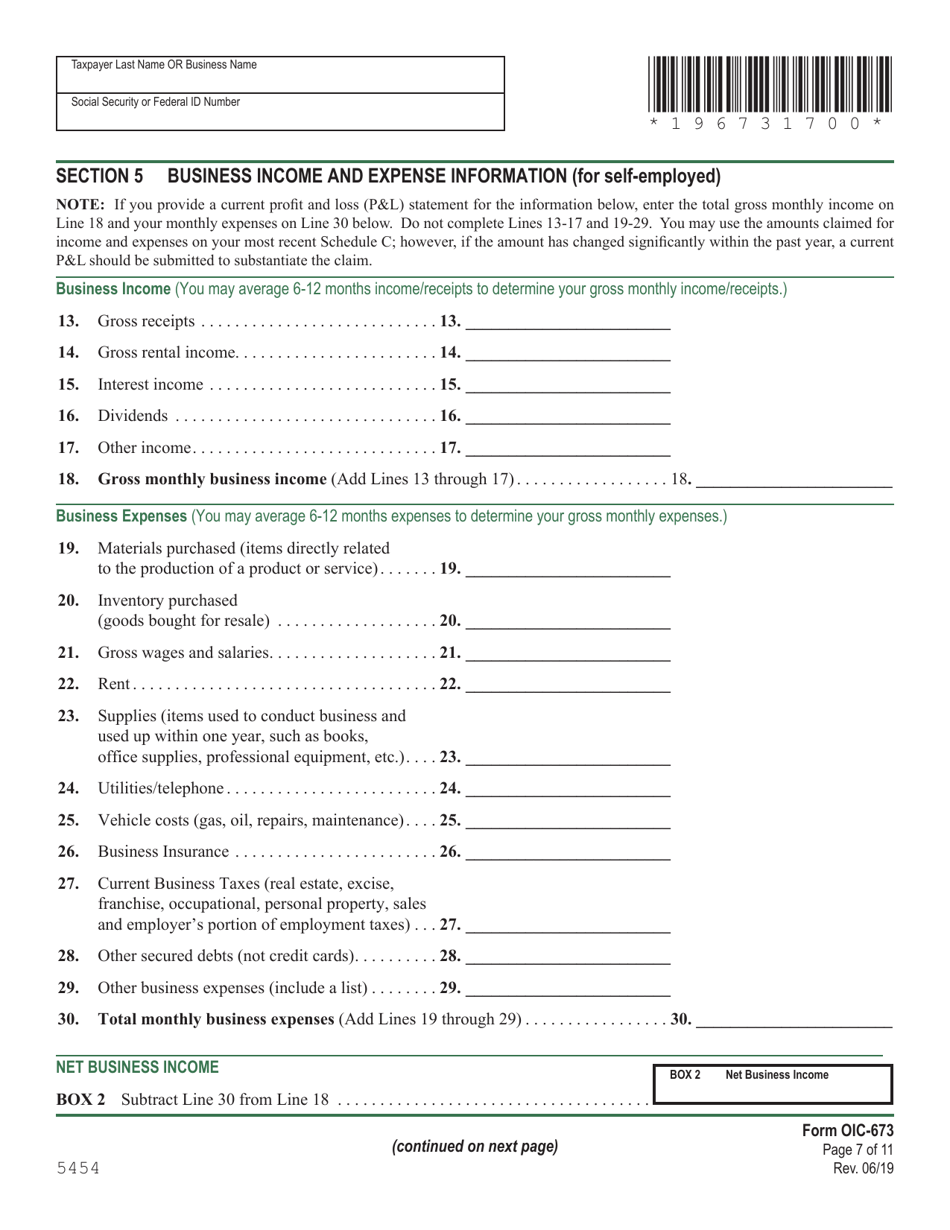

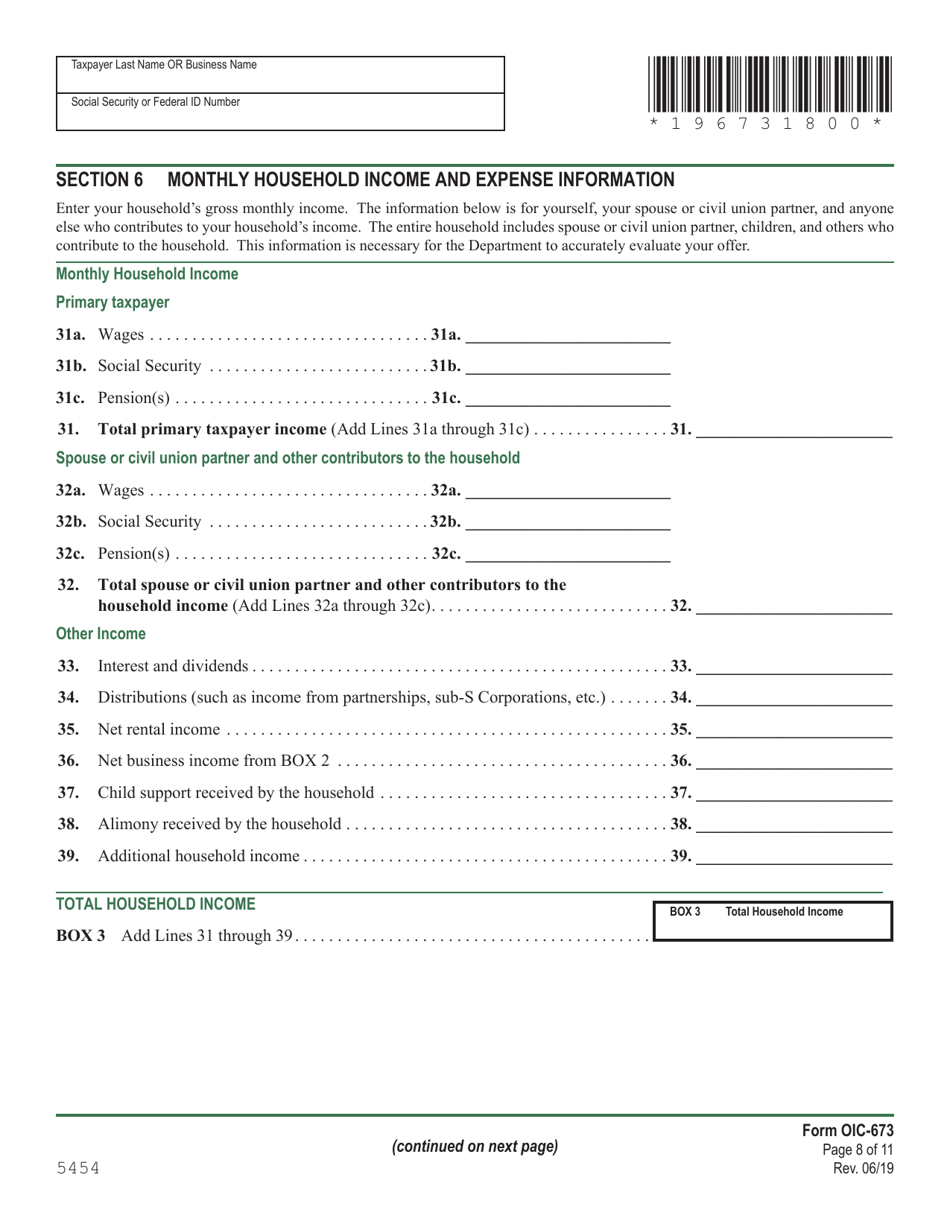

A: You will need to provide information about your income, expenses, assets, and liabilities.

Q: What happens after I submit VT Form OIC-673?

A: After you submit VT Form OIC-673, the Vermont Department of Taxes will review your financial information and determine if you qualify for a payment plan or other resolution options.

Q: What if I have questions or need assistance with VT Form OIC-673?

A: If you have questions or need assistance with VT Form OIC-673, you can contact the Vermont Department of Taxes for guidance.

Q: Is VT Form OIC-673 applicable for both individuals and businesses?

A: No, VT Form OIC-673 is specifically for wage earners and self-employed individuals in Vermont.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of VT Form OIC-673 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.