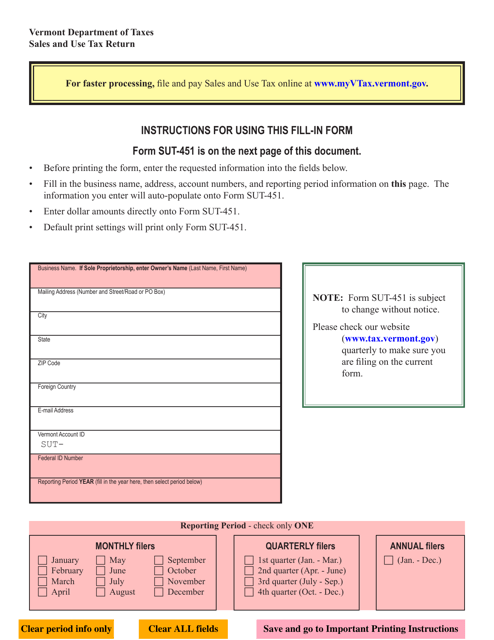

This version of the form is not currently in use and is provided for reference only. Download this version of

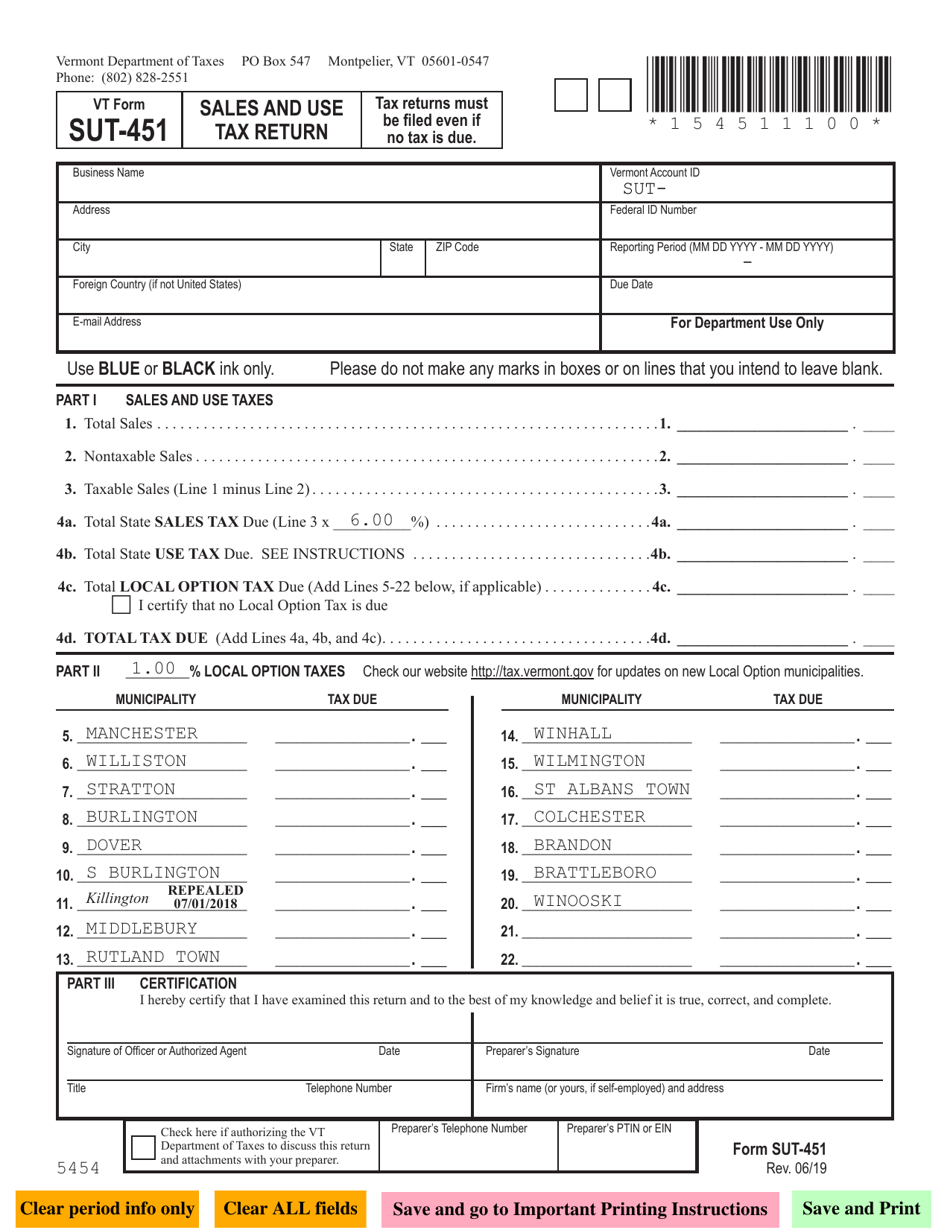

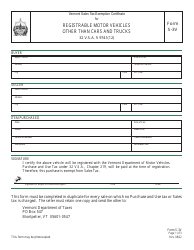

VT Form SUT-451

for the current year.

VT Form SUT-451 Sales and Use Tax Return - Vermont

What Is VT Form SUT-451?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form SUT-451?

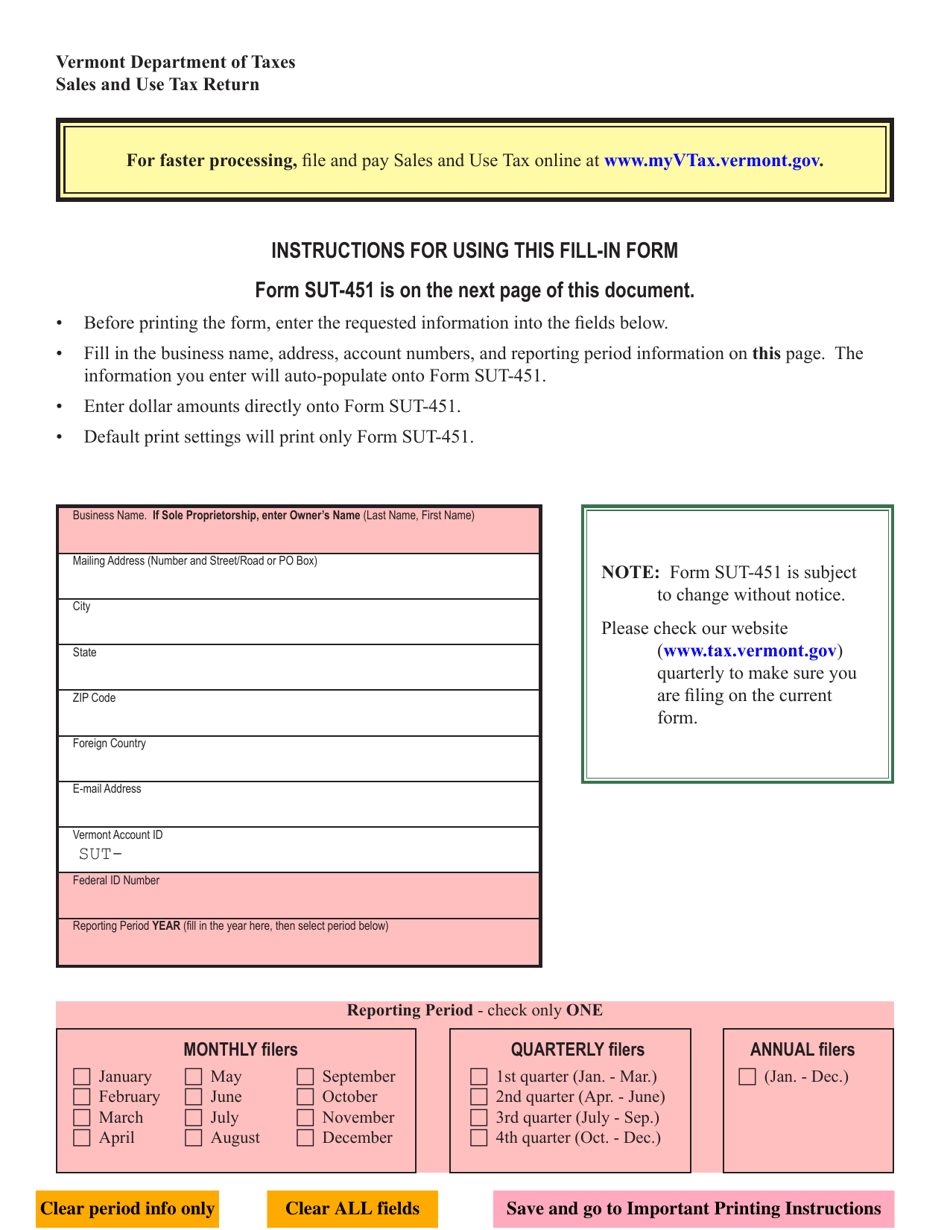

A: Form SUT-451 is the Sales and Use Tax Return for the state of Vermont.

Q: Who needs to file Form SUT-451?

A: Any business or individual that sells or uses taxable goods or services in Vermont needs to file Form SUT-451.

Q: What is the purpose of Form SUT-451?

A: The purpose of Form SUT-451 is to report and remit the sales and use tax owed to the state of Vermont.

Q: When is Form SUT-451 due?

A: Form SUT-451 is due on a quarterly basis, with the due dates being April 25th, July 25th, October 25th, and January 25th.

Q: What should I include when filing Form SUT-451?

A: When filing Form SUT-451, you should include information on the total sales and use tax owed, any tax credits or exemptions claimed, and any other relevant information requested on the form.

Q: Are there any penalties for not filing Form SUT-451?

A: Yes, there are penalties for not filing Form SUT-451, including late filing penalties and interest on unpaid taxes.

Q: Is Form SUT-451 only for businesses?

A: No, Form SUT-451 is not only for businesses. Individuals who make taxable sales or use taxable services in Vermont are also required to file the form.

Q: What if I have questions about Form SUT-451?

A: If you have questions about Form SUT-451, you can contact the Vermont Department of Taxes for assistance.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form SUT-451 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.